National Australia Bank (NAB) recently announced the launch of its stablecoin, AUDN, which is backed by the Australian dollar. The move comes amid the exponential growth in digital payments, ownership, and trading in cryptocurrency, stablecoins, and other digital assets in Australia over the last few years.

In a recent conversation with Danny Armstrong, NAB’s Chief Innovation Officer, Howard Silby, highlighted the importance of stablecoins as essential building blocks for the new web3 economy and offering stable cash links to other blockchain applications. The Australian dollar-backed stablecoin is expected to avoid the fluctuations associated with cryptocurrencies and offer a more efficient means of payment than traditional methods.

In the interview, we explored topics such as the advantages of stablecoins, the risks associated with conducting transactions on the public blockchain, and NAB’s future plans. Minted in several currencies, Howard emphasised the potential to facilitate cross-border transactions and high-value use cases, such as the carbon market and repo transactions. He also discussed green deposits and sustainable finance, supply chain financing and trade settlements and much more.

We invite you to watch the full interview to learn more about NAB’s stablecoin and its potential benefits for various industries and use cases.

2023年3月16日,澳大利亚财政部发布了一份资本弱化法规的草案,旨在加强澳大利亚的资本弱化法规,并将其与经合组织(OECD)的最佳实践准则对齐。此项法案将对于2023年7月1日起税务财年的资本弱化计算带来重大变革。

2023年3月16日,澳大利亚财政部发布了一份资本弱化法规的草案,旨在加强澳大利亚的资本弱化法规,并将其与经合组织(OECD)的最佳实践准则对齐。此项法案将对于2023年7月1日起税务财年的资本弱化计算带来重大变革。

对于属于“一般类投资者”(“general class investors”) 的实体(请参见下文),现有的资本弱化法规将被以下测试所取代:

- 固定比率测试 (Fixed Ratio Test (‘FRT’))

- 集团比率测试 (Group Ratio Test (‘GRT’))

- 外部第三方债务测试

新增的基于利润的规则旨在降低使用过多债务扣除对澳大利亚税基所造成的风险。正如《解释性备忘录》中所述,新规则预计比现有的资本弱化法规更为严格,相对于现有测试,在新的测试下相关实体应预计会有更为严苛的结果。

这些法规适用于哪些实体?

如上所述,新规则适用于“一般类投资者”。一般类投资者是指在现有资本弱化法规中除了“金融实体”或“授权存款机构”外的任何其他实体。一般类投资者包括:

- 受外国人控制的澳大利亚实体或澳大利亚常设机构

- 控制外国实体或外国常设机构的澳大利亚实体。

好消息是,以下资本弱化豁免会被保留并继续适用:

- 少于两百万澳币债务抵扣的豁免

- 持有90% 澳大利亚资产豁免(集团90% 或以上资产位于澳大利亚)

- 资产证券化实体的豁免

在拟议的法规中对于“金融实体”以及“授权存款实体”的定义,除了以下的两个重要改动,其它定义将保持不变:

- 缩小了对金融实体定义的修订,以进一步限制适用于金融实体的优惠安全港杠杆规则,并

- 用下文所述更严格的外部第三方债务测试替换了现有适用于金融实体(非ADI)的“外部方同等债务测试”

新法规的内容如下:

以下表格提供新测试的主要条件,更加详细的内容将在下文中列出

| 新测试 | 当前测试 | 适用范围 |

|---|---|---|

| 固定比率测试 (FRT) | 安全港债务测试 (Safe Harbour Test) | 默认情况下将应用FRT,除非纳税人选择应用其他方法。 净债务抵扣超过“税收EBITDA”30%的部分将不允许抵扣(即扣除利息收入后的净债务抵扣)。如果纳税人持续使用FRT,被禁止的税务抵扣在符合条件后可于15 年内可以进行抵扣。 |

| 集团比率测试 (GRT) | 全球杠杆债务测试 (Worldwide Gearing Test) | GRT 的目的是为使用高杠杆的跨国集团提供机会,可能比默认的FRT提供更高的利息扣除。只有在满足以下条件后,一般类投资者才可以选择使用GRT 来代替默认的FRT 测试: 测试实体为集团成员(即在集团合并报表中已非权益形式进行合并),且集团的EBITDA不低于零。 GRT不允许超过 “集团比率收益限制” 的净债务扣除(下文将进一步解释,但基本上是一个基于集团EBITDA的概念)。 虽然GRT对高度杠杆化的集团有潜在好处,但这种方法通常涉及复杂的计算和实操方面的挑战,下文将进一步解释。 |

