ATO draft guidance on Intangibles Arrangements between related parties

01/06/2021

The Australian Taxation Office released draft Practical Compliance Guideline 2021/D4 on 19 May 2021 (Draft PCG), outlining how international arrangements connected with the development, enhancement, maintenance, protection, and exploitation (DEMPE) of intangible assets and/or migration of intangible assets (Intangibles Arrangements) will be assessed.

Intangibles Arrangements is the long-awaited and last tranche of ATO’s focus areas following the revision of OECD Transfer Pricing Guidelines in 2017.

The Draft PCG discusses ATO’s risk assessment framework on Intangibles Arrangements based on the risk factors described as High, Medium, or Low.

| Focus area | High risk | Medium risk | Low risk |

|---|---|---|---|

| Documentation and evidence of commercial considerations and associated decision making, availability of alternative arrangement, and financial benefits | Not available | Available, but no incomplete | Available and complete |

| Form of Intangibles Arrangements, consistency with its substance, and related payments | No legal documents available Inconsistency between legal documents and actual conditions No justification for payments | Available but incomplete legal documents, consistency with actual condition, and payments | Complete information |

| Identification of intangible assets and connected DEMPE activities, and whether the entity performing DEMPE activities has the capability, financial capacity and/or assets to do so in substance | No information of intangible assets, DEMPE activities and the entity | Incomplete information | Complete information |

| Documentation and evidence of tax and profit outcomes | No information whether the economic outcomes and benefits align with DEMPE activities Inconsistency between tax and profit outcomes with the commercial economic substance of Intangibles Arrangements Inconsistency between characterisation and quantum of Intangibles Arrangements and the anticipated tax and non-tax benefits | Incomplete information | Complete information |

The following examples have been adapted from the PCG, and illustrate the application of these risk factors.

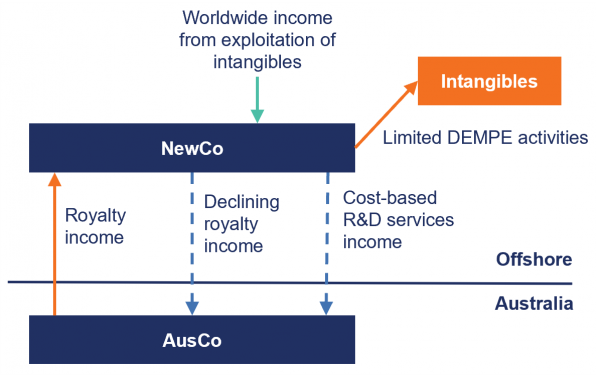

High-risk example 1: Centralisation of intangible assets

Facts:

- AusCo owns, manages and controls DEMPE activities of the group’s intangible assets

- AusCo and the global group decide to transfer these intangible assets from AusCo to be centralised in a new foreign entity, NewCo

- NewCo will receive worldwide royalty income from the rights to exploit the Existing Intangibles and any New Intangibles developed, while AusCo receives a declining royalty from NewCo associated with the exploiting the Existing Intangibles

- AusCo continues to undertake majority of DEMPE activities while receiving a cost-based remuneration under the R&D service agreement. NewCo hires additional staff and acquires additional assets, but these are not sufficient to allow NewCo to wholly manage, perform and control the DEMPE activities for the intangibles.

The above arrangement is regarded as a High-Risk Intangibles Arrangement because:

- There is a risk that this arrangement is not commercially rational for AusCo and may not be consistent with AusCo’s best economic interests having regard to the commercial options realistically available, disregarding potential tax impacts. The risk is emphasised when no documentation is available to substantiate the decision making or potential tax impacts that were taken into account

- AusCo has not been properly remunerated for the DEMPE activities it performs

- In the absence of this arrangement, AusCo would continue to own and derive income from the intangibles. AusCo would not need to pay royalties to NewCo.

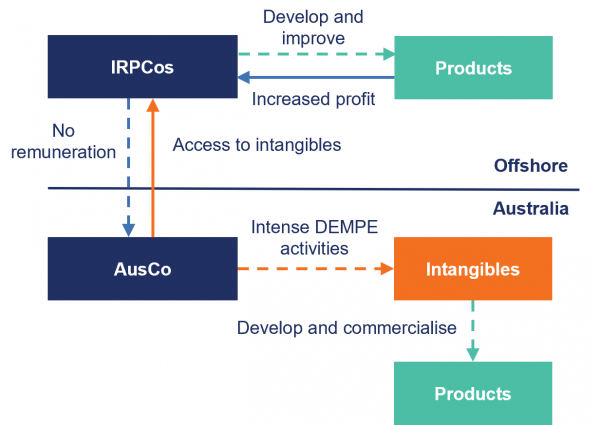

High-risk example 2: Non-recognition of Australian intangible assets and DEMPE activities

Facts:

- AusCo owns trademarks connected to products and services exclusively distributed in Australia. AusCo manages, performs and controls DEMPE activities and assumes associated risk of the intangibles

- AusCo’s DEMPE activities increase in intensity, resulting in new intangible assets. AusCo does not account for these in its financial statements or register them for legal protection. Likewise, AusCo’s global group does not maintain a comprehensive contemporaneous R&D or intellectual property policy or other relevant guidelines

- AusCo’s international related parties (IRPCos) are granted access to the new intangible assets to improve their products and services. No documentation is available for this arrangement

- The profitability of IRPCos increases as a result of accessing and exploiting the new intangibles and the DEMPE activities performed by AusCo

- AusCo does not receive any compensation for the intangibles.

