As part of the State Taxes Acts and Other Acts Amendment Bill that has been introduced to Parliament, the Allan government is set to expand the Vacant Residential Land Tax (VRLT) from 1 January 2025 to apply statewide. Currently, the VRLT applies to only inner and middle suburbs of Melbourne.

VRLT will continue to be payable at 1% of capital improved value of residential property that has been vacant for at least 6 months in a calendar year. The change will take effect from 1 January 2025, effectively capturing land which is vacant for more than 6 months during 2024. VRLT will also expand to apply to residential land that remains undeveloped for five years or more from 1 January 2026.

The existing exemptions for holiday homes and properties being renovated will remain in place. Developers that currently hold vacant land will receive a two-year extension, if they have received a building permit in the initial five-year period in which the land is vacant.

The State Revenue Office (SRO) will have the power to extend the five-year period in certain circumstances that are beyond the control of the developer. The SRO will also have considerable discretion to determine exemptions.

Underlying reasons for the changes

These changes come as part of the government’s push to meet its target to build 80,000 extra homes per year.

The changes look to put pressure on Victorian owners of vacant homes and land to make the homes available for rent or sale and develop vacant land. This much was confirmed in Treasurer Tim Pallas’ speech to the Property Council in which he stated that the “clear message to landowners is to either develop land or sell it to someone who will”.

Impacts

The impacts of the current and new measures are outlined as follows:

| Current | New | |

|---|---|---|

| Homes captured | Approximately 900 homes captured under the VLRT. | An additional 700 homes to be captured in the state-wide expansion. |

| Undeveloped properties | Approximately 3000 to be captured in the expansion |

In focus

Statewide expansion from 1 January 2024

- references to a ‘specified geographic area’ will be removed from the Land Tax Act 2005, allowing the VRLT to be expanded to include all vacant residential property statewide

- the current exemptions will still apply

- the tax rate will remain at 1 per cent.

Undeveloped land from 1 January 2025

The VRLT will apply to vacant residential land that has been vacant for 5 years or more if the land is:

- within a municipal district of a Council listed in the new Schedule 2B (essentially all Melbourne Metropolitan local government areas), and

- within a zone other than a ‘non-residential zone’ (these are based on AVPCC numbers specified in the Bill), and

- not solely or primarily used for or under development for a non-residential use.

This 5-year period will apply in instances where the land has had the same ownership during the 5 year period.

Land is under development for a non-residential use if:

(a) an application is made for a permit 10 under the Planning and Environment Act 1987 in relation to the use or development of the land for a non-residential use; or

(b) a request is made under the Planning and Environment Act 1987 for an amendment to a planning scheme that would authorise a non-residential use of the land; or

(c) an application is made for a permit or 20 approval under the Building Act 1993 in relation to the use or development of the land for a non-residential use.

Exemptions from the VRLT is available for:

- land contiguous to land used as a principal place of residence where it has the same owner

- land that cannot be developed for residential purposes due to its physical attributes, or where a matter prohibits lawful use or development, such as a restrictive covenant or environmental orders.

Commissioner discretion

- The Commissioner of State Revenue will be granted significant discretion to grant exemptions from VRLT if:

- Land is intended to be solely or primarily used or developed for non-residential use; and

- There is an acceptable reason for the land not yet being used or developed in that way.

- The Commissioner has the power to determine that land is ‘not vacant’ if a residence is to be constructed and there is an acceptable reason that this has not commenced.

- The Commissioner may impose the VRLT under its discretion if the land is deemed to have been transferred with the intention of receiving a reduction or exemption.

Full details are outlined in the Bill which is currently before parliament and the accompanying Explanatory Memorandum. Debate on the Bill will resume later this month, with it being likely that the Bill moves to the Legislative Council in November.

How SW can help

Reach out to our state taxes experts if you would like to discuss the potential impact of these changes on your current or future property or land holdings. The SW team can also assist with applying to the Commissioner for exemptions, where applicable.

Contributors

The New South Wales (NSW) Chief Commissioner’s guidelines on stamp duty and property leasing provide essential guidance for calculating the dutiable value of complex lease agreements.

Understanding these rules is vital for developers, landholders, and businesses involved in leasing property, especially with conditions that require the lessee to undertake construction or improvements. This article aims to explain the guidelines, discuss their impact, and offer actionable insights for clients.

Introduction

Stamp duty is a tax levied on particular transactions, such as sales and leases of real estate. While it’s a straightforward affair in most circumstances, complex leases involving non-monetary considerations, like property improvements or long-term conditions, can be complicated. The NSW Chief Commissioner’s guidelines offer examples and conditions under which dutiable value is calculated differently than one might expect.

