Recently, the Treasury released a revised exposure draft (ED) proposing to require certain large multinational enterprises to publicly report selected tax information on a country-by-country basis effective on or after 1 July 2024.

On 12 February 2024, the Treasury released the revised exposure draft (ED) and explanatory materials (EM), collectively referred to as ‘Revised Draft Bill’, proposing to require certain large multinational enterprises (MNEs) to publicly report selected tax information on a country-by-country (CbC) basis. The amendments are proposed to be effective on or after 1 July 2024.

The amendments builds on the original Draft Bill (April 2023 ED & EM) released as part of the 2022-23 Budget. Read more about our SW transfers pricing experts commentary on the initial announcement.

Key changes under the Revised Draft Bill include:

- a threshold has been established – the reporting obligation for CbC reporting parent is triggered only when the aggregated Australian sourced turnover reaches AUD $10 million for the income year

- disclosure requirements have been scaled back, removing specific items such as effective tax rate, list of intangible assets, and related party expenses

- information will be required on a CbC basis for Australia and specified jurisdictions (subject to ongoing update), and on either a CbC basis or an aggregated basis for the rest of the world.

Who is subject to reporting?

The reporting obligation applies to a CbC reporting parent of a CbC reporting group with an Australian presence (regardless whether it is Australian based or not). It is triggered only if the CbC reporting parent’s Australian-sourced aggregated turnover is AUD $10 million or more for the income year. If a CbC reporting parent’s reporting period is not an income year, it must assume the reporting period is an income year for calculating aggregated turnover.

What should be disclosed?

Under the Revised Draft Bill, a CbC reporting parent is required to publish selected tax information on a strictly CbC basis for Australia and specified jurisdictions, such as Hong Kong and Singapore, while allowing information to be provided on either a CbC basis or an aggregated basis for the rest of the world.

Selected tax information must be sourced from audited consolidated financial statements to ensure the information is reconcilable and verifiable. If not available, the information should reflect what would be shown in such statements had the entity been a listed company.

