SW is delighted to announce the appointment of Matt Birrell, Director, to the SW Executive Board, effective 1 July 2024.

Says Chair of SW, Mr Stephen O’Flynn, “As the leader of the Property & Infrastructure Group and the Business Development Tax Partner, Matt has demonstrated exceptional leadership and expertise. He is also well-known for hosting our Federal Budget webinars, providing insightful analysis and guidance.

Matt’s strong focus on commercial and advisory support for his clients reflects his strategic capabilities, which will be a tremendous asset to our Board. His experience and insights will be crucial as we navigate our key priorities and continue to drive the firm’s success. We look forward to the valuable contributions Matt will make in his new role.”

Matt fills the vacancy created by Partner Hayley Underwood, who steps down from the Executive Board after 3 years’ service to take on leading the Assurance & Advisory division.

“I would like to thank Hayley for the important contribution that she has made to the Executive Board during a period of significant growth of the firm. She has demonstrated exceptional leadership on our Quality and Risk Committee that has ensured that we have built on some great foundations to elevate a whole of firm approach to this important area. I wish her all the best in her knew role as the Divisional Head of Assurance and Advisory” said Mr O’Flynn.

Mr Matt Birrell stated: “I’m truly honoured to be voted onto the board by my Partner colleagues and I’m genuinely excited to take an active role in upholding our firm’s governance and strategy. We have an outstanding commitment to quality and risk management, and I’m looking forward to working with my fellow board members to continue driving our success in these areas as we grow.”

Hayley reflects on her time on the SW Board: “Reflecting on my service, I am proud of the progress we’ve made together on our strategic priorities, particularly the investment we have made in our system of quality management. Our continued commitment to quality has been crucial in supporting our growth.”

Over the next four years, SW will strategically focus on Growth, People, and Digital, with leadership, governance, and culture serving as the foundational pillars for our success. Ranked 22nd in the 2024 Australian Financial Review Top 100 Accounting Firms*, SW remains an attractive choice for clients and practitioners seeking a firm with a solid financial foundation and a forward-looking vision.

Matt Birrell will work closely with board member Greg Will, Duane Rogers as CEO, Bessie Zhang, Stephen O’Flynn (Chair) and independent director, Sangeeta Venkatesan.

SW congratulates Matt on his appointment and thanks Hayley for her significant contribution during her tenure.

*Of all national accounting practices, SW ranks 9th

Supporting the firm’s brand awareness campaign: Australia’s best kept accounting secret

On 18 June 2024, the New South Wales Government released its 2024-25 budget with plans to increase the foreign purchaser duty surcharge and foreign owner land tax surcharge.

From the 2025 land tax year (1 January 2025), the NSW Government will increase the rate of the foreign purchaser duty surcharge from 8% to 9%.

The foreign resident duty surcharge is levied on foreign buyers of residential property in NSW, with various exemptions available. This includes Australian incorporated property developers (and trustee companies) being able to seek a refund of the surcharge paid within 12 months of a sale of a home on residential land or sale of a residential lot, if the land has been held for less than 10 years.

From January 2025, the NSW Government will also increase the surcharge rate of land tax applied in addition to land tax rates for foreign persons, foreign companies, trustees of foreign trusts, from 4% to 5%.

Existing exemptions continue to be available from the land tax surcharge, including Australian developers being able to seek a refund (where eligibility requirements are met).

For further information we have released a summary about the different state foreign owner surcharge land taxes and duties.

How can SW help?

SW has considerable experience in assisting foreign investors to determine the most favourable state or territory to invest in property developments. This includes advising on refunds or exemptions for property developers, build-to-rent concessions, the availability of exemptions and ex gratia relief from surcharges, and the specific advantages and disadvantages of different property assets.

If you would like any further information, please contact a member of the SW tax team.

Contributors

SW Accountants & Advisors (SW) is excited to announce the promotion of Luke Fernandes to partner effective 1 July 2024. This expansion of the national partner network reflects the firm’s ongoing dedication to growth and client support.

Mr. Duane Rogers, CEO and Partner of SW congratulates Luke on his appointment, stating, “Luke’s dedication and commitment to our clients and team have been exemplary. His involvement in mentoring, training, and participation in our Financial Services, Agribusiness, and Automotive industry groups showcases his leadership. Completing his Master of Tax Law recently further underscores his expertise in his field.”

National Head of Tax, Ms. Sam Morris adds, “Luke is recognised for his ability to navigate complex and technical issues with a personable approach that leads to excellent results. He is a problem solver and has significantly contributed to staff engagement, retention, and development.”

