Another win for the ATO on transfer pricing litigation involving inbound related party financing.

Singapore Telecom Australia Investments Pty Ltd v Commissioner of Taxation [2021] FCA 1597

On 17 December 2021, the Federal Court of Australia (the Court) decided in favour of the ATO against STAI in a transfer pricing dispute involving the pricing of inbound related party financing (the Case). Notably this was another ATO victory, following Chevron(1) four years ago.

The Case reinforces the importance of commerciality surrounding financing transactions with international related parties. The Court tends to weigh heavily not only on the commerciality of the terms of the loan contract but also on the commercial nature of the dealings and interactions between the parties.

Multinational groups (MNEs) with Australian operations should self-assess their existing and proposed intra-group loan arrangements to identify the implications of the Case, amid a series of resurging ATO review programs.

Loan notes

- Original – 28 June 2002

- Amendment – 31 March 2003

- Amendment – 30 March 2009

Interest denial – A$895 million over four years 2010–2013

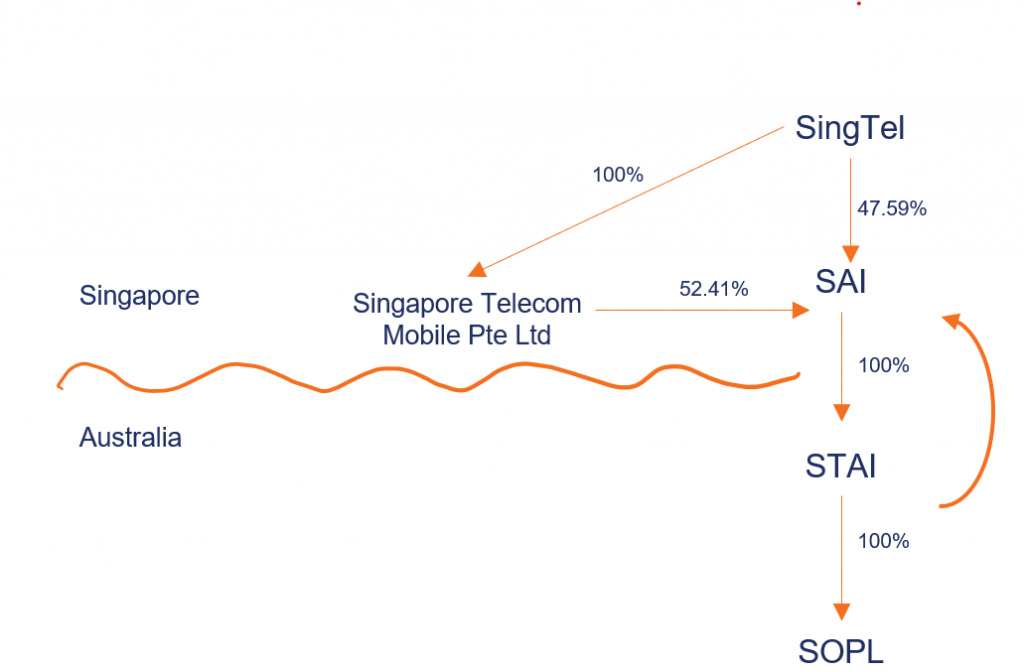

Singapore Telecommunications Ltd (SingTel) is a publicly listed company resident in Singapore, principally engaged in the operation and provision of telecommunications systems and services.

In May 2001, Singtel Australia Investment Ltd (SAI) and Singapore Telecom Australia Investments Pty Ltd (STAI) were incorporated, with residency in Singapore and Australia respectively. In October 2001, SAI acquired 100% of the shares in Cable & Wireless Optus Ltd. The acquired company was then renamed to Singtel Optus Pty Ltd (SOPL). The acquisition was funded by SingTel via debt and equity contributions, which substantially involved external debt raised by SingTel.

In June 2002, under a group restructure, STAI acquired all the shares in SOPL from SAI for approximately A$14.2 billion. This was funded by the issue of A$9 million of shares to SAI, and A$5.2 billion of Loan Notes under a Loan Note Issuance Agreement (LNIA). The terms of the LNIA were amended over time, as follows.

| Timing | Key terms |

|---|---|

| Original LNIA | •Applicable interest rate – (BBSW + 1%) x 10/9 (withholding tax gross-up) •No guarantee provided by SingTel •Payment of accrued interest could be deferred and capitalised •Amounts outstanding were repayable on demand by SAI and could be repaid at any time by STAI Facility maturity date – just under 10 years (term added in December 2002) |

| 2003 Amendment | •Interest accrued to date (A$286 million) was relieved •Interest only commences to accrue / payable after specific profit benchmarks were met by STAI •4.552% was added as a ‘premium’ to compensate for the interest-free period, so the applicable interest rate became (BBSW + 1%) x 10/9 + 4.552% |

| 2009 Amendment | •Floating BBSW converted to a fixed rate at 6.835% •Applicable interest rate therefore increased to 13.2575% |

Key decisions

The Court’s decisions were primarily based on the application of Subdivision 815-A of the Income Tax Assessment Act 1997 (ITAA 1997) in determining whether STAI derived any transfer pricing benefit from the LNIA.

Commerciality

- the interest rate and other conditions under the original LNIA might be expected to have continued through the whole life of the LNIA.

- In the case of the 2003 Amendment:

- both STAI and SAI were exposing themselves to uncertainty risk as to when the profit benchmarks would be met.

- STAI’s argument that this amendment was needed to address SOPL’s cashflow issues was rejected. The original LNIA already permitted STAI to defer and capitalise interest.

- An independent entity in the shoes of SAI would not be expected to agree to the interest accrued to date (A$286 million, which was a substantial sum) to be treated as not having accrued.