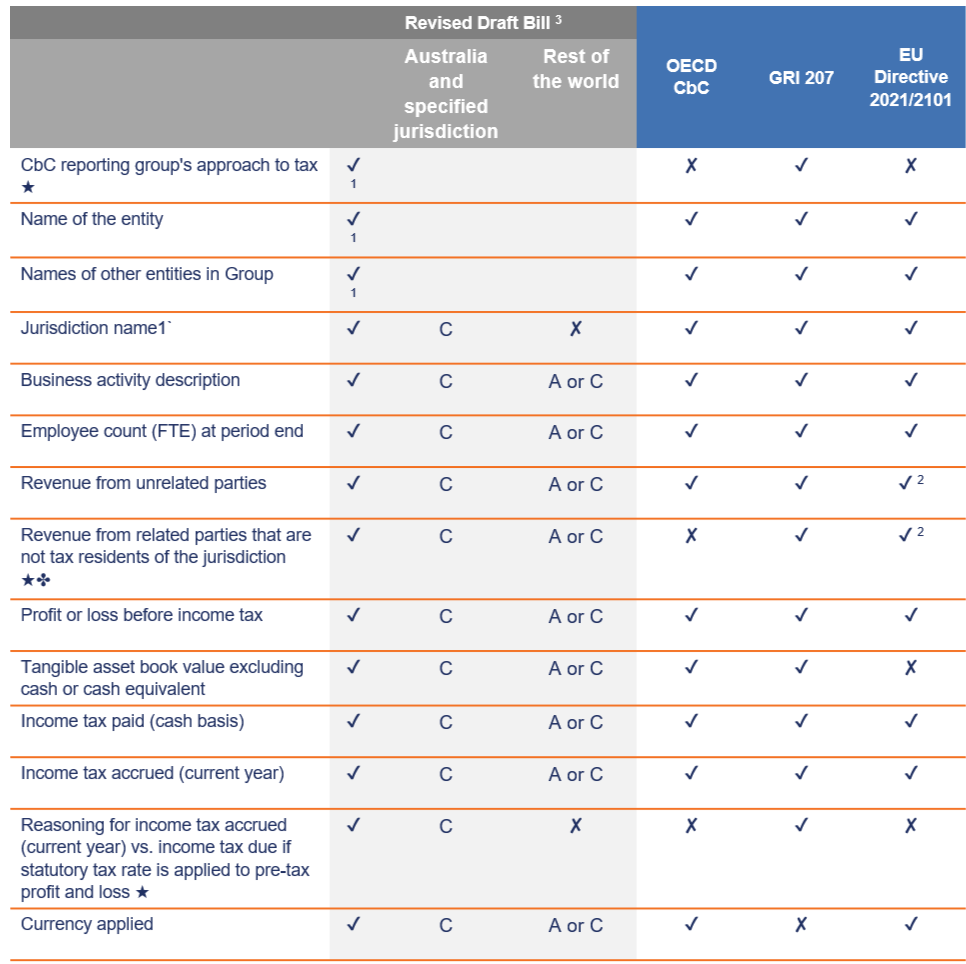

The below table compares information required under different regimes and summarises relevant information to be disclosed on a CbC basis or an aggregated basis.

A – Aggregated basis

C – CbC basis

★ – Not required under the existing confidential CbC Reporting regime

✤ – New requirements under the Revised Draft Bill

1 CbC reporting parent is required to disclose the general information.

2 Under the EU Directive, only the aggregated revenue needs to be reported, without separating unrelated party and related party revenues.

3 The Commissioner will receive the information in the approved form from the CbC reporting parent, and then make available on an Australian government website.

When is it due?

The Revised Draft Bill, once legislated, is expected to apply to reporting periods commencing on or after 1 July 2024. Submission of the public CbC report will be due no later than 12 months after the end of the relevant income year.

For example, for an entity with a reporting period ending on 31 December, the first reporting period would be 31 December 2025, with the report submission due by 31 December 2026.

The existing confidential CbC reporting obligations and the new public CbC reporting obligations will operate in parallel, but they are distinct and separate reporting regimes.

Penalties for non-compliance

Australian resident entities will be penalised for refusing or failing to comply with their obligation to publish the selected tax information.

A CbC reporting parent is liable to an administrative penalty if the entity fails to publish the required information (including information to correct a material error) on time.

The penalty is 500 penalty units ($156,500 based on the current rate of $313 per penalty unit) for each period of 28 late days or part thereof, up to a maximum of 2,500 penalty units (currently $782,500). Penalty units may increase in future.

How SW can help

As Australia moves towards greater transparency in tax matters, it is important for MNEs, both Australian-headquartered and foreign-owned with Australian operations, to stay ahead of these changes. SW is committed to providing you with proactive support to navigate these complexities.

Our tax experts can assist with:

- Impact assessment: Assessing the impact of public CbC reporting on your group.

- Approach planning: Advising on the strategic implications of the additional disclosure requirements (e.g. CbC reporting group’s approach to tax, reasoning for income tax accrued vs income tax due) in your unique circumstances, and helping you prepare for these disclosures.

- Compliance management: Developing and implementing a robust process to ensure seamless compliance with the reporting obligations, minimising the risk of penalties.

- Stakeholder communication: Facilitating effective communication with your foreign CbC reporting parent and other relevant stakeholders to enhance understanding/coordination within your group.

Please reach out to our expert team or your SW representative, if you would like to know more or need assistance.

Contributor

The Meakins case examines the deductibility of holding costs for vacant land. The findings emphasise the importance of demonstrable, income-generating activities to support tax deduction claims on vacant land, offering crucial insights for property investors and taxpayers.