| 外部第三方债务测试 | “非关联方”债务测试 | 一般类投资者可以选择针对特定的所得税年度,选择使用这个测试,但是有一些特殊限定条件。 对于一般类投资者,这个选择必须由所有关联实体作出——一般类投资者的关联实体有“一个入选所有入选”的要求。 该测试比现有的“非关联方”债务测试更为严格,下文将进一步解释,因为其仅适用于与非关联方借款相关的债务扣除。 该测试禁止超过实体的外部收益限制的债务扣除。 |

税务 EBITDA

税务EBITDA是指实体的应税收入(包括前一年补偿的税前损失)或损失进行以下调整:

- 加上当年度的净债务抵扣。

- 加上实体的固定资产折旧和资本性资产抵扣(capital work deduction)。

- 加上在当年使用的过往年度税损。

如果最后一步的结果为负,则税务EBITDA为零。

特殊扣除规定

依照新法规,在过去15年内因FRT而被禁止的债务扣除(FRT的禁止抵扣)的实体可以在某些情况下申请特殊抵扣。这对于早期运营中收入较低的实体尤其重要。

但是,只有在以下情况下才允许特殊扣除:

- 实体在禁止抵扣的年份和申请抵扣的年份之间继续使用FRT,且

- 对于公司而言,在使用过去年度被禁止的FRT 抵扣时,该公司必须通过修改版的连续所有权测试(COT)。值得注意的是信托或其他实体并没有类似的要求。

每年的特殊扣除金额将仅限于FRT比例比当年净债务抵扣高的部分。这意味着在特殊扣除年份中,将适用30%的税务EBITDA限制。实体可以将其过去15个收入年度中每个被禁止的FRT金额可用于该超额部分。

为了将FRT被禁止的金额纳入到一个税务合并集团中,相关的税务合并集团法规也进行了修改。

集团比率测试 (GRT)

全球杠杆率测试将被新的以利润为基础的GRT所取代。如果一个实体的净债务扣除超过了集团收益比率限制,那么该实体的债务抵扣将被禁止。

只有在实体是集团的成员时,才可以使用GRT,实体需要做出不可撤销的选择来使用此测试。集团由全球母公司实体和所有其他集团实体组成,这些实体在母公司审计的合并财务报表中被完全按行合并。

GRT不能结转被禁止的抵扣,如果一个实体改为使用GRT,那么之前根据FRT计算的任何被禁止的抵扣都将被取消。

一个实体的集团收益比率限制是由以下组成:

- 收入年度的集团比率(Group Ratio),和

- 该实体的当年税务EBITDA。

集团比率的计算为集团净第三方利息支出除以集团EBITDA。

在OECD指导意见中包括三种不同的模型,其中简单性和合规性的考量是不同的。不幸的是,似乎澳大利亚采用了一种繁琐的模型,这将需要针对全球集团进行大量的计算和理解,以确定集团的EBITDA和净第三方利息支出。对于在澳大利亚的小型子公司而言,它们难以从集团母公司实体获得信息,因此GRT可能是不切实际的。

集团净第三方利息支出是指在该期间内作为净第三方利息支出纳入集团财务报表中的金额。但是,需要对集团的合并财务报表进行调整,

- 包含与利息相似的金额及任何按照时间价值计算的其它金额,

- 减去支付给 集团之外的关联实体的利息。

集团EBITDA是以下各项之和:

- 净利润(不包括税费)

- 调整后的净第三方债务

- 折旧和摊销。

然而,如果GR集团中任何实体的EBITDA小于零,则该实体的EBITDA将被排除在集团EBITDA之外。这意味着,如果一个实体是集团的成员,为了确定该实体的可扣除债务扣除金额,就需要分析该实体的财务报表,而不能仅仅依赖于合并财务报表。这将会是一个费时和繁琐的过程,特别是对于较大和更复杂的集团。

