The Federal Government’s economic stimulus package

23/03/2020

The Federal Government yesterday announced a series of significant tax concessions aimed at stimulating investment.

Updated 3 July 2020

Businesses will be able to claim accelerated depreciation on new assets for the remainder of the year under the latest extension to the $150,000 instant asset write-off program unveiled by the Federal Government on the 9 June. After expanding the program from assets worth $30,000 to $150,000 in response to the COVID-19 pandemic in March, the Federal Government has now extended the deadline for making claims from July 1 2020 to December 31 2020.

The Federal Government has released its second stage of the financial support package to help businesses and households survive the escalating COVID-19 crisis. The second stage of announced measures will mean that a total of $189 billion (across the forward estimates) is being injected into the Australian economy by the Federal Government.

The expanded support package includes the following targeted financial support measures:

- Support for workers and households

- Assistance to business to keep people in a job

- Regulatory protection and financial support for businesses to stay in business

Support for workers and households

Coronavirus supplement – $14.1 billion

- Temporary expansion of the eligibility to income support payments

- Establishing a new temporary Coronavirus supplement to be paid at a rate of $550 per fortnight

- To be paid to both existing and new recipients of the:

- JobSeeker Payment

- Youth Allowance jobseeker

- Parenting Payment

- Farm Household Allowance

- Special Benefit

- The Coronavirus supplement will be paid for the next 6 months

- Eligible income support recipients will receive the full amount of the $550 Coronavirus supplement on top of their payment each fortnight

- An increase of up to 5,000 staff for Services Australia will assist to support delivery of new Government measures

Payments to support households – $4 billion

- A further $750 payment to social security and veteran income support recipients and eligible concession card holders (excludes those who are receiving an income support payment that is eligible to receive the Coronavirus supplement).

- Payment will be made automatically from 13 July 2020 to around 5 million social security, veteran and other income support recipients and eligible concession card holders.

Early release of superannuation – $1.2 billion

Individuals in financial stress as a result of the Coronavirus may access up to their superannuation as follows:

- $10,000 in 2019-20

- $10,000 in 2020-21

Affected individuals can apply online through myGov:

- before 1 July 2020 to access their 20019-20 amount

- before 30 September access their 2020-21 amount

- released amounts will not be subject to tax and will not impact entitlements to Centrelink or Veterans’ Affairs payments.

Eligibility

To apply for early release, an individual must satisfy any one or more of the following requirements:

- be unemployed.

- be eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance.

- On or after 1 January 2020, be either:

- made redundant

- working hours were reduced by 20% or more

- if you are a sole trader, your business was suspended or there was a reduction in your turnover of 20% or more

Temporarily reduce superannuation minimum drawdown rates

- A temporary reduction of the minimum drawdown requirements for superannuation pension accounts

- The minimum drawdown for account based pensions and similar products will reduce 50 per cent for 2019-20 and 2020-21

Reducing social security deeming rates – $876 million

- In addition to the deeming rate changes announced in the first package, there will be a further 0.25 per cent reduction of the deeming rates

- As at 1 May 2020 the:

- lower deeming rate will be 0.25 per cent

- upper deeming rate will be 0.25 per cent

Assistance to business to keep people in a job

JobKeeper Payment: $130bn

The Government will provide a fortnightly payment of $1,500 per eligible employee to businesses impacted by COVID-19 from 30 March 2020 for a maximum period of 6 months.