The recent Administrative Appeals Tribunal (AAT) case Meakins and Commissioner of Taxation [2023] AATA 3852 (Meakins), highlights its significance in the context of tax deductions for holding vacant land in Australia. The key tribunal findings emphasise the importance of several critical factors including assessment of income-generating intent, the lack of substantial activity and implications of inaction. The ruling reinforces that expenses related to vacant land are not typically deductible unless the land is used for income-generating purposes.

Background

The taxpayer purchased vacant land at North Fremantle in 2006. Initially, there was a clear intent to develop this land, transforming it into an income-generating asset.

Despite these initial plans, the development of the property did not proceed but the taxpayer continued to claim deductions for holding costs. The taxpayer attributed this inaction to changing economic circumstances that affected the ability to move forward with the development. As the years passed, these circumstances, combined with other unforeseen challenges, led to the property remaining largely undeveloped and unused.

This lack of tangible development activity raised significant questions from the tax authorities about the legitimacy of the tax deductions claimed for holding the property. The AAT agreed with the Commissioner that the interest expenses were not deductible.

Key issues and tribunal findings

The tribunal’s decision hinged on several critical factors:

- Assessment of income-generating intent: A pivotal aspect of the tribunal’s decision was assessing the taxpayer’s intent for income generation. The tribunal scrutinised the nature of expenses incurred, investigating whether they were legitimately aimed at producing assessable income or were merely veiled as part of a business operation. This scrutiny was crucial, as tax law requires a direct link between the expense and the income-producing activity. This case highlights that taxpayers must demonstrate a clear and direct connection between the expenditure on vacant land and their efforts to generate assessable income, such as active steps towards development or concrete plans for business use.

- Lack of substantial activity: The tribunal expressed significant concerns over the absence of meaningful development or use of the property for income generation over 17 years. This prolonged period of inactivity was a key factor in casting doubt on the legitimacy of the claimed deductions. The case underscores the importance of active engagement and development efforts in property investment to substantiate claims for tax deductions. The tribunal’s focus was not just on the intent to generate income but also on the tangible actions taken towards this objective. This serves as a reminder that mere ownership of property, without substantial and active efforts towards its income-producing use, is insufficient to justify tax deductions for holding expenses.

- Implications of inaction: The extended period of inaction raised significant questions about the trust’s true intent behind holding the land. The tribunal examined the absence of concrete actions towards developing or using the property for income generation, contrasting this with the claim for deductions. This inaction was seen as indicative of a lack of serious commitment to using the property for income-producing purposes.

This highlights that in the realm of tax law, intentions must be backed by actions. Taxpayers must be mindful that inactivity or lack of substantial effort in developing or using their property can undermine their claims for tax deductions and invite scrutiny from tax authorities.

Implications for taxpayers

The Meakins case echoes the sentiments expressed in ATO Ruling TR 2023/3, particularly regarding the deductibility of expenses for vacant land. The ruling emphasises that expenses related to vacant land are not typically deductible unless the land is used for income-generating purposes.

Whilst the case addresses an interest deduction claimed before the introduction of Section 26-102, the decision serves as a crucial reminder for taxpayers holding vacant land (where deductions can still be obtained) for the need of a clear demonstration of income-generating intent and activity when claiming deductions on vacant land. Taxpayers must ensure that their investment strategies align with tax laws to avoid disputes and penalties.

Actions required

- Review current holdings:

- Assessment of vacant land holdings: Conduct a thorough review of your current vacant land holdings. Assess each property, taking into consideration the Meakins case and the ATO Ruling TR 2023/3, to understand how these legal precedents impact your ability to claim deductions.

- Analysis of development plans: For each holding, evaluate the status of any development plans or activities. This includes reviewing timelines, actions taken, and any delays or changes in plans.

- Documentation: Having detailed and organised records that clearly demonstrate the purpose and use of the land is always useful.

Keeping abreast of these rules and seeking professional advice can save both time and money, helping to avoid potential pitfalls down the line.

Get in touch with SW

Our expert team here at SW is here to guide you every step of the way. Please reach out if you need support or have any questions.