The Impact

Understanding the guidelines has immediate implications for businesses and developers. Depending on the length and conditions of the lease, dutiable values can differ significantly:

Long-Term Leases:

Leases exceeding 50 years may have a dutiable value of nil, thereby avoiding stamp duty.

Conditional Leases:

Conditional leases often involve stipulations where the lessee (tenant) must undertake certain actions like construction or significant property improvements either as a condition to the grant of the lease or as a condition of the lease itself.

If a lease is granted for non-monetary consideration comprising improvements to the property, the full cost of the construction (including builder margins) undertaken or to be undertaken by the developer is taken to be the value of the improvements. This value is determined on entry into the agreement for lease or a lease.

In the absence of evidence of the valuation of the undertaking, the Chief Commissioner has stated in Circular Practice Note (CPN027) that he is prepared to use the following methodology to calculate the proportion of the value attributable to the improvements:

| Term of Lease | % of cost of improvements |

|---|---|

| 10 years or less | 100 |

| Greater than 10 but not more than 20 years | 75 |

| Greater than 20 but not more than 30 years | 50 |

| Greater than 30 but not more than 50 years | 25 |

| Greater than 50 years | nil |

| Periodic lease or lease for a term that cannot be ascertained when the lease is made | 100 |

For instance, in a 15-year lease where the lessee is obligated to make improvements worth $20 million, the dutiable value for calculating stamp duty would be 75% of the improvement costs, which amounts to $15 million.

Here are some other key points to note for a conditional lease:

- Valuation Reports: In certain cases, you can provide a professional valuation report to show that the future value of the improvements you have made will be less than the original cost of those improvements. This can help in lowering the stamp duty payable

- Compliance and Documentation: It’s essential to maintain complete documentation of the improvements carried out, including permits, invoices, and reports, to substantiate the dutiable value calculated based on improvement costs

- Implications for Tenants and Landlords: Tenants must be aware that the costs of improvements could impact the dutiable value, while landlords need to consider how these conditions might affect the lessee’s ability to carry out the lease terms.

Premium and Prepaid Rent:

Leases may involve upfront payments, which are often categorised as premiums or prepaid rent. These payments can significantly influence the dutiable value of the lease, and consequently, the amount of stamp duty that may be payable.

In many instances, upfront payments serve as the total consideration for the lease. As a result, these payments could either inflate the dutiable value or, in some situations, completely negate the requirement for stamp duty, depending on the lease terms and other conditions.

For example, consider a scenario where XYZ Pty Ltd enters into a 15-year lease for an industrial building with a prepaid rent of $15 million. The lessee has the option to satisfy this prepaid rent either through a cash payment or by undertaking construction improvements with an agreed value of $20 million. In the event of an early termination of the lease for reasons other than the lessee’s default, the lessee would be entitled to a proportionate refund of the prepaid rent. No stamp duty is payable on this lease arrangement, regardless of whether the lessee opts for a cash payment or construction improvements, as both options are considered to be forms of prepaid rent

Failure to grasp these nuances could result in incorrect stamp duty payments, leading to financial and legal repercussions.

Other Transactions Triggering Duty

In addition to standard leases, there are various other transactions that could also attract stamp duty, according to guidelines set out in CPN027. These include:

- Early Termination by Lessor: When a lessor terminates a lease early for specific reasons, such as granting a new lease to another lessee or selling the premises, duty may be payable on any consideration for these arrangements

- Legal Fees over $1,000: If a lessee pays or agrees to pay the lessor’s legal fees, which are non-refundable and greater than $1,000, then duty may be applicable. However, this does not apply to the extension or renewal of a lease where legal fees are paid as rent

- Option to Lease for a Premium: An option to lease land in NSW for a premium may be dutiable

- Assignment of Lease: The transfer or assignment of an existing lease can also attract stamp duty

- Novation of Agreement: Modifying the parties in an agreement for a lease could trigger stamp duty

- Attornment of Leases: In cases of attornment on the sale of a property, stamp duty may also be applicable.

Actions Clients Need to Take

Property leasing can be complicated. We recommend the following steps:

- Consult a Tax Advisor: Given the complexities, consulting a tax advisor is paramount for ensuring compliance and financial optimisation

- Conduct Valuation: If property improvements are involved, get a valuation to establish a dutiable value

- Document Thoroughly: Keep thorough records of lease terms, conditions, and any upfront payments or improvements made

- Stay Updated: The Chief Commissioner’s guidelines may evolve. Regularly review any updates to remain in compliance

- Liaise with Legal Teams: Ensure that all legal aspects are squared away, especially in leases involving intricate conditions or non-monetary considerations.