实体必须保留记录集团比率,显示计算中已考虑的细节。这些计算细节必须在实体的所得税申报年度之前准备好并保留五年,以备未来税务审查使用。

外部第三方债务测试

外部第三方债务测试是一项新测试,依照外部第三方债务来决定债务扣除的额度。在外部贷款人采取比FRT规定更高的杠杆水平的情况下,对纳税人可能有所利益。但是,采用此测试将导致任何在FRT下被禁止并被结转的抵扣被取消。外部第三方债务的概念是有限的,它是指满足以下条件的债务:

- 债务是发行给借款人的非关联方的实体;

- 债务未被关联方持有(禁止发行后将债务转让给关联方);

- 债务持有人只能追索借款实体的资产;

- 实体只能将债务收益用于以下两种情况:

- 资助澳大利亚业务,和

- 投资于产生应税收入或澳大利亚永久机构所属资产。

因此,在以下情况中不能使用该测试:

- 由母公司或借款人以外的其他方提供的担保;

- 对除借款人以外任何一方的资产进行的担保

然而,好消息是,草案中包括了对作为集团融资工具的实体(在草案中称为传导融资者)的豁免条款。融资工具的豁免仅适用于(除其他事项外)融资条款是以与放贷人追索权仅限于最终借款人及传导融资者相关贷款资产的资产为基础,贷款条件也是相同的情况。此外,传导融资者的豁免通常仅适用于传导融资者是澳大利亚居民纳税人(在不是澳大利亚居民的情况下,必须是在澳大利亚产生应税收入)的情况。

澳大利亚借款用于资助海外投资

根据《1997年所得税征管法》(Cth)(ITAA 1997)第25-90和第230-15节的规定,一个实体可以就取得海外非应税非豁免收入的债务利益所产生的成本得到抵扣。通常,全球企业的澳大利亚控股公司会利用这项规定来抵扣收购海外子公司产生的利息支出。

然而,相关规定已经被修改,以防止在取得根据ITAA 1997第768-5节(关于股息的参与豁免)所得的非应税非豁免收入方面,产生债务抵扣。

相关日期

政府正在征求利益相关者对草案法规及其解释材料的意见,以实施此措施,目前正在进行咨询,截止日期为2023年4月13日。

新的法规将适用于2023年7月1日或之后结束的税务年度。对于早期结算的实体(例如,会计年度截止日期为12月31日的实体),该草案中还未具体规定。

纳税人应如何准备?

我们建议纳税人开始规划,以便在2023年7月1日草案法规实施时做好准备。虽然我们预计可能会进行一些小的技术性修改,但草案法规主要基于OECD的指导原则。

因此,在2023年6月30日之前,纳税人可能需要重新安排债务安排并重新审查交易文件。在决定是否进行债务重组时,纳税人应该考虑其影响,包括财务、税务和商业方面的影响,以及与此相关的成本和风险。为了最大程度地减少税务风险,纳税人应该寻求专业税务建议,并制定具体的计划,以确保他们遵守相关法规和规定。

