Understanding Build-to-Rent (BTR) concessions across Australia can be complex — so we’ve broken it down to make it easier for you to compare the key differences and eligibility criteria in each State and Territory.

This guide provides a clear, side-by-side comparison of BTR definitions, tax concessions, and access requirements across all Australian jurisdictions. If you’re planning a BTR project or need help navigating the rules, get in touch with our property tax experts for tailored advice and strategic support.

SW-Build-To-Rent-comparison-of-states-and-territories-May-2025How can SW help?

We have helped clients navigate the complexities of the BTR scheme and determine their eligibility requirements. As specialists in property funds and property development, we provide strategic tax advice to support the success of your project.

For the 8th consecutive year, SW has been recognised as a finalist in Beaton’s Client Choice Awards, solidifying its position as one of the leading accounting and consulting firms across Australia and New Zealand.

This year, SW proudly took home the award for Best Provider to Financial & Insurance Services and was a finalist in four other prestigious categories, reinforcing its unwavering commitment to excellence in client service and innovation.

CEO Duane Rogers reflected on the firm’s continuous recognition, stating, “Since first entering in 2018, these awards have given us valuable insight into how we engage with clients and position ourselves in the market. Being recognised year after year is a testament to the trust our clients place in us. Winning in the Financial & Insurance Services category, alongside being recognised as a finalist in key areas such as Most Innovative Firm and Most Trusted Firm, highlights our dedication to delivering exceptional client experiences and staying true to our values.”

Dr. George Beaton, Executive Chairman of Beaton, praised SW’s achievement, noting, “Their recognition across multiple categories showcases their leadership and dedication in an increasingly competitive industry. Trust in professional services is evolving, with clients demanding more transparency, responsiveness, and genuine relationships. SW stood out for its ability to not only meet but exceed these expectations, reinforcing its position as a leader in client service and integrity.”

Their exceptional client service and industry leadership set them apart in a highly competitive market.”

SW values client feedback as a cornerstone of its service excellence, actively engaging through Beaton debrief surveys and direct discussions with Chief Marketing Officer, Ms. Amanda Lee.

Ms. Lee emphasised the significance of these conversations, explaining, “Being responsive to our clients and truly listening to their needs is at the heart of what we do. Every conversation gives us valuable insights that help shape our services and refine how we support our clients. This ongoing dialogue ensures that we continue to improve, evolve, and deliver the high standards of service our clients expect from us.”

SW’s 2025 Client Choice Awards recognition

Winner

- Best Provider to Financial & Insurance Services

(>$30m revenue)

Finalist

- Best Accounting & Consulting Services Firm

($30-$100m revenue) - Most Innovative Accounting & Consulting Services Firm

(>$30m revenue) - Most Trusted Firm: Accounting & Consulting Services

(>$30m revenue) - Best Provider to Government & Community

(>$30m revenue)

The Client Choice Awards recognise excellence in professional services through direct client feedback, highlighting the evolving standards and expectations within the industry. Beaton’s commitment to transparency and objectivity upholds the credibility of the awards, underscoring the vital role of client satisfaction in defining industry benchmarks.

SW extends its congratulations to all winners and finalists for their exceptional contributions to the professional services sector in 2025 and commends the Beaton team their hard work and dedication in this important endeavour. For more details, click here.

Media contact

Amanda Lee | Chief Marketing Officer

alee@sw-au.com | M: +61 430 322 306

Significant global entities (SGEs) face stricter Country-by-Country (CbC) reporting in 2025 with new formats, tighter exemptions, public disclosures, and harsher penalties.

2025 marks an important year for SGEs in respect of their CbC reporting obligations. The compliance standards have significantly heightened due to several developments in the Australian CbC reporting regime, including:

- new format for short form local file

- tightened (non-public) CbC reporting exemptions

- enaction of public CbC reporting

- further increased failure-to-lodge on time penalties.

Here’s what you need to know ahead of the busy CbC reporting compliance season.

1. New format for short form local file

On 14 November 2024, the Australian Taxation Office (ATO) issued a new CbC reporting template incorporating the new short form local file format. The new template applies to reporting periods beginning on or after 1 January 2024.

Background

As a mandatory disclosure component in the local file, short form previously has provided general information of the Australian taxpayer in a highly descriptive manner. However, this has fallen short of delivering detailed data anticipated by the ATO due to inconsistent and/or incomplete content being submitted.

The new format aims to address these inconsistencies by increasing the granularity and comparability of the information required, particularly for significant restructures and new intangible arrangements.

