Enduring the storm and preparing for the rebound

23/03/2020

The past week has continued to be very difficult for financial markets. We don’t know how long the pandemic will last and we don’t know how severe the downturn will be but we do know that once we pass through the worst of it, we need to be prepared for the eventual rebound.

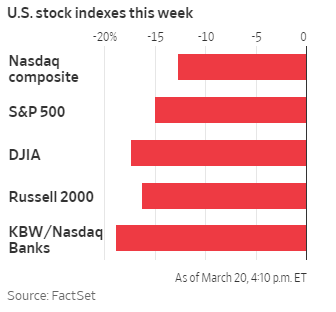

The past week has continued to be very difficult for financial markets with the S&P/ASX 200 Index closing the week down 722.7 points, or 13.1 per cent and overseas markets not faring any better with the benchmark S&P500 down 15%.

Source: Australian Financial Review

The backdrop to these falls was the continued expectation of substantial slowdowns in the Australian and Global Economy with the market re-pricing expected future earnings as companies continued to either reduce or completely withdraw their earnings guidance. We have started to see GDP estimates from some of the big investment houses forecasting large contractions in growth over the current and following quarter ranging from -4% through to -14% and there is no doubt that the short term impact will be severe.

Over the coming months we must also brace ourselves for some very ugly numbers with reports in the U.S. suggesting that America could see unemployment claims of over 1 million “or worse” per week and in Australia we have already seen massive drops in business revenue and consumer spending across the entire economy.

The coming months will be difficult not only for investors but for the entire country and world as we grapple with not just the economic cost of the coronavirus but with the human impact it will have on families, friends, colleagues and clients.

So what do we need to do?

Continuing to provide you with advice

Firstly, let us address what we are doing to maintain the continuity of our business so we can keep advising you. As a business we have initiated a decentralised operating model where staff can effectively work from home. We are well equipped to meet with clients over Zoom and other online applications, in lieu of face-to-face meetings. This will allow us to continue to work with you and advise you “come what may”.

We have established an online hub for all our clients to access the latest information and updates on Government support, our Business Continuity Plan and other updates relevant to supporting you during the coming months which can be found here.

Forecasting what the future holds

By now you all know our views on forecasting which is an educated guess at best and complete crystal balling at worst. What we do know is there will be a massive contraction in global GDP, which is what is currently being re-priced into markets, and that there will be substantial impacts on the Australian and global economies, most temporary although some may be permanent.

The Wall Street Journal is reporting predictions emerging for losses of up to five million jobs in the U.S. this year (Goldman Sachs is estimating that initial jobless claims in the U.S. for the week just gone could rise to 2.25 million) and a downturn that would last months at least, and would in some ways rival—and possibly even surpass—the severity of the 2007-09 slump triggered by the housing collapse and subprime loan debacle. It is important that whilst we consider these forecasts we need to be cautious as they are presenting a universe of potential outcomes based on available data at the time. This is demonstrated in the chart below which shows how these forecasts have changed drastically in the space of just 3 weeks as the scale of the pandemic becomes clear.

The answer will be somewhere in between all of these possible outcomes and keeping ourselves informed for future action is the most appropriate strategy right now.

Staying invested and enduring the storm

We have talked in our last two updates (1. Market volatility and investing for the long term; 2. Staying invested for long term returns) about staying invested and not making decisions based on fear and emotions. This message continues to apply as, while the markets may still decline, when they do bounce back (as shown in GDP in the chart above) we need to be invested to capture all of the upside as the correlation between record negative and positive days in the markets makes timing virtually impossible and when done is more likely a result of luck than skill.

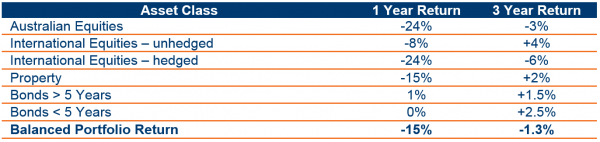

It is also important to remember that your portfolios are well diversified and liquid and it is important that we continue to keep perspective on the long term. The table below shows broadly the rolling 1 and 3 year returns for the asset classes that clients are typically invested into. Note that this is not your return but is what a balanced portfolio of the funds we use has returned. Your actual returns will be different based on your asset allocation, your specific funds, your additional investments/holdings (such as property, cash and other assets) and the timing of when you invested your money.