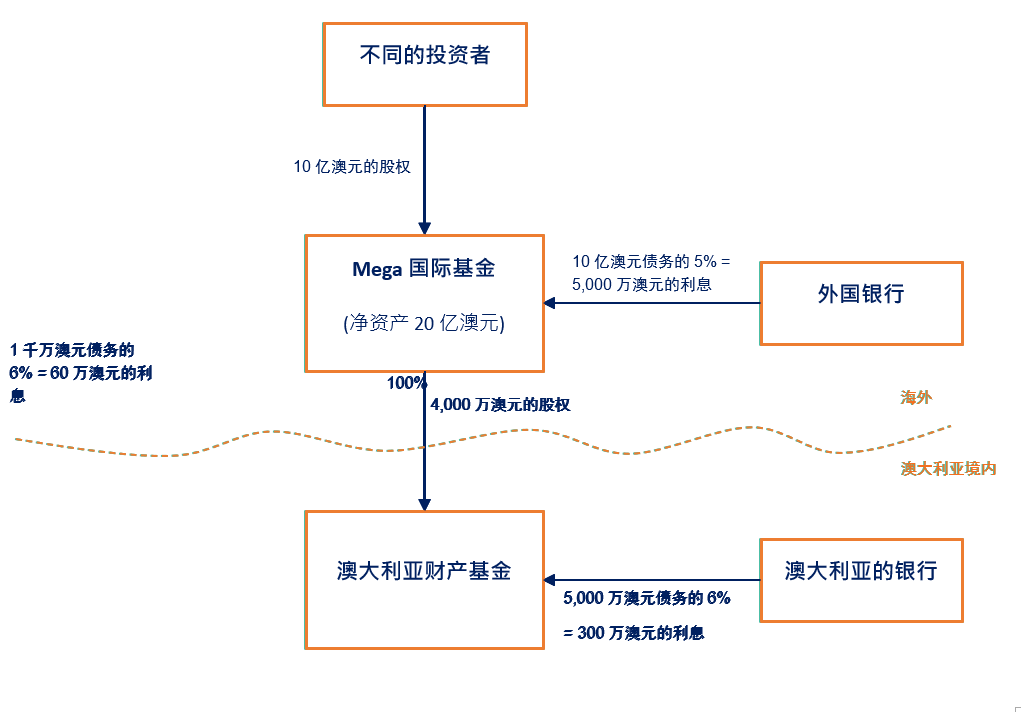

示例

| 科目名称 | 应税所得 ($) | 税务EBITDA($) |

|---|---|---|

| 营业收入 | 9,500,000 | 9,500,000 |

| 利息收入 | 500,000 | |

| 利息 – 澳大利亚银行(澳元) | (3,000,000) | |

| 利息 – Mega国际基金(澳元) | (600,000) | |

| 税务折旧(澳元) | (4,000,000) | |

| 其他支出(澳元) | (5,000,000) | (5,000,000) |

| 税收(亏损)/利润(澳元) | (2,600,000) | 4,500,000 |

每项测试下禁止税务抵扣的金额为

| 测试名称 | 禁止抵扣金额 | 计算 |

|---|---|---|

| 固定比率测试(FRT) | $1.75m | 净债务抵扣 = $3.1m($3.6m 减去 $500k); 固定比率收益限制 = $1.35m($4.5m 的 30%); 禁止抵扣金额 = $1.75m($3.1m 减去 $1.35m) |

| 集团比率测试(GRT) | $850k | 实体净债务抵扣 = $3.1m($3.6m 减去 $500k); 实体的集团比率收益限制 = 集团比率(50% – 详见下文)x 税务 EBITDA($4.5m)= $2.25m; 集团比率 = 集团净第三方利息支出($53m)÷集团 EBITDA(假定为 Mega 国际基金的账务净利润)($106m)= 50%; 禁止扣除金额 = $850k($3.1m 减去 $2.25m) |

| 外部第三方债务测试 | $600k | 实体债务抵扣 = $3.6m; 外部第三方债务 = $3m(请注意,管道规则不适用于从外国银行借款,因为 Mega 国际基金未获得应纳税的澳大利亚收入 – 假定澳大利亚物业基金的收入受到了受托投资方的扣缴税的影响); 禁止扣除金额 = $600k($3.6m 减去 $3m) |

我们信永中和如何帮助您?

我们的信永中和团队可以提供以下方面的帮助:

- 对您的债务扣除可能受新规则影响的潜在影响进行建模;

- 评估重新组织集团融资结构的可行性;

- 考虑是否有一个替代测试适用于您的情况并且会带来好处。

请联系您的信永中和顾问,从我们的专业税务团队获得支持。

We are thrilled to announce that we have been named a finalist in two key categories for the beaton Client Choice Awards.

“For the sixth consecutive year, we have been recognised as a finalist for Best Accounting Firm ($30m – $100m revenue), and for the second year in a row, we have been named as a finalist for Best CX Firm overall. These are exceptional results and speak to the strength of our embedded values underpinning our behaviour and naturally shaping our CX,” said Mr Duane Rogers, CEO of SW.

“Our commitment to excellence in both our accounting and advisory services, and client experience, has been unwavering, and it is truly an honour for each and every one of our team members to be recognised for our efforts. I am incredibly proud of what we have accomplished, and also thank our clients for their ongoing support and feedback that allows us to keep improving.”

The Beaton Consulting + Research (‘beaton’) team analysed over 17,000 points of data, with 276 firms entering, being the most ever from across Australia and New Zealand, so the competition is significant!

Executive Chairman of Beaton, Dr George Beaton stated: “The number and calibre of entrants to the Client Choice Awards continues to improve year on year. For 20 years, through Beaton Benchmarks we’ve watched the professional services industry drive up client service standards in every sector. It is impressive to watch and fascinating to see the heights to which firms can soar by listening to client feedback and drawing on benchmarks to continuously improve and deliver excellent client service.”