- In the case of the 2009 Amendment, the floating rate was generally dropping during the Global Financial Crisis. While there was no expert evidence that 6.835% was an arm’s length substitute for the 1-year BBSW, it did not appear commercially realistic for a fixed rate conversion.

The Court took the view that enterprises dealing wholly independently with one another in STAI and SAI’s circumstances would not have agreed to the conditions per the amended LNIAs (effectively accepting the ‘No Amendment Model’ submitted by the Commissioner):

Comparability

STAI contended that the effective credit spread of the LNIA over its entire life (144 basis points plus a withholding tax gross-up) was lower than the credit spread that might reasonably be expected to have been agreed in an arm’s length debt capital markets (DCM) transaction between independent parties.

However, the Court found this approach:

- departed too far from the actual transaction. The actual transaction involved a vendor and purchaser of shares, and an issue of loan notes as partial consideration for the acquisition of the shares. It did not involve a DCM bond issue.

- involved the calculation (in hindsight) of the effective credit spread of the LNIA, rather than focusing on what independent parties in the positions of SAI and STAI might be expected to have agreed in June 2002, and at the time of each amendment.

Parental guarantee

Critical to the disagreement between the ATO and the taxpayer’s sides regarding the pricing of the debt was the degree of uplift in STAI’s credit quality for SingTel’s implicit support.

The Court found that it was reasonable to expect an independent entity in the position of SAI would require security for the provision of the loan, and the parent company in the position of SingTel would be likely to prefer to provide a guarantee rather than allow its wholly-owned subsidiary to suffer a greater amount in interest expense (which would likely affect the parent’s financial position), having regard to the following:

- there was a material difference between the credit rating of SingTel (AA-/A1) and that of STAI (BBB- to BB / Ba1 to Ba3) at the relevant time (June 2002)

- the very large size of the transaction

- SingTel actually provided a guarantee in relation to Optus Finance Pty Ltd’s $2 billion bank facility.

There was no probative evidence that SingTel charged a fee for guaranteeing the obligations of Optus Finance Pty Ltd under the $2bn facility. Notably, the lack of supporting evidence for the presence of a guarantee fee was also a key controversial area in Chevron.

Impact on Australian MNEs involving inbound related party financing

The Case further evidences the ATO’s tight scrutiny on cross border related party financing, and their commitment to standing up to challenges from the taxpayer in court.

For taxpayers, the Case appears to re-affirm that a ‘narrow’ benchmarking based approach in defending a transfer pricing position may not be adequate, in the absence of probative evidence on commerciality. The ATO were particularly vigilant in this aspect – for example: the ATO took the view that the profit benchmarks applied under the 2003 Amendment appeared to have been reverse-engineered to be met not at the time that STAI became profitable, but at the time it exhausted carried forward tax losses.

While the Case did not consider the application of Subdivision 815-B of ITAA 1997 (‘new’ rules which are already 8 years old), taxpayers may have to face a higher bar for evidencing arm’s length conditions through more rigorous steps for self-assessment, given the explicit ‘reconstruction’ provisions under section 815-130.

Considerations for your business

If your group is involved in cross border related party financing transactions, we suggest that you consider:

- Is there adequate probative evidence that demonstrates the commercial drivers of your transactions, including any amendments to their terms?

- Are the terms and conditions in the agreements common in the market?

- Was the pricing determined based on hindsight, or conditions occurring ‘real-time’?

- Are the comparables sought for self-assessing arm’s length prices true comparables?

- Is your transfer pricing self-assessment in line with the ATO’s documentation standards?

If you feel unsure about these implications, contact one of our SW international tax and transfer pricing specialists below.

Contributors

Stephanie Mulyawan

E smulyawan@sw-au.com

(1) Chevron Australia Holdings Pty Ltd v Federal Commissioner of Taxation (2017) 251 FCR 40

Over the last year, the immediate expensing of assets for tax purposes has been subject to a raft of changes and extensions owing to the impact of COVID-19.

Updated 10 June 2021 (including announcements in the 2021/22 Federal Budget)

In this alert, our tax experts have detailed the key dates and conditions of eligibility for the instant asset write-off and full expensing of depreciable assets announced in the 2020/21 and 2021/22 Federal Budgets.

The multiple amendments to the rules have seen variations and extensions in eligibility thresholds, asset cost thresholds and installation date requirements. What was designed to be a simple tax cash flow benefit to encourage investment has now become relatively complex.

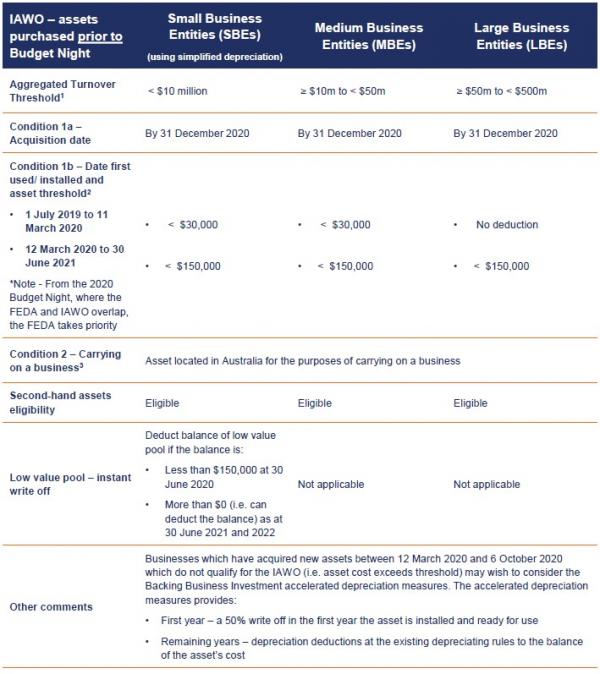

The Federal Government introduced the Full Expensing of Depreciable Assets (FEDA) measures in the 2020 Budget, which was an extension to the existing Instant Asset Write Off measures (IAWO).

