Revised draft for Australian public country-by-country reporting

27/02/2024

Recently, the Treasury released a revised exposure draft (ED) proposing to require certain large multinational enterprises to publicly report selected tax information on a country-by-country basis effective on or after 1 July 2024.

On 12 February 2024, the Treasury released the revised exposure draft (ED) and explanatory materials (EM), collectively referred to as ‘Revised Draft Bill’, proposing to require certain large multinational enterprises (MNEs) to publicly report selected tax information on a country-by-country (CbC) basis. The amendments are proposed to be effective on or after 1 July 2024.

The amendments builds on the original Draft Bill (April 2023 ED & EM) released as part of the 2022-23 Budget. Read more about our SW transfers pricing experts commentary on the initial announcement.

Key changes under the Revised Draft Bill include:

- a threshold has been established – the reporting obligation for CbC reporting parent is triggered only when the aggregated Australian sourced turnover reaches AUD $10 million for the income year

- disclosure requirements have been scaled back, removing specific items such as effective tax rate, list of intangible assets, and related party expenses

- information will be required on a CbC basis for Australia and specified jurisdictions (subject to ongoing update), and on either a CbC basis or an aggregated basis for the rest of the world.

Who is subject to reporting?

The reporting obligation applies to a CbC reporting parent of a CbC reporting group with an Australian presence (regardless whether it is Australian based or not). It is triggered only if the CbC reporting parent’s Australian-sourced aggregated turnover is AUD $10 million or more for the income year. If a CbC reporting parent’s reporting period is not an income year, it must assume the reporting period is an income year for calculating aggregated turnover.

What should be disclosed?

Under the Revised Draft Bill, a CbC reporting parent is required to publish selected tax information on a strictly CbC basis for Australia and specified jurisdictions, such as Hong Kong and Singapore, while allowing information to be provided on either a CbC basis or an aggregated basis for the rest of the world.

Selected tax information must be sourced from audited consolidated financial statements to ensure the information is reconcilable and verifiable. If not available, the information should reflect what would be shown in such statements had the entity been a listed company.

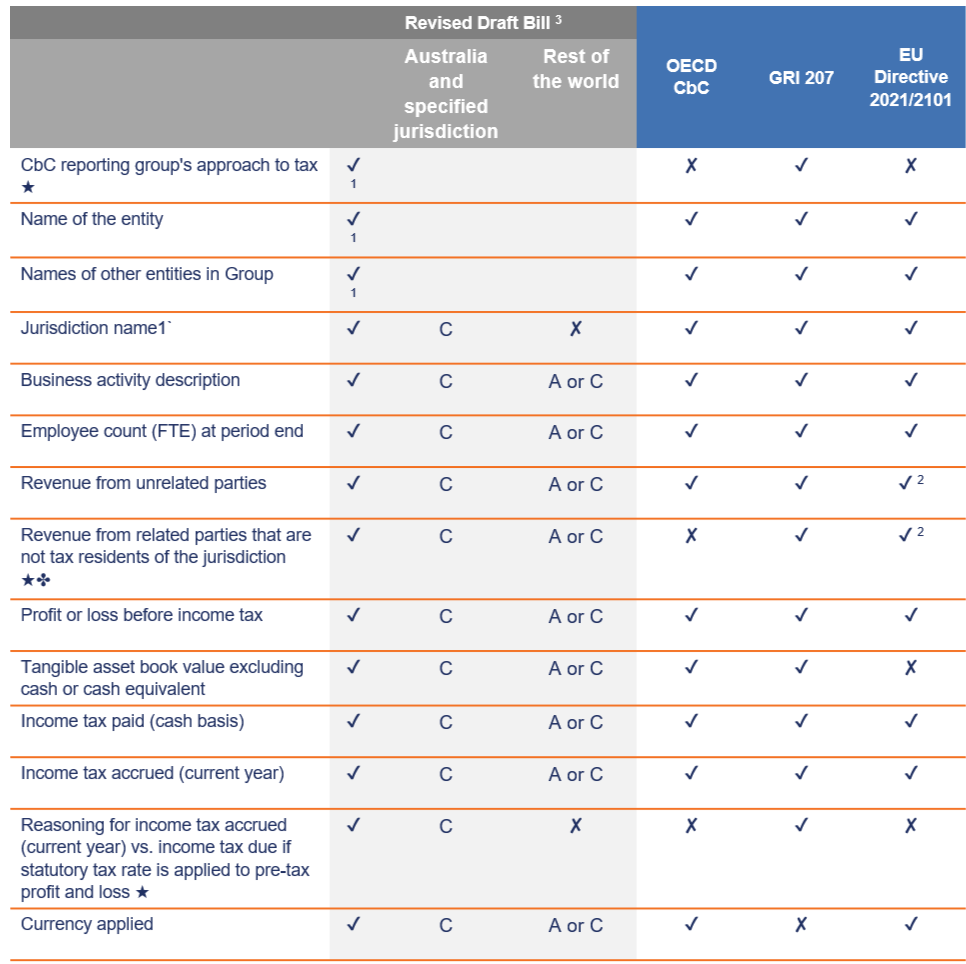

The below table compares information required under different regimes and summarises relevant information to be disclosed on a CbC basis or an aggregated basis.

A – Aggregated basis

C – CbC basis

★ – Not required under the existing confidential CbC Reporting regime

✤ – New requirements under the Revised Draft Bill

1 CbC reporting parent is required to disclose the general information.

2 Under the EU Directive, only the aggregated revenue needs to be reported, without separating unrelated party and related party revenues.

3 The Commissioner will receive the information in the approved form from the CbC reporting parent, and then make available on an Australian government website.

When is it due?

The Revised Draft Bill, once legislated, is expected to apply to reporting periods commencing on or after 1 July 2024. Submission of the public CbC report will be due no later than 12 months after the end of the relevant income year.

For example, for an entity with a reporting period ending on 31 December, the first reporting period would be 31 December 2025, with the report submission due by 31 December 2026.

The existing confidential CbC reporting obligations and the new public CbC reporting obligations will operate in parallel, but they are distinct and separate reporting regimes.

Penalties for non-compliance

Australian resident entities will be penalised for refusing or failing to comply with their obligation to publish the selected tax information.

A CbC reporting parent is liable to an administrative penalty if the entity fails to publish the required information (including information to correct a material error) on time.

The penalty is 500 penalty units ($156,500 based on the current rate of $313 per penalty unit) for each period of 28 late days or part thereof, up to a maximum of 2,500 penalty units (currently $782,500). Penalty units may increase in future.

How SW can help

As Australia moves towards greater transparency in tax matters, it is important for MNEs, both Australian-headquartered and foreign-owned with Australian operations, to stay ahead of these changes. SW is committed to providing you with proactive support to navigate these complexities.

Our tax experts can assist with:

- Impact assessment: Assessing the impact of public CbC reporting on your group.

- Approach planning: Advising on the strategic implications of the additional disclosure requirements (e.g. CbC reporting group’s approach to tax, reasoning for income tax accrued vs income tax due) in your unique circumstances, and helping you prepare for these disclosures.

- Compliance management: Developing and implementing a robust process to ensure seamless compliance with the reporting obligations, minimising the risk of penalties.

- Stakeholder communication: Facilitating effective communication with your foreign CbC reporting parent and other relevant stakeholders to enhance understanding/coordination within your group.

Please reach out to our expert team or your SW representative, if you would like to know more or need assistance.