Never a dull moment in US politics and tax policies – the proposed section 899 has come and gone in a matter of weeks. What are the ramifications for Pillar Two?

Just few weeks after the US Congress passed the One Big Beautiful Bill Act (the OBBBA), including the controversial Section 899 ‘revenge tax’, the Senate has implemented a number of changes to the OBBBA. The revised version of the OBBBA excludes this revenge tax. This change comes after a recommendation from US Treasury Secretary Scott Bessett to remove the tax as part of a deal with the G7 nations (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States). This removal follows widespread concern that the tax was expected to reduce foreign investment into the US costing US jobs.

This version of the OBBBA narrowly passed in the US Senate on 1 July 2025 with Vice President Vance casting the tie breaking vote. Now the OBBBA needs to be reconsidered by Congress prior to the 4 July deadline self-imposed by President Trump.

Arising from the deal with the G7 nations is the newly proposed ‘side-by-side’ solution, whereby US-parented multinational groups would be exempt from the Income Inclusion Rule (IIR) and the Undertaxed Profits Rule (UTPR) under the Organisation for Economic Cooperation and Development’s (OECD) Pillar Two. This is on the basis that the US has its own domestic minimum tax rules.

The removal of proposed Section 899 is great news for Australian entities with investments and/or business interests in the US. This is because there will not be an increase of 5% per annum, for up to an additional 15% beyond the existing reduced treaty rate. Furthermore, no change to the minimum tax of 10% imposed on large corporations per the base erosion and anti-abuse tax (BEAT) regime.

Considering the US parent group exemption is struck between the US and G7 nations (which does not include Australia), the impact on Australia’s implementation of Pillar Two is currently unclear. This is a live issue for multinationals, given the IIR and DMT, and UTPR apply to income years starting 1 January 2024 and 2025, respectively.

G7 statement on global minimum taxes

Following the signing of executive order in January this year by President Trump to ‘defend US tax sovereignty’ and outlining concerns regarding the Pillar Two rules agreed by the OECD/G20 Inclusive Framework (representing over 140 countries), the US and G7 nations came to a joint understanding in their recent summit addressing global minimum tax and tackling tax planning and avoidance. The ‘side-by-side’ arrangement is based on the following principles:

- Multinationals with a US parent will be fully exempted from the application of UTPR and IIR (i.e. 15% minimum corporate tax) with regard to domestic and foreign profits

- commitment to identifying substantial risks, including base erosion and level-playing concerns

- simplifying Pillar Two administration and compliance framework

- considering changes to Pillar Two treatment of substance-based non-refundable tax credits aligning with treatment of refundable tax credits.

In return for the US parented group exemption, the proposed section 899 ‘revenge tax’ has been removed from the Senate bill, which was passed overnight.

What this means to Australia (and Pillar Two)

The removal of section 899 will be welcomed by Australian groups that invest and conduct business in the US. This is particularly relevant for superannuation funds taxed at 15% in Australia, where the additional US tax could not be credited and would have directly and immediately impacted investment returns.

This G7 announcement also represents a landmark change to the international tax environment as Pillar Two was developed due to global concerns over the digital economy and base erosion, which worsened in the past two decades.

Noting the Australian domestic minimum tax and IIR, and UTPR affect income years commencing 1 January 2024 and 2025, many practical issues remain unsolved:

- As this is a G7 agreement, would it be approved under the broader OECD inclusive framework, representing more than 140 countries?

- How would the US entity exclusion play out at the global and Australian domestic level, and will there be roll-back of the legislation, given the intention of these laws is predominantly to target US multinationals?

- What is the adverse impact on Australian multinationals since the exclusion provides a structural tax advantage to US multinationals?

- Would there be any side deals between Australia and other jurisdictions?

- How would the Commissioner (and the ATO) administer the law in the interim while negotiations take place, given a full year has passed since the legislation came into effect?

How SW can help

The ever-evolving nature of US and global tax policies require continued vigilance from Australian entities and their advisors.

SW will monitor and keep you informed as developments happen.

Reach out to your SW contact or our specialist tax contacts listed in this alert for advice.