How SW can help

Understanding the NSW Chief Commissioner’s guidelines is essential for any party involved in complex property leasing situations. SW experts can provide professional advice to help you keep abreast of these rules, helping to avoid surprises in the future.

Contributor

The Australian Taxation Office (ATO) has finalised Taxation Ruling TR 2023/3, an update to the draft ruling TR 2021/D5. This ruling, effective from 1 July 2019, focuses on the deductibility of expenses related to holding so called “vacant” land. Taxpayers considering holding or investing in land need to understand the implications of this ruling.

Summary

Section 26-102 of the Income Tax Assessment Act 1997 denies land holding cost deductions where there is no substantial and permanent structure in use or available for use on the land. Various exceptions apply, including where the land is in use for carrying on a business, or the taxpayer is a company. Ruling TR 2023/3 clarifies the ATO’s view on Section 26-102 and provides examples to illustrate its application.

The main points of this ruling are:

- deductions are permissible only when the land is actively used in income-generating business activities or meets specific criteria, such as having a substantial and permanent structure.

- the structure must be in use or available for use. Residential premises constructed or substantially renovated must be lawfully able to be occupied and this would occur when the certificate of occupancy is received

- various exceptions are provided, including for corporate entities and certain trusts

- property developers would typically be carrying on a business – however not always where the land is owned in a Special Purpose Vehicle (SPV)

- the relevant area of land for the purposes of section 26-102 is determined by the area that the relevant loss or outgoing relates

- the timing of expenses and income-earning activities is important in determining the deductibility of interest expenses.

Key Concepts

Structure in use or available for use

Section 26-102 specifies that deductions are permissible only when the land is actively used in income-generating business activities or meets specific criteria, such as having a substantial and permanent structure. A substantial and permanent structure is one that is fixed to the land and has a degree of durability and permanence. Examples of such structures include buildings, sheds, silos, windmills, and solar panels.

Carrying on a business and property developers

Section 26-102 does not apply where the taxpayer is using the land in carrying on a business. The Ruling states that whether activities on the land amount to ‘carrying on a business’ is a question of fact’. Property developers will generally not be affected by Section 26-102 provided they are carrying on a business. Land held by a developer for future development would be considered ‘available for use’.

However, where land is held in an SPV (with no other activities), special consideration should be given to whether the SPV is carrying on a business.

Relevant Area and multiple titles

The Ruling provides some practical guidance where holding costs relate to:

- Only a portion of the land under a single title, or

- Across multiple titles

Where the holding costs relate to only part of the land under a property title then for the purposes of determining if there is a substantial and permanent structure on the land, it is sufficient that such a structure exists somewhere on that part of the land. The structure does not need to take up all of that part of the land or all the land under the property title.

Where the holding costs relate to land held under multiple titles, the Ruling states that it will be sufficient where a substantial and permanent structure exists somewhere on the area of land to which the loss or outgoing relates.

Implications

The deductibility of holding costs becomes more complex for non corporate taxpayers.

Individuals may find their ability to claim deductions for holding costs like property taxes and loan interest limited, depending on the land’s usage. The ruling narrows the scope for claiming these deductions, making the land’s actual usage a pivotal factor.

Companies have a distinct advantage when it comes to deductions for holding vacant land. Corporate tax entities are generally exempt from limitations on claiming deductions for holding costs of vacant land during the income year in which the loss or outgoing is incurred. This exemption provides these companies with greater flexibility in their tax planning strategies, allowing them to optimise their tax position while holding vacant land for business purposes.

When vacant land is held in a SPV the situation becomes complex. If the SPV is not a company (or owned by companies), the SPV must meet specific criteria to be eligible for deductions, such as actively using the land or making it available for use in a business. Failure to meet these criteria could result in the SPV being ineligible to claim deductions for holding costs, which could have significant tax implications.

Example: Holding Land in a Company vs. a Discretionary Trust

The following table compares the situations of holding land in a company versus a discretionary trust:

| Entity | Criteria | Deductibility |

|---|---|---|

| Company | Exempt from limitations on claiming deductions for holding costs of vacant land during the income year in which the loss or outgoing is incurred | Yes |

| Discretionary Trust | Must meet specific criteria to claim deductions, such as actively using the land or making it available for use in a business | Depends |

Actions required

- Review Current Holdings: Examine your vacant land holdings to assess how the ruling impacts your ability to claim deductions

- Analyse Business Activities of land owners (particularly SPVs): Determine whether you are entitled to rely on the carrying on a business exemption and whether SPVs would qualify

- Documentation: Ensure proper documentation is in place to substantiate any claims for deductions

- Strategic Planning: Re-evaluate your long-term investment or business strategies in light of this ruling and make necessary adjustments.

