ATO increases GST engagement with Top 100 and Top 1,000 taxpayers

13/11/2024

The ATO has introduced a Supplementary annual GST return as part of its engagement with the Top 100 and Top 1,000 taxpayers.

The returns will be used to assess the confidence level of a taxpayer’s compliance with GST law, and their investments placed into GST governance.

The Supplementary annual GST return will first apply to the 2024-25 financial year for those Top 100 and Top 1,000 taxpayers who received a GST assurance rating on or before 30 June 2024. The ATO will notify taxpayers if they are required to complete the return and provide the submission deadline. In the meantime, the ATO has published the form and detailed instructions so taxpayers can begin their preparation.

What information does the GST return contain?

The return contains several questions for impacted taxpayers and their advisors, including:

- how the taxpayer has actioned ATO recommendations, areas of low assurance or red flags raised as part of the most recent review

- how the taxpayer has maintained or increased its level of GST governance, and whether there have been any material business or systems changes that impact its GST control framework since the last review

- whether the taxpayer has undertaken any reconciliation between its audited financial statements and its annualised business activity statements

- whether the taxpayer has taken any material uncertain GST positions; and

- whether the taxpayer has identified any material GST errors in the period and how these have been rectified, and whether the taxpayer claimed any material amounts of credits in the period that were referrable to earlier periods.

Who needs to lodge?

Taxpayers who received one of the following on or prior to 30 June 2024 must lodge the annual return:

- Top 100 GST Assurance Report

- Top 1,000 Combined Assurance Review Report with a GST assurance rating

- Top 1,000 GST Streamlined Assurance Review

Due dates

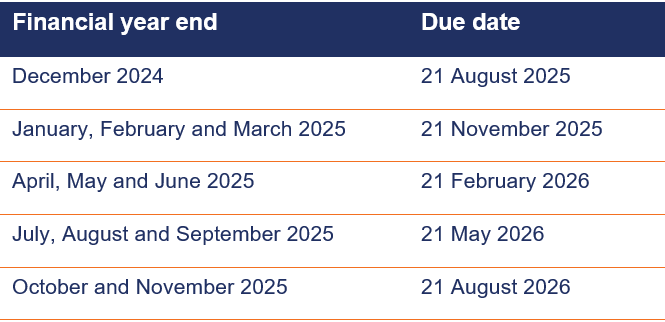

Taxpayers who received a GST assurance report on or prior to 30 June 2024 must lodge the return annually from the 2024-25 financial year. The following table sets out the relevant due dates:

How SW can help

Reach out to our GST experts for help reviewing your GST governance and ensure your annual GST return is completed accurately.

Taxpayers should also review their progress on implementing action items from their last ATO assurance review as part of the process of completing the return. By executing action items, this will reinforces the ATO’s confidence in their compliance and reduces the risk of future challenges for your business.