Contributors

General interest charge (GIC) and Shortfall Interest Charge (SIC) incurred from 1 July 2025 will no longer be deductible, increasing the after tax cost of carrying a tax debt.

Taxpayers have historically been able to claim tax deductions for GIC and SIC imposed by the ATO. This helped offset the financial burden of these penalty interest charges which are designed to encourage timely tax payments.

However, the Treasury Laws Amendment (Tax Incentives and Integrity) Act 2025, which received Royal Assent on 27 March 2025, changes this treatment.

From 1 July 2025, any GIC or SIC incurred will not be deductible regardless of whether the debt relates to an earlier income year. If you have a Substituted Accounting Period (SAP), these changes will apply to you from your next accounting period starting after 1 July 2025.

These changes aim to encourage timely and accurate tax payments by increasing the financial cost of tax debt.

Background

Understanding the nature of these interest charges is fundamental to grasping the significance of this change.

- General Interest Charge applies when any tax liability or related amount remains unpaid beyond its due date, accumulating daily on a compounding basis until the debt is cleared.

- Shortfall Interest Charge operates differently. It applies when tax returns are amended and reveal that insufficient tax was originally paid, with the charge calculated daily from the original due date until the amended assessment is issued.

The timing of when interest charges are “incurred” becomes critically important under the new rules. Interest charges are considered incurred when the ATO issues an assessment, not when they accrue daily. Thus, an amended assessment issued on 30 June 2025 would result in fully deductible SIC, while the same assessment issued two days later would be non-deductible, regardless of how much of the interest period relates to pre-July 2025.

The legislation also addresses the corresponding treatment of remissions, creating a logical symmetry in the tax system. Since GIC and SIC will no longer be deductible when incurred after 1 July 2025, any subsequent remission of these charges by the ATO will no longer need to be included as assessable income.

Who is impacted?

Every Australian taxpayer with a tax debt is affected but the impact depends on individual circumstances.

Small and medium enterprises face the most severe consequences, representing a significant portion of the ATO’s collectable debt and often have limited access to alternative financing. These businesses frequently rely on ATO payment plans during cash flow difficulties, making the increased cost burdensome.

Taxpayers with existing ATO payment arrangements extending beyond 1 July 2025 need particular attention as any GIC accruing after this date will be non-deductible even if it relates to pre-existing debt.

What is the impact?

The financial impact goes beyond the immediate loss of tax deductions. Effective costs of GIC increased to full statutory rates, making the ATO debt among the most expensive forms of financing for businesses, often more costly than loans or credit facilities.

Cash flow planning becomes more complex as businesses must budget for the full cost of any potential tax penalties. The change also affects the strategic value of voluntary disclosures as the cost of resulting SIC cannot be partially offset through tax deductions.

Resultantly, the measure creates hardship for taxpayers already in financial difficulty. Unlike commercial lenders offering payment holidays or restructured terms during hardship, the ATO’s remission process remains rigorous and uncertain. This could force businesses to seek more expensive emergency financing rather than manage their tax debt through extended payment arrangements.

For professional advisors, the change necessitates more proactive tax planning and closer monitoring of compliance deadlines. The increased cost of penalties makes preventive advice more valuable while raising stakes for compliance failures.

Steps to take

Settle outstanding tax debts and review current arrangements

Immediate action is required before 1 July 2025 to minimise exposure to non-deductible charges. Taxpayers should prioritise clearing any outstanding tax liabilities by reviewing and accelerating existing payment arrangements with the ATO.

Where full payment is not possible, exploring alternative financing options with deductible interest should be considered.

Professional review of tax compliance processes can prevent future GIC and SIC charges. You can avoid payment delays by implementing robust systems to meet lodgement deadlines, ensuring accurate self-assessment, and establishing better cash flow forecasting.

Consultation and planning

For taxpayers with complex affairs or with previously incurred regular penalty charges, professional advice should be sought immediately. Consultations should focus on:

- compliance improvements,

- alternative financing strategies,

- and understanding specific timing implications of the new rules.

Businesses should review their financial forecasting and budgeting processes to factor in increased cost of any future tax penalties. Additionally, insurance products or facility arrangements providing emergency tax funding should be explored for comprehensive risk management.

