VIC COVID-19 commercial rent relief

27/08/2021

The Governor in Council released the Commercial Tenancy Relief Scheme Regulations 2021 on 24 August 2021.

The scheme seeks to provide rent relief to commercial tenants affected by COVID-19 and operates in a similar manner to the Regulations released in March 2020, which expired on 28 March 2021. However, there are key differences including more specific details as to how to calculate the tenant’s decline in turnover and a mandatory reassessment process which will adjust the relief percentage from 31 October 2021.

Outlined below are the key eligibility requirements, the turnover reduction calculation methodology and the processes to be followed.

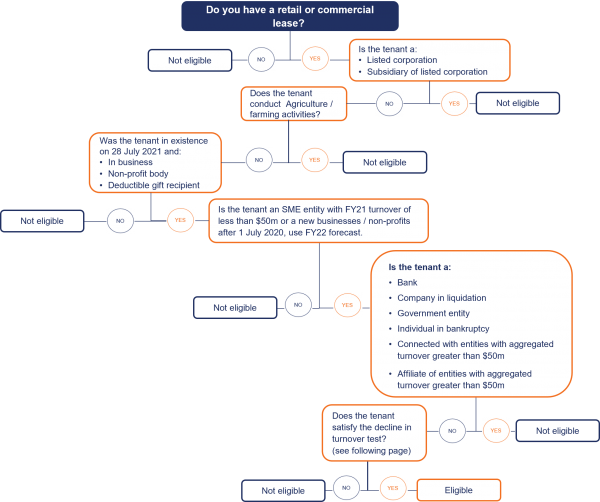

Eligibility

Decline in Turnover Test

Turnover means Current GST Turnover as defined in the GST Act, with some modifications in Regulation 11.

Decline of at least 15% for ACNC registered charities (with some exclusions); or 30% for all other entities.

Turnover test, periods to compare:

- If a tenant commenced trading before 1 April 2019,

- Any consecutive 3-month period between 1 April 2021 and 30 September 2021; compared to either:

- the equivalent period in 2019; or

- the tenant’s chosen applicable alternative comparison periods (see table on page 4 for alternative options).

- If a tenant commenced trading after 1 April 2019, but before 1 April 2021:

- any consecutive 3-month period between 1 April 2021 and 30 September 2021; compared to

- the tenant’s chosen applicable alternative comparison periods (see table on page 4 for alternative options)

- If tenant commenced trading on or after 1 April 2021,

- the period that is agreed to by negotiation between landlord and tenant; compared to

- the tenant’s chosen applicable alternative comparison periods (see table on page 4 for alternative options)

Process for agreeing rent relief

- Tenant assesses eligibility.

- Tenant requests relief. A request must be in writing and include a statement from the tenant that:

- the tenant is an eligible tenant

- the tenant satisfies the decline in turnover test including:

- Turnover for the test period

- Turnover for the comparison period

- Whether an alternative comparison period used

- Details of the calculation of decline in turnover

- The decline in turnover percentage

- The reduction in rent that would satisfy the minimum requirements of the regulations, consistent with the proportion of decline in turnover percentage provided

- Any other circumstances that the tenant would like to include.

- Within 14 days of making the request, the tenant must provide evidence of the turnover figures used including at least one of the following:

- Accounting record extracts

- Business Activity Statements

- Bank statements

- A statement prepared by a practising accountant.

The evidence must be accompanied by a statutory declaration from the tenant.

If a tenant fails to provide evidence within the required 14 days then the request automatically lapses. Up to 3 requests for relief can be made, i.e. 2 more if the first lapses. If they let 3 requests lapse then the tenant cannot apply again.

- Landlord makes offer within 14 days, unless otherwise agreed, of receiving everything required from the tenant including the request noted in 2. above, supporting evidence and the statutory declaration:

- the offer must be for rent reduction which at a minimum is proportionate to the decline in turnover

- at least 50% of the reduction must be a waiver and the balance can be a deferral.

- Tenant and landlord to negotiate.

- If no agreement is reached within 15 days of the landlord’s offer of rent relief, the tenant is deemed to have accepted the landlord’s offer unless the tenant has referred the matter to the Small Business Commissioner or the landlord’s offer does not comply with the requirements noted in 3) above.