The Client Choice Awards recognise best practice in the professional services sector and are based on client feedback for professional services firms in Australia and New Zealand. There are no panels, judges or self-nominations, only client ratings that are independently researched by beaton. Full client feedback responses are sent directly and confidentially to Beaton, not the firms, encouraging objectivity and honesty.

Congratulations to all winners and finalists for 2023. Click here to view the details.

Media contact

With multiple economic factors currently affecting the property industry, we are delighted to bring you this property development seminar with experts who have lived through boom & bust periods, and have genuine advice and insights into the industry’s current challenges and opportunities.

The interactive face to face event was hosted by SW property expert, Sejla Kadric, and Director, Greg Will, and opened the floor to questions after our speakers shared valuable insights into structuring, financing and managing your developments during, and as we leave, a recession.

Join us for lunch before hearing from expert developer from Monno, Dean Fossey, Charter Keck Kramer MD Bennett Wulff, and Daniel Sollorz, Senior Director at CBRE.

Event Details

Date

Tuesday 2 May 2023

Location

SW Sydney Office, Level 7, Aurora Place, 88 Phillip Street

Time

12.30pm for a light lunch, seminar 12.45pm – 2pm

Contact us

If you have any queries or would like more information, please contact the Marketing team via marketing@sw-au.com.

SW hosts

Gregory Will

Director, Business & Private Client Advisory

SW

Sejla Kadric

Director, Business & Private Client Advisory

SW

Guest speakers

Dean Fossey

Director

Monno Pty Ltd

Bennett Wulff

Managing Director | NSW

Charter Keck Cramer

Whether you’re considering being part of our team or have already submitted an application, please join us for our Open office!

See what its really like to work at SW. Learn more about our divisions, the accounting profession and make connections from Grads to Partners over nibbles and drinks.

We hope to see you there!

Event details

SW Melbourne Open office

Date

Wednesday, 26 April 2023

Time

5.30pm – 7pm

Location

SW Melbourne Office

Level 10, 530 Collins Street, Melbourne

RSVP

Click here to RSVP for our Melbourne open office event.

SW Sydney Open office

Date

Thursday, 27 April 2023

Time

5.30pm – 7pm

Location

SW Sydney Office

Level 7, Aurora Place, 88 Phillip Street, Sydney

RSVP

Click here to RSVP for our Sydney open office event.

Dress code

Smart Casual

Please contact peopleandculture@sw-au.com should you have any questions.

Greg Will, SW Director and specialist business advisor, talks to Mike Loder, the host of Ticker News, about a recent report on how Australian small and medium sized enterprises (SMEs) are performing in the current economic climate.

The report was conducted in partnership with Small Business Australia, a respected advocacy group for SMEs, to identify the key issues that are causing Australian small businesses continue to struggle in the post Covid era.

Ahead of the 2023 Federal Budget on 9 May, the SW & SBA Business Sentiment survey is open once again. We are asking sole traders and owners and managers of SMEs to share their experience and add their voice to help us understand the issues on the ground. If you would like to take the survey, click here.

Upcoming event for Small Business

Opportunities for growth, investment and trade are critical to everyone’s success, so SW Accountants & Advisors has once again partnered with Small Business Australia (SBA) to get to the heart of what business is looking for from the Budget, come Tuesday 9 May 2023. Take the survey to tell us what you need from the budget and sign up for our Budget Breakfast webinar as ANZ, SBA and SW experts unfold the Budget for you.

The Australian Treasury released Exposure Draft legislation aimed at strengthening Australia’s thin capitalisation (thin cap) rules. The Government is seeking feedback on the Exposure Draft which also proposes to disallow interest on debt used to fund foreign companies.

The Exposure Draft, released on 16 March 2023, is in line with the Government’s commitment to address tax avoidance practices of multinational enterprises and streamline with (OECD) best practice guidelines. To learn more about the previous announcements, see our article about the Proposed changes to Australia’s thin capitalisation rules.

From 1 July 2023, the new proposed thin cap provisions will replace the existing rules and limit the amount of interest deductions for certain entities. With 3 months before its intended commencement, the Government has finally released a draft of the new rules. The Exposure Draft legislation is open for consultation until 13 April 2023 with submissions to the Australian Treasury.

