ATO guidance on outbound interest-free loans between related parties

24/08/2020

The Australian Taxation Office (ATO) released Draft Schedule 3 (the Draft Schedule) to Practical Compliance Guideline (PCG) 2017/4 (the Guideline) on 12 August 2020, outlining how the transfer pricing risk associated with outbound interest-free loans between related parties will be assessed.

This is a follow-up step taken by the ATO since the release of Schedule 1 to PCG 2017/4 three years ago targeting transfer pricing risk associated with inbound cross-border related party loans.

The PCG does not constitute a ‘safe harbour’ nor conclude whether taxpayers’ financing arrangements comply with relevant Australian tax laws, however the ATO expects taxpayers to use the PCG as the basis for self-assessing whether their related party financing arrangements are risky and offers opportunities for taxpayers to transition arrangements to lower risk positions. The self-assessment of loan risk is expected to be taken into account in completing the Reportable Tax Position (RTP) schedule where required as part of the annual income tax return.

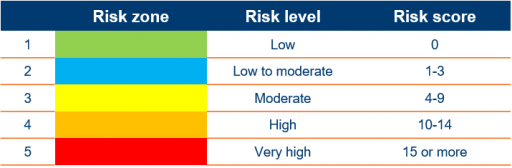

Starting with a ‘high risk’ zone

The ATO advises that an outbound interest-free loan will be considered ‘high risk’ in the first instance, resulting from a 10 risk score assigned for zero interest rate. This normally means that the ATO is likely to commence a review as a matter of priority.

The risk level could escalate into ‘very high’ if the loan currency is inconsistent with the operating currency of the lender, or the sovereign risk of the borrower entity is AAA or AA (each indicator attracting an extra 10 risk score). In this case, the ATO could proceed directly to audit, and increasing difficulty is expected for dispute resolution.

Potential risk level modification

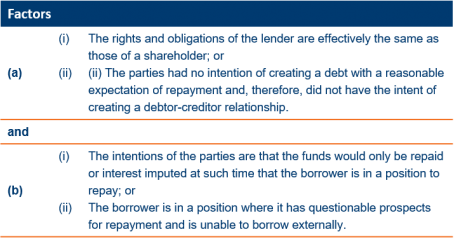

The ATO notes that the risk level may potentially be reduced in circumstances where:

- the zero interest rate is an arm’s length condition of the loan, or

- the substance of the loan is an equity contribution, or

- independent parties would not have entered into the actual loan and would have entered into an equity funding arrangement.

In circumstances where a ‘yes’ can be answered (with evidence) to each of the below basic factors, the 10 risk score (before consideration of currency and sovereign risk) is modified to 3 (‘low to moderate’ risk zone), meaning the ATO will only review by exception.

The following additional factors collectively may support a further reduction of the risk score from 3 to nil (‘low’ risk zone), in which case the ATO’s compliance action will be minimal:

- The current arrangement aligns with the best commercial and economic interests (among all realistically available alternatives) of both the fund provider and the recipient.

- Absence of the lender’s rights to enforce payment (e.g. no fixed maturity date).

- There are restrictions on additional equity investment into the borrower’s jurisdiction.

- Evidence can be provided to demonstrate:

- the purpose of funding was to acquire capital assets for core business expansion

- it is industry practice to enter into long-term investments

- the borrower is not in a position to repay until its cash flow turns positive over the long run

- the borrower is unlikely to secure funds externally, and

- the purpose was aligned with the group’s policies and practices.

Examples

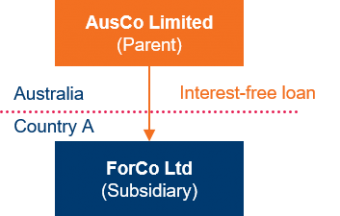

Example 1: Country A subsidiary of an Australian mining company

|

Facts:

|

The above arrangement automatically falls into the ‘high risk’ zone scoring 10 (zero rate) risk points in the first instance.

The risk score can be reduced to 3 after accounting for the following basic factors.

✔ Rights and obligations of a shareholder – AusCo Limited is the parent of ForCo Ltd

✖ No intention of creating a debtor-creditor relationship – Restrictions on foreign ownership requires the form of funding as a loan

✔ Intention that funds repaid or interest imputed when borrower is in a position to repay – preferential payment status for ForCo Ltd to repay when producing positive cash flows

✔ Borrower has questionable prospects for repayment and unable to borrow externally – third-party debt available but not in accordance with group policies and practices

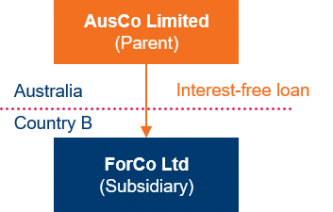

Example 2: Country B subsidiary of Australian manufacturing company

|

Facts:

|

The above arrangement automatically falls into the ‘high risk’ zone scoring 10 (zero rate) risk points in the first instance.

The risk score cannot be reduced after accounting for the following basic factors.

✔ Rights and obligations of a shareholder – AusCo Limited is the parent of ForCo Ltd

✖ No intention of creating a debtor-creditor relationship – A documented loan in place evidencing a legal obligation to repay

✖ Intention that funds repaid or interest imputed when borrower is in a position to repay – ForCo Ltd’s healthy financial position and good creditworthiness evidence its ability to repay the loan.

✖ Borrower has questionable prospects for repayment and unable to borrow externally – ForCo Ltd has sufficient cash flow and has external interest-bearing bank loans.

AusCo Limited could transition to the ‘low risk’ zone if an arm’s length interest rate were charged.

Key takeaways

The Draft Schedule provides a useful framework (with understandable examples) to facilitate taxpayers’ risk self-assessment on their outbound related party loan arrangements. While some risk-determining factors may appear (illusively) clear-cut in the first instance, taxpayers should ensure robust documentation is put in place to substantiate their eligibility for a lower risk zone. Taxpayers with significant outbound interest-free loans may consider revisiting the charging basis, as the ATO is expected to include the Schedule in future tax compliance or assurance reviews.

Comments on the Draft Schedule are open until 14 October 2020, and no date of effect has yet been specified. It is likely that many taxpayers will need to lodge income tax returns before the Draft Schedule is finalised, which may require disclosure of a higher risk rating on cross-border interest-free loans in the RTP schedule than would otherwise be the case.

Contact us

| Daren Yeoh 杨成光 | Helen Wicker 韦贺岚 | Yang Shi 施洋 |