As a guideline:

- IAWO apply to assets purchased prior to the 2020/21 Federal Budget (6 October 2020)

- FEDA measures apply to assets purchased on or after the 2020/21 Federal Budget (6 October 2020)

There may be some overlap in rules between the IAWO and the FEDA, in particular for assets purchased after 6 October 2020. Where this is the case the FEDA measures takes priority.

The tables below, summarises the measures (as they currently stand) for the 2020 income year and onwards. For simplicity we have not included thresholds or eligible requirements prior to the 2020 income year.

Federal Budget 2021/22

In the 2021/22 Federal Budget (on 11 May 2021), the Federal Government announced that they will extend the FEDA until 30 June 2023. It was otherwise due to finish on 30 June 2022. Other than the extended date, all other elements of FEDA will remain unchanged. This will be law when the Bill receives Royal Assent.

Please note

- The term aggregated turnover includes group companies located within and outside of Australia. Your global consolidated annual report will be a good starting reference point.

- The IAWO and FEDA provisions do not apply to certain assets including capital works asset (e.g. buildings and structural improvements), certain primary production assets or assets that have been allocated to a low-value pool or software development pool.

- A passive entity (e.g. entity holding a rental property) may not qualify as carrying on a business. You should discuss this with your adviser.

- For a LBE, a depreciating asset that starts to be held after the 2020 Budget time is excluded from the FEDA if:

- the entity entered into a commitment to hold, construct or use the asset before the 2020 Budget time; or

- the asset is a second hand asset.

- In the 2021/22 Federal Budget (on 11 May 2021), the Federal Government announced that they will extend the FEDA until 30 June 2023 (i.e. it will cover assets installed and ready for use by 30 June 2023). This will be law when the Bill receives Royal Assent.

- No immediate expensing under the FEDA. However, LBE can look to utilise the IAWO measures and claim an immediate deduction for the full cost of eligible second-hand assets costing less than $150,000 if they are purchased by 31 December 2020 and installed ready for use by 30 June 2021.

- For those entities which may not otherwise qualify for FEDA, alternative tests are available to be able to access the FEDA measures (similar to the measures available for LBEs). To satisfy the new test, companies must have:

- less than $5bn in total statutory and ordinary income, excluding non-assessable non-exempt income (generally assessable income Australia) in either the 2018-19 or 2019-20 income year; and

- invested more than $100m (cumulative) in Australia in tangible depreciating assets in the 2016-17 to 2018-19 income years.

The alternative tests allows businesses with an aggregated turnover of more than $5bn (due to the income of an overseas parent or associate) to qualify on the basis that they meet the additional investment requirements based on Australian activities.

Things to consider for your business

- If the IAWO measures do not apply for depreciable assets purchased prior to 6 October 2020, can the accelerated depreciation rules apply?

- There may be situations where the IAWO rules provide a better benefit over the FEDA including:

- where LBE acquires a second-hand asset; or

- where an entity acquired, or first used or installed ready for use, the asset on or after 12 March 2020 and prior to the Budget time

- What entities (domestically and internationally) may be grouped for the purposes of the ‘aggregated turnover’ test. This may be more complicated for multinational businesses.

- Are passive entities (e.g. property trusts) considered as ‘carrying on a business’?

- Consider reducing PAYG instalments if the entity is considering purchasing significant depreciating assets that may be eligible for a write off under the IAWO or FEDA.

- The FEDA is optional. Therefore, it may be worth considering whether incurring the tax deduction in a lump sum would be more beneficial than over time under the normal depreciation rules. Examples where taxpayers may wish to opt out include:

- Ability to carry forward losses and satisfy loss testing rules

- Ability frank dividends or receive other tax credits

- Taxpayers prefer to align accounting and tax depreciation

- Taxpayers have the choice to apply the FEDA on an asset-by-asset-basis.

- The ATO has indicated that significant FEDA and IAWO deduction disclosure information will be included in 2021 and later year returns. Record keeping will be required to be tailored to be able to make these disclosures.

Get in touch

Contact one of our experts to learn more about the impacts this may have to your business and how to navigate these changes.

Contributors

Jae Debrincat

View LinkedIn profile

As of November 2021, all company directors will need to apply for a Director identification number (Director ID). This is part of new requirements implemented by the Australian Government.

A Director identification number is a unique identifier and has been introduced to prevent the false or fraudulent use of directors’ identities.

Who needs to Apply for a Director ID

You need a Director ID if you are an “eligible officer” of:

- a company, a registered Australian body or a registered foreign company under the Corporations Act 2001 (Corporations Act)

- an Aboriginal and Torres Strait Islander corporation registered under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act)

- Charity or not-for-profit organisation that is a company or Aboriginal and Torres Strait Islander Corporation, for instance public companies limited by guarantee

- Director of Incorporated Associations which have an Australian Registered Body Number (ARBN) – an incorporated association that is registered with ASIC and trades outside of the state or territory in which it is incorporated will be affected even if they are not ACNC registered.

An eligible officer is a director or an alternate director who is acting in that capacity.

There is provision for other types of officers to be prescribed by regulation so there may be further changes to this in the future.

When to apply for a Director ID

The Director ID application will be available from November 2021, with transitional arrangements for existing and new directors. When you need to apply for a Director ID will depend on when you become a director, as set out below:

| Date person becomes an eligible officer | Must apply |

|---|---|

| On or before 31 October 2021 | By 30 November 2022 |

| Between 1 November 2021 and 4 April 2022 | Within 28 days of appointment |

| From 5 April 2022 | Before appointment |

Directors in place prior to 31 October 2022 for Indigenous corporations that are governed by the CATSI Act will be required to apply for a Director ID by 30 November 2023 and those who become eligible officers after 1 November 2022 will need to apply before their appointment.