Who do the new thin cap rules apply to?

The new regime applies to:

- foreign controlled taxpayers and taxpayers with foreign operations. These remain broadly unchanged from the existing rules

- only applies to general investors and, in part, to financial entities

- certain exemptions will continue to apply – including the $2 million (debt deduction) de minimis exemption.

What are the new tests?

The new regime’s safe harbour will be broadly based on the taxpayer’s current year taxable income – instead of the current safe harbour which is based on a taxpayer’s balance sheet.

The new safe harbour will be known as the Fixed Ratio Test (FRT). The FRT will limit interest deductions to 30% of a taxpayers Tax EBITDA. The Tax EBITDA will broadly be calculated as a taxpayer’s taxable income adjusted for interest deductions, losses and tax depreciation. Any non-deductible interest can be carried forward for 15 years.

Two other tests will be available:

- The Group Ratio Test (broadly replacing the worldwide gearing test)

- The External Third Party Debt Test (broadly replacing the arms length debt test).

The Group Ratio Test will apply to disallow interest deductions by applying a group ratio to the taxpayer’s tax EBITDA – instead of the 30% FRT. The group ratio is calculated by applying a complex formula broadly equal to the third party interest expense of the global group divided by the Group EBITDA.

As the name suggests, the External Third Party debt test will only apply to debt issued to external parties – meaning taxpayers may no longer be able to deduct interest issued to related parties even where third parties would have loaned funds on the same terms.

Other changes

The Government also proposes to repeal current provisions that allow interest and debt deductions referrable to foreign investments. Under the exposure draft, interest would not be deductible where it was referable to the derivation of non-assessable non-exempt dividend income.

What are the details of the rules?

A more detailed analysis of the exposure draft proposals is contained in our Technical Briefing in the Download below. We encourage you to talk to the SW team to understand these changes further.

Application Date

The new legislation is set to apply to income years commencing on or after 1 July 2023. Disappointingly, there is still uncertainty on the application date for entities that are early balancers (for example, the entity has a 31 December year-end).

How should taxpayers prepare?

We recommend that taxpayers start planning for the draft legislation to be implemented on 1 July 2023. Whilst we expect there to be minor technical amendments, the draft legislation is predominantly based on the OECD guidance.

Therefore, restructuring debt arrangements may be necessary, and transaction documentation needs revisiting prior to 30 June 2023.

Taxpayers should consider whether restructuring debt arrangements are necessary and the impact of doing so.

How can SW help?

Our experts can assist with:

- modelling the potential impact of the new rules on your debt deductions

- assessing the feasibility of restructuring the financing structure of the group

- considering whether one of the alternative tests would be applicable and beneficial to your circumstances.

Reach out to your SW advisor for support from our specialist tax team. Please also download the document below for a deeper dive into the technical details.

Contributors

The Australian Taxation Office (ATO) has updated its guidance on effective tax governance for the Top 500 private groups in Australia. The Top 500 program focuses on preventive action, and its key concept is ‘Justified Trust,’ which ensures confidence in the community that the largest private groups are paying the correct amount of tax.

To achieve Justified Trust, private groups need to satisfy four key areas, including the effective operation of a tax governance framework. The ATO has outlined seven key principles for effective tax governance, and private groups need to satisfy the first four principles to achieve Justified Trust.

Drawing insights from the ATO’s findings report, the ATO has further outlined ten items that demonstrate effective tax governance frameworks.

While the Top 500 program targets private groups with a specific size, the ATO’s emphasis on tax governance is relevant to all substantial private groups.

What is the Top 500 program?

The program deviates from the typical ATO review in that it focuses on preventive, rather than corrective, action and is underpinned by the concept of Justified Trust. The program is targeted at groups that are not public or foreign owned:

- with over $250 million in turnover, regardless of net asset value

- with over $500 million in net assets, regardless of turnover

- with over $100 million in turnover and over $250 million in net assets

- that are market leaders or groups of specific interest.

My private group is not subject to the Top 500 program – is this still relevant to me?

Whilst the main focus of this alert is the Top 500 private groups, the answer to this question is yes. Increasingly, the ATO is placing emphasis on tax governance as a concept relevant to all substantial private groups, so it is not something that is confined to the Top 500.

