Our team brings extensive expertise in managing the complex taxation and compliance responsibilities associated with Deceased Estates.

We work seamlessly with Executors, Court Appointed Administrators and their legal representatives to ensure every aspect of the estate’s tax obligations is handled with precision. This includes the preparation and lodgement of all required returns, accurate declaration of income, application of deductions, and the identification, quantification and reporting of capital gains tax events.

Deceased Estates often involve intricate tax considerations and strict compliance requirements. We provide clear, strategic advice and practical support in areas such as:

- Lodging the Final Tax Return for the Deceased and any outstanding prior year returns

- Preparing and lodging Deceased Estate and Testamentary Trust Tax Returns as required

- Preparing Financial Accounts for Deceased Estates or Testamentary Trusts where necessary

- Providing clear, accurate beneficiary statements to ensure distributions are correctly included in beneficiaries’ personal returns

- Delivering Capital Gains Tax advice, including guidance on asset treatment and applicable time limits

- Liaising with the ATO to confirm the deceased’s outstanding tax position prior to finalising the estate

- Assisting with ongoing compliance or wind-up matters for private companies, trusts and SMSFs forming part of the deceased group

- Preparing private binding ruling applications, for example, seeking the Commissioner’s discretion to extend the two-year period for disposal of a principal place of residence

- Managing voluntary disclosures, including complex ATO liaison to obtain tax histories and reach timely, appropriate outcomes for estate finalisation

- Establishing and managing Testamentary Charitable Trusts, including compliance with Australian Charities and Not-for-profits Commission (ACNC) requirements

- Preparation and lodgement of a Foreign Resident Capital Gains Withholding certificate for a foreign Executor, where the Deceased’s main residence has been sold.

Key contacts

Taxpayers who have received a GST assurance rating through the ATO’s Top 100 or Top 1,000 programs are now required to complete the GST Supplementary Schedule. There is also an increasing expectation for taxpayers to undertake the GST analytical tool (GAT) or similar reconciliation on an annual basis to understand the variances between their financial statements and GST reporting.

Introducing CTS GAT, our powerful solution that automates and streamlines the GAT process. Whether you’re currently using our CTS full tax compliance software or prefer a standalone tool, CTS GAT compares the financial statements with GST reported on Business. Activity Statements (BAS) by running an analysis to highlight any differences. CTS GAT helps ensure accuracy, efficiency and confidence in your GST reporting.

CTS enables you to streamline and automate your entire tax reporting and compliance process. These include:

- accounts integration

- tax management

- accounting for income taxes

- consolidated tax return preparation

- generation of tax journals and disclosures for the financial statements.

CTS streamlines the calculation of tax balances to be included in the financial statements.

The outcome – CTS delivers increased integrity, efficiency and effectiveness.

CTS automatically:

- calculates the current and deferred tax balances

- generates the journals required to be posted

- generates the comprehensive AASB 112 compliant disclosure notes to be incorporated into the financial statements.

This means that the complex tax effect accounting is simplified, with the hard work being done for you.

Features and benefits

CTS has a number of features and benefits that our customers take advantage of every day.

Tax Return preparation

CTS integrates the tax reporting and tax return preparation process. This feature mitigates the duplication of work and costs. CTS tax returns can be lodged manually or electronically with the ATO via the Standard Business Reporting (SBR) portal.

CTS facilitates record keeping and linking of all workpapers. The workpapers are systematic and form the basis of support in the event of a tax audit.

Integrity

With the automation function, automatic links, rigorous testing and in-built validation features, you can be confident with the outputs from CTS.

Tax management

The tax management component enables listing and monitoring of required tasks. This means stronger communication and more effective supervision.

Support

Our training and customer support is characterised by exemplary professionalism which means availability and prompt resolution of issues. When you ring our support line you will speak to a fully qualified tax professional who will be able to understand and resolve your issues.

Access to the helpline is provided at no extra cost.

Added value

CTS is backed by an easy to read help screen, written to promote understanding of highly technical tax effect accounting issues, which includes leading technical commentary and numerous practical examples.

Evaluate performance

CTS generates information to assist with the evaluation of the company’s performance and financial position.

Consolidation function

CTS enables the consolidation of the tax effect accounting balances and disclosure notes using a ‘bottom up’ approach. The system also enables the preparation and lodgement of the consolidated income tax return and schedules.

Geographic mobility

CTS enables subsidiaries/finance functions in different geographic locations to use the same tax effect accounting and tax return preparation software. The foreign currency translation functionality automates the translation, of local currency to the group’s reporting currency.