How SW can help

Understanding the application of TR 2023/3 is essential for anyone holding or planning to hold vacant land. Keeping abreast of these rules and seeking professional advice can save both time and money, helping to avoid potential pitfalls down the line. Our expert team is here to support you every step of the way.

Contributor

The NSW Budget delivers a $3.1 billion housing and planning investment package to address the state’s housing crisis. However, the property sector will also face increased taxes as the Government announced some significant tax changes in the Budget. SW experts has summarised all these changes below.

1. Corporate reconstruction and consolidation exemption concession amended to a 90% concession

The 100% duty exemption currently in place for eligible corporate reconstruction and consolidation transactions will be replaced with a concession requiring only 10% of the duty that would otherwise be payable to be paid.

Under the proposed transitional rules, the rules currently in force (i.e. a 100% exemption) are still expected to apply to:

- transactions occurring before 1 February 2024, or

- a transaction occurring on or after 1 February 2024 if an application for the exemption is made on or before 1 April 2024 and the transaction arose from an agreement or arrangement entered into before 19 September 2023.

2. Landholder amendments

a. Landholder acquisition thresholds for private unit trust schemes

The threshold for the acquisition of a significant interest in a private unit trust that is a landholder will be reduced from 50% to 20% for acquisitions in private unit trusts after 1 February 2024 (unless it relates to an acquisition from an agreement or arrangement entered into before 19 September 2023).

However, the 50% threshold will remain for acquisitions in:

- private companies

- unit trust schemes which are registered with Revenue NSW as a wholesale unit trust or imminent wholesale unit trust. These are a new category of unit trust (see below).

The 90% acquisition threshold for ‘public landholders’ (i.e., certain listed companies, certain listed unit trusts and widely held unit trust schemes) remains unchanged.

b. Landholder acquisition thresholds for wholesale unit trust scheme and proposed wholesale unit trust scheme registration

A separate regime is intended to be introduced for wholesale unit trusts. Under the proposed amendments, the Chief Commissioner may register wholesale unit trust schemes, which is expected to have the effect of preserving the 50% acquisition threshold for these entities.

The Chief Commissioner may register a private unit trust scheme as a wholesale unit trust scheme if satisfied that:

- it was not established for a particular investor

- at least 80% of its units are held by ‘qualified investors’ (including listed companies and trusts, public superannuation funds and other wholesale unit trust schemes)

- no qualified investor (alone or in aggregate with associated persons) holds 50% or more of its units

- any other requirements specified by the Chief Commissioner to be published in a gazette (not yet published). Note, the Victorian registration requirements are not similarly open ended.

The Chief Commissioner may register the private unit trust scheme as an “imminent wholesale unit trust scheme” if satisfied it will meet the abovementioned criteria within 12 months of the first issue of units to a “qualified investor”.

The Chief Commissioner may also cancel the registration if satisfied of any disqualifying circumstances, such as a failure to comply with a condition of registration. This may result in any historical acquisitions in the unit trust scheme as being assessable.

Acquisitions in a trust are taken to be acquisitions in a registered wholesale unit trust scheme or an imminent wholesale unit trust scheme if:

- the acquisition occurs on or after 1 February 2024, and

- an application is made to register the scheme before 1 May 2024, and is subsequently approved.

c. Changes to tracing / linked entity rules

The threshold for tracing property through linked entities of a landholder will also be reduced from 50% to 20%, similar to Victoria and Northern Territory.

The changes to the above landholder duty provisions will apply to acquisitions that are completed on or after 1 February 2024 unless they arose from an agreement or arrangement entered before 19 September 2023.

This change is significant as many more entities will be treated as landholders e.g. a company holding a 25% interest in a landholding company or trust. Transactions involving upstream entities will need to be carefully managed.

3. Increase in fixed and nominal duty amounts

The fixed and nominal duty amounts for various transactions under the Duties Act 1997 (NSW) will be increased. For example, this includes increases in the nominal duty:

- on a declaration of trust over unidentified property signed in NSW (or electronically by a trustee based in NSW) from $500 to $750

- on transfers occurring in conformity with an agreement upon which duty has been paid, from $10 to $20

- on certain concessions, including change of trustee concession from $50 to $100, or certain managed investment scheme concessions from $50 to $500.

These changes will apply to most transactions occurring on or after 1 February 2024, regardless of whether they arise under an arrangement entered into before this date. The exception being that nominal duty for transfers of land under agreements entered into before 1 February 2024 will remain at $10.

4. End to the duty exemption for certain zero and low emission vehicles

The exemption from motor vehicle registration duty ceases to be available to zero and low emission vehicles from 1 January 2024. The transitional provisions allow battery electric vehicles and hydrogen fuel cell electric vehicles purchased (or for which a deposit was paid) before 1 January 2024 but that had not yet been registered by that date to continue to access the exemption.