Since joining the firm in 2012 from BDO, Luke has moved from the Business and Private Client Advisory division to the Tax division. With 16 years of experience, he has built a strong reputation as a trusted advisor in Funds, Agribusiness, Automotive, and private family groups. As Manager of the Financial Services Industry Group, Luke has led property tax and accounting webinars and delivered technical training to the Property Council of Australia’s members. He regularly presents at the Property Funds Association Next Gen networking sessions in Melbourne and Sydney.

Luke is also an active member of the Agribusiness group and the firm’s Community Opportunities Together Committee, where he leads the Movember initiatives. He is dedicated to developing junior team members, mentoring many to achieve manager roles.

SW’s commitment to growth is demonstrated by our focus on senior leaders, creating pathways and an environment for their success. Mr. Rogers notes, “We invest in supporting great talent, equipping them with the tools to provide exceptional advice and support to clients and staff, and to become long-term leaders in the firm. I am confident Luke will add significant value in his new role.”

Luke’s promotion follows the appointments of Trent Godden-Minette, Kirsty McDonnell, Vanessa Priest, and Christine Krause earlier this year. SW now boasts 41 partners across Brisbane, Melbourne, Sydney, and Perth.

On 11 June 2024, the Queensland Government released its 2024-25 budget with plans to increase the additional foreign acquirer duty and foreign owner land tax surcharge.

The Queensland Government will increase the rate of the additional foreign acquirer duty (AFAD) from 7% to 8% from 1 July 2024,

AFAD is levied on foreign buyers of residential property in Queensland, with ex gratia relief offered to Australian-based foreign entities whose commercial activities involve significant developments by adding to the supply of housing stock in Queensland (subject to eligibility requirements).

From July 2024, the Queensland Government will also increase the surcharge rate of land tax applied in addition to land tax rates for foreign companies, trustees of foreign trusts and absentees, from 2 %to 3%.

Ex gratia relief from the land tax surcharge will continue to be offered for Australian-based foreign entities whose commercial activities make a significant contribution to the Queensland economy and community (subject to eligibility requirements).

For further information we have released a summary about the different state foreign owner surcharge land taxes and duties.

Concluding remarks

While the increased rate of the AFAD will bring Queensland in line with Victoria and New South Wales’ foreign owner transfer duty surcharge rates, Queensland’s increased foreign owner land tax surcharge will still be more generous than other states.

How can SW help?

SW has considerable experience in assisting foreign investors to determine the most favourable state or territory to invest in property developments. Given foreign owner transfer duty surcharge rates are becoming more uniform across Australia, it may become less clear what are the specific advantages in investing in specific states and territories. However, other drivers that are still relevant to structuring foreign investments in specific states and territories include build-to-rent concessions, the availability of exemptions and ex gratia relief from surcharges, and the types of property assets that will be invested in.

If you would like any further information, please contact a member of the SW tax team.

Contributors

The ATO recently issued a Decision Impact Statement on the employee or contractor matter in the JMC case, clarifying the contractual elements necessary to distinguish between independent contractors and employees under the Superannuation Guarantee (Administration) Act 1992 (SGAA).

The ATO’s Decision Impact Statement regarding the Full Federal Court’s decision in JMC Pty Ltd v FC of T [2023] FCAFC 76 highlights the importance of including genuine rights to subcontract, delegate or assign services in contracts between independent contractors and engaging entities if this aligns with commercial objectives.

Employers should review current contractual arrangements to ensure certainty over the application of extended meaning of employee under section 12(3) of the SGAA.

The Commissioner stated that if a contract includes such a right, the contract is not considered to be wholly or principally for the labour of the worker. This is not within the extended definition of “employee” under section 12(3) of the SGAA provided the contractual right is not challenged as being a sham, having been varied by the parties or unenforceable. Where the contract does not make it clear the ATO will form its position based on the available evidence of the contractual arrangement.

While the ATO Decision Impact Statement does not have the same force of law as a public ruling, it marks the first time since the JMC Case that the ATO has stated explicitly that the existence of a right to delegate, subcontract or assign will exclude a worker from the extended definition of “employee” under section 12(3) of the Superannuation Guarantee (Administration) Act 1992 (SGAA).

The JMC Pty Ltd Case

In this case the appellant (JMC), a provider of higher education programs, engaged Mr H under a number of short-term contracts between 1 April 2013 and 30 June 2016 as well as between 1 July 2017 and 31 March 2018 to provide teaching services.