How SW can help

SW can help you navigate this significant transition through urgent pre-30 June 2025 reviews of current tax positions and outstanding liabilities.

We can guide you on opportunities for voluntary amendments remaining fully deductible, assist with clearing your existing debts before the deadline, and analyse more cost-effective financing arrangements that are than extended ATO payment plans incurring non-deductible interest charges from July 2025.

We can also discuss ways to strengthen your tax compliance framework. This includes implementing robust systems to prevent future penalty charges, restructuring cash flow planning to account for the higher after-tax cost of tax debt, and providing expert advocacy when ATO remission applications may be warranted.

Our comprehensive approach ensures clients understand the technical timing complexities of these changes and practical steps needed to minimize their long-term financial impact.

Contributors

On 22 May 2025, the United States (U.S.) House of Representatives passed section 899, a retaliatory and penalty tax targeting inbound investments to the U.S. by foreign entities from countries (including Australia) imposing ‘discriminatory taxes’ against U.S. entities.

As part of the One Big Beautiful Bill Act (the Bill) passed by the U.S. House of Representatives, section 899 Enforcement of Remedies Against Unfair Foreign Taxes will be introduced to the Internal Revenue Code and expected to affect Australian entities from 1 January 2026. This is implemented as a retaliatory tax against foreign countries that the U.S. deems to have ‘unfair foreign taxes’ imposed on U.S. multinationals and individuals operating overseas. The Bill will now go to the U.S. Senate, where passage is likely but not assured.

As Australia will satisfy the definition of a discriminatory foreign country (DFC) this tax will adversely impact all Australians who invest or do business in the U.S. Australian taxpayers will have an additional 5% of tax levied upon their U.S. source income and certain capital gains in the first year and increasing by 5% annually. The section intends to override the reduced treaty rates under the U.S. – Australia Double Tax Agreement (DTA), but the agreed rate is used as the baseline for subsequent increases and capped at 20% above the statutory rate.

Background

On 20 January 2025, President Trump signed an executive order declaring that the OECD global tax deal does not apply to the U.S. A memorandum followed, warning that the U.S. would retaliate against any foreign country imposing unfair or extraterritorial taxes on U.S. citizens or companies.

Under the proposed section 899, a DFC is a country that has any of the following in force:

- Digital service tax (DST),

- undertaxed profits rule (UTPR) under the Pillar Two GloBE rules,

- diverted Profits Tax (DPT), or

- extraterritorial/discriminatory taxes that the U.S. Treasury deems to be borne disproportionately by U.S persons.

Whilst the Treasury Secretary must issue quarterly reports listing DFCs, Australia is on the ‘blacklist’, considering the ‘bad’ taxes DPT and DST have been in force since 2018 and the UTPR commenced on 1 January 2025.

Who is affected

The proposed Section 899 levies an additional tax on ‘applicable persons’, defined as any of the following entities:

- Governments of a DFC,

- individuals (other than a U.S. citizens/resident) who are tax residents of a DFC,

- foreign corporations that are tax residents of a DFC, other than U.S.-owned corporations,

- private foundations created or organised in a DFC, broadly not-for-profits,

- any foreign corporation, other than a publicly held corporation, that is more than 50 percent owned (by vote or value) directly or indirectly after applying certain attribution rules by other applicable persons,

- any trust (including a complying superannuation fund) for which the majority of beneficial interests are held by applicable persons (above); and

- foreign partnerships, branches, and any other entity identified by the Treasury Secretary concerning a discriminatory foreign country.

How Section 899 tax applies

Section 899 provides for increased rates of tax with the five categories:

- Effectively connected income (i.e. business income) – currently 21%,

- US source non-effectively connected income (i.e. investment income) – currently 30%,

- branch profits tax – currently 30%,

- gain on disposal of U.S. real property – currently 15%, and

- income received from foreign private foundations – currently 4%.

The tax rate would be a 5% increase in the first year and would increase by 5% each year after.

By way of examples:

- Under the US – Australia DTA, withholding tax (WHT) on a ‘portfolio interest’ (i.e. <10% interest) dividend is 15%. The initial tax liability under section 899 would increase the WHT from 15% to 20% instead of 30% to 35%. The potential liability is capped at 50% (being statutory rate of 30% + cap of 20%).