Application process

The preferred process is to apply for a MyGovID and then apply online using the ABRS website. This may be difficult for some directors including foreign directors but there are alternative application processes available by telephone or paper applications.

We will provide further information in November 2021 once the application process is open. Although we cannot do your application for you, we can assist you in the process. Please do not hesitate to reach out to your SW Consultant to gain their assistance and more detailed instructions.

Get in touch

Reach out to your SW advisor or one of our key contacts for any questions about the Director ID’s and/or assistance with the process.

Contributors

Changes to charity land tax exemption to increase University land tax bills.

The recently released Windfall Gains Tax and State Taxation and Other Acts Further Amendment Bill 2021 has introduced Victoria’s new Windfall Gains Tax and included changes to the charity exemption for land tax.

This should be considered closely by Universities that hold land in Victoria as it will impose:

- land tax on certain land owned by Universities that has not historically been subject to land tax; and

- a significant new value capture tax where University land is rezoned (particularly where it is rezoned from public land to residential land).

Land Tax

The land tax exemption for charities has been narrowed so that it is now only available where land is:

- used and occupied by a charity exclusively for charitable purposes; or

- is vacant and has been declared by the University to be held for future use and occupation by a charitable institution exclusively for charitable purposes.

It is believed that this change was introduced to reverse the decision in University of Melbourne v Commissioner of State Revenue (Vic) which allowed the charity land tax exemption to apply to student accommodation located on the University of Melbourne Campus that is operated by a third-party student accommodation provider.

However, the amendment is likely to have a broader impact.

Universities will need to determine if land and buildings that they own but rent to or is used by third parties is ‘occupied’ by the University.

This would include not just student accommodation facilities rented to students, but any other buildings or facilities that are leased to businesses to provide services to students on campus such as banks, travel agents, cafes, etc.

Windfall Gains Tax

For a summary of the new Victorian Windfall Gains Tax please refer to our Windfall gains tax alert.

Relevantly for universities where land is rezoned it will be subject to Windfall Gains Tax unless the 15-year charity waiver applies.

The waiver is available where the land is continued to be held for 15 years after rezoning by the charity.

This waiver can continue to be available where the rezoned land is transferred to another charity and the new charity elects to receive the land with the deferred windfall gains tax liability and any accrued interest and commits to the land being used by a charity exclusively for charitable purposes.

How can SW assist?

If you believe that you will be affected by the WGT or have any questions on how to navigate these changes, please contact us – either your usual SW contact or any of our key contacts.

After being deferred 12 months from the original Victorian Budget announcement, the windfall gains tax (WGT) will come into effect on 1 July 2023. This applies to uplifts in land value resulting from amendments to planning schemes that take effect on or after 1 July 2023 and is payable by the owner of the land when the liable rezoning occurs.

Threshold and rate

WGT only applies to aggregate taxable value uplifts in in excess of $100,000.

| Taxable value uplift | Rate of WGT |

|---|---|

| Less than $100,000 | Nil |

| $100,000 – 500,000 | 62.5% |

| > $500,000 | 50% |

Grouping and aggregation provisions apply so that the $100,000 threshold applies to the aggregate of all properties owned by the same owner or group of owners that are rezoned under the same planning scheme amendment.Excluded rezoning

Excluded rezoning includes the following:

- a rezoning between schedules in the same zone

- a rezoning that causes land to be brought within the Growth Area Infrastructure Contribution (GAIC) area within the Planning and Environment Act 1987

- the first rezoning after 1 July 2023 of land that was in the GAIC contribution area immediately before that date

- a rezoning that causes land to be included a public land zone, or that causes land that was in a public land zone to be in a different public land zone.

Transitional measures

WGT will not apply where:

- a sale of land was negotiated prior to announcement on 15 May 2021 where the sale is completed after the rezoning. This is to recognise that parties would not have anticipated this tax when negotiating the terms of the deal

- an option to purchase land was entered into before 15 May 2021 where either:

- the option has not been exercised before the rezoning

- the option has been exercised but the contract of sale has not been completed before the rezoning.

The terms of the contract of sale must have been settled at the time the option was granted. A right of first refusal or similar options where the price and other terms of the sale have not been settled is not covered.

Uplift in value

The taxable value uplift is the difference in the capital improved value (CIV) of the land immediately before and after the rezoning takes effect (CIV2 – CIV1).

The uplift is less any deductions to be prescribed by the regulations. It is not known at this stage what deductions might be prescribed.

The former value (CIV1) is the most recent valuation in force for the land while the latter (CIV2) is determined through a supplementary valuation certified by the Valuer-General. The supplementary valuation values the land as at the same date as CIV1, but as if the rezoning was in place at that time. In this way, it only captures the value uplift arising from the rezoning.

Multiple occupancies/titles

Land is based on a single title.

If land has been valued based on multiple occupancies, the Commissioner may determine the value of the land by adding the various occupancy valuations relating to that land.

Where an occupancy spans more than one title, the occupancy valuation can be apportioned to obtain a valuation of the land (i.e. the land on each title).

Grouping

Broad grouping provisions apply with grouping of corporations based on the grouping provisions in the Land Tax Act 2005. These include related companies and companies subject to common control.

Land held on Trust

If land is held on trust, the trustee is to be assessed for windfall gains tax on the aggregated taxable value uplift of all the land that is subject to each separate trust. However, related trusts are grouped.

Trusts are related trusts if the same person or persons have a controlling interest in each trust.

A person or persons together control a trust if they have:

- the ability to control the appointment of the trustee

- an entitlement to more than 50% of the income or capital of the trust.

In the case of a discretionary trust the Commissioner may determine that a person is, or persons together are, entitled to more than 50% of the income or capital.

Deferral of liability

The WGT becomes payable when the rezoning takes effect under the Planning and Environment Act 1987.