Key changes

Departing from the old format as a narration-based attachment, the new format incorporates short form directly into the Message Structure Table embedded in LCMSF Schema Version 4.0 template, in conjunction with local file Part A and Part B.

Specifically, some of the new disclosures required include:

- business strategy – required for all the main business lines / functions rather than on a whole-of-entity basis, including information on how each business line strategy overlaps

- organisational structure – must disclose Australia to overseas reporting lines for the most senior Australian-based individual by function/activity, not necessarily for the entire Australian business. Changes of reporting relationships throughout the year also need to be disclosed.

- significant restructures and new intangible arrangements – these types of arrangements will result in additional disclosures in greater level of details (over 50 questions expected), some of which are highly prescriptive such as:

- type of restructure (including any change in related party financing) or new arrangement involving transfer, licence or creation of intangibles

- total capital value of the restructure or intangible arrangement

- description of anticipated Australian and global tax impact

- commercial context and anticipated commercial impact

- step plan outlining steps of the restructure or intangible arrangement (as an attachment)

- each step involved in the restructure or intangible arrangement (including all connected steps involving overseas related parties). A series of disclosures will need to be disclosed for each step.

While only “significant” restructures are reportable, the definition of significant restructures is very broad. Certain restructures are deemed as significant regardless of its materiality, for example:

- changes in ownership by controlling entities

- changes in residence, entity classification or tax status of controlling entities or related counterparties

- related overseas counterparty acquires or licenses significant intellectual property from another overseas related party

- related overseas counterparty commences or expands an offshore arrangement treated as impacting the functional profile or level of remuneration of Australian operations

- new arrangements involving transfer, licence, or creation of intangibles involving the Australian control group.

There are non-reportable exclusions for restructures and intangible arrangements, however the eligibility criteria are strict and may require an extensive process of information gathering and evaluation at both Australian and overseas counterparty levels.

When the changes apply

| Entity type | When do the changes apply | Lodgement due date |

| December balancers | year ended 31 December 2024 | 31 December 2025 |

| June balancers | year ended 30 June 2025 | 30 June 2026 |

SW has upgraded our in-house CbC reporting software that complies with the LCMSF Schema Version 4.0 template, to support smooth transition of local file reporting under the new format.

2. Tightened (non-public) CbC reporting exemptions

On 29 November 2024, the ATO released its updated guidance on exemptions from lodging one or more of the CbC reporting statements. This new approach is significantly more stringent than in the past and will apply to all CbC reporting exemption requests received on or after 1 January 2025.

Available exemption categories

There will generally be only three circumstances where an exemption may be granted upon receiving a formal request.

| Exemption category | Exemption available |

| You are an Australian CbC reporting parent, or a member of a group consolidated for accounting purposes with an Australian CbC reporting parent, where the group has no foreign operations. | CbC report |

| The annual global income of your foreign CbC reporting parent is AUD $1bn or more but falls below the CbC reporting foreign currency threshold in the jurisdiction of the foreign CbC reporting parent. | CbC report |

| You were a CbC reporting entity in the preceding year due to your membership of a group of entities but left that group during the CbC reporting year due to a demerger or sale to a third party and will not be a CbC reporting entity under your new structure for the foreseeable future. | CbC report and master file |

Exemptions will be granted for a period of one year predominantly, and the exemption request should be made after the tax return has been lodged for the associated income year and financial statements are available.

Exemptions outside of the three categories above may only be considered in exceptional circumstances.

Of an important note, there is generally no administrative relief available for the local file with respect to reporting periods on or after 1 January 2024, where such relief was available in the past where the Australian taxpayer did not involve in international related party dealings.

Tax exempt entities under Division 50 of the Income Tax Assessment Act 1997 (e.g. Australia headed university groups) remain to have access to CbC reporting relief, if no overseas presence exists.

3. Public CbC reporting is now law

The lodging of public CbC report by applicable SGE groups will be mandatory effective from income years beginning on or after 1 July 2024, withthe proposed legislation for public CbC reporting receiving royal assent on 10 December 2024.

The final law is broadly similar to the revised exposure draft (released in February 2024), which SW analysed.