The ATO’s ‘Next 5000’ program, for example (which focuses on groups with a net wealth of $50 million plus) also places significant emphasis on tax governance in assessing taxpayers tax affairs. All private groups of significant size are encouraged to have a documented tax governance framework tailored, of course, to their scale, operations and resources. Therefore the comments below relating to tax governance matters have relevance to a broader range of groups.

‘Justified Trust’ and the benefits

A Top 500 private group needs to meet the four key areas listed below at a ‘whole of group’ level to achieve the Justified Trust threshold:

- ensuring that effective tax governance frameworks, processes and procedures are in place

- risks flagged to market in the ATO’s Taxpayer Alert and Ruling programs are not present in the group

- the tax treatments applied to tax issues arising from ordinary and atypical transactions are demonstrated as correct

- differences between accounting and tax results are complete and understood in context.

Once a private group has attained Justified Trust, the benefits generally include a ‘lighter touch’ approach to reviews of the group by the ATO for three years.

Effective operation of the tax governance framework

To achieve Justified Trust, the implementation and effective operation of the tax governance framework is an essential requirement.

The ATO has outlined seven key principles for what constitutes an effective tax governance framework, with an emphasis on the importance of the first four principles (noted above) as ‘required items’ and the remaining three principles listed below as ‘additional items’:

- professional and productive working relationship

- timely lodgements and payments

- ethical and responsible behaviour.

In practice, a private group should likely satisfy these three items if the ‘required items’ are effectively executed.

Drawing insights from the findings report (which is generally published annually), the ATO has recently further outlined ten items derived from the four principles for which a private group can rely upon to demonstrate that its tax governance framework is operating effectively and as intended.

Principle 1: Accountable management and oversight

- Ensuring the segregation of tax and reporting governance, such that no one individual is solely responsible for the group’s entire tax function.

- Whilst reporting lines may be in place to ensure the controlling mind(s) determines the group’s desired tax outcome, processes set in place to achieve that outcome should be independent of the controlling minds.

Principle 2: Recognise tax issues and risks

- The ATO would take greater comfort if the group could demonstrate that the preparation of tax return includes an independent review of the draft return by an external advisor.

- Where returns are prepared externally, the group or the tax agent can readily provide documentation evidencing that correct tax treatments have been considered for significant and/or atypical transactions, and be able to explain any differences between tax and economic outcomes.

- The tax governance framework for the group’s trading entities is reviewed and endorsed by the Board annually. Processes enabling the identification and addressing of weaknesses are in place.

- Substantiation exists to support group’s position on FBT.

Principle 3: Seek advice

- An annual check-in with the ATO. There is a similar requirement under the 3-year monitoring and maintenance period upon reaching Justified Trust.

- Documentation showing escalation thresholds (for internal decision making and/or external advice) were complied with and advice was sought on uncertain tax positions.

Principle 4: Integrity in reporting

- Documentation supporting financial records of entities within the group reflecting a true and fair view of their performance and position.

- Procedures detailing any differences in financial performance between accounting and tax consolidated groups (i.e. book vs tax outcomes).

Apart from the unwavering emphasis on the importance of maintaining detailed documentation of procedures for tax function, another observation worth noting is that a high assurance rating could be achieved satisfying at least three out of the ten items illustrated.

Are you ATO-review ready?

In preparation for a risk review by the ATO, private groups should:

- Consider their tax processes and tax risk management policies and procedures and ensure that appropriate documentation exists to support these and how they operate in practice. Whilst a lengthy formal tax governance framework will not be necessary in all cases, clients are encouraged to have their processes documented in a manner suitable to their organisation.

- Ensure that group structure charts are up to date and other relevant documentation, including trust deeds, signed trustee resolutions are on hand and readily accessible.

- Ensure that tax positions on contentious items are appropriately documented and differences between tax and accounting results are readily explicable.

How SW can help

SW has extensive experience in assisting clients and their advisors with the design, documentation and testing of tax governance frameworks and the ATO’s tax compliance program (such as the Top 500 and Next 5,000 reviews).

Should you have any queries in relation to tax governance issues, Justified Trust, ATO reviews or other related matters, please reach out to your SW contact or Key Contacts listed here.

Contributors

Poker machine money laundering is in the spotlight again after concerns around serious and organised criminals targeting pubs and clubs to launder money.

