A journey across the abyss

30/03/2020

For many of you, and certainly for us, the last few weeks have been a whirlwind as the scale and complexity of the position, not just in Australia, but the entire world finds itself in seems to grow more precarious by the hour.

It was only one short month ago that global stock markets hit all-time highs, company reporting seasons showed strong profits and whilst guidance was moderated, it appeared we were set for a continuation of growth, low unemployment and consistent earnings.

Today, that narrative has been turned on its head with Governments rapidly authorising massive bailouts and support measures for beleaguered industries, the nationalisation of some companies, utilising war time powers to compel production and losing patience very quickly with those who flout the rules and recommendations.

Given that so much has changed in such a short space of time, it is important that we continue to ensure that, whilst we manage the short term, we also keep our strategies and investments aligned for the long term.

Short Term

Late last week the Australian Prime Minister talked about putting business into hibernation; a process that was already underway by a large swathe of corporate Australia, that will now be supported by Government assistance and support.

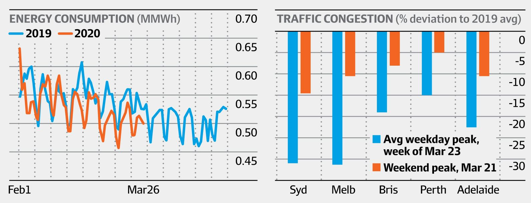

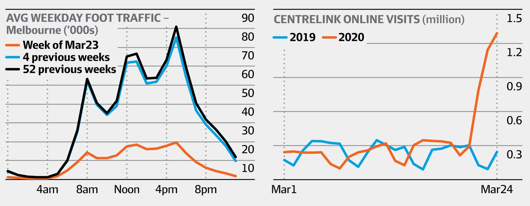

The six charts below show different views on the Australian economy, but they all tell the same story: commerce, consumption and employment are all being impacted. Energy consumption is down, traffic congestion, foot traffic, new jobs advertisements and spending on services have all fallen dramatically.

Conversely, spending on goods and online visits to Centrelink have spiked as people both prepare for potential lockdown scenarios and reach out to the Government support net that has been greatly expanded to deal with the unprecedented shock to the Australian economy.

Source: AFR, WATTCLARITY, ANZ, TOMTOM, CITY OF MELBOURNE, SIMILARWEB, SEEK, CBA.

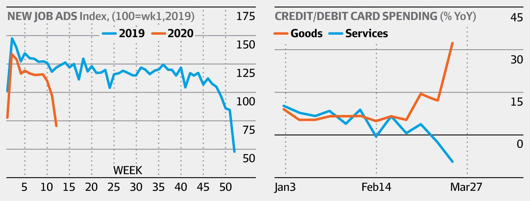

We have talked extensively over the past three weeks about the need to stay invested, bunker down and weather the storm. Last week was an example of why we have, and continue, to recommend this given the correlation between record negative and record positive days and weeks during crises. Whilst in Australia, the strong gains that the market had generated faded on Friday with another 5% sell off, the market still closed the week higher than it opened, so staying invested has contributed to a reduction (albeit a very small one) in the falls from the prior weeks.

Source: AFR

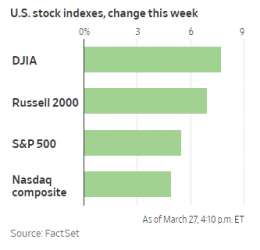

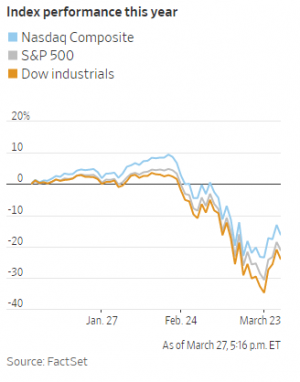

The story in the United States however was much more positive, with indices posting double-digit gains for the week— the Dow surging 13% and the S&P 500 10% on the back of the relief package announced. The U.S. is still some 20% down from the highs of just last month but had we not stayed invested we would have been out of the market and missed the biggest weekly gain since 1938.

In difficult times markets can be unpredictable and react in ways that defy accepted logic or common sense. Take, for example, Thursday’s trading where, prior to opening, the U.S. Department of Labour announced jobless claims data of 3.285m for the week ending 21 March. Prior week claims were only 282,000 – that’s an eleven-fold increase (or 15 times from two weeks ago); the spike was twice consensus estimates of 1.5m; and it far exceeds the prior weekly record of 695,000 in October 1982. Notwithstanding the sheer scale of these numbers, the S&P500 closed up almost 5% for the day.

As we have and will continue to advise, staying invested is the most appropriate course of action for long term capital preservation which has been demonstrated again in the past week, along with the countless other examples and data sets we have from history.

Medium Term

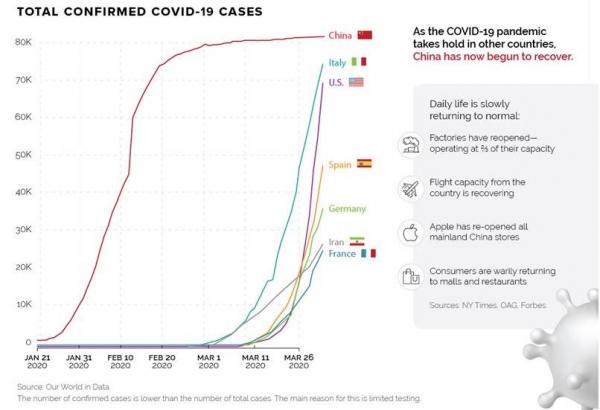

The medium term outlook is still unclear and probably for the first time in modern history we are potentially seeing a decoupling, perhaps just temporarily, of the global economy as we have come to know it. With virtually all countries closing their borders to non-citizens, individual economies will be somewhat sheltered from the wider global economy and may all end up on slightly different trajectories. To demonstrate this we can look to China who, after some initial missteps, took decisive and swift action to contain and control the virus and as a result we can see that they have flattened their curve substantially.