5. Other minor amendments

- revise the land tax indexation formula to ensure that the NSW Valuer General can determine the correct land tax threshold for the 2024 land tax year

- require that a person occupying a property as their principal place of residence must own at least a 25 per cent interest in the property to be eligible for the land tax exemption. The transitional provision provides that those who already claim the principal place of residence exemption but own less than 25% may continue to claim the exemption for the 2024 and 2025 land tax years. The minimum ownership requirement will then apply to those owners from the 2026 land tax year

- re-enact a power of the Chief Commissioner to remit interest and include a new power for the Chief Commissioner to issue guidelines about how interest must be remitted.

How SW can help?

Reach out to our state taxes experts if you would like to discuss further.

Contributors

Changing the definition of ‘employee’ in the Fair Work Act will reverse landmark High Court decisions establishing that ‘contract is king’, increasing uncertainty and risk for businesses of all sizes.

On 4 September, the Fair Work Legislation Amendment (Closing Loopholes) Bill 2023 (Bill) was introduced into Parliament. Among the sweeping reforms proposed in the Bill, arguably, the change to the definition of ‘employee’ in the Fair Work Act 2009 (FW Act) may most warrant further consideration.

The new definition will reverse recent High Court cases (CFMMEU v Personnel Contract Pty Ltd; ZG Operations Australia Pty Ltd v Jamsek) establishing that in circumstances where there is a comprehensive written contract, the question of whether an individual is an employee of a person is to be determined solely with reference to the rights and obligations in the terms of that contract. This provided businesses with practical certainties as the classification of individuals as employees/contractors that was clear at the beginning of working relationships would remain consistent throughout the working relationship.

Instead, the definition of ‘employee’ and ‘employer’ under the FW Act will revert to be determined by reference to the real substance, practical reality, and true nature of the relationship between the parties. Effectively, the conduct of the parties after a contract is entered into will be considered under the ‘multi-factorial assessment’ in determining if there is an employment relationship. This means that businesses may engage an individual with the understanding that they are hired as an independent contractor, but later could be deemed an employee.

Navigating employer obligations – a new challenge

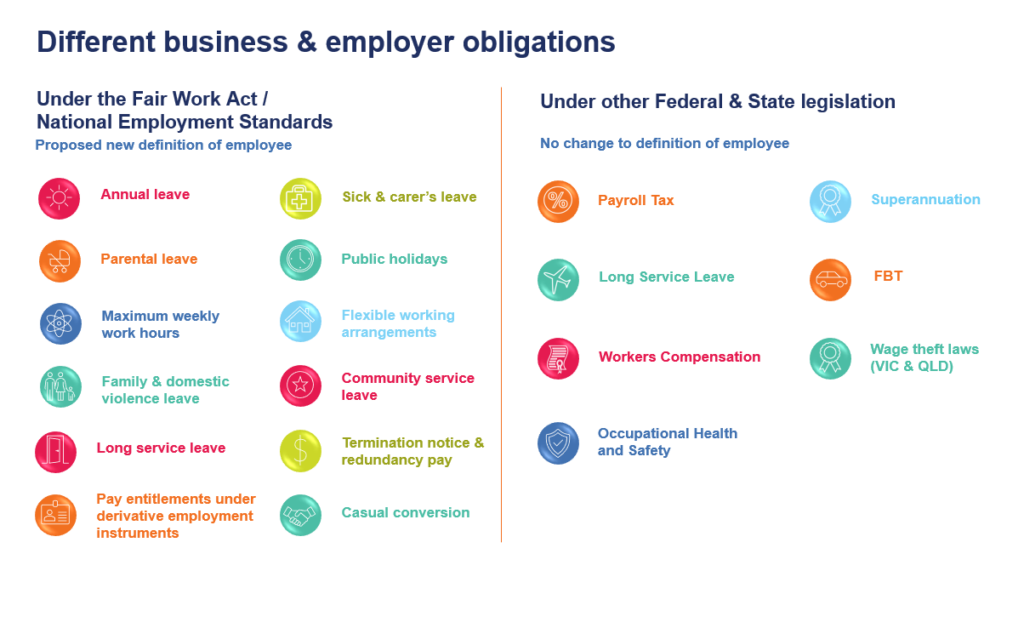

A significant issue that does warrant further consideration is that the new definition of ‘employee’ will only apply to the FW Act, while the definition of ‘employee’ in other Federal and State legislation is proposed to remain unchanged. Given businesses will have multiple overlapping obligations and responsibilities for each ‘employee’ (depending on which Act you’re referring to), the selective application of this new definition can lead to further complexity and fragmentation in complying with employer obligations.