Who are affected?

| Who does it apply to? | The reporting obligation applies to a CbC reporting parent of a CbC reporting group with an Australian presence |

| Conditions | Only triggered if the CbC reporting parent’s Australian-sourced aggregated turnover is AUD $10m or more for the income year. If a CbC reporting parent’s reporting period is not an income year, it must assume the reporting period is an income year for calculating aggregated turnover. |

| Publishing requirements | The CbC reporting parent is required to publish selected tax information in the approved form to the Commissioner of Taxation, with the Commissioner facilitating publication on an Australian government website. |

When will the law apply?

| Entity type | When do the changes apply | Lodgement due date |

| December balancers | year ended 31 December 2025 | 31 December 2026 |

| June balancers | year ended 30 June 2025 | 30 June 2026 |

What information will need to be submitted and made public?

While there is significant overlay between the disclosures required under the existing non-public CbC report and the new public CbC report (such as by-jurisdiction revenue, tax and headcount data), the bar under the public CbC reporting is higher.

For example, it requires disclosure of the group’s approach to tax for which the Global Reporting Initiative’s Sustainability Reporting Standards GRI 207: Tax (2019) should be treated as the primary source of guidance.

For Australia and specified jurisdictions determined by the Minister, information must be published on a CbC basis. For all other jurisdictions, the CbC reporting parent has a choice to publish the same information on either a CbC basis or an aggregated basis.

Information published must be sourced from audited consolidated financial statements. In circumstances where the CbC reporting parent has not prepared audited consolidated financial statements, the information published must be based on amounts that would be shown in such statements, had the entity been a listed company.

It is expected that information must be submitted in XML schema as the approved form, and the detailed format will be released by mid 2025. SW will have our in-house public CbC report software ready by that time.

What exemptions are available?

In addition to the CbC reporting groups with a small Australian presence (less than $10m AUD Australian-sourced income), it is unclear what other specific exemptions are available (for example, if tax exempt Australia headed university groups with no overseas presence are exempt).

Generally, it appears that any further exemptions will be at the Commissioner’s discretion.

The ATO is working on a practical guidance on exemptions, which is expected to be completed by mid 2025.

4. Increased penalty rates

SGEs may face further increased penalties in the event of late lodgements.

| Days late | Failure-to-lodge on time penalties | |

| For forms due from 7 Nov 2024 | For forms due before 7 Nov 2024 | |

| 28 or less | $165,000 | $156,500 |

| 29 to 56 | $330,000 | $313,000 |

| 57 to 84 | $495,000 | $469,500 |

| 85 to 112 | $660,000 | $626,000 |

| More than 112 | $825,000 | $782,500 |

What’s next

As Australia embraces greater tax transparency, the compliance costs for SGE groups are continuously increasing, and the compliance bar is heightening. It is crucial for affected taxpayers and associated CbC reporting groups to stay informed and respond to these changes in a timely and efficient fashion.

- For Australia based CbC reporting parents, it is time to commence planning from a process and resource perspective to ensure due satisfaction with the relevant reporting requirements.

- For overseas headquartered CbC reporting groups, the Australian group members should ensure ongoing and proactive dialogue put in place with the group parents so that the group’s readiness and awareness of the Australian reporting requirements are well established.

This document is not intended to be formal advice. As these CbC reporting developments are complex and evolving, we recommend affected taxpayers reach out to our Transfer Pricing specialists to learn how these changes may impact your business.

Contributors

The Commissioner has sought special leave to appeal the Full Federal court decision that unpaid present entitlements are not loans for the purpose of Division 7A.

Since the appeal application has been made, the Commissioner has released a decision impact statement outlining their approach to Division 7A in the interim, pending the outcome of the appeal process.

For more insight on the original decision of the Full Federal Court see our previous alert.

What the Commissioner states

The Commissioner states that they will:

- continue to apply the law as though an unpaid present entitlement (UPE) is a loan for Division 7A purposes

- consider the application of other provisions (for example section 100A) where UPE remain unpaid.

- not issue any amended assessments, private binding rulings or objection decisions. If such decisions are required to be made, decisions will be made in accordance with the ATO’s existing view.

What an appeal involves

An appeal to the High Court is a 2-step process.

- There must be a special leave application accepted by the High Court (at this stage the Commissioner has only lodged an application) and

- if the special leave application is accepted, there will be a full hearing. However, only 10 – 15% of special leave applications are accepted by the High Court.

How SW can help

There is going to be a period of uncertainty for taxpayers about how to treat an UPE given the Commissioner’s position and the Commissioner’s chance of success.

In the meantime, we encourage you to discuss the Bendel decision and its impact on your own group’s UPEs with your SW contact or the specialist tax contacts listed in this alert.

Contributors

The final Higher Education Research Data Collection (HERDC) specifications for the collection of 2024 data have been released. It’s a great outcome to have further clarification on the treatment of Shared Income to Non-Higher Education Providers.