The chart also shows the current trajectory of the three countries most impacted by the outbreak being Italy, the U.S. and Spain (note this data is from 26 March) who have all redoubled their efforts at containment and time will tell whether they can flatten their curve as quickly as China did, with the relative differences in Government policy and philosophy being the key factor. Italy appears to be following the example of China with strict lockdowns across the whole country whilst the U.S. is putting lockdowns in place in heavily affected areas but questions remain about containment within those areas and whether people who have left (unintentionally or otherwise) have broken containment lines. If countries are able to flatten their curve and bring the virus under control we can also look to China for a glimpse of what the journey through to the other side looks like.

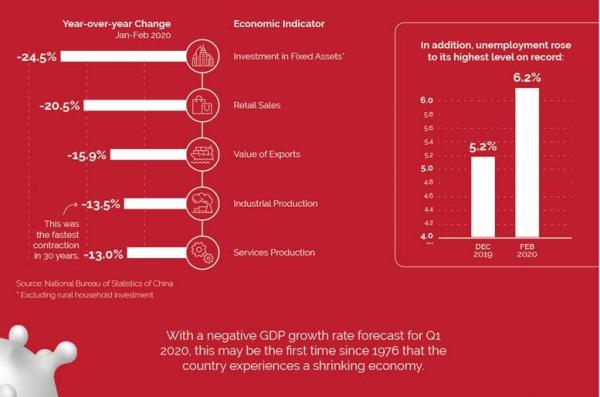

The chart below shows the impact on the Chinese economy on the journey through the lockdown period:

We will continue to watch the Chinese economy, including keeping regular dialogue with our network, Partners and staff in our 24 China mainland offices to see what lessons we can learn and understand how a post virus recovery takes shape.

What we do know is that world Governments are now implementing many of the recommended protocols that only a few weeks ago were considered unnecessary. Importantly, in recent testimony to the U.K. Parliament, Professor Neil Ferguson, the epidemiologist who headed the Imperial College of London’s virus modelling that led Governments in the U.K. and the U.S. to ramp up their efforts to contain COVID-19 spread, reduced his assessment of the deaths that might occur in the U.K. in the presence of social distancing and other measures now in place. Importantly, though he also clarified that their latest estimates also suggest that the virus is slightly more transmissible than previously thought, lethality estimates remain unchanged and without the current measures their assessment remains that the U.K. would see the scale of deaths reported in their original study (namely, up to approximately 500,000).

These two pieces of information speak to the difficult position the Australian Government finds itself in and the balance they need to consider between “lives and livelihoods” as the Prime Minister has outlined. This balance needs to be designed so that the least amount of people are affected by the virus, whilst ensuring that when we emerge on the other side people have jobs to go back to which in turn will create consumption, which then creates more jobs so that our post virus world can revert to normal – or a perhaps a new normal.

So the medium term continues to remain uncertain and this uncertainty continues to see volatility in markets that will only abate once the path to the other side becomes clear.

Long Term

Will our lives be changed? Will the economy be changed? wWll our jobs be changed? We suspect the answer to all of these questions will be yes, but there will be degrees and nuances, none of which anyone can see with any clarity now, or even in the medium term.

From an investment perspective the markets are always adapting, always processing new information and always adjusting their value based on future expected returns. Where these returns will come from is always a combination of unknowns so staying invested, diversified and positioned for the recovery and then capitalising on the changing face of the Australian and Global economies is the most appropriate strategy.

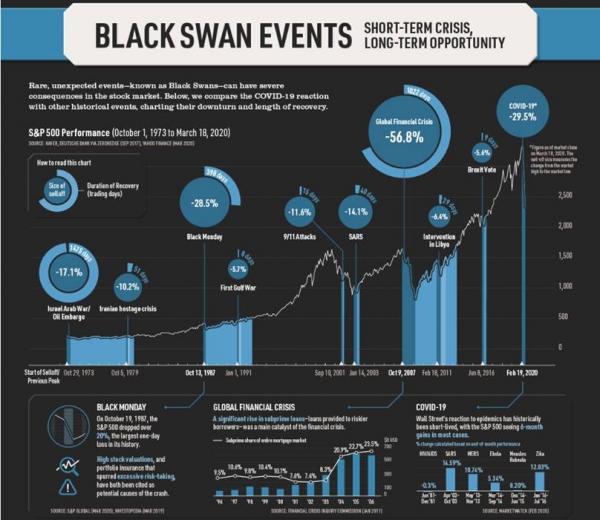

Our final chart for this week looks back in time to the various “Black Swan” events (the unknown unknowns from last week’s article) and the longer term opportunities for investors that opt to stay in their seat or carefully deploy their capital during these times.

As the Australian and global economies slowly move into hibernation for an indeterminate period of time we must all cross this abyss together knowing that whilst we may be heading for more uncertainty and volatility “it is always darkest just before the dawn” and when we emerge on the other side history tells us that opportunity and prosperity will endure.

If you have any queries, concerns or just want to have a chat, make sure you reach out to your ShineWing Australia advisor.

Contacts

| Daniel Minihan |