User friendly

CTS has been developed within the Microsoft Excel environment, providing a user friendly and familiar working platform for users. While CTS is intuitively simple to use, we have incorporated a detailed step-by-step user guide. This means most of the process can be delegated and less time is needed to become familiar with the software.

The users of CTS operate in the following sectors:

Agribusiness

Automotive

Engineering

Distribution

Financial institutions

Funds management

Global trading

Government

Manufacting

Mining & oil refinery

Power generation

Professional services

Publications

Property development

Renewable energy

Shipping & logistics

Software & IT services

Utilities

Empowering Indigenous entities with tailored accounting services, our team excels in fostering your growth as a strategic partner.

The SW team offers a wide range of tailored services to Indigenous organisations and individuals. We are dedicated to empowering Indigenous entrepreneurs and organisations by offering customised services that align with their cultural values and aspirations.

With deep expertise in Indigenous business practices, and a passion for fostering economic growth, our team is committed to delivering exceptional results.

Our partners have deep experience in working with large Aboriginal Corporations, Native Title Trusts, Prescribed Bodies Corporate, Commercial Enterprises and Regulatory bodies.

Who we work with

- Native Title Aboriginal Corporations and Trusts

- Aboriginal Corporations

- Aboriginal owned businesses

- government Agencies

- Non-Aboriginal corporates partnering with Aboriginal businesses

Services

We provide a range of services to support Indigenous organisations, no matter their size of maturity of operations. These services include:

- applications for Deductible Gift Recipient Status

- assistance with negotiating Indigenous Land Use Agreements

- assistance with Grant applications

- assistance with sourcing and negotiating debt funding

- assistance with managing interactions with investment advisors

- bookkeeping and accounting

- business valuations

- coordinating regulatory examinations on behalf of Aboriginal Corporations

- compliance reviews and health checks

- corporate secretarial services

- financial due diligence

- governance advice and training

- internal audit services

- outsourced CFO services

- Regulatory Examinations on behalf of the Office of the Registrar of Indigenous Corporations

- project management

- statutory audits and assurance

- tax consulting and compliance

- tax exemption applications

- Wealth Management Services

Demonstrated capability

Examples of some of the work we have undertaken to support Indigenous business.

CFO Advisory services

We have provided CFO services to a number oflarge Aboriginal Corporations with complex operations. The scope of these services extends to cover oversight of the accounting functions, management reporting, financial reporting, audit coordination, tax compliance, treasury management, coordination with investment advisors and funding institutions, grant applications and acquittals, property developments and stakeholder management.

Corporate secretarial

Corporate Secretarial services have been delivered to a number ofNative Title and other Aboriginal Corporations. These services have included ORIC compliance, coordination with Chairs and CEOs to prepare board meeting agendas, board meeting attendance and minute keeping, maintenance of action registers, maintaining membership records, governance advice and training.

Bookkeeping & accounting

We have provided, and continue to provide, comprehensive bookkeeping and accounting services to a number of Native Title and other Aboriginal Corporations operating in a broad range of industry sectors, including mining services, hospitality, property, primary industries, and others.

Regulatory examinations

Regulatory Examinations have been on behalf of the Office of the Registrar of the Office of Indigenous Corporations (“ORIC”) in a number of Australian states. The experience and knowledge that we have gained from conducting these examinations positions us well to conduct compliance reviews for Aboriginal Corporations and to assist with coordinating the process when these Corporations are subject to ORIC examinations.

Deductible Gift Recipient Status

We have assisted a number of Corporations in obtaining deductible gift recipient/ tax exempt status, working in collaboration with external legal advisors.

Grant Funding Applications

Significant grant funding capacity building from the National Indigenous Australians Agency and Lotterywest was successfully obtained for a remote Aboriginal Corporation, and we are assisting the Corporation with implementing the capacity building initiatives.

Financial due diligence

We have performed financial due diligences for a number of Aboriginal Corporations to assist them in evaluating and making informed decisions about potential business

In the evolving landscape of Environmental Social Governance (ESG) considerations, our services are designed to assist clients in navigating the complexities of sustainability-related initiatives.

We collaborate with seasoned scientists and subject matter experts to deliver a wide spectrum of sustainability-focused solutions tailored to our clients’ specific needs.

