UGC releases Draft Regulations facilitating entry of foreign campuses in India

20/02/2023

The University Grants Commission (the “UGC”) has published the Draft Regulations that provide a framework for the establishment and operation of campuses of foreign higher educational institutions (FHEI) in India.

Under the proposed regulations, foreign institutions may set up a campus in India independently to conduct undergraduate and higher-level degrees in India in all disciplines.

The Regulations impose certain eligibility criteria on foreign institutions seeking to establish a campus in India, such as a ranking amongst the top 500 universities in the world or a reputed foreign institution. The Regulations shall be drafted to regulate foreign universities while allowing them to conduct undergraduate and post-graduate, doctoral, post-doctoral and other programmes, a vision as envisaged in National Education Policy 2020 while complying with the Indian laws and regulations.

One of the soaring positives in the Draft Regulations is that they purport to provide a foreign higher educational institution with a significant amount of independence including ability to devise its fee structure and recruit faculty and staff domestically as well as from outside India.

Foreign institutions are also required to obtain necessary approvals from the UGC including validation on the capability i.e., financial and infrastructural capability to operate such campus in India. However, FHEI are free to appoint faculty and staff including decision on their qualification, salary structure etc while ensuring that they are at par with the main campus of the country of origin.

The regulations will come into force from the date of publication in the Gazette of India.

We believe that this development and the Gujarat International Finance Tec (GIFT) city initiative will bring a new era of international presence of foreign institutions and opportunities for students and faculty in India.

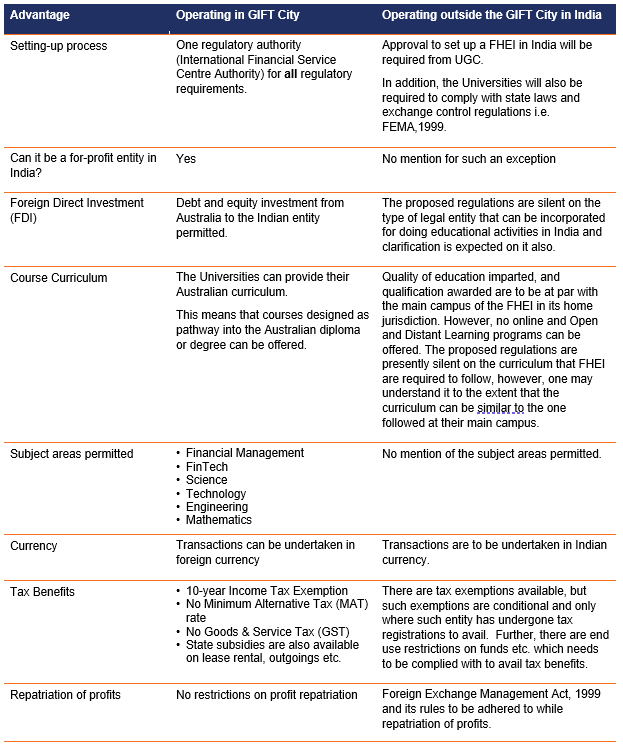

Where we compare these proposed regulations with the existing regulations introduced by the International Financial Services Centre Authority (IFSCA) for GIFT city campus, there are certain nuances which we have tried to capture below:

How can SW help

If you’d like further information or would like to explore the potential benefits of these new regulations, please contact one of our tax experts based in Australia or India.

Contacts

Stephen O’Flynn

Director

SW Australia

Rahul Sanghani

Senior Manager, Tax

SW Australia

Saurrav Sood

Practice Leader, International Tax & Transfer Pricing

SW India