Boosting Cash Flow for Employers – $31.9 billion

- The Government is providing up to $100,000 to eligible small and medium sized businesses, and not for-profits that employ people, with a minimum payment of $20,000

- The payment will be delivered over two tranches in 2019-20 and 2020-21

- No application for the payments will be required as these will flow automatically through the ATO

- ‘Payments’ will be delivered as an automatic credit in the activity statement system

- If the entity is in a refund position, the ATO will deliver the refund within 14 days of processing

- The payments will be tax free

First payment

- Employers will receive a payment equal to 100 per cent of their salary and wages withheld with the maximum payment capped at $50,000

- The minimum payments to be received by small business will be $10,000

- Payment will be available from 28 April 2020

Second payments

- The second payment will be made from 28 July 2020

- Eligible entities will receive an additional payment equal to the first tranche of the Boosting Cash Flow for Employers payment received

Eligibility

- Small and medium business entities:

- with aggregated annual turnover under $50 million

- that employ staff

- established before 12 March 2020

- NFPs entities (including charities):

-

- with aggregated annual turnover under $50 million

- that employ staff

- established before or after 12 March 2020

- Aggregated turnover is calculated on a worldwide basis – this means that entities with turnover less than $50 million in Australia but with significant overseas operations will be unlikely to qualify

Regulatory protection and financial support for businesses to stay in business

Coronavirus SME Guarantee Scheme

- The Government will establish the Coronavirus SME Guarantee Scheme to support small and medium enterprises (SMEs) to get access to working capital

- Under the Scheme, the Government will guarantee 50 per cent of new loans issued by eligible lenders and will guarantee up to $20 billion to support $40 billion in SME loans made to Australia businesses

- The new loans under the Scheme:

- can be up to $250,000 over a three-year term

- won’t have repayments on them for the first six months

- will be unsecured

- will be subject to lenders’ credit assessment processes

- The Scheme will commence by early April 2020 and be available for new loans made by participating lenders until 30 September 2020

Providing temporary relief for financially distressed businesses

- A temporary increase to the threshold at which a creditor can issue a statutory demand on a company and the time such companies have to respond to statutory demands they receive

- Temporary relief for directors from any personal liability for trading while insolvent

Date: 3 July 2020

The Federal Government released an economic stimulus package designed to encourage business investment, maintain employment and support those impacted by COVID-19 through an instant / accelerated asset write off and cash payments. The package included important tax concessions.

Impact

Businesses with an aggregated turnover of less than $500 million will benefit from two tax concessions announced by the Morrison Government:

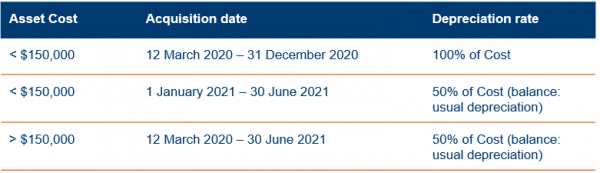

- Assets costing up to $150,000 purchased between:- 12 March 2020 and 31 December 2020 will attract an immediate tax write off- 1 January 2021 and 30 June 2021 will attract a 50% tax write off, with the balance depreciated over the effective life of the asset

- Assets costing more than $150,000, purchased between now and 30 June 2021 will attract a 50% tax write off with the balance depreciated over the effective life of the asset.

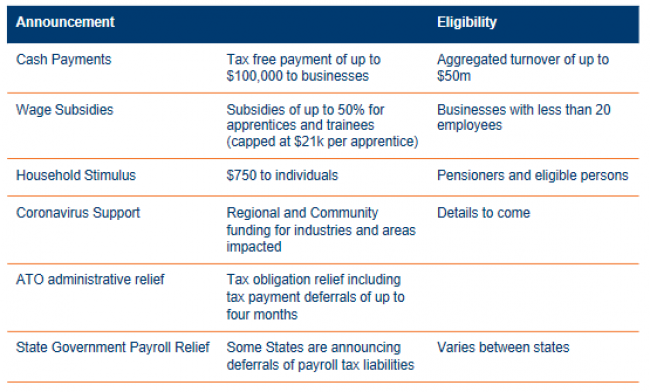

In addition to the depreciation concessions, the stimulus package includes:

Get in touch

The concessions apply only to businesses and to those businesses that meet the eligibility requirements. The tax write offs will only apply to depreciable assets. Please reach out to one of our tax experts below to determine the potential benefits to your business.