Final guidance issued on thin capitalisation – arm’s length debt test (ALDT)

19/08/2020

The Australian Taxation Office (ATO) finalised on 12 August 2020 its guidance (Practical Compliance Guideline (PCG) 2020/7) on the application of the arm’s length debt test, a methodology available to support excess debt deductions above the thin capitalisation safe harbour level.

In conjunction with Taxation Ruling (TR) 2020/4 1 released on the same day, the ATO delivered an increasingly rigorous expectation on how taxpayers should apply the ALDT. The PCG is effective for income years commencing on or after 1 January 2019.

Background

The ATO accepts that the ALDT will be satisfied where, considering (only) the borrower’s Australian business, the:

- Entity’s debt is not greater than the amount of debt the Australian business would reasonably be expected to have; and

- Debt capital would reasonably be expected to have been provided to the Australian business by independent commercial institutions on arm’s length terms and conditions.

Whilst applying the ALDT requires the application of arm’s length concepts that are similar to a transfer pricing analysis, it differs from transfer pricing in so far as the analysis is undertaken against a hypothetical entity (based on specific factors contained in the legislation).

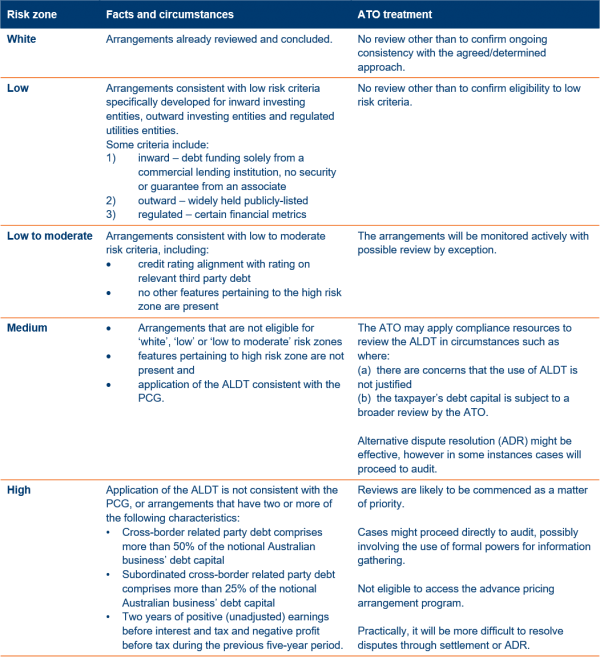

The ATO is of the view that there are only limited circumstances in which an independent Australian business would gear in excess of 60% and that the ALDT is more likely to be relied upon in an industry where it is common practice to operate with higher debt to equity ratios (such as regulated infrastructure entities). The ATO is therefore of the opinion that the use of the ALDT poses a greater risk of non-compliance compared to using other thin capitalisation methods (such as the safe harbour). PCG 2020/7 represents the ATO’s view on what it considers a reasonable approach in undertaking the ALDT and where the ATO will allocate compliance resources. As for other tax risk areas, the ATO uses a colour-zone based categorisation to determine risk, and indicate where it will focus compliance resources.

The risk assessment framework

The PCG sets out the ALDT risk framework into five risk zones:

ALDT analysis framework

Based on our experience, the majority of taxpayers seeking to use and rely on the ALDT will fall under the medium or high risk zones, meaning the ALDT needs to be applied in accordance with the detailed framework set out in the PCG.

1. Identifying the notional Australian business

The notional Australian business needs to be constructed on a stand-alone entity basis reflecting commercial activities only in connection with Australia and assuming no foreign interests, associate entity debt or credit support provided by associates.

2. Identifying the arm’s length terms and conditions

A credit rating for the notional Australian business will need to be established as a reference point for identifying the broader arm’s length terms and conditions of debt interest. The ATO notes that this process must be based on independent parties in the same industry and transfer pricing principles.

3. Considering all relevant factors

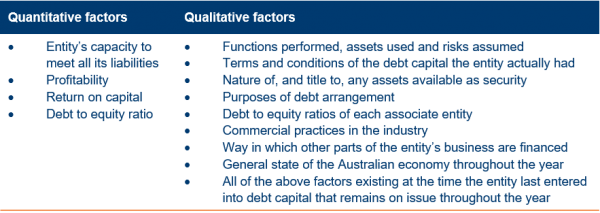

The ALDT must take into account all the following factors in determining the arm’s length debt amount in relation to the Australian business from the perspective of the borrower and independent lenders.

The quantitative factors need to be weighted to give rise to an arm’s length debt amount. The qualitative factors need to be designated as to whether each has an adverse, neutral or supportive impact on the debt amount derived. The ATO notes that the weighting exercise should be based on evidence and publicly available information.

Key takeaway

The final guidance is expected to increase taxpayers’ compliance burden in their ALDT self-assessment. Unhelpfully, the ATO has only provided the one example in the PCG, and this example is based on a regulated entity scenario. This leaves significant uncertainty for general industry taxpayers. To meet the ATO’s expectation, taxpayers should use best endeavours to put in place a robust analysis and evidence to substantiate an arm’s length debt amount.

The ALDT is annual process. However, it is noteworthy that taxpayers may have experienced impairment of asset values or additional debt drawdowns resulting from COVID-19. The ATO allows taxpayers who would otherwise rely on the safe harbour debt amount to apply a simplified approach to the ALDT for the 2020 year provided certain criteria can be met.

Contacts

| Stephen O’Flynn | Matt Birrell | |

| Helen Wicker | Yang Shi |

1. TR 2003/1 was replaced.↩