AusNet decision | CGT Rollover relief & ‘nothing else’

13/03/2024

The decision in AusNet Services Limited v Commissioner of Taxation [2024] FCA 90 has been handed down and could be a win for taxpayers with its impact on the ‘nothing else’ criteria for CGT rollover relief.

AusNet Services Limited faced a distinct challenge in trying to extricate themselves from a previously chosen rollover relief election, when hindsight showed that a different approach could lead to greater tax benefits. Though AusNet Services Limited lost the case, the decision may well assist taxpayers seeking to rely on CGT rollover relief more generally.

Background

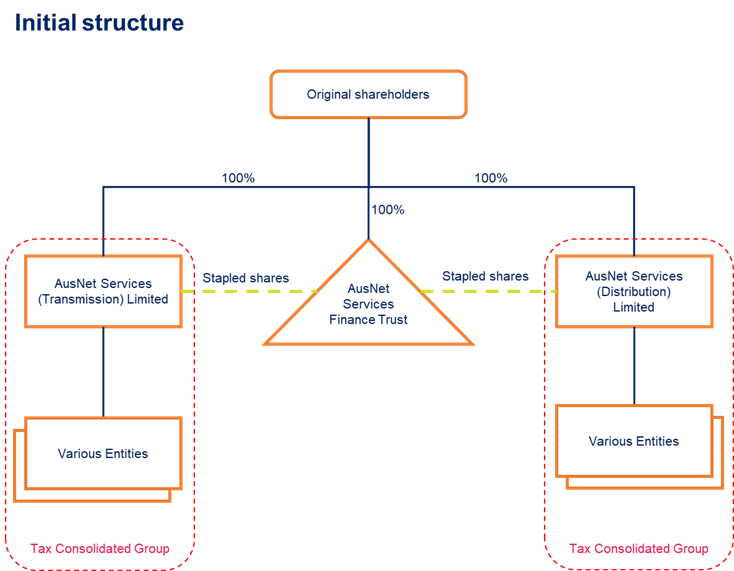

The Ausnet Group consisted of the following entities which were stapled:

- AusNet Services (Transmission) Limited (Transmission).

- AusNet Services Finance Trust (Finance).

- AusNet Services (Distribution) Limited (Distribution).

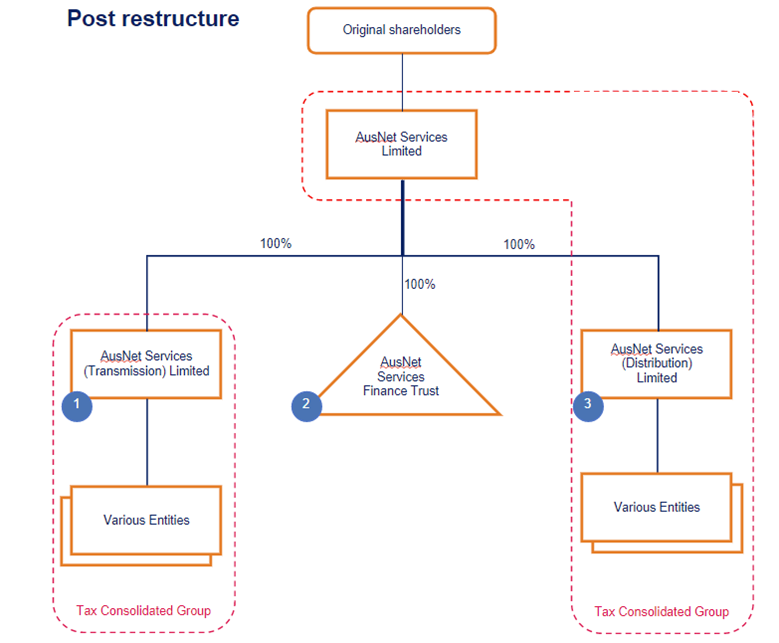

After a separate dispute with the Australian Taxation Office, it was decided to interpose a new entity above the AusNet Group and form a new tax consolidated group (TCG).

As shown in the above ‘post restructure’ diagram, after the 3 companies were unstapled, AusNet Services Limited (AusNet Services) acquired each of the 3 companies under a scrip-for-scrip exchange in the following order:

- Transmission,

- Finance, then

- Distribution.

The original intention was that CGT rollover would be sought for the interposition of the new head company under Division 615 of the Income Tax Assessment Act 1997. On the same day as the interposition, AusNet Services elected to apply Division 615 (noting this is a separate election that automatically applies for the shareholders where the new interposed entity is the head company of a TCG). This election was supported by the Class Ruling CR 2015/45 (link) that AusNet Services sought from the Commissioner.