The owner may elect to defer up to 100% of the payment for up to 30 years. Interest accrues at the 10-year bond rate applying from time to time.

Unpaid or deferred WGT will constitute a first charge on the land, and the WGT liability will be included on property clearance certificates issued under the Taxation Administration Act 1997.

The deferral will generally cease when a dutiable transaction occurs under the Duties Act, such as transfer of the land, or a relevant acquisition in a landholder. Where there is a relevant acquisition in a landholder, 100% of the WGT becomes payable although the interest acquired in the landholder may be as low as a 20% interest.

Deferral will not cease if an excluded dutiable transaction occurs including:

- the acquisition of an economic entitlement in relation to land under the Duties Act 2000

- a transfer to a legal personal representative of a deceased

- a no consideration transaction where the transferee elects to assume the liability to pay the whole of the deferred windfall gains tax and any accrued interest payable

- a relevant charitable land transaction where the transferee charity elects to assume the liability.

A no consideration dutiable transaction means one where there is no monetary or non-monetary consideration. The election must be made on or before the date of completion of the dutiable transaction.

Subdivided land

If land that is subject to deferred WGT is subdivided, the tax and interest are rolled over to each child lot created by the subdivision. The liability of the parent title is apportioned to each child lot by reference to the size of all lots created by the subdivision. The whole liability that the parent title was subject to is apportioned only to the lots created by the subdivision. No liability is attributed to areas contributed to public land, roads, reserves or common property.

Exemptions

Residential land

Up to 2 hectares of residential land on single title (including primary production land with a residence) is exempt from the WGT, regardless of whether it is a principal place of residence.

Residential land is land that has a building that is designed and constructed primarily for residential purposes. It also includes land where a residence is being constructed.

Primary production land with a residence on it or where a residence is being constructed or renovated is residential land, notwithstanding that the primary use of the land is primary production. However, only land on the single title with the residence is residential land.

Residential land does not include commercial residential premises, a residential care facility, a supported residential service or a retirement village.

If the residential land (on one or more titles) exceeds 2 hectares, the WGT is assessed on the land on each title based on an adjusted taxable value uplift calculated in accordance with a formula. This spreads the benefit of the 2 hectare exemption across all titles by reducing the taxable value uplift of each title in proportion.

Charities

Charities will not pay any WGT on land they own that has been rezoned, so long as the land is used and occupied by a charity exclusively for charitable purposes for 15 years after the rezoning.

Errors

Rezoning to correct errors in the Victoria Planning Provisions or a planning scheme is exempt.

Rezoning already commenced

Exemption applies where the owner of land can establish to the Commissioner’s satisfaction that the owner requested the planning amendment before 15 May 2021, the request was created and registered in the Amendment Tracking System by the council before 15 May 2021, and the owner of the land incurred costs above a threshold amount (see below).

An exemption also applies where the owner requested the Planning Minister to make the planning amendment before 15 May 2021, the Minister agreed before 15 May 2021 to prepare the amendment, and the owner of the land had incurred costs above the threshold amount.

The threshold amount means the lesser of:

- 1% of the capital improved value of the land immediately before the WGT event

- $100 000.

Note that the costs must have been incurred by the owner. It would not appear to cover costs incurred by a developer, where the developer incurs costs relating to land subject to an option or a conditional contract.

How SW can assist

If you believe that you will be affected by the WGT or have any questions on how to navigate these changes, please contact us – either your usual SW contact or any of our experts below.

Get in touch

The Victorian Government has introduced Build to Rent Concessions in the form of a 50% reduction in land tax and an exemption from the land tax Absentee Owner Surcharge.

Build to Rent (BTR) projects which will in turn ensure Victorians have access to more rental homes and a greater range of housing options.

BTR Benefits will be introduced to promote Victorian BTR projects. The BTR Benefits will comprise of:

- A 50% reduction in land tax for eligible BTR projects;and

- Exemption from Absentee Owner Surcharge for eligible BTR projects.

Both benefits will be available for a period of up to 30 years.

The concessions will only apply to eligible BTR developments. A BTR development is one or more buildings that are constructed or substantially developed for the purpose of providing multiple dwellings for lease under residential rental agreements.

An eligible BTR development must meet the following requirements for a continuous period of 15 years from the occupancy date:

- It must provide for at least 50 self-contained dwellings

- It is owned by the same owners

- It must be managed by a single management entity (except affordable housing or social housing projects)

- It must be suitable for occupancy after 1 January 2021 and before 1 January 2032; and

- It must be rented or available for rent under a residential rental agreement. The tenant must have an option of at least a 3 year fixed term rental but may elect a shorter term.

The owner of the land must apply to the Commissioner for the BTR Benefits.

A land owner must notify the Commissioner within 30 days if it has claimed a BTR Benefit and there is a change in circumstance that results in the land no longer being eligible. The land owner may then be liable for BTR special land tax which effectively claws back the concessions for all prior years together with interest.

The BTR benefits are largely similar to the concessions introduced in NSW with one noticeable difference being that the Victorian concessions do not provide an exemption from the Foreign Purchaser Additional duty. Instead, landowners will need to specifically apply for an exemption for this additional duty if applicable.

What action needs to be taken?

The BTR concessions are only available to eligible projects. A review should be undertaken of proposed projects to determine eligibility.

How SW can help

Our team can assist with this review and the application to the Commissioner. Reach out to one of our property experts below for support.

Get in touch

Robert Parker

In the 2020-2021 Federal Budget, the Government announced the Super Reforms – Your Future, Your Super measure. A measure aiming to reduce employees accumulating multiple super accounts when moving jobs. These changes will come into effect from 1 November 2021.

What is Super Stapling?

Currently, where an employee does not nominate a complying superannuation fund, the employer is required to provide the minimum superannuation contributions, currently 10% of ordinary time earnings, to their default superannuation fund.