The main changes between the 2023 specifications and 2024 specifications are as follows:

- Reorganisation of sections: The ‘HERDC specifications – updates to note’ section was moved to the beginning of the document, and the ‘Introduction’ was shifted to the second section to enhance the document’s flow.

- Clarification on data usage: A minor amendment was made to specify that preliminary HERDC data may be shared with Knowledge Commercialisation Australasia (KCA) to assist with its Survey of Commercialisation Outcomes from Public Research (SCOPR) data collection, validation, and reporting processes.

- Materials required: The table detailing required materials was reworded and repositioned within the document for better comprehension.

- Inclusions and exclusions on income return:: Section 4.2.1(a) was restructured into parts (a) and (b) to provide clearer guidance on non-Commonwealth Government top-ups.

- Subsidiaries and affiliates: Clarifications were made regarding the eligibility of subsidiaries and affiliates as research end-users for the Research Training Program (RTP) industry internship weighting.

- Shared income: An example was expanded to demonstrate the treatment of shared income with non-Higher Education Providers (non-HEP) organizations that are neither affiliates nor subsidiaries. Example: If HEP A receives a grant of $50,000 and allocates $20,000 to HEP B and $5,000 to a non-HEP organization that is not an affiliate or subsidiary, HEP A should report only the remaining $25,000 as its R&D income. HEP B would report the $20,000 it received, while the $5,000 allocated to the non-HEP organization is not reportable by either HEP.

- Sub-category 3.8 International Government (Other): Grants from the US National Institutes of Health were removed as an example in this sub-category.

- References to the department: Updates were made to clarify that references to the department pertain to the Australian Government Department of Education.

Each HEP must arrange for an audit of the Category 1, 2, 3 and 4 R&D income in their respective R&D income return and provide the department with a Special Purpose Audit Report under the Auditing and Assurance Standard Board (AASB) Auditing Standard ASA800, which clearly certifies that the R&D income recorded is correct. The audit report is due 30 June 2025.

How SW can help

With a dedicated education group, we specialise in performing HERDC audits for HEPS. If you are looking for an experience team to perform your HERDC audit, please reach out to Christine Krause and Matthew Paull.

We will be at ARMS 2025 Melbourne Conference– looking forward to connecting and sharing insights from the HERDC 2024 audits.

The Full Federal Court decision in the Bendel appeal1 has significant implications for Division 7A, overturning the Commissioner’s long-standing position that treats unpaid present entitlements as loans.

Background

The Full Federal Court has unanimously dismissed the Commissioner’s appeal from the AAT decision in the Bendel case in its judgement handed down on 19 February 2025.

Full details of the original AAT decision and relevant background can be found in our previous alert here.

The facts involved the Commissioner applying his long-standing view that an unpaid present entitlement (UPE) owed to a private company would fall within the definition of a ‘loan’ for Division 7A purposes. In the Commissioner’s view (as first published in Taxation Ruling TR 2010/3 and Law Administration Practice Statement PS LA 2010/4 as subsequently refined in Taxation Determination TD 2022/11), a UPE owed to a private company will be a loan for Division 7A purposes in the year following that in which the distribution is made.

The term ‘loan’ has an extended statutory definition for Division 7A purposes and includes ‘the provision of credit or any other form of financial accommodation’ and ‘a transaction (whatever its terms or form) which in substance effects a loan of money’. Prior to the Federal Court decision in Bendel, the Commissioner’s view has essentially been that a UPE that remains outstanding once the company has knowledge of the UPE would be a loan within the meaning of one or both of these elements of the extended definition.

The decision

The basis of the Full Federal Court in Bendel is disarmingly straightforward. The Court placed particular importance on various statutory provisions in Division 7A that referred to the ‘repayment’ of a loan and noted the distinction between a transaction or arrangement that creates an obligation to repay an amount and a transaction or arrangement that creates an obligation to pay an amount. Having regard to the language used in the relevant provisions of Division 7A, the Court concluded that to fall within the definition of ‘loan’ for Division 7A purposes the arrangement must be one that gives rise to an obligation to repay. A UPE is lacking this fundamental feature because the trustee of the relevant trust has an obligation to pay or discharge a UPE but does not constitute an obligation to repay the relevant amount. The Court’s view is succinctly stated in paragraph 93 of the judgement as follows:

‘…..s 109D(3) requires more than the existence of a debtor-creditor relationship. It requires an obligation to repay and not merely an obligation to pay.’