The above arrangement is regarded as a High-Risk Intangibles Arrangement because:

- The absence of legal agreements may impede AusCo’s ability to protect its interests of the intangibles

- The lack of compensation for the use of the intangibles may be inconsistent with arrangements expected between independent parties.

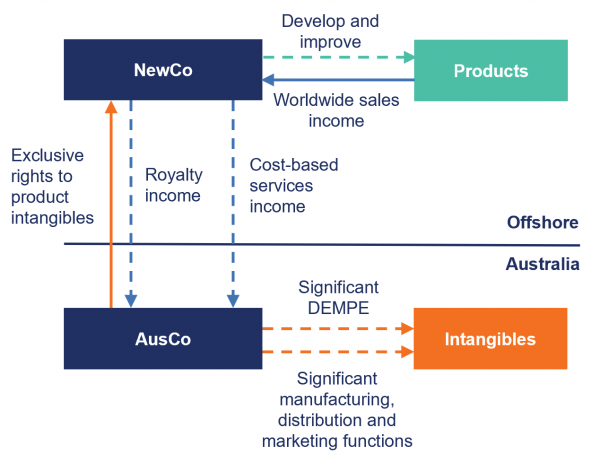

High-risk example 3: Migration of pre-commercialised intangible assets

Facts:

- AusCo undertakes years of R&D in Australia to develop a new product range, which results in the development of pre-commercialised intangible assets. The intangibles are owned by AusCo and are strategically important to the business

- Prior to the commercialisation of the intangibles, AusCo and the global group decide to incorporate a new offshore entity, NewCo, to own the rights to the intangibles. NewCo does not have sufficient assets to undertake DEMPE activities while AusCo has the capability and capacity to develop, manufacture and commercialise products associated with the intangibles. No documentation is available to substantiate the commercial rationales underpinning this decision or consideration of potential tax impacts

- AusCo and NewCo enter into a license agreement, which transfer the effective control of the intangibles from AusCo to NewCo. All the worldwide income that will be received from the global commercial sales of the related products will be derived by NewCo. NewCo pays ongoing royalties to AusCo in relation to worldwide sales of related products. No documentation is available to substantiate the arm’s length nature of the pricing or terms of this arrangement

- NewCo enters into a service agreement with AusCo where AusCo agrees to provide services for the development, manufacture, and distribution of the new products for a cost-based remuneration. No documentation is available to substantiate the arm’s length nature of the pricing or terms of this arrangement

- After the transfer, AusCo continues to employ specialised staff and uses its expertise and assets to manage, perform and control DEMPE activities associated with the intangibles. In the meantime, NewCo has limited relevantly qualified staff and manages and performs limited activities, owns limited assets, and assumes limited risks in connection with the intangibles

- AusCo employs specialised staff and uses its expertise and assets to manufacture and sell related products to the global market under the service agreements while it only receives cost-based remuneration. NewCo continues to have limited qualified staff, manages, and performs limited activities, and assumes limited risks in connection with the manufacture, distribution and marketing of related products while it derives worldwide income from the sale of related products

The above arrangement is regarded as a High-Risk Intangibles Arrangement because:

- There is a risk that AusCo’s entry in the license agreement and service agreement is inconsistent with comparable arrangements expected between independent parties. The risk is emphasised when no documentation is available to substantiate its decision making or potential tax impacts that were taken into account

- AusCo does not require NewCo as a partner to develop or commercialise the intangibles as it had the capability, expertise and capacity to do so

- The transfer results in AusCo not being able to derive worldwide income from the sale of related products

- NewCo did not have the capability or capacity to manage and be responsible for the rights and obligations it had under the Licence Agreement in connection with the Product Intangibles and the New Products which were instead, in substance, controlled and managed by AusCo.

Key takeaways

While the Draft PCG provides a detailed framework intended to facilitate taxpayers’ self-assessment of risks associated with related party intangible arrangements, the framework lacks quantitative risk indicators (as opposed to other PCGs). The framework reflects a move away from the traditional focus on legal ownership of intangibles to where the DEMPE activities are performed and the entity able to bear the risks associated with those activities.

In documenting where the DEMPE functions are performed, multinationals should have regard to commercial evidence (i.e. internal reviews / board presentations / briefing materials) associated with intangible arrangements, which may not be reflected in conventional transfer pricing documentation.

It is noteworthy that self-assessment of Intangible Arrangements are required for taxpayers who complete a Reportable Tax Position (RTP) schedule (i.e. Part of Category C disclosures).

The level of uncertainty resulting from transfer pricing disputes involving Intangibles Arrangements could be significant. Taxpayers should take prompt actions to thoroughly assess their material Intangibles Arrangements.

How SW can assist

Contact one of our experts below to discuss how the Draft PCG affects your Intangible Arrangements.