We have an accredited auditor who is registered under the Australian Government Clean Energy Regulator, Greenhouse and Energy Auditor (Category 2) under 75A of the National Greenhouse and Energy Reporting Act 2007. He has been providing assurance services as a Category 2 auditor since 2012.

Governance and advisory

- Governance frameworks

- ESG strategy and policies

- Climate risk management framework

- Climate risk register

- Sustainability reporting compliance framework

- Sustainability policies

Identification of risks and opportunities

- Stakeholder identification engagement

- Materiality assessment

- Current state / baseline analysis

- Develop a roadmap / plan

Design and implementation of systems and processes

- Systems required to capture data for sustainability reporting including:

- HR data

- Corporate-wide data

- Marketing information

- Data captured about customers and suppliers

- CO2 data reported will need to be measured

- Reliance on experts where required

Reporting and assurance

- Sustainability report

- Assurance over sustainability reporting

- Sustainable finance reporting and assurance

- IFRS advisory

- IFRS advisory and assurance services over Australian Carbon Credit scheme

Proven clean energy assurance experience

Our comprehensive range of audit and assurance services covers all schemes overseen by the Clean Energy Regulator and Climate Active including:

- National Greenhouse and Energy Reporting

- Emissions Reduction Fund

- Soil carbon

- Savanna fire management

- Reforestation projects

- Renewable Energy Target

- Safeguard mechanism

- Emissions intensive trade exposed

- Climate Active verification audits

- Carbon Disclosure Project (CDP)

These assurance services focus on the following key aspects:

- Verification of reported emissions reductions data to ensure accuracy and completeness.

- Reviewing carbon abatement estimation tools, such as SavCAM, FullCam, GIS abilities

- Review interaction with the guarantee of origin (GO) scheme and offsets integrity standards

- Verification of project activities to ensure they meet the eligibility requirements under the ERF

- Identification and reporting of any potential non-compliance issues that may arise during the auditing process

- Providing guidance and support to help businesses navigate the reporting and auditing requirements under the ERF

- Our expertise in auditing for the clean energy sector allows us to help businesses meet their compliance obligations under the ERF and contribute to Australia’s emissions reduction goals.

Clean Energy Assurance Services: Comprehensive audit and assurance services covering Clean Energy Regulator and Climate Active schemes, including safeguard mechanism, emissions reduction fund, renewable energy target exemptions, and climate active verification. We ensure accuracy, eligibility, and compliance, supporting businesses in meeting emissions reduction goals.

Indigenous Business Services: Tailored services for Indigenous organisations and individuals, empowering them with culturally aligned solutions. We work with Native Title Aboriginal Corporations, Aboriginal-owned businesses, government agencies, and non-Aboriginal corporates partnering with Indigenous businesses. Our services range from financial management to regulatory examinations, supporting economic growth.

Deceased Estates Services: Expert support for Executors, Court Appointed Administrators, and legal representatives navigating the complex tax and compliance obligations of Deceased Estates. We manage everything from final and outstanding tax returns to capital gains tax events, testamentary trust reporting, and ATO liaison. Our services include preparing financial accounts, beneficiary statements, and private binding ruling applications, as well as assisting with SMSFs and Testamentary Charitable Trusts. With clear advice and precise implementation, we ensure estates are finalised efficiently and in full compliance.

In today’s era payroll emerges as an organisation’s lifeblood, underscored by the importance of transparency, compliance, and corporate accountability.

While payroll compliance ought to be the crowning jewel in an employer’s compliance agenda, the payroll compliance function often remains reactive and relatively unsophisticated, lagging behind other obligations like tax or financial accounts.

The heart of this complexity lies in the negotiation of pay entitlements, often struck between employers and employee bodies with distinct objectives. SW offers a holistic, multidisciplinary approach to payroll advisory, combining our expertise in payroll operations, systems, wage compliance, and processes and controls.

Our track record includes involvement in Australia’s major wage remediation programs, giving us a deep understanding of the standards required for third-party reviews and regulatory scrutiny.

Challenges in payroll

Overcomplicated payroll processes

Often, those tasked with negotiating pay entitlements might not have extensive experience in translating these into operational payroll processes. This can lead to rules that are both intricate and ambiguous.

Software limitations

Globally, the market for payroll and time & attendance software is not expansive. For Australian operations, many systems necessitate significant customisation to align with local requirements.

Adapting in-house payroll

As scrutiny and expectations intensify, internal payroll operations are swiftly evolving. Yet, the workforce’s upskilling to meet these advanced roles is a gradual progression.

