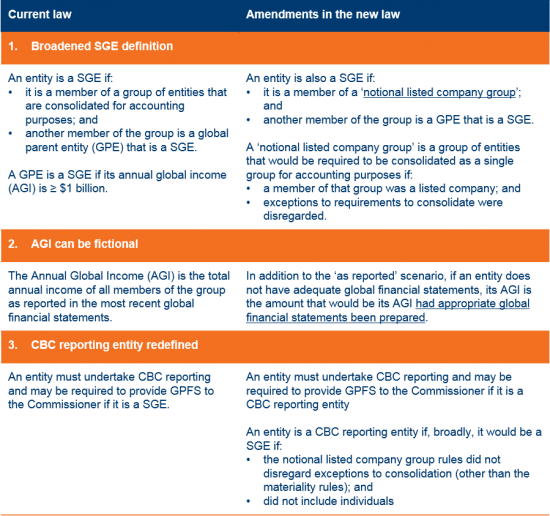

Extending the definition of SGE

01/06/2020

More taxpayers will be caught by the broadened Significant Global Entity (SGE) definition.

With the Royal Assent received on Treasury Laws Amendment (2020 Measures No.1) Bill 2020 on 25 May 2020, the definition of SGE is officially broadened. This means more entities will be subject to:

- Country-by-Country (CBC) Reporting and general purpose financial statements (GPFS) filing obligations effective from income years starting on or after 1 July 2019; and

- failure to lodge penalty up to $525,000 per document.

What are the key changes

What the taxpayer should do

Taxpayers may need to take greater care in relying on the AGI as reported in the consolidated financial statements to determine if it is a SGE. Due to the complexity in applying various concepts set out above, non-individual taxpayers (particularly if they were previously not SGEs) should immediately revisit whether they are subject to CBC reporting and GPFS filing obligations, as the new law applies retrospectively from 1 July 2019.

Our international tax and global transfer pricing experts can assist you navigating through the complexities arising from the new SGE landscape.

Get in touch

| Daren Yeoh |

| Helen Wicker |

| Tim Hogan-Doran |

| Yang Shi |