In the 2020-2021 Federal Budget, the Government announced the Super Reforms – Your Future, Your Super measure.

One of the key elements is the super stapling.

A stapled super fund is an existing superannuation account which is linked, or ‘stapled’, to an individual employee so that it follows them as they change jobs.

If a fund is recorded, then employers must send contributions to the fund for an employee, unless the employee requests for a change.

Employers will be obligated to search for their new employees’ existing fund and a new account can only be created with the employer’s default fund once it is confirmed by the ATO that it cannot identify a stapled fund for the employee.

Employers may also need to request the employees’ stapled super fund details if they are either:

- Temporary residents

- Covered by an enterprise agreement or workplace determination made before 1 January 2021.

Employees will be able to see details of their stapled super fund via their personal MyGov account (as long as it is linked to the ATO portal).

When does it come into effect?

Super stapling will come into effect from 1 November 2021.

It is still mandatory for employers to provide employees with a Standard Choice of Fund form.

Employers need to record when it provides the form and when it collects a completed form from the employee. Where an employer has nominated the default superannuation fund, it can still provide details of that Fund in Part B of the form.

If the employer does not meet choice of super fund obligations, additional penalties may apply. In the first 12 months, the ATO has indicated it may apply some leniency with penalties for non-compliance with the ‘stapled’ fund rules unless there is evidence that the employer did not make reasonable attempts to comply with the ‘stapled’ fund rules.

Why the change?

This measure aims to reduce employees accumulating multiple super accounts after moving from one job to another throughout their working life.

Having more than one super account can be costly as it can means employees are paying multiple sets of fees and insurance premiums.

Stapling should also make it easier for employees to keep track of their super savings.

Do employers still need to have their own default or preferred funds?

The answer is yes.

If a new employee is not already a member of a superannuation fund, then the employer is generally required to offer them a choice of fund. If the employee does not choose a fund, the employer will nominate the company’s default fund, which will then become their stapled fund.

Will existing employees be affected?

Existing employees are not expected to be affected by these changes.

Employers will continue to make their compulsory SG payments to the same super fund account they do today.

Do these new rules apply to contractors?

The answer is yes.

The rules will apply equally to a person who works under a contract that is wholly or principally for the supply of their labour. In this case, the person is considered and treated like an employee under the SG regime.

How employers can prepare prior to 1 November 2021?

- Ensure you are able to request stapled super fund details from the ATO. Check and update your access levels of your authorised representatives in your ATO online service (Business Portal). This will ensure employers can request the new employee’s ‘stapled super fund’ details from the Australian Taxation Office (ATO) during the onboarding procedure.

- Review onboarding forms to capture a new employees ‘stapled super fund’ account details.

- Review and amend employment contracts if required. For new employees commencing on or after 1 November 2021, current superannuation clauses will need to be updated to refer to the possibility of contributions being made into an employee’s stapled fund.

- Consider how super stapling may impact participation agreements with default funds. For example, where the default fund offers fee discounts or tailored pricing which is conditional upon a certain percentage of employees being in the default fund, such arrangements could be adversely impacted by super stapling.

What employers need to do from 1 November 2021 ?

- If your new employee has chosen their super fund, you will need to pay into their chosen fund.

- If your employee has not chosen their super fund, you will need to obtain the stapled super fund details from the ATO. The stapled super fund details can only be requested after you have submitted a tax file number (TFN) declaration or Single Touch Payroll pay event linking your new employee to your business. There is no limit to the number of requests you can make. To request a stapled super fund, you or your business authorised representative need to log in to the ATO online services portal and provide the employee’s details (including their TFN, full name, date of birth and address). You should be notified of the result within minutes and will be sent to the authorised representative.

Employers can make a bulk request if you are onboarding more than 100 new employees at once. A bulk request form will be made available in excel format for download from 1 November 2021.ATO will notify your employee of the stapled super fund details they have provided to you.

If an employee has more than one fund, they will be automatically stapled to the one that has been active (received a contribution) most recently. Where there is more than one active fund rules will be applied to select the most appropriate fund, for example, the fund with the biggest balance.

- If the stapled super fund account provided by the ATO cannot accept contributions for the employee, you will need to make another request via the ATO online services portal.

- If the same stapled super fund account is returned, you will need to contact ATO to obtain an alternative stapled super fund account. If there is no alternative fund, the ATO will advise whether the contributions can be made to the employer’s default superannuation fund or another fund that meets the choice of fund rules.

How SW can help

- SW has an outsourcing team to assist with your payroll function. We can assist employers understand and become familiar with the new requirements to make this change as easy as possible.

- Review your onboarding process and provide advice around current procedures used to obtain super account details and recommend possibly a more efficient onboarding procedure.

- We are a registered tax agent and can request the stapled super fund details for employees for you.

Get in touch

Legal expert

E alison.baker@hallandwilcox.com.au

Recent changes to land tax and duties will impact foreign property owners.

Most States across Australia tinkered with their foreign owner land tax and duty regimes as part of their last budget. None of these changes were good for foreign investors. These changes mainly impact residential property but they also impact on commercial property in some states.

We have updated our tables to summarise the foreign owner land tax and duty surcharges that apply in Victoria, New South Wales, Queensland, Australian Capital Territory (foreign purchaser land tax only), South Australia (foreign purchaser duty only), Western Australia (foreign purchaser duty only) and Tasmania (foreign purchaser duty only):

Foreign owner land tax surcharges

Most States provide an exemption for Australian based foreign owners who are significant developers or make significant contributions to the State’s economy.

Foreign owners who would like to consider their eligibility for exemption from these surcharges should contact either Stephen O’Flynn or Abi Chellapen.

Valuer General Vic v AWF Propco 2 Pty Ltd [2021] VSCA 274 handed down. The Victorian Court of Appeal has come to an unanimous judgement that ‘above ground assets’ installed on leasehold land are chattels and not fixtures.