The contracts between JMC and Mr H included the following terms and conditions:

- Mr H would be paid an hourly rate for delivering lectures and marking exams

- Mr H would submit invoices specifying the teaching services provided along with timesheets and signed weekly lesson plans

- JMC would have a degree of oversight / control over Mr H (through JMC’s managing academic officer)

- Mr H was given the ability to subcontract or assign performance of services under the contracts, subject to written approval from JMC and

- JMC would have a right to deduct costs associated with a failure to give a timetabled lecture.

The Full Federal Court held that Mr H was not an employee of JMC within the ordinary meaning of the term or the extended definition in section 12(3) of the SGAAon the basis that there was a real right to subcontract, delegate or assign performance of services under the contracts despite the fact that the right was subject to written consent.

The ATO’s View

The Commissioner stated that if a contract includes such a right, even subject to consent from the engaging entity, the contract will not be considered to be wholly or principally for the labour of the worker. Therefore, a worker in these circumstances would not fall within the extended definition of “employee” under section 12(3) of the SGAA provided the contractual right is not challenged as being a sham, having been varied by the parties or unenforceable.

The ATO has confirmed that where the contract does not make it clear whether the worker has a right to delegate, subcontract, or assign their work, or is found to be a sham, the ATO will form its position as to the application of section 12(3) of the SGAA 1992 based on the available evidence of the contractual arrangement.

How we can help

The ATO’s Decision Impact Statement on the JMC case highlights the importance of including genuine rights to subcontract, delegate or assign services in contracts between independent contractors and engaging entities if this aligns with commercial objectives.

We suggest employers review current contractual arrangements in place to ensure you have certainty over the application of extended meaning of employee under section 12(3) of the SGAA.

We can assist in ensuring you have appropriate measures in place and make suitable disclosures regarding employment tax obligations where necessary. Get in touch with your SW contact to discuss what this decision and subsequent ATO decision impact statement means for your business.

Contributors

The foreign owner land tax surcharge increases the ongoing costs of owning property in Victoria, New South Wales and Queensland.

The foreign owner duty surcharges are targeted at foreign purchasers and increase the transaction costs of purchasing property in all states except the Australian Capital Territory.

However, in Victoria and Queensland there is an exemption for Australian based foreign owners who make significant contributions to the Victorian or Queensland economies.

The general rules may be modified by specific measures implemented as part of each government’s response to COVID-19 (i.e. Victoria’s temporary tax surcharge and reduced threshold).

Land Tax & Duty by State or Territory

Our SW property and tax experts have created a summary of the various foreign owner surcharge land taxes and duties for each Australian State and Territory. Learn what the surcharges are, who’s affected and the available exemptions.

Foreign owners surcharge land tax by State or Territory in Australia

SW-Foreign-Owner-Land-Tax-Surcharges-in-Australia-2024-v2Foreign owners surcharge duty by State or Territory in Australia

SW-Foreign-Owner-Duty-Surcharges-in-Australia-2024-v2Get in touch

For more information get in touch with our property tax experts. We can assist foreign owners apply to the Commissioner for this exemption to avoid this ongoing cost.

Contributors

The ATO has upcoming reporting obligations affecting those offering employee share schemes (ESS). Find out how the CTS ESS Toolkit, our ATO-approved software can simplify your reporting obligations.

Upcoming ATO reporting obligations

The Australian Taxation Office (ATO) have reporting obligations in place, affecting employers who issue shares or share options to their employees. The deadlines to comply with the reporting requirements are:

- ESS statements are due to be issued to employees by 14 July 2024.

- ATO reports are due for lodgement with ATO by 14 August 2024.

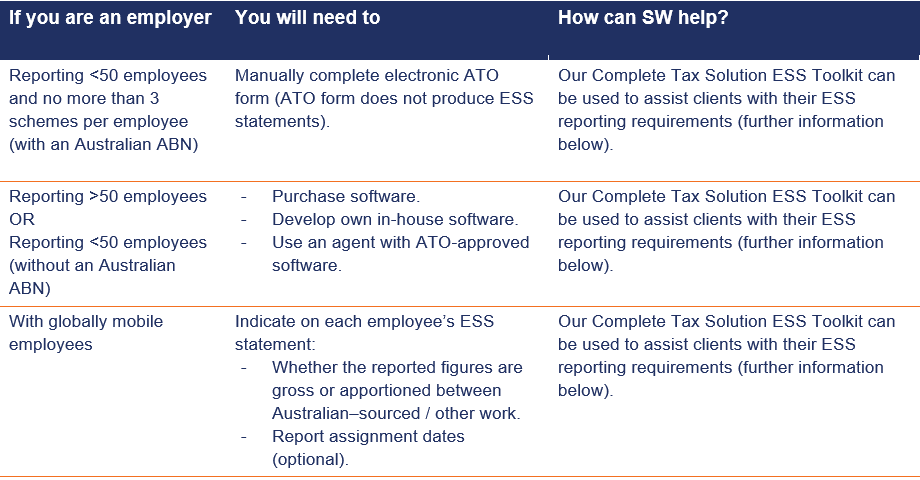

What do the ATO reporting obligations mean for you?