As shown in the graphic below, businesses may be required to provide ‘employee entitlements’ to individuals taking into account post-contractual conduct under the FW Act, but not necessarily under other legislation. For example, this could lead to a worker being entitled to only those minimum pay and work entitlements provided by the FW Act, but not entitled to superannuation, workers’ compensation or long service leave. The increased complexity means there is a higher risk that businesses get it wrong. Practically, even where a business understands its various obligations and has the in-house capability to get it right, it is likely to increase the complexity of their internal processes and may require significant changes to their internal HR/payroll systems.

An alignment of the definition of employee across the various obligations which would involve co-operation between the State/Territory Governments and the Federal Government would go a long way to providing clarity and certainty for businesses. At the very least, a consistent definition across Federal Legislation should be considered.

In recognition of the complexity, the Australia Taxation Office (ATO) has historically had softer penalties for the inadvertent misclassification of employees and has recently been consulting on practical guidance that employers can rely upon to reduce ATO scrutiny.

ATO’s compliance approach

The Draft Practical Compliance Guideline 2022/D5 provides the factors the ATO takes into consideration in applying compliance resources to review worker classification (note that this has yet to be updated for the recent High Court cases mentioned previously). These factors include:

- whether there is evidence that both parties agreed to the arrangement to have a given worker classification

- whether both parties understand the tax and superannuation consequences of the classification

- whether specific advice confirming the worker classification was sought from an appropriately qualified third party, such as a solicitor or tax professional

- whether the performance of the arrangement has deviated significantly from the contractual rights and obligations agreed by the parties, and

- whether the correct tax, superannuation, and reporting obligations are being met.

While this guidance only applies to obligations administered by the ATO and is still in draft, it contains practical steps which if followed reduce the risk of misclassification across various obligations significantly. Therefore, it is prudent for businesses to consider the level of risk their current arrangements face and take proactive steps to ensure they have ‘low-risk arrangements’. By ensuring internal processes consider the factors above, this may reduce the likelihood of the ATO applying compliance resources to review the business’ worker arrangements and increase the likelihood of correctly classifying workers.

How SW can help?

The SW Team has expertise in assisting businesses and employers in complying with their employment obligations. By analysing contract language, payment schedules, delivery timelines and termination clauses, we provide businesses with the confidence that they are complying with the correct worker classification.

Considering the complexity of navigating employer obligations, our dedicated team designed a process that is considered low risk by the ATO.

Understanding and Setup – understanding the processes and controls that are in place to classify worker arrangements followed by designing a compliance program based on factors in the ATO practical compliance guideline to reduce risk.

Outsourced or co-sourced assistance – assistance with the classification of workers for various obligations, documentation as well as ongoing compliance activities.

In addition, SW can assist with more comprehensive, once-off review or advisory needs:

- conduct a comprehensive review of your assisting agreements and structure

- provide tailored advice on compliance and potential exclusions

- assist with private rulings for prospective arrangements with the relevant tax authority

- assist with voluntary disclosure if needed

- data analytics services to focus attention on higher risk arrangements across all suppliers paid.

Contact the SW Team today to schedule a consult and ensure that your business is prepared. Our expert team is here to support you every step of the way.

Contributors

SW experts have prepared a video series to tell you some important matters you need to know about taxation and wealth management in Australia. 信永中和專家為您講解有關澳洲稅務架構及資產管理既重要事項。

Best ways to structure for your investment and business in Australia | 找尋最佳澳洲投資及商業架構

Tax Residency & Capital Gain Tax | 澳洲稅務居民資產增值稅

The VCAT decision in Oliver Hume Property Funds v Commissioner of State Revenue held that units issued to investors under a capital raise via an Information Memorandum (IM) to fund the acquisition of a property in Victoria are to be aggregated as associated transactions for the purpose of the landholder duty rules.

This means that investors acquiring an interest in a Fund through the IM after the Fund has entered into a contract to acquire property may be subject to landholder duty, effectively imposing double duty on the transaction.

The taxpayer is appealing the decision. In the meantime, capital raisings with respect to Victorian property will need to be more carefully managed. The State Revenue Office (SRO) is unlikely to provide a private ruling with respect to this issue until the appeal is determined. The SRO has stated in discussions that there were particular circumstances in the Oliver Hume case that led to this outcome. However, the relevant facts as referred by VCAT noted nothing significantly different from any other capital raising through an IM or Product Disclosure Statement (PDS). It seems that the 2 factors that the SRO and the court focused on were:

- in order for shares to be issued to investors, a minimum subscription needed to have been met

- there was a unity of investors, in that they were all joining together to acquire an interest for a common purpose, being a particular residential project.