In the latest in a series of cases on wind turbines installed on leasehold land, the Victorian Court of Appeal in a unanimous judgement has found that the ‘above ground assets’ including the towers, rotor blades and nacelles making up the wind turbines were chattels and not fixtures at common law.

As an alternative ground, if the assets were fixtures, they were tenant’s fixtures and s154A of the Property Law Act had the effect that they retained their character as chattels and did not become part of the land.

The case is in stark contrast to the recent decision of the NSW Supreme Court in SPIC Pacific Hydro Pty Ltd v Chief Commissioner of State Revenue. Both cases involve very similar facts, but the outcomes are diametrically opposed.

SPIC Pacific Hydro case

In the SPIC Pacific Hydro case Payne JA decided that the wind turbines were part of an integrated electricity generation facility. The turbines were integral to the functional use of the land as a wind farm operation and therefore were fixtures. Payne JA considered that the terms of the lease (which required the assets to be removed and the land restored at the end of the lease) was not determinative. The intention of annexation had to be determined objectively and the terms of the lease between the parties was not decisive. Payne JA considered the decision of the first instance judge in AWF PropCo but declined to follow the Victorian Supreme Court decision as he considered the Victorian judge had placed too much weight on the terms of the lease.

The Victorian Court of Appeal considered that that Payne JA overstated the primary judge’s reliance on the lease arrangements and concluded:

Accordingly, we consider that the primary judge was correct to have regard to the terms of the AWF Leases and the right and obligation to remove the above ground AWF Assets as relevant to her finding that they are chattels. It is not correct, as submitted on behalf the Valuer-General, that the primary judge weighed evidence regarding the subjective intention of the parties instead of applying the common law test requiring an objective assessment of the purpose or object of affixation.

The Victorian court of Appeal also took a different view to Payne JA on whether the turbines were part of an integrated electricity generation facility, concluding that:

The above ground AWF Assets form part of a single power generating facility. They were installed on the land for that specific purpose. However, they are not homogenous and the degree of integration of the individual items is limited. There is a connection by cable and by road between the substations, the buildings and the wind turbines. However, each wind turbine functions as an asset in its own right and does not rely on the other turbines in order to function. As the wind turbines are not interdependent, any one or more of them can be shut down while others remain in operation. AWF Prop Co can at any point remove turbines — whether for replacement, repair, refurbishment or simply to reduce the number of turbines. Clearly the substations, buildings and cabling have no purpose without operational turbines, but they are not dependent on there being a particular number of turbines.

In our view, the extent of integration does not speak to the AWF Assets being fixtures. This is particularly so having regard to the fact that the operator can come onto the land pursuant to its leasehold rights and, in a matter of just a few days, take out important items —one or more of the wind turbines — without impact on the other items.

Consequently, we now have two Supreme Court authorities – one in NSW and one in Victoria – that are at odds with each other.

Get in touch

If you believe that you may have been affected by this judgement or have any questions, please contact your SW advisor or one of our experts below.

Robert Parker

Carmelin De Francesco

Following the webinar on 16 September, we have collated some of the FAQs to assist you and your organisation to make these changes.

What we can assist with

- Collating a list of all employees who have continuous service

- Reviewing periods of continuous employment to determine any periods of a break in service

- Determining average weekly earnings to calculate the LSL entitlement

- Quantifying the LSL entitlement for all eligible employees and adoption of AASB 119 where required to comply with Australian Accounting Standards)

- Preparation of journal entries to accrue LSL’s at month/year end to book in your financial accounts

- Advice around the payment of LSL where an employee requests a period of LSL while still employed, upon termination or resignation. What are considered ordinary times earnings and is Superannuation Guarantee to be paid

- Review of payroll systems to provide you with comfort:

- Employees are set up correctly

- LSL settings applied correctly

- Accuracy of weeks and dollar amounts accrued

- LSL taken has been recorded correctly to reduce entitlements

What information would we require in respect of your employees to undertake a review of any potential LSL liabilities ?

- Employment start date

- LSL calculation date

- Dates and types of any breaks in service

- Weeks of LSL already taken

- Ordinary pay (usually for those employees who work normal weekly hours)

- Highest Average Weekly Earnings (usually for those employees who are casual or seasonal workers):

- Total earned in last 52 weeks

- Total earned in last 260 weeks

- Total earned for the period of continuous employment

No sensitive payroll data required such as employee names, tax file numbers, addresses, date of births, taxing details.

FAQs

If we had an employee who is contracted casually, however works on a regular basis with the impression to work at least 4 days a week and we have offered a FT/PT position, however was declined by the individual and requested to remain casual. Are we at any risk with this?

A casual employee is not required to accept an offer to convert. Employers should keep a record of all offers made and all acceptances and rejections. Employers should also ensure their employment contracts are up to date and maximise protection against possible future claims.

Does casual rate loading (25%) cover annual leave and long service entitlements

Where a casual employee is not required to convert to permanent staff under the Fair Work Act, they will remain as a casual employee. A casual employee is not entitled to annual leave and similar leave for personal, bereavement, parental etc. The casual rate loading is paid to compensate the employee for not having an entitlement to paid leave breaks.

The casual hourly rate loading does not include an amount to cover long service leave and an employer cannot include a loading to compensate for non-payment of long service leave.

A casual employee is entitled to long service leave where their employment is considered continuous and has exceeded the minimum service period. Where this applies and the casual employee takes long service leave, the average weekly earnings is calculated on the casual employee’s current pay rate including the loading component.

How does this apply to small business with only one or two employees where one employee is casual? The casual employee has been steadily employed and receiving 25% loading.

A small business employer (an employer with fewer than 15 employees at a particular time, taking into account the employees of associated entities of the employer) is covered by the new casual employment provisions in the Fair Work Act 2009 (Cth).