Our approach

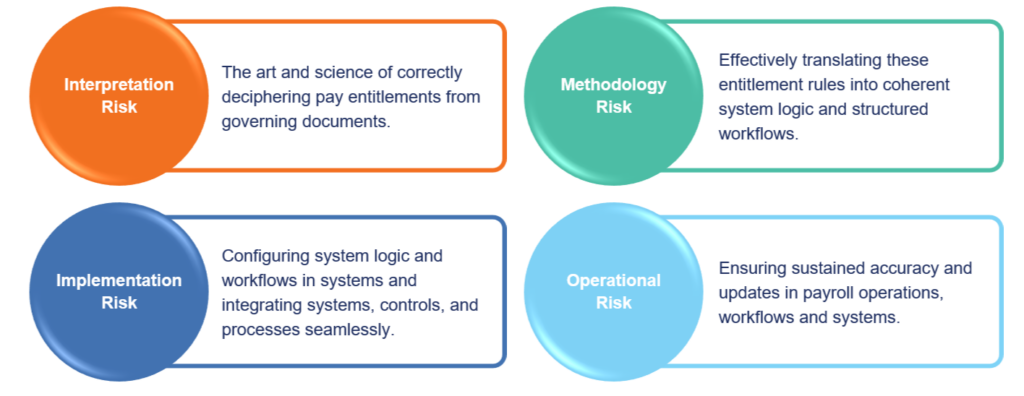

We anchor our approach in four core pillars of risk, crafting our services to resonate with each client’s individual circumstances.

Payroll has evolved to become much more complex

Historically, the emphasis on payroll compliance has been process-oriented. However, contemporary challenges require an ability to identify risks with legal interpretation, payroll calculation methodologies, payroll systems and implementation of payroll systems, payroll processes and controls and the risks that can arise when running payroll.

Recognising the unique nature of each client’s payroll environment, we offer bespoke solutions based on:

- Technology systems in use

- Pay environment complexity

- Payroll function capability

We advocate for a co-sourced integrated service model, partnering with you for continuous improvement in the payroll function.

Our top-down approach encompasses:

- Understanding Payroll Governance | Identifying risks in people, systems, processes and pay rules

- Developing or adding to a Payroll Compliance Plan | Addressing identified risks and suggesting projects

- Co-sourcing execution | Collaboratively implementing the plan.

Our specific offerings

Superannuation is an integral part of planning for your retirement.

The growing complexity of the superannuation sector has led to the need for consumers with a SMSF to be better informed about the quality of advice accessed. SMSF specialisation recognises Chartered Accountants who have undertaken specific, relevant study, and have a level of experience necessary to be a specialist in the field. SW prides itself on being able to provide this specialised service, and our qualified team offer a holistic service responsive to individual needs and concerns.

SW looks after all facets of superannuation, including:

- Setting up SMSFs

- Auditing of SMSFs

- Statutory reporting

- Administration systems

- Strategies to access your superannuation in retirement

- Transition to retirement strategies

- Managing all aspects of compliance regarding complex SMSF investments, pensions, and limited recourse borrowing arrangements.

Our experienced team work closely with business owners, management teams, directors and boards to provide practical support for your growth and success. Sustaining or expanding a successful business requires a relationship with a trusted advisor. In real terms, we know that you want someone that you can have the challenging conversations with in relation to your strategic, operational and financial position.

We can support you with a range of services, including:

- accounting and taxation compliance

- business advisory

- business health check

- business and financial structures

- corporate governance

- international business advisory

- outsourced accounting solutions

- performance improvement

- process and system improvement

- strategic planning

- succession planning

- wealth management and estate planning.

We assist with the successful design or transformation of your organisation’s governance, systems, processes and culture.

The nature of the Risk Advisory services we provide reflect the purpose for which they are needed by your organisation and can be tailored to meet your specific risk needs, across the following areas:

- strategic

- operational

- foundations & compliance

- governance & culture

- crisis, resilience & reputation

- financial

- regulatory

- cyber, IT & technology.

Our team use international Internal Audit standards, following a risk-based methodology. Through this approach, we understand that better practices need to be practically applied and proportionate to the nature of the risk and your organisation’s risk appetite and growth expectations.

We understand the value of engaging with stakeholders across your organisation, management and the board and have experience across all industry sectors.

Assurance services

Our Assurance services assist a business to review enterprise, functional or project controls and provide an independent view on their design and operating effectiveness. These services span a range of risk areas. For further detail, please download our brochure.