The issue with a Division 615 rollover is that the cost base of the shares that Ausnet Services (the interposed entity) holds in Distribution is equal to the cost base of the Distribution’s assets net of liabilities. Where there is significant value in the goodwill of Distribution, the ACA will be skewed to the goodwill, rather than other assets which have tax benefits.

Because of the rules that apply under Division 615 to determine the cost base of shares acquired in the 3 companies, AusNet Services came in time to experience what might be described as ‘rollover regret’. With the benefit of hindsight, AusNet Services came to realise that the effects of the Division 615 were disadvantageous for the group in relation to the acquisition of Distribution. Unfortunately, the relevant legislation explicitly states that once the decision to apply Division 615 is made, it cannot be revoked. The only recourse for amendment was therefore to contend that Division 615 should not have been applicable to Distribution in the first place.

Rollover relief and ‘nothing else’

Whilst there were several arguments raised by AusNet Services as to why rollover relief under Division 615 should not apply, for the purposes of this alert we will be focusing only on the argument that is pertinent to a number of tax rollover relief provisions, which will have broad implications.

The argument boils down to the following question:

- Was there a scheme for reorganising the affairs of Distribution under which the original shareholders received shares in Ausnet Services for disposing of their shares in Distribution (and ‘nothing else’)?

Notably the ‘and nothing else’ requirement is an important precondition for rollover relief in several other rollover provisions beyond Division 615, including:

- Subdivision 124-E – exchange of shares in the same company or units in the same trust;

- Subdivision 124F – exchange of rights or options in a company or unit trust;

- [IK1] Subdivision 124Q – exchange of stapled ownership interests for ownership interests in a unit trust;

- Division 125 – demerger relief.

Arguments of the case

| AusNet Services arguments | Court view |

| There was no scheme for reorganising the affairs of Distribution, as AusNet Services was not a shelf company. The reference to ‘its affairs’ in section 615-5(1)(c) meant that Division 615 only applied where the affairs of Distribution were not amalgamated or merged. Note that the Commissioner has previously indicated in earlier rulings on predecessor provisions that rollover relief may not be available where multiple entities are being restructured unless the interposed company is a shelf company – see Taxation ruling TR 97/18 (link). | The affairs referred to in 615-5(1)(c) relate to the affairs of the shareholders and not that of the original or interposed company. In any event, Distribution, Finance and Transmission were a single economic unit and their affairs could not be dealt with in isolation. Essentially, the Court did not accept that it was a requirement of Division 615 that a shelf company be used where a new company is interposed between multiple entities and their shareholders. |

| Distribution failed to meet the and ‘nothing else’ criteria of the rollover relief because the shareholders of Distribution received: shares in AusNet Services, which, unlike the shares in Distribution, included substantial franking credits; andan increase in value of the AusNet Services shares due to the synergy created by Distribution, Transmission and Finance being brought under the one umbrella parent entity. | The Court has interpreted the and ‘nothing else’ condition quite narrowly, where it stated that: By its terms, s 615-5(1)(c) focusses on that which a shareholder receives under the scheme in exchange for the shares. It does not look to the consequences of the scheme, but rather the consideration or quid pro quo received for the disposal of the shares. In this case the implementation deed specifically stated that for each share disposed of in Distribution, one share in AusNet Services would be received. Therefore, this quid pro quo would be viewed as the relevant consideration in determining the and ‘nothing else’ criteria. Where there were consequences of the scheme that arguably added further value to the consideration received, they would be ignored in the application of the and ‘nothing else’ condition. As an aside, it is interesting to note that in Class Ruling CR 2015/45 and the present case, the Commissioner accepted that there could be successive rollovers that were eligible for relief under Division 615. This should be contrasted with the Commissioner’s views in Taxation Determination 2020/6. Given the comments of the court, we would expect that the Commissioner’s views in Taxation Determination 2020/6 would need to be reconsidered. |

AusNet lost in this case however the narrow construction of the and ‘nothing else’ condition is a win for taxpayers.

Key takeaways

- The key outcome is essentially that certain rollovers may have broader application than what was previously thought to be the case (at least by the Commissioner). The Court’s concluded is that the and ‘nothing else’ requirement may not be as challenging as the Commissioner has to date indicated.

How SW can help

If you are considering a group restructure and/or have any queries on the contents of this article, please contact our expert team here at SW.