No one is happy with negative numbers but it is important to make sure we also have context to them including:

- Equity markets are currently some 30% off their highs, but portfolio returns are not at these levels;

- Many of you will recall the risk profiling we did with you which showed that over the past 30 years the largest negative return in any 1 year was -20% (during the GFC) but that once we moved out to 3, 5 and 10 year time frames this variability reduced and turned positive;

- Our portfolios are highly diversified holding over 5,000 different stocks and bonds so we will be well positioned to benefit from the eventual rebound when it comes; and

- We have strong liquidity in cash and Bonds which should be underpinned by the substantial quantitative easing across global financial markets

So for the short term we need to bunker down and wait for the storm to pass.

Preparing for the rebound

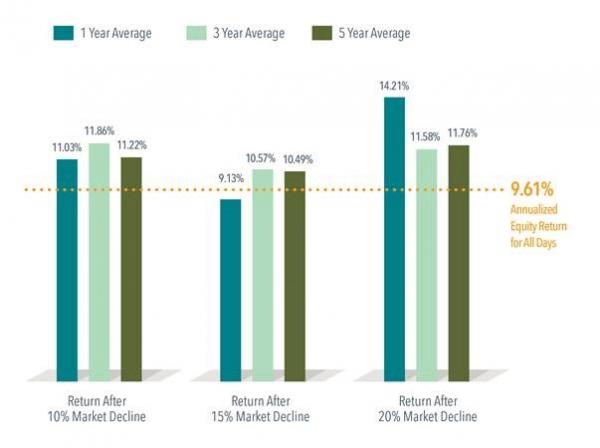

We don’t know how long the pandemic will last and we don’t know how severe the downturn will be but we do know that once we pass through the worst of it we need to be prepared for the eventual rebound. The chart below shows the Total U.S. Market Index Returns between July 1926 and December 2019 at various decline intervals.

Source: Fama/French Total US Market Research Index Returns, July 1926-December 2019

In general the higher the decline the larger the rebound over the following periods so the importance of staying invested to capture these returns becomes imperative. As your advisors we are working in the background to review your portfolios and make sure that you are best positioned to benefit from the upswing.

We are currently working through a series of asset class reviews, risk and return modelling, strategic and tactical asset allocation and currency and hedging overlays with a view to conducting a rebalance to your strategic asset allocation in July and August upon receipt of year end cash distributions. This process is designed to ensure that we have your overall investment and asset mix optimised to benefit from the expected long term rebound in global economies and stock markets and should be broadly timed to the peak of the pandemic and hopefully the start of it turning.

In any crisis, be it humanitarian, financial or some combination of both as we are seeing right now, the application of the Johari window, the idea of unknown unknowns created in 1955 by two American psychologists, Joseph Luft and Harrington Ingham, can be useful. Whilst this might seem an obscure reference it was used most recently by Donald Rumsfeld when talking about U.S. Defence Policy:

- There are known knowns – that is to say there are things we know we know – Markets have fallen and GDP will slow;

- There are known unknowns – that is to say there are things we know we don’t know – How deep will the recession be, how long will it last for, when will the rebound start and how strong will it be; and

- There are unknown unknowns – that is to say there are things we don’t know we don’t know

In providing you with advice on your investments and strategy we are focused on the first two and making sure that you can endure the storm and that we are prepared for the recovery when it comes. We will leave the unknown unknowns to the shouting voices and talking heads for now and continue to provide you with informed updates, advice and adjustments to your strategy as the situation evolves and warrants.

If you have any queries, concerns or just want to have a chat, make sure you reach out to your ShineWing Australia advisor.

Contacts

| Daniel Minihan |