- Agreed position to be documented by lease variation or other agreed approach.

Rent relief period

The period commences on either:

- 28 July 2021

- For complete and successful requests made on or before 30 September 2021

- The date of the request

For complete and successful requests made after 30 September 2021

The period ends 15 January 2022.

Mandatory Reassessment – before 31 October

For agreements reached on or before 30 September 2021, the tenant must provide the following by 31 October 2021 for re-assessment:

- Turnover for the quarter ended 30 September 2021.

- Turnover for the comparison period being:

- If the tenant began trading before 1 July 2019, the quarter ended 30 September 2019; or

- If the tenant began trading between 1 July 2019 and 31 March 2021, the quarter ended 30 June 2021; or

- An alternative test period (should be same as used for first request), including details of the comparison method.

- The percentage change in the above two periods

- Another statutory declaration.

The net percentage change is then used for the purposes of calculating rent relief from 31 October 2021.

If the tenant fails to provide the necessary information by 31 October, the rent relief agreement no longer applies to the extent that it relates to any waiver of rent from the assessment date. That means only the deferred portion of any rent relief will continue after 31 October.

Subsequent relief

Tenants can apply for further relief if their financial circumstances materially change, following the process described above under “Process for agreeing rent relief” subheading.

Any new rent relief agreement will apply in substitution of the original agreement.

Extension of term

The landlord must offer an extension on the same terms as were in place on 28 July equivalent to the period for which rent is deferred. E.g. if 3 months rent is deferred, 3 months must be added to the term of the lease.

Deferred rent

The landlord cannot request payment until after 15 January 2022.

Deferred amount is to be paid over the greater of the remaining term of the lease, including any extension, and 24 months.

Previous deferrals

Any leases subject to rent deferrals under the previous (2020) rent relief scheme, must have the repayment of those deferrals paused and resumed after 15 January 2022.

Dispute resolution

Either party can refer a dispute to the Small Business Commissioner for mediation.

Further powers are provided to the Small Business Commissioner to make a binding order in certain circumstances.

Application can be made to VCAT for review of a binding order in certain circumstances.

Alternative comparison periods

| Test | Comparison period |

|---|---|

| Began trading after 1 April 2019 | – If commenced trading between 1 April 2019 and 31 March 2020, the sum of each whole month turnover before 1 April 2020, divided by the number of whole months, multiplied by 3 – If commenced trading between 1 April 2020 and 31 March 2021, the sum of each whole month turnover before 31 July 2021, divided by the number of whole months, multiplied by 3 – If commenced trading after 1 April 2021, the total turnover to 31 July 2021, divided by the number of days trading, multiplied by 92 |

| Business acquisition or disposal affecting comparison turnover | Turnover for first full whole month after the acquisition or disposal multiplied by 3 |

| Business restructure affecting comparison turnover | Turnover for first full whole month after the restructure multiplied by 3 |

| Substantial increase in turnover by: – 50% or more in the 12 months before, or – 25% or more in the 6 months before, or – 12.5% or more in the 3 months before the (2021 COVID) turnover test period | Turnover for the 3 months immediately before the (2021 COVID) turnover test period |

| Business affected by drought or natural disaster | Turnover for the same period in the year immediately before the declaration of drought or natural disaster |

| Business has irregular turnover. Applies if business is not cyclical and in the 12 months before the turnover test period, the lowest consecutive 3 months turnover is no more than 50% of the highest consecutive 3 months turnover | Use the average monthly turnover in the 12 months before the turnover test period multiplied by 3 |

| Sole trader or small partnership with sickness, injury or leave | Turnover from the month immediately before the month of illness multiplied by 3 |

| Tenant temporarily ceased trading for 1 week or more during comparison period | – Turnover for 3 months immediately before the month in which the business ceased trading, or – Turnover for the same period but in the year before the business ceased trading |

How SW can assist

Our teams can assist commercial landlords and tenants to calculate the decline in turnover, assessing eligibility, the application and negotiation process.

Reach out to one of our experts below for a conversation about your circumstances.

Blake Rodgers