Whilst the Full Federal Court decision confirms the correctness of the AAT decision, the reasoning of the Full Federal Court was different. The AAT decision focussed less on interpretation of the relevant statutory provisions and more on the history of the relevant provisions and extraneous material. The appeal judgement is much more conventional and based on the interpretation of the provisions of Division 7A itself.

What does the decision mean?

This judicial decision is a major blow to the Commissioner and will potentially have widespread ramifications for private groups where the use of company beneficiaries is commonplace. The emphatic Full Federal Court decision means that, as the law stands, a UPE is not a loan for Division 7A purposes.

Unless the Commissioner seeks and is granted special leave for a High Court appeal which then overturns the Full Federal Court decision, this decision will stand. This would mean that the Commissioner would need to resile from his position that a UPE owed to a private company represents a loan made by the private company to the distributing trust.

A number of public rulings, practice statements and determinations are based on the premise that has been unanimously rejected by the Full Federal Court, including but not limited to those pronouncements referred to above. The decision will have potential implications not only for UPEs owing directly between a trust and a private company beneficiary, but also the Division 7A rules relating to transactions undertaken by trusts where there is a UPE owing to a company beneficiary (Subdivision EA of Division 7A).

The original AAT Bendel decision was widely regarded as interesting but, being a decision of the AAT, was one that was viewed with some caution. The unanimous Full Federal Court decision is clearly quite a different proposition.

Practical issues – what to do with UPEs?

Until the matter of any further appeal process is determined, the practical question that requires consideration is how to deal with any UPEs affected by the decision in the meantime. This may affect UPEs that came into existence in the 2023 year that, in the Commissioner’s view prior to the latest Bendel decision, were regarded as loans in the 2024 year. It will also impact 2024 and subsequent years’ UPEs until the final outcome is known with certainty. In addition, this important decision will clearly impact on some existing ATO reviews and disputes on foot relating to private groups.

It is unlikely that a decision with respect to the Commissioner’s special leave application (if made) would be known prior to lodgement date of the 2024 tax returns. It is possible that the ATO may approach the Federal Government for a legislative amendment in response to this decision. However, given that an election is only months away, it is unlikely that any legislative change will happen in the near term.

We would expect the Commissioner would issue a Decision Impact Statement and/or a Practical Compliance Guideline on the current decision in the event that an appeal is sought. Taxpayers and ATO officers will need guidance as to how to practically deal with UPEs owing to private companies in the event that the Commissioner seeks to (and is granted leave to) appeal the decision.

A further word of caution.

A further word of caution should also be noted. As resounding a victory as this decision is for the taxpayer, assuming that the decision stands, it does not mean that UPEs owing to companies can be left on foot indefinitely without fear of challenge by the Commissioner. The Commissioner has other ‘weapons in his armoury’ that could be deployed to challenge long-standing UPEs owing to corporate (or, indeed, other) beneficiaries of a trust, including section 100A. The Commissioner’s views on the potential application of section 100A to trust distributions to beneficiaries. that remain unpaid also need to be borne in mind when considering trust distribution matters. The Commissioner’s views on section 100A are themselves the subject of some controversy and will presumably subject to judicial review at some future date, but for the present these views remain on foot.

Furthermore, as noted above, if UPEs owing to companies are left on foot, Trusts will need to be cautious about lending to other associated entities due to the application of Subdivision EA.

How SW can help

SW will continue to monitor and keep you informed on a timely basis of any further developments in this space. It will be important to closely monitor the ATO’s response to this decision and any appeal process that might be instigated by the ATO.

In the meantime, discuss the Bendel decision and its impact on your own group’s UPEs with your SW contact or the contacts listed for this article.

Contributors

[1] Commissioner of Taxation v Bendel [2025] FCAFC 15.

The Land Tax Assessments for 2025 are being issued by the relevant State Revenue Offices (SRO). Are they correct and are you paying too much Land Tax?

Usual Land Tax Assessment process

Each Council/Shire engages a Licensed Valuer for the purpose of valuing each property in their municipality in respect of:

- The Capital Improved Value (CIV) – Land plus any improvements

- Site Value/Unimproved Land Value – Land Only

If you conduct any building activity including obtaining certain permits, the council/shire can issue an Amended Rates Notice at any time.

The Council/Shire will declare a range of rates during their annual budgeting process that will then been multiplied usually by the CIV to determine the annual council/shire rates payable by the land owner.

The rates will vary depending upon the use and the relevant planning scheme that applies to the land. For instance there will generally be different rates per dollar for:

- Residential Land containing a dwelling

- Vacant Residential Land

- Industrial Land

- Vacant Industrial Land

- Farm Land

- Native Vegetation etc.