Both of these factors are common in most offers under an IM or PDS. SW is working with the Property Council of Australia and Law institute of Victoria to have further discussions with the SRO to get a better understanding of what made the facts and circumstances of the Oliver Hume case different, and to understand their position with respect to reviewing capital raising transactions in the past and in the future, as we await the court’s decision.

As discussed below under Background, the legislation is drafted widely and we are of the view that the legislation needs to be amended to ensure that capital raises are not captured under the landholder duty provisions (regardless of the outcome of this Appeal). The outcome of double duty for funds trying to raise capital to acquire property in Victoria will be an inhibitor to property acquisitions in Victoria.

The outcome in this case also raises uncertainty with respect to other States (except for NSW) that have similar provisions drafted for the aggregation of associated transactions.

Background

In Victoria, landholder duty only applies to investors who acquire a significant interest an interest of 20% or more if the landholder is a private unit trust, and 50% or more if the landholder is a private company.

In determining whether a landholder has acquired a significant interest, the interests of associated persons and interests acquired in associated transactions are aggregated and treated as a single acquisition.

The term associated transaction is quite broadly drafted as an acquisition of an interest in a landholder by another person in circumstances which:

- those persons are acting in concert, or

- the acquisitions form, evidence, given effect to or arise from substantially one arrangement, one transaction or one series of transactions.

Given the broad definition in the legislation, the Victorian State Revenue Office released Revenue Ruling DA.057 Meaning of Associated Transaction which stated that the Commissioner will not regard acquisitions of interests by independent members of the public as an associated transaction if the acquisitions are made in response to a genuine public offer under a product disclosure statement or prospectus lodged with the Australian Securities and Investments Commission. However, this will not apply if:

- under the public offer, one person’s acquisition in a landholder is made subject to and conditional upon another person’s acquisition, or

- the Commissioner considers that a person is taking advantage of this concession, particularly in cases where the public offer does not convert the landholder to either a listed company or public unit trust scheme.

Example 2 of the ruling also provides an example where a private unit trust raises funds from 15 investors known to the responsible entity. In this example, the investors can apply for any number of units and their acquisition would not be conditional upon achieving a minimum level of subscription. The SRO’s view was that the investors’ acquisitions would not be considered associated transactions.

Oliver Hume case

In our view, the facts of the Oliver Hume case are no different from capital raises by other Funds through Information Memorandums (IMs). The facts were as follows:

- a special purpose entity (SPV) was established to acquire a site for a resi development

- the SPV was funded by debt and equity

- the fund was marketed to sophisticated investors so it was not an ASIC regulated raising

- the IM was distributed to investors appearing in Oliver Hume’s database. Oliver Hume held a database that had details of investors who had invested in their funds in the past

- the IM was also distributed to third parties as part of consultancy and referral agreements

- as soon as a target of $1.8 million is achieved, shares will be allotted to investors

- $1.8 million shares were offered at $1 to some 18 investors

- 14 of the 18 investors were from Oliver Hume’s database, 4 were external (2 were referred from the consultancy agreements and 2 were completely external).

The SRO commenced their investigation in 2017 and a decision was made in 2019 that the taxpayer was subject to landholder duty. As the SRO viewed the arrangement as substantially one arrangement, the interests acquired by the purchasers were aggregated and the landholder duty assessment was raised in 2020 for 99.99% of the land value in 2020. In 2021, the SRO made a determination confirming the assessment (but partially remitting penalties). Oliver Hume requested the decision be referred to VCAT.

Court decision

The court held that regard must be had to the actions and motives of both the transferor and transferee. The shareholders (although not associated with each other) each had a united purpose of becoming shareholders in the Company. The Commissioner outlined the following factors in support of the view that the transactions were related, connected and interdependent in a way that was integral to the circumstances:

- transactions stemmed from the same offer and terms outlined in the IM

- transactions were conditional on each other and interdependent, they would only occur if target subscriptions were met

- purpose of the transactions were the same – raise $1.8M as part of a syndicated managed investment vehicle for a residential development project

- investors applied to invest around the same time and under the same offer with documents defining the common purpose

- possible to infer a unity of purpose for the investors, as they agreed on the terms based on the IM to support the development of the property and agreed to the constitution which established the management structure.

The Court also held that the Commissioner’s concession provided in the Ruling has no force in law.

How SW can help

The SW team has extensive experience assisting property fund managers across a broad range of accounting and advisory services.

We can provide you with expert advice across the lifecycle of your fund, from initial setup and structuring, to capital raising, compliance, risk management and more.

Should you have any questions on the implications of this decision on your individual business circumstances, please reach out to your SW contacts listed here.