- The tax rate applicable to the business income of a foreign company is potentially 41% (corporate tax rate of 21% + cap of 20%)

When would it apply

If the Bill passes U.S. Senate, section 899 would apply to Australian entities from income years commencing 90 days after the date of enactment. Given the U.S. has a 31 December year end it is expected that this would commence from 1 January 2026.

Should we be concerned

The constant changes in U.S. fiscal and economic policies mean that we are living in a world of uncertainties and financial pain. Whether you are a multinational or an individual with superannuation savings, you will be adversely impacted by this proposed tax.

Australian entities should evaluate the impact of the proposed tax if they

- invest in U.S. assets,

- have subsidiaries or branch in the U.S.,

- derive dividend, interest, royalties or other income sourced from the U.S.,

- derive salaries (or similar income) that are taxed in the U.S.,

- have made tax equalisation payments in relation to expatriates working in the U.S.

How SW can help

SW will continue to monitor and keep you informed on a timely basis on further developments in this space.

We encourage you to discuss with your SW contact or the specialist tax contacts listed in this alert on how the proposed tax may impact you.

Contributors

With the Federal Election now run and won, the Federal Labor Government will re-introduce its proposed legislation – Division 296 – Better targeted superannuation concessions.

The legislation targets individuals with a Total Superannuation Balance (TSB) above $3 million held across all super funds regardless of accumulation or retirement phase.

Under the previously proposed legislation that lapsed prior to the election, the proposed start date was 1 July 2025.

The Division 296 tax introduces a 15% tax on earnings from superannuation balances that exceed $3 million at the end of each financial year.

This tax does not apply to the total superannuation balance, only earnings attributed to the balance above $3 million.

The current proposed legislation does not index the $3 million threshold.

Calculating the Division 296 tax liability

Calculation of earnings

Earnings = (TSB at the end of the current year + Withdrawals – Net Contributions) – TSB previous financial year

Calculation of proportion earning attribute to balances above $3 million

Proportion of earnings = (TSB at the end of the current year – $3 million)/TSB previous financial year

Calculation of tax liability

Tax liability = 15% x Earnings x Proportion of Earnings

Example calculation

Pete has the following balance in superannuation as of:

- 30 June 2026 – $4,000,000

- 30 June 2027 – $4,300,000

During the year Pete contributed $30,000 to superannuation

During the year Pete withdrew via an account-based pension $80,000

Earnings = ($4,300,000 + $80,000 – $30,000) – $4,000,000 = $350,000

Proportion of Earnings above $3 million = ($4,300,000 – $3,000,000)/ $4,000,000 = 32.5%

Tax Liability = 15% x $350,000 x 32.5% = $17,062.50

Payment of Division 296 tax liability

The individual will choose how to pay, either paying the tax personally or releasing funds from superannuation.

Taxation of unrealised gains

As a result of the calculation, Division 296 taxes unrealised gains. This means that superannuation members will be taxed on the increase in the value of their investments even if the investment has not been sold or disposed of.

Some superannuation funds that hold illiquid assets such as property or unlisted investments may be compelled to sell assets prematurely or in adverse market conditions.

Division 296 losses

When the earnings are negative, these amounts can be carried forward so long as the TSB is greater than $3 million at the start or end of the year. These amounts can be offset against future positive earnings before applying the proportion calculation.

How SW can help

At this stage it is unclear what the final legislation will look like, or if indeed the start date will be 1 July 2025.

Valuations will be scrutinised for assets that do not have a readily available market price such as property and unlisted investments.

Keeping funds in superannuation remains the most tax-effective choice for some members.

There is still time to assess the impact of the proposed legislation to implement strategies prior to 30 June 2026.

Superannuation members should wait until the final legislation is passed before withdrawing large superannuation balances. Once funds are outside superannuation you may not be able to re-contribute them back.

You should seek professional advice from your SW contact as each superannuation member’s taxation circumstances will differ.

