Build to Rent investment legislation released, designed to ease Australia’s housing shortfall

11/04/2024

The much-anticipated draft Build to Rent (BTR) legislation has been released for consultation, intended to significantly boost Australian developments in order to help ease Australia’s significant housing shortfall.

The SW Property & Infrastructure team are at the forefront of key changes and impacts related to BTR and the proposed legislation. Our submission to Treasury will cover all the noteworthy intricacies that will have long term ramifications on the BTR sector as detailed below.

Legislation will not be backdated

It is disappointing that the legislation will not be back dated for the small number of BTR pioneers that commenced construction on projects before 9 May 2023. These projects will be subject to the 30% Managed Investment Trust (MIT) Withholding Tax rate (WTR) imposed on residential property which may leave these small number of assets stranded and as these properties will not have concessional BTR MIT WHT treatment they will be more difficult to sell.

BTR projects are anticipated to be predominately funded by large offshore investors who already have exposure to this asset class internationally.

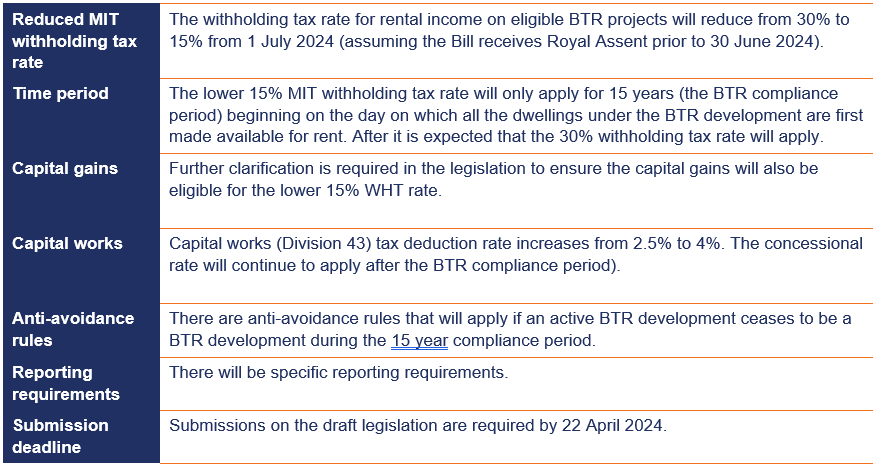

Key points

Who’s eligible?

BTR developments must meet the following eligibility criteria:

- The development’s construction commenced after 7.30pm on 9 May 2023. Unfortunately, the Government has stuck with the original start date for the legislation.

- The development consists of 50 or more residential dwellings made available for rent to the general public.

- The development continues to be owned by a single entity, at any one time, for at least 15 years. BTR developments can still be sold during the 15 year compliance period as long as the dwellings in the BTR development continue to be owned by a single entity. The 15 year period does not reset if the BTR development is sold to another entity.

- Dwellings must be offered for lease terms of at least 3 years (unless a shorter term is requested by the tenant)

- At least 10% of the dwellings in a BTR development must be offered as affordable dwellings throughout the 15 year compliance period.

Does this reduce ‘Red Tape’?

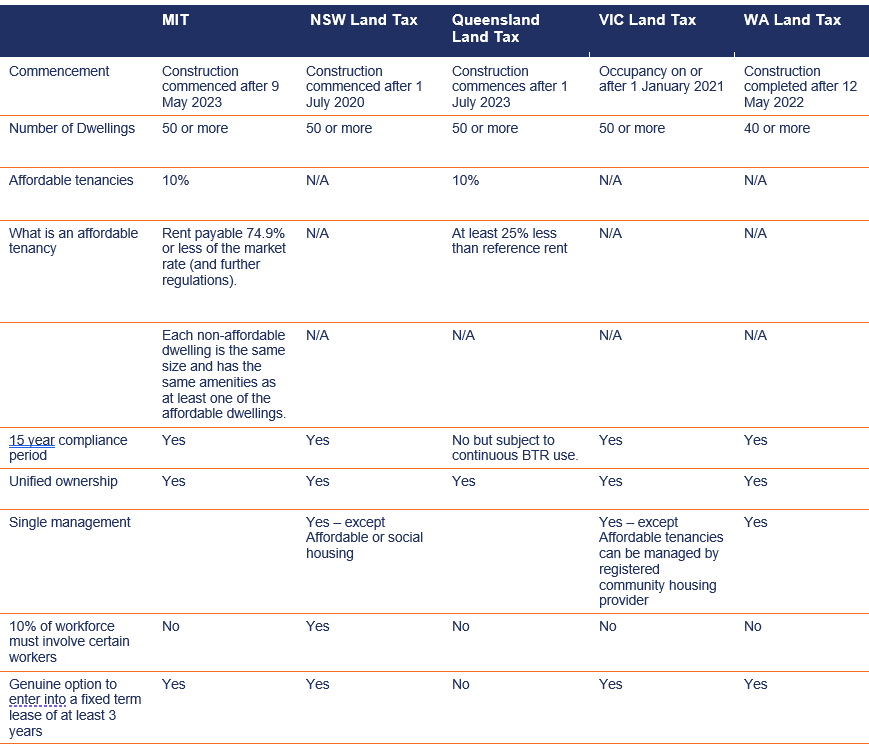

The Government’s promise of cutting red tape and planning hurdles to attract more institutional investment in the housing sector seems inconsistent with the legislation’s complexity. The new rules appear more difficult to satisfy than most of the State BTR land tax concessions (as indicated in the below analysis).

- The Government has imposed a requirement to include 10% affordable tenancies in BTR developments.

- In an active BTR development, there will likely be different types of dwellings with different sizes, total floorspace and different amenities: number of bathrooms, number of bedrooms, etc.

- The owner of the BTR development must make at least one of each apartment or dwelling types available as an affordable dwelling, that is dwellings of comparable size and amenities.

- This is to prevent a BTR owner from allocating only the lowest standard dwellings in a development as affordable dwellings, that is the lowest total floorspace, least number of bedrooms, least number of bathrooms etc.

Use of foreign capital now requires an affordable tenancy component

A number of the state land tax concessions do not require an affordable tenancies component. Therefore, this will now need to be factored into the rental profile of BTR developments in NSW, VIC and WA where they are looking to fund developments using foreign capital.

15 year compliance period

As the 15% MIT WHT rate is only available for 15 years, the concession is not very beneficial considering the long-term nature of BTR developments and is not consistent with the original announcement that did not mention any restriction on the period of the lower 15% MIT WHT rate.

All other commercial property held by a MIT is broadly subject to a 15% MIT WHT rate during the duration of the asset holding period by the MIT so it unclear why such a restriction has been imposed on the BTR sector.

Comparison with State BTR regimes

The following table summarises the key features comparison of NSW, Queensland, Victorian and Western Australian BTR land tax concessions. There are also BTR exemptions for South Australia, Tasmania and ACT.

Get in touch

Should you have any questions regarding the new BTR MIT legislation or would like to contribute to our submission on this issue please contact either Abi, Stephen or Matt.