1 in 3 SME’s will struggle to meet their financial commitments in 2023 report

01/03/2023

SW Accountants & Advisors and Small Business Australia sentiment survey reveals alarming insights into the struggles and hardships faced by SME’s.

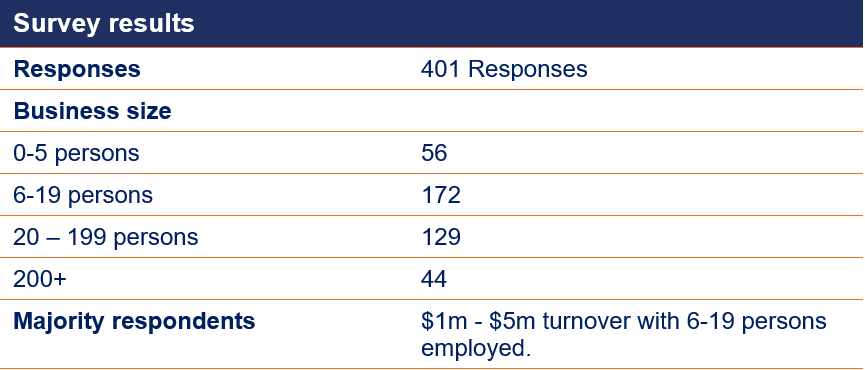

A ‘Small Business Sentiment’ survey conducted by SW Accountants & Advisors in partnership with Small Business Australia has revealed insights into the struggles and hardships faced by SMEs in Australia, with 30% of the 400+ businesses that responded indicating they would find it difficult to meet their financial commitments through 2023.

“This survey provides a clear picture of the challenges faced by SMEs in Australia, and the urgent need for government support. As we head into the May 2023 Budget, it’s clear that SMEs need help as they juggle increasing business costs, cash flow, managing employees, hybrid work policies and work-life balance,” said small business specialist Director of SW Accountants, Greg Will.

Top 5 issues for SMEs

Mr Will, who has over 20-years’ experience in helping SME’s manage and grow their businesses, said that in addition to the ongoing financial struggles that the survey also uncovered the top 5 issues faced by small to medium business owners:

- SMEs need help with employees, including attraction, retention, incentivisation and wage pressures

- Managing cash flow is critical, including budgeting, forecasting, and access to capital – debt or equity

- Businesses face a cost of doing business increase, including all costs like wages for staff, running costs, rents, etc., without being able to pass on higher prices on sales, leading to margin pressure

- SME owners need more time in the day to do everything, which is leading to work-life balance issues, mental health problems, and frustration

- White-collar SME businesses are struggling with work-from-home or work-from-the-office policies, leading to hybrid work policies as the fifth priority for 2023.

Other significant findings from the Small Business Sentiment survey included the impact of the change to minimum wage, the ability to meet financial commitments, supply chain disruptions, and business reliance on migrant labour.

Sector insights

The report broke down into specific sectors showing that half (50%) of the businesses in Accommodation and Food Services, Education and Training, and Manufacturing are impacted by the change to minimum wage increases, leading to increased financial pressure. Additionally, a whopping three-quarters (76%) of Manufacturing respondents believed their businesses are weaker now than before the COVID pandemic due to supply chain and skilled labour shortages.

The survey also highlighted that despite a slight easing of supply chain issues as we head into 2023, 43% of those in Construction will struggle to meet their financial commitments, which will continue to have significant impacts on housing, whilst staff shortages continue to remain a significant issue for the manufacturing and construction sector.

Bill Lang, Executive Director of Small Business Australia says: “The Small Business Sentiment survey has highlighted the struggles faced by many SMEs in Australia and the urgent need for sensible and stable government policies to support this sector in 2023. SW and SBA will continue to advocate for the needs of SMEs and provide expert guidance and support to ensure their survival and growth in 2023.”

This survey is the first of its kind, with SW and SBA planning to conduct another deep dive across all sectors to compare results from last year ahead of the budget in May 2023. The findings of the survey will provide a foundation for SMEs to advocate for their interests and highlight their struggles with the federal government and policy makers.

Upcoming event for Small Business

Opportunities for growth, investment and trade are critical to everyone’s success, so SW Accountants & Advisors has once again partnered with Small Business Australia (SBA) to get to the heart of what business is looking for from the Budget, come Tuesday 9 May 2023. Take the survey to tell us what you need from the budget and sign up for our Budget Breakfast webinar as ANZ, SBA and SW experts unfold the Budget for you.

Media contact

About the survey

About SW

About us – SW Accountants & Advisors (sw-au.com)

As an independent, national firm with a strong presence across Brisbane, Melbourne, Perth, and Sydney, SW offers a wide range of accounting and business advisory services. With 40 Partners and 300 staff, we are committed to delivering exceptional value to our clients. We are proud to be ranked as the 22nd largest firm by revenue in the 2022 AFR Top 100 Accounting Firms and the 10th largest national practice in Australia.

At SW, we believe in building real relationships and connectivity, both locally and globally. As a member of the SW International network , we provide integrated global services to our clients. Our international headquarters are located in Hong Kong, and our member firms offer assurance, business advisory, corporate finance, and tax consulting services. Additionally, we are a member of the Praxity Alliance, which enables us to leverage our combined global footprint and connections in over 110 countries across the USA, Europe, Asia Pacific, and the Middle East.

About Small Business Australia

Over 5 million Australian own or work in small businesses. Small Business Australia’s purpose is to ensure a thriving sector and financial security for these 5 million Australians. Small Business Australia conducts research with small businesses across Australia and provides information, advice and services to small businesses and the major organisations that support them. The Foundation Partners in Small Business Australia’s Buy Local movement include Australia Post, Nab, Telstra, PEXA and SW.