State Government focuses on balancing the operating budget and providing cost of living relief for families, but questions remain over how the States ballooning debt burden will be significantly reduced by this Budget.

Our experts explore the key takeaways from the 2025/26 Victorian State Budget and answer what’s on the table for businesses, industries and communities across Victoria- uncovering opportunities of resilience and growth for your financial landscape.

Relevant observations of the Victorian Budget 2025-26 include the following:

- While the Budget focuses on providing cost of living relief to Victorians, it does little to tackle the State’s debt which is forecast to reach a record $194 billion within four years. Notably, the Budget’s operating surplus of $600 million is $1 billion less than was forecast in December. While Victoria will spend $6.5 billion in new initiatives in 2025-26 only half of that will be offset through savings. This will result in a net increase of $3.1 billion in new spending compared to last year’s budget.

- While no new taxes have been introduced in the Budget, taxation revenue is forecast to be $41.7 billion in 2025-26 and grow by an average of 4.7% per year over the forward estimates.

- Despite the ongoing fierce debate around the fire services levy and emergency services and volunteers fund levy (ESVFL) (which will come into effect from 1 July 2025), the Budget forecasts that the ESVFL will generate $1.6 billion in 2025-26. This indicates that it is unlikely that the Government will remove or amend the ESVFL, which would create a substantial shortfall in the Victorian Government’s revenue that would cause its thin operating surplus to go into deficit.

What does the State Budget mean for you?

Our Fast Facts provide an overview of the budget insights and highlight potential opportunities for you.

Take a look at what the Victorian State Budget mean for you in 2025 below:

Contributors

The Australian Taxation Office (ATO) has upcoming reporting obligations for entities offering employee share schemes (ESS). Find out how the Complete Tax Solutions Employee Share Scheme (CTS ESS Toolkit), our ATO-approved software, can help you meet these requirements efficiently and accurately.

Upcoming ATO reporting obligations

The ATO requires employers who issue shares or share options to employees to complete their reporting obligations. The deadlines to comply with the reporting requirements are:

- ESS statements are due to be issued to employees by 14 July 2025,

- ATO reports are due for lodgement with ATO by 14 August 2025.

What do the ATO reporting obligations mean for you?

Our innovative solution | CTS ESS Toolkit

Our CTS ESS Toolkit, an ATO-approved and compliant software, enables employers to simplify their online annual employee share scheme reporting obligations.

We are one of only a handful of providers to have passed ATO testing and have ATO approval for our specialised software. Using the CTS ESS Toolkit, SW has been successfully working with businesses to meet their ESS lodgement requirements.

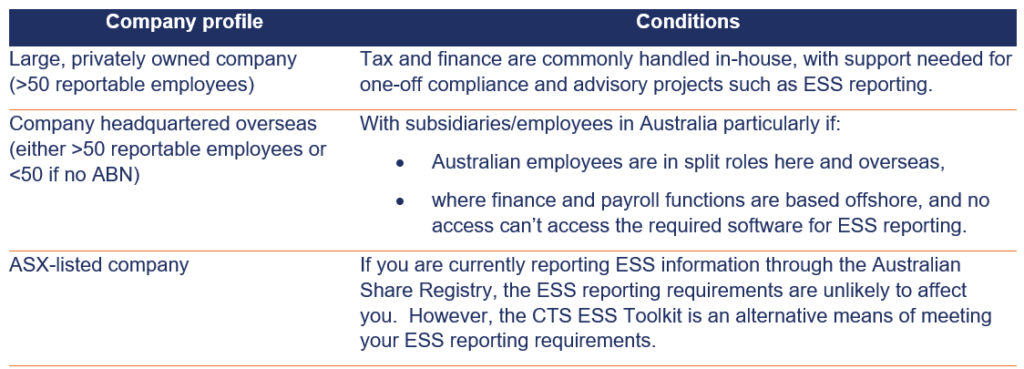

The table below outlines the types of companies that are most likely to benefit from using the CTS ESS Toolkit.

Significant global entities (SGE)

SGEs are entities that have an annual global turnover of A$1 billion or more. SGEs are subject to increased Failure to Lodge (FTL) penalties for late lodgement of every ATO document or approved form. The SGE penalties are currently $165,000 for each 28 days in which an approved form is lodged after the due date up to a maximum of $825,000. The lodgement of ESS reporting falls within this definition.