Objecting a Council/Shire Rates Notice

You usually have 60 days to object to a Council/Shire Rates Notice from the issue date, with most objections being:

- Inappropriate valuation

- Assessed area being incorrect

- Incorrect classification/rate applied

- Property no longer owned etc.

The Council/Shire then provides the following two values to the SRO:

- Site Value – used to produce the Land Tax Assessments

- CIV – used to calculate Vacant Residential Land Tax

The 2025 Land Tax Assessments take into account land held at midnight on 31 December 2024 and use the value as prepared by councils in 2024.

Is your Land Tax assessment correct?

You also have 60 days to object to a Land Tax Assessment from the issue date.

In addition, as Land Tax is a self-assessment system you need to consider whether:

- all the land you or the entity owns is included and the apportionment is correct

- dimensions and description of the land being valued are correct

- is any land which you have bought/sold disclosed?

- if you receive multiple assessments for the same own – for instance individuals name may be spelt wrong etc

- any exemptions are correctly applied – for instance primary production land, principal place of residence, exempt status etc

- whether Absentee Owner Surcharge should be or should not be charged

- whether any Vacancy Residential Land Tax has been correctly assessed

- land subject to the Trust surcharge has been correctly assessed

- correct ownership is disclosed – trust as opposed to company etc.

It is often easier to object against the Council Rates Notice as in essence this information is then fed through to the SRO.

Where the valuation is not appropriate, it is prudent to obtain supporting evidence which in many cases will include a formal Valuation from a Property Valuer to support a lower and correct valuation.

There is a cost/benefit assessment to be done when lodging an objection.

How SW can help

To assist you we can:

- review the Land Tax Assessments to ensure that you are correct – remembering that it is a self-assessment system

- consider whether the Site Value is appropriate and if not consider lodging an objection.

The passing of the Build-to-Rent (BTR) Managed Investment Trust (MIT) legislation marks a pivotal moment for the Australian property market, addressing long-standing barriers to foreign investment and encouraging the growth of the BTR sector.

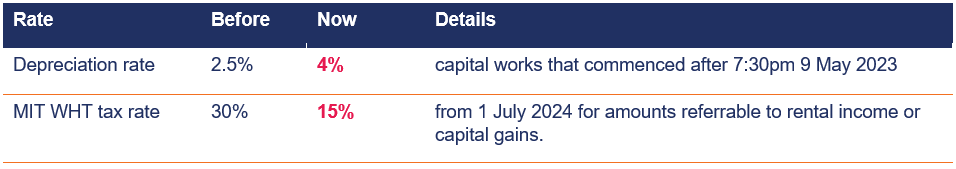

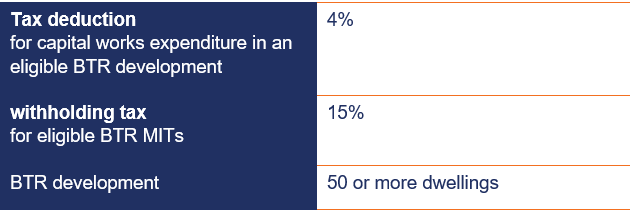

The legislation has passed both houses of parliament and will apply to eligible BTR developments to:

- increase the depreciation rate from 2.5% to 4% for capital works that commenced after 7:30pm 9 May 2023

- reduce the MIT WHT tax rate from 30% to 15% from 1 July 2024 for amounts referable to rental income or capital gains. This will align the MIT WHT rate with commercial property (i.e. office, retail and industrial).

The higher 30% MIT WHT rate was a major impediment to foreign investment in the BTR sector. This legislation should help boost foreign investment in the BTR sector with the PCA announcing that it could deliver 80,000 new homes over the next 10 years.