Our team will closely monitor the case and provide further information if there are any updates.

Contributor

Th regulatory framework for Managed Investment Schemes (MIS) are currently under review. The consultation paper seeks feedback on the existing regulation.

The central objective of this review is to evaluate the adequacy and relevance of the existing regulatory structure, pinpoint regulatory gaps, and explore improvements to mitigate unwarranted financial risk exposure for investors.

The review is part of the Government unveiled plans for Treasury to conduct a review of the regulatory framework governing MIS, in the October 2022‑23 Federal Budget.

Focus of the MIS review

The review will focus on the following current regulation areas:

- criteria of investor’s wholesale client status

- responsible entities’ roles and obligations.

The criteria establishing an investor’s wholesale client status

The criteria for a wholesale client is currently under review. Chapter 7 of the Corporations Act 2001 contains several tests in relation to specific products.

Current thresholds for establishing wholesale investor status include:

- where initial amount paid by investor at time of investment is at least $500,000 or

- a qualified accountant provides a certificate which states that the client’s

- net assets are equal to or exceed $2,500,000 or

- gross income for the last two financial years is at least $250,000 per annum.

Responsible entities’ roles and obligations

A key focus area of the review is the governance of the scheme. Effective governance demands ongoing vigilance for transparency and accountability.

Ensure you are aligned with current standards and practices within the Australian financial sector. It is crutial to adapt governance practices to match evolving regulations through consistent regulatory monitoring, and seek guidance from legal and regulatory specialists.

You can find the announcement detailing the primary issues under review here.

Make sure you’re ready

Each MIS provider should assess the impact on their business. The outcome of the consultation could alter the type of license needed to maintain current distribution.

MIS providers are advised to consider reviewing the consultation paper and their investor thresholds. Each case is different, we can provide expert advice that is right for your business.

How SW can help

The SW team has deep financial services sector experience, and specialises in funds management. We can provide you with the right guidance to assess the regulatory changes and their impact to your business.

Contributors:

Following the 2023/24 Federal Budget announcement to reduce the regulatory burden facing general insurers, the Australian Treasury released Exposure Draft legislation on 10 July 2023, to be applicable for income years starting on or after 1 January 2023.

Requirements for calculating tax liabilities that arise from general insurance contracts are set out in Division 321 of the ITAA 1997.

The existing legislations broadly align with the requirements of AASB 1023, which was replaced by AASB 17 as the mandatory accounting methodology for insurance contracts for financial reporting purposes from 1 January 2023.

The proposed amendments will ensure general insurers be able to continue prepare their income tax returns and align tax treatments of insurance contracts with audited financial reporting information.

Proposed changes

Liability for incurred claims

The existing rules in Subdivision 321-A provides that assessable income or deduction for an income year is determined by comparing the outstanding claims liability at the end of that year against prior income year.

In the proposed draft legislation, this would be replaced with the AASB 17 concept of “liability for incurred claims”, being the fulfilment cash flows related to past services allocated to the relevant group contracts at that date.

The amount is further adjusted to exclude any costs (e.g. claims handling costs, etc) that could not be directly attributable to a particular claim and by the present value of estimated recoveries.

Liability for remaining coverage

The existing rules in Subdivision 321-B provide that assessable income or deduction for an income year is determined by comparing the unearned premium reserve at the end of that year against prior income year using a five-step method.

Under the proposed change, this concept is replaced with “liability for remaining coverage”, defined as fulfilment cash flows relating to future services allocated to the relevant group of contracts at that date.

This amount is then adjusted for tax purposes to exclude certain items (defined within AASB 17), including onerous contracts and fulfilment cash flows that are not premiums (e.g. certain reinsurance premiums, commissions, etc.).

What has not changed?

Payment of claims

The tax treatment for payment of claims has not changed. In that regard, a claim under general insurance policies is treated as paid and therefore deductible, even in situations where funds have not actually been disbursed at year end, if the claim is settled within the income year, the relevant liability is no longer reflected as liability for incurred claim and payable by the insurer at the end of that income year.

Gross Premiums

Gross premium income received or receivable for an income year in respect of general insurance policies will continue to be included in the general insurer’s assessable income.

Application Date

The new legislation is set to apply to income years beginning on or after 1 January 2023, to align with the application of AASB 17.

Transitional arrangements are available in the first income year to ensure no permanent differences will arise for general insurers on adoption of AASB 17.

How SW can help

The Treasury is currently seeking submissions, with the consultation period concluding on 21 July 2023.

SW will be monitoring for new announcements and introduction of the bill and will keep you updated once additional information is available.

Please reach out to your SW Partner or contact for any assistance on how this may impact your business.