With the news regarding SkyCity, AUSTRAC has cited ‘systemic failures’ in the operator’s anti-money laundering and counter-terrorism financing (AML/CTF) programs, particularly regarding the failure to have a transaction monitoring program and to carry out appropriate ongoing customer due diligence, including on some very high-risk customers.

Australia’s thriving pub and club industry is not exempt from scrutiny. Electronic gaming machine operators, including pubs and clubs with electronic gaming machines (EGMs) are required to actively mitigate and manage their money laundering and terrorism financing (ML/TF) risks. Business with entitlement to operate 15 or less EGMs may be exempt from some obligations, however they must still enrol with AUSTRAC and report suspicious matters.

AML/CTF requirements for gaming machines operators

Pubs and clubs with EGMs should ensure they have/do the following:

- Complete a risk assessment to identify money laundering and terrorism financing risks your business faces and tailor your AML/CTF program to the business.

- Collect and verify ‘know you customer’ (KYC) information.

- Have a transaction monitoring program.

- Have ongoing customer due diligence and carry out additional checks on higher risk or suspicious customers.

- Report suspicious matters to AUSTRAC e.g. if you suspect a person is linked to crime or a customer is not who they claim to be. Low reporting compared to peers may indicated an ineffective AML/CTF program.

- Do not tell customers that you have reported them in a suspicious matter report (SMR).

- Maintain accurate records of transactions e.g. a cheque register of payouts.

- Have processes so that staff working on the gaming floor can help to identify and report suspicious behaviour.

- Have an employee due diligence program.

- Submit annual compliance reports to AUSTRAC.

- Notify AUSTRAC of any changes such as a new compliance officer or updated contact information.

- Undertake regular independent reviews of Part A of your AML/CTF program.

How can SW help?

Our highly experienced team works closely with organisations across multiple industries, including the tourism and hospitality sectors, to ensure their AML/CTF programs are compliant and appropriate to the needs of the business. We can review your current programs and processes, advise where the gaps are, or review your compliance with AML/CTF requirements.

Reach out to our experts for an obligation free discussion about your current program, details about how we can help with a review of your AML/CTF program and provide tailored recommendations.

Contacts

For employers lodging fringe benefits tax (FBT) returns, the volume of declarations and record keeping documentation is arduous and ongoing. Last week the Australia Taxation Office (ATO) issued four draft instruments that aim to reduce this.

The draft legislative instruments specify acceptable alternative record-keeping obligations (other than an employee declarations) in respect of expense payment fringe benefits. Whilst they are still in draft, they are intended to apply for the year ending 31 March 2023.

This is welcome news for many employers, as the changes will significantly reduce the volume of record duplication and the ever-challenging task of chasing employees for declarations to calculate FBT liability.

Draft FBT instruments

Following a review of record keeping requirements last year, proposed changes to travel diary and relocation transport records were released, and the ATO has now issued the following four draft instruments for consultation:

- LI 2023/D3 in respect of overseas employment holiday transport

- LI 2023/D4 in respect of travel to an employment interview or selection test

- LI 2023/D5 in respect of remote area holiday transport

- LI 2023/D6 in respect of car travel for a work-related medical examination, work-related medical screening, work-related preventative health care, work-related counselling or migrant language training

The draft instruments propose that employers be able to maintain alternate records to reduce the taxable value of transport benefits.

It has been clarified that this information can come from different records, but must be in English. This will allow employers to rely on existing corporate records, including travel calendars.

Records include:

- details of the employee and associates, including the number of family members who travelled in the car (if applicable)

- the make and model of the vehicle driven

- departure and arrival location, including the address

- the dates of travel, and

- the total number of whole kilometers travelled, not excluding any kilometers travelled whilst at the destination.

How can SW help?

With the intended date of application to be from 1 April 2023, it is an ideal time for employers to review their current FBT processes, with a view to adjustments for these alternative records from 31 March.

The majority of FBT lodgments are due by 21 May.

Assisting employers to ease the FBT return preparation process is a key service of the SW Tax team. Our experts are on hand to advise you, and our proprietary CTSplus FBT software is highly automated to assist employers. Please reach out to the team for a complimentary exploratory conversation.

If you have any thoughts or suggestions regarding the draft legislative instruments, please contact your SW advisor or the contacts here.