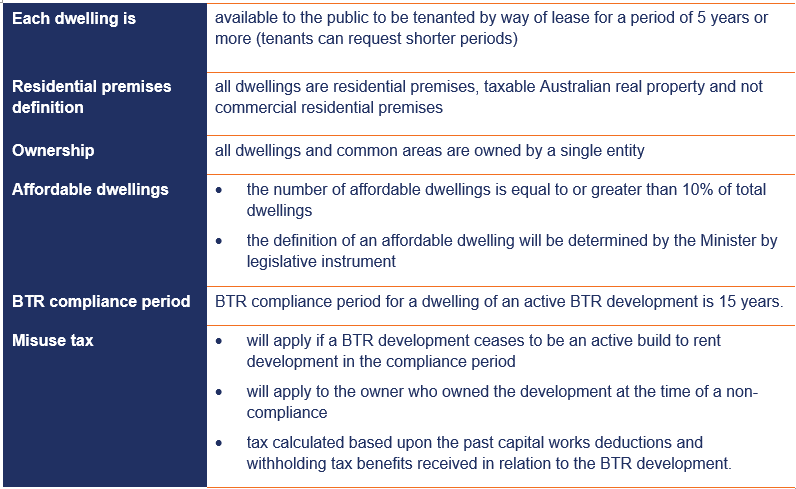

Key impact of recent amendments

The key points from the recent amendments to the Bill that have been incorporated into the final legislation are:

- It will apply for all eligible BTR developments even if they existed prior to 9 May 2023. This was an important change and ensures that those businesses pioneering BTR have not been left high and dry

- A minimum lease period of 5 years must be offered to tenants (tenants can request shorter periods)

- BTR misuse tax will apply to the entity that owns the BTR development immediately before that development ceased to be an active BTR development ensuring the appropriate owner bears the liability

- The lease terms are to be determined by the Minister by legislative instrument

- The definition of an affordable dwelling will be determined by the Minister by legislative instrument

Key features of legislation

The key features of the BTR MIT legislation are:

Dwelling features

For our original release on the BTR legislation and more details on the various State BTR regimes please click here.

How SW can help

We are specialists in property funds and property development and can provide valuable advice on your projects.

The State Taxation Further Amendment Bill 2024 introduces key reforms for Victoria, including expanded CIPT duty exemptions, strengthened FPAD and AOS provisions, a land tax exemption for charitable housing providers, payroll tax updates, and other minor amendments.

The State Taxation Further Amendment Bill 2024 (the Bill) received Royal Assent on 3 December 2024.

The key changes proposed by the Bill include:

- further duty exemptions for land in the Commercial and Industrial Property Tax (CIPT) Scheme

- reinforcement of the existing Foreign Purchaser Additional Duty (FPAD) and Absentee Owner Surcharge (AOS) provisions and

- a new land tax exemption for charitable housing providers.

Other amendments to payroll tax and other minor exemptions have also been proposed. We have unpacked these major state taxation changes below.

Key changes explained

Further Commercial and Industrial Property Tax (CIPT) exemptions

The CIPT scheme was introduced to replace stamp duty for future transactions involving commercial and industrial properties that have entered and continue to qualify under the scheme (referred to as CIPT Land). For further details take a look at our webinar or article on CIPT.

Under the newly introduced framework, stamp duty is intended to be levied one last time when a property enters the CIPT scheme through an initial qualifying transaction (‘entry transaction’).

Despite inclusion into the CIPT scheme, certain subsequent transactions (‘non standard transactions’) involving dutiable leases, fixtures and economic entitlements remain subject to duty.

The Bill introduces changes to provide upfront exemptions and concessions for ‘non-standard transactions’ which are defined as transactions such as the grant, transfer, or surrender of dutiable leases, or the acquisition of fixtures or economic entitlements related to CIPT Land.

Non-standard transaction exemptions

These ‘non-standard transactions’ will be exempt from duty if one of the following applies:

- at least three years have passed since the land entered the CIPT scheme, and the non-standard transaction agreement is made after this period or

- the entry transaction involved a 100% interest in the land, or the total interests transacted in the land amount to 100% and

- the value of the CIPT land when it entered the CIPT regime was not reduced by a lease over the land, economic entitlement in relation to the land and did not exclude the value of an interest in fixtures on the land.

The above upfront exemption is aimed at circumstances where appropriate duty has previously been paid as part of the land entering the CIPT.

Where full duty has not been paid, the Commissioner may exercise discretion to waive or reduce the duty payable on these transactions. The Commissioner considers:

- the proportion of the initial interest acquired during the entry transaction and any additional interests subsequently acquired in the land

- the degree to which the land’s value was diminished by other interests, such as leases, economic entitlements, or excluded fixtures, at the time the entry transaction was assessed for duty

- the time interval between specific transactions related to the land

- any other factors the Commissioner deems relevant.

Foreign Purchaser Additional Duty (FPAD) & Absentee Owner Surcharge (AOS) provisions

Under the Duties Act 2000 (Vic), FPAD applies extra taxes on the acquisition of residential land by foreign purchasers in Victoria. Similarly, under the Land Tax Act 2005 (Vic), the AOS imposes additional taxes on foreign owners holding land in Victoria.