The public officer of the company is responsible for the company’s obligations under the income tax law, including the timely lodgement of approved forms with the ATO. If your company is part of an SGE, we recommend implementing systems for timely lodgements of ESS reports with the ATO.

How SW can help

There is limited time to meet ESS reporting requirements. The ATO is particularly emphasising on ensuring corporates comply with timely and accurate reporting obligations.

Now is the time to ensure your business is prepared for reporting season. We offer a fully outsourced service or license our software.

Please contact Sam Morris or Justin Batticciotto to learn how to comply with the ATO reporting requirements and discover how our CTS ESS Toolkit can assist.

Contributor

The ATO has introduced an annual self-review return requirement for non-charitable NFP organisations with an active Australian Business Number (ABN) to confirm their eligibility for income tax exemption. The inaugural NFP self-review return for the 2023–24 income year was due by 31 March 2025.

Please refer to our previous article for details on the questions found in the return.

What happens if you lodge your return late?

If your NFP has missed the 31 March 2025 deadline, it is important to submit the return as soon as possible. The ATO has suspended penalties for late lodgement of the 2023-24 return with its transitional support for the NFP sector.

From July 2025, the ATO will review NFPs that intentionally ignore their obligations and non-compliant NFPs may face further scrutiny and potential tax liabilities.

Steps to take if you haven’t lodged yet

If your NFP has not yet submitted the return, the following steps will help you fulfil your obligations and demonstrate to the ATO you’ve taken action:

Lodge your return immediately

NFPs can submit their self-review return using the ATO’s Online Services for Business or the self-help phone service at 13 72 26. A registered tax agent can also assist with lodgement.

Updating your NFPs ABN details

Accurate ABN details are essential for tax-exempt eligibility. If your organisation’s details have changed, update them via:

- submitting a Change of Registration Details form.

If a Change of Registration Details form has already been lodged and is pending, the ATO will acknowledge this during their records review.

Future compliance and potential reviews

The ATO is committed to supporting NFPs that make genuine efforts to meet their obligations. However, from July 2025, organisations that ignore their self-review return requirements and fail to engage with the ATO may face:

- compliance reviews

- financial penalties and

- loss of income tax exemption.

How SW can help

To avoid repercussions and maintain compliance, ensure your organisation submits the self-review return as soon as possible and keeps up with ongoing reporting requirements.

Our NFP experts can assist with the preparation and lodgement of the return and assess your border eligibility for income tax exempt status.

Contributors

支柱二实施了一套全球最低税框架,旨在确保跨国企业按公平原则纳税,不论其经营所在地。

本常见问答栏目针对支柱二的实施、对企业的影响以及合规要求这几方面的重要问题提出了看法。无论贵公司想了解实际税率、报告义务还是豁免,都可以在此找到清楚扼要的答案。

Last night the 2025 Federal Budget was handed down by the Treasurer aiming to address inflation, higher interest rates and cost of living.

Australia is facing significant economic challenges, and some predict a difficult time ahead. With inflation, tariffs, interest rates, the cost of living, and housing pressures rising—alongside a decline in exports—Australians want to know what is in Treasurer Jim Chalmers’ cookbook to tackle these issues and what solutions he can put on the table for the country.

We explore the key takeaways from the 2025/26 Federal Budget and answer what’s on the table for businesses, industries and communities across Australia- uncovering opportunities of resilience and growth for your financial landscape.

What does the Federal Budget mean for you?

Our Fast Facts provide an overview of the budget insights and highlight potential opportunities for your sector.

Take a look at what the Federal Budget means for you in 2025:

Follow us on LinkedIn to receive the latest updates on Federal Budget and other important industry news.

Pillar Two introduces a global minimum tax framework aimed at ensuring multinational enterprises pay a fair level of tax, regardless of where they operate.

This FAQ section addresses key questions about its implementation, impact on businesses, and compliance requirements. Whether you’re looking for insights on effective tax rates, reporting obligations, or exemptions, you’ll find clear and concise answers here.