The primary exception is that a small business employer is not required under the new provisions to offer permanent employment to casual employees.

How about we have employees transfer from our corporate or sister companies overseas? Will the service years start from they start with the overseas employer?

It will depend on the applicable State LSL Act and the terms of the employee’s contract. We set out below some examples of the State Acts and recommend that you review the applicable State Act for any employees who transferred from an overseas related entity.

In Victoria, the LSL Act provides for ‘one employer’ that includes a related corporation or a corporation with substantially the same directors and/or same management, the employment will be continuous. The Victorian Act does not limit the geographic location of the related corporation.

In Queensland the LSL Act has a similar provision for the meaning of same employer and does not limit the location of the related entity, although the employee must be in Queensland at the time of termination or taking of leave.

In WA, there was a case, Venier’s case, where the court ruled to exclude the employee’s 26 years overseas employment with a related entity.

If in education we have casual sports staff managing kids sport that is seasonal, summer sport and winter. The coach works in summer coaching students tennis at the College in consecutive years is this considered continuous for LSL?

The employment of the casual sports staff will be considered continuous where the absence is due to seasonal factors. The absence will not break service even where it is longer than the required 12 weeks under the LSL Act (Vic) 2018.

So, LSL pay is calculated differently depending on whether the leave is being taken during service or being paid out when employment ends?

The calculation of long service leave is the same for an employee who takes long service leave or is paid out on termination of employment. The calculation is based on the employee’s average weekly earnings (taking the highest of average earnings of 52 weeks, 260 weeks, or the entire service period) x the weeks accrued based on the employee’s service period. Where the long service leave is paid out on termination, there is no superannuation payable under the Superannuation Guarantee Administration Act (SGAA) 1992.

If an employee refuses conversion, must you offer again after another 12-month period?

Not under the Fair Work Act 2009 (Cth). However, the employee will retain a right to request conversion in the future.

Do we need to look at LSL for long term casuals that have been terminated in the last few years eg in 2020

Short answer Yes. Where a casual employee has terminated and their previous employment provided for continuous service exceeding the legal entitlement to long service leave, either on a pro-rata or full entitlement basis. The employee would have generally have 6 years to make a claim after the date of termination under the law of limitations under the Statutes Act.

Have casual employees always been entitled to LSL? If not when did it begin?

Short answer Yes. In Victoria, the LSL Act 2018 (2018 Act) applies from 1 November 2018 and replaced the LSL 1992 (Vic) Act. (1992 Act)

Under the former 1992 Act, amendments were made with effect from 1 January 2006 to specifically include casual and seasonal employees. Prior to 1 January 2006, the Act did not include specific reference to casual employees, although the courts had determined over the past decades that many casuals were entitled to long service leave where they had continuous employment with one employer.

The 2018 Act did include specific changes for absences that would not constitute a break in service, e.g. paid and unpaid parental leave up to 104 weeks.

If you are taking over a business do your casual workers start from zero?

The answer depends on what has been negotiated in the business sale agreement. Generally, where an employee remains with the business after sale, the new employer is responsible for the employee’s long service leave entitlement. The period of employment with the old employer transfers to the new employer and becomes liable for the entire service period. It is common in sale contracts for the long service leave entitlement to be documented and quantified and the purchaser reduces the agreed business sale price by the assumption of the liability representing the after-tax cost of the long service leave accrued. This would include the casual employees where they satisfy the continuous employment requirement.

Further in relation to a sale of business, where an employee is dismissed by an old business owner and employed by the new business owner within 12 weeks of their dismissal to do work which is substantially the same as for the old employer, the employment is deemed continuous.

How do you terminate a casual employee?

Issue a letter of termination to the casual employee to state the contract of employment has been terminated. Generally the contract of employment will not have a notice period.

Do ‘normal’ on-costs apply to LSL payouts?

Long service leave is considered rateable remuneration for the applicable State payroll tax and Workcover laws. This covers both long service leave taken and leave paid out on termination.

Unused long service leave paid out on termination is not subject to the minimum superannuation contributions under SGAA 1992.

Are there template letters offering casual conversion and a template letter to say they are not eligible for casual conversion?

The Fair Work Ombudsman provides template letters to assist employers. Alternatively, you can seek advice to obtain a letter tailored to your organisation.

How about the company that has no part time or full-time positions available due to COVID-19. Does the employer still have to move a casual who is willing to convert to PT or FT?

The focus of the casual conversion provisions is not on whether there is an ‘available’ position.

In relation to an eligible employee, an employer should consider whether if during at least the last 6 months, the employee has worked a regular pattern of hours on an ongoing basis which, without significant adjustment, the employee could continue to work as a full-time employee or a part-time employee (as the case may be).

An employer is not required to make an offer of conversion to a casual employee if there are reasonable grounds not to make the offer. The Fair Work Act 2009 (Cth) sets out a non-exhaustive list of grounds that are reasonable grounds for deciding not to make an offer.

Is there ‘regular employment’ of a roster done around someone’s university timetable so that they are not refusing shifts. They are offered shifts around their timetable each semester during the COVID lockdown. We have not rostered most of the casual to work for the last 3 months or more, do I have to still give them the casual conversion?

In relation to an eligible employee, an employer should consider whether if during at least the last 6 months, the employee has worked a regular pattern of hours on an ongoing basis which, without significant adjustment, the employee could continue to work as a full-time employee or a part-time employee (as the case may be).

You should consider the pattern of work of the employee in the last 6 months and consider whether the employee could the employee could continue to work as a full-time employee or a part-time employee (as the case may be) without significant adjustment.

Get in touch

For any specific questions regarding your situation or to discuss navigating these changes for your organisation, reach out to one of our experts.

Janelle McPhee

Legal expert

Alison Baker