The amendments are intended to address the risk that the existing provisions were invalid by reason of an inconsistency with theInternational Tax Agreements Act 1953 (Cth), which gives force to certain non-discrimination clauses in international tax treaties.

The Commonwealth Act was amended to explicitly state that state taxation laws override these international tax agreements in cases where these is an inconsistency. Despite this clarification, there remains a risk that courts could find the historical application of the FPAD and AOS invalid if they are deemed inconsistent with the Commonwealth law as it was at the time the alleged tax liabilities were incurred.

The new proposed provisions outline that if an FPAD or AOS liability is found to be invalid because of an inconsistency, a new replacement tax will be imposed which will mirror the original liability.

The proposed amendments will have the following practical effect, notwithstanding that the amendments will not apply if the liabilities are determined to be valid:

- if the FPAD or AOS liability between 1 January 2018 and 8 April 2024 are deemed invalid, the taxpayer will still owe the same equivalent amount under the new provisions and

- in circumstances where the taxpayer has paid the FPAD or AOS liability, the previous payment of the invalid tax will satisfy their liability under the replacement tax.

These proposed amendments ensure that the Victorian taxes are imposed as they were intended.

Exemption for charitable housing providers

The proposed changes under the Bill create a new exemption under section 78D of the Land Tax Act 2005 (Vic) (Housing provided for the relief of poverty) which applies to land owned, managed, or controlled by a charitable institution that is occupied, or available for occupation, by residents solely in connection with the institution’s charitable purpose of relieving poverty.

The new exemption is also available to vacant land owned by a charitable institution and declared to be held for such future use and occupation. However, the caveat to this is that the Commissioner must be satisfied that the land will be exempt land within 2 years, or a period longer as approved by the Commissioner.

As is the case with other land tax exemptions, the exemption may apply on a partial basis if the Commissioner is satisfied that only a part of land is land that meets the exemption requirements. Land tax will remain assessable on the part of the land that is not exempt.

How SW can help

Contact one of our state taxes experts to discuss how the proposed amendments may impact you.

Contributors

The Office of Management and Budget (OMB) has finalised significant changes to the Guidance for Grants and Agreements, aimed at improving clarity, consistency, and compliance in managing US Federal grants and financial assistance.

The OMB Guidance for Financial Assistance (Uniform Guidance) issued to all Federal agencies for use across all United States Federal Grants is the first major revision since its establishment in 2013.

The OMB originally established the requirements for federal grants management in 2013 consolidating and superseding requirements from several guidance documents related to the Federal financial assistance management and implementation of the Single Audit Act.

The four objectives for the current revisions, effective 1 October 2024 are:

- incorporating statutory requirements and administrative priorities to ensure consistency with statutory authorities

- reducing agency and recipient burden that included increasing several monetary thresholds that have not been updated for a number of years

- clarifying sections that recipients or agencies have interpreted in difference ways

- rewriting applicable sections in plain language, improving flow and addressing inconsistent use of terms.

What is the impact?

Organisations should review the revised Uniform Guidance changes and determine if there are any impacts on their current federal awards. Changes that may impact organisations include the following:

- increased the Single Audit threshold from $750,000 to $1,000,000 (section 200.501)

- increased the threshold for determining Type A programs to $1m if the total annual expenditures of all federal programs for a non-federal entity are $34m or less. This was previously $25 million or less (section 200.518)

- raised the de minimis rate non-federal entities can use for indirect costs from 10% to 15%. Recipients and subrecipients that do not have a current federal negotiated indirect cost rate may elect to charge a de minimis rate of up to 15% of modified total direct costs when this change goes into effect

- revised the threshold value for equipment from $5,000 to $10,000

- inclusion of a requirement that recipient and sub-recipient internal controls include cybersecurity and other measures to safeguard information

- changes to procurement standards.

SW are education specialists

Our approach to Uniform Guidance audits offers best practice expertise in a practical and commercial manner that is delivered using senior personnel with significant educational sector experience.

We have worked with 35 of the 41 major Australian universities and have extensive experience in assisting education providers with an appropriate audit of US Government sourced funds as required by the OMB Guidance for Federal Financial Assistance.

Our experts can assist with:

- quality expertise and industry insight in compliance with OMB’s Guidance for Federal Financial Assistance reporting requirements

- assessment of internal controls to ensure that research grants are managed in compliance with legislative/regulatory requirements

- direct link to Guidance for Federal Financial Assistance experts in the US, and

- tailored and collaborative audit methodology.