Proposed changes to the definition of ‘employee’: Closing loopholes or opening uncertainty?

21/09/2023

Changing the definition of ‘employee’ in the Fair Work Act will reverse landmark High Court decisions establishing that ‘contract is king’, increasing uncertainty and risk for businesses of all sizes.

On 4 September, the Fair Work Legislation Amendment (Closing Loopholes) Bill 2023 (Bill) was introduced into Parliament. Among the sweeping reforms proposed in the Bill, arguably, the change to the definition of ‘employee’ in the Fair Work Act 2009 (FW Act) may most warrant further consideration.

The new definition will reverse recent High Court cases (CFMMEU v Personnel Contract Pty Ltd; ZG Operations Australia Pty Ltd v Jamsek) establishing that in circumstances where there is a comprehensive written contract, the question of whether an individual is an employee of a person is to be determined solely with reference to the rights and obligations in the terms of that contract. This provided businesses with practical certainties as the classification of individuals as employees/contractors that was clear at the beginning of working relationships would remain consistent throughout the working relationship.

Instead, the definition of ‘employee’ and ‘employer’ under the FW Act will revert to be determined by reference to the real substance, practical reality, and true nature of the relationship between the parties. Effectively, the conduct of the parties after a contract is entered into will be considered under the ‘multi-factorial assessment’ in determining if there is an employment relationship. This means that businesses may engage an individual with the understanding that they are hired as an independent contractor, but later could be deemed an employee.

Navigating employer obligations – a new challenge

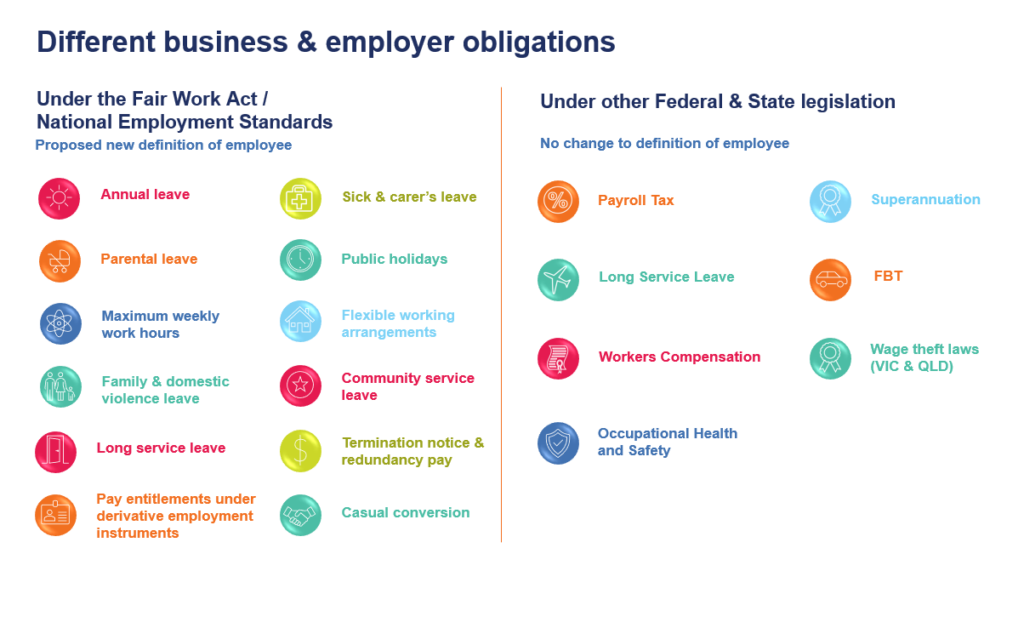

A significant issue that does warrant further consideration is that the new definition of ‘employee’ will only apply to the FW Act, while the definition of ‘employee’ in other Federal and State legislation is proposed to remain unchanged. Given businesses will have multiple overlapping obligations and responsibilities for each ‘employee’ (depending on which Act you’re referring to), the selective application of this new definition can lead to further complexity and fragmentation in complying with employer obligations.

As shown in the graphic below, businesses may be required to provide ‘employee entitlements’ to individuals taking into account post-contractual conduct under the FW Act, but not necessarily under other legislation. For example, this could lead to a worker being entitled to only those minimum pay and work entitlements provided by the FW Act, but not entitled to superannuation, workers’ compensation or long service leave. The increased complexity means there is a higher risk that businesses get it wrong. Practically, even where a business understands its various obligations and has the in-house capability to get it right, it is likely to increase the complexity of their internal processes and may require significant changes to their internal HR/payroll systems.

An alignment of the definition of employee across the various obligations which would involve co-operation between the State/Territory Governments and the Federal Government would go a long way to providing clarity and certainty for businesses. At the very least, a consistent definition across Federal Legislation should be considered.

In recognition of the complexity, the Australia Taxation Office (ATO) has historically had softer penalties for the inadvertent misclassification of employees and has recently been consulting on practical guidance that employers can rely upon to reduce ATO scrutiny.

ATO’s compliance approach

The Draft Practical Compliance Guideline 2022/D5 provides the factors the ATO takes into consideration in applying compliance resources to review worker classification (note that this has yet to be updated for the recent High Court cases mentioned previously). These factors include:

- whether there is evidence that both parties agreed to the arrangement to have a given worker classification

- whether both parties understand the tax and superannuation consequences of the classification

- whether specific advice confirming the worker classification was sought from an appropriately qualified third party, such as a solicitor or tax professional

- whether the performance of the arrangement has deviated significantly from the contractual rights and obligations agreed by the parties, and

- whether the correct tax, superannuation, and reporting obligations are being met.

While this guidance only applies to obligations administered by the ATO and is still in draft, it contains practical steps which if followed reduce the risk of misclassification across various obligations significantly. Therefore, it is prudent for businesses to consider the level of risk their current arrangements face and take proactive steps to ensure they have ‘low-risk arrangements’. By ensuring internal processes consider the factors above, this may reduce the likelihood of the ATO applying compliance resources to review the business’ worker arrangements and increase the likelihood of correctly classifying workers.

How SW can help?

The SW Team has expertise in assisting businesses and employers in complying with their employment obligations. By analysing contract language, payment schedules, delivery timelines and termination clauses, we provide businesses with the confidence that they are complying with the correct worker classification.

Considering the complexity of navigating employer obligations, our dedicated team designed a process that is considered low risk by the ATO.

Understanding and Setup – understanding the processes and controls that are in place to classify worker arrangements followed by designing a compliance program based on factors in the ATO practical compliance guideline to reduce risk.

Outsourced or co-sourced assistance – assistance with the classification of workers for various obligations, documentation as well as ongoing compliance activities.

In addition, SW can assist with more comprehensive, once-off review or advisory needs:

- conduct a comprehensive review of your assisting agreements and structure

- provide tailored advice on compliance and potential exclusions

- assist with private rulings for prospective arrangements with the relevant tax authority

- assist with voluntary disclosure if needed

- data analytics services to focus attention on higher risk arrangements across all suppliers paid.

Contact the SW Team today to schedule a consult and ensure that your business is prepared. Our expert team is here to support you every step of the way.