Our innovation solution | CTS ESS Toolkit

Our ‘Complete Tax Solutions Employee Share Scheme’ Toolkit (CTS ESS Toolkit), an ATO-approved and compliant software enables employers to simplify their online annual employee share scheme reporting obligations.

Using the CTS ESS Toolkit, SW have been successfully working with businesses to meet their ESS lodgement requirements since electronic reporting began. We are one of only a handful of providers to have passed ATO testing and have ATO approval for our specialised software. CTS ESS Toolkit is designed to help you meet the ATO’s ESS reporting requirements.

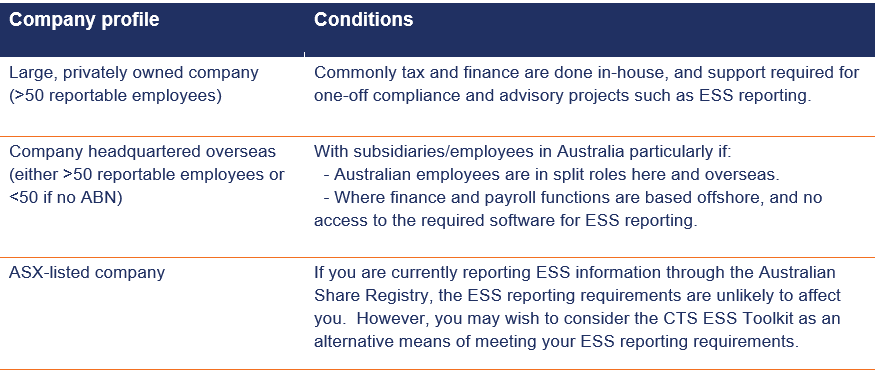

The table below outlines the types of companies that are most likely to benefit from using the CTS ESS Toolkit.

Significant Global Entities

Significant Global Entities (SGE) are entities which are part of a group with annual global turnover of A$1 billion or more. SGEs are subject to increased Failure to Lodge (FTL) penalties for late lodgement of each and every ATO document or approved form. The SGE penalties are currently $156,500 for each 28 days in which an approved form is lodged after the due date up to a maximum of $782,500. The penalties apply to each and every late lodgement of an approved form. We consider the lodgement of ESS reporting would fall within this definition.

The public officer of the company is responsible for the company’s obligations under the income tax law, including the timely lodgement of approved forms with the ATO. If your company is part of an SGE, we recommend that you implement systems to ensure timely lodgements of the relevant ESS reports with the ATO.

Next steps

Time is limited to make the necessary arrangements to comply with the ESS reporting requirements. The ATO is particularly keen to ensure corporates are compliant and provide timely and accurate reporting.

Now is the time to ensure your business is not left behind and that everything is ready for reporting season. We can provide a fully outsourced service or license our software.

To discuss how to comply with the ATO reporting requirements or learn more about how our ESS Toolkit will help you, please contact Sam Morris or Justin Batticciotto on the details below.

Contributors

Justin Batticciotto

Last night the 2024 Federal Budget was handed down by the Treasurer aiming to address inflation, higher interest rates and cost of living.

Businesses and individuals are feeling the pressure navigating through challenging conditions. These economic conditions require strategic foresight and adaptive measures from the Australian government.

This year’s Federal Budget comes at a critical time and carries high expectations to deliver solutions that address these pressing issues. We explore the intricacies of the 2024/25 Federal Budget and reveal the Hidden Gems— opportunities and insights that could be the key to resilience and growth for your financial landscape.

What does the Federal Budget mean for you?

Our Fast Facts provide an overview of the budget insights and highlight potential opportunities for your sector.

Take a look at what the Federal Budget means for you in 2024:

Follow us on LinkedIn to receive the latest updates on Federal Budget and other important industry news.

With another super rate increase from 1 July 2024, make sure salary reviews are completed and your payroll is up to date.

From 1 July 2024, the superannuation guarantee (SG) rate will increase from 11% to 11.5%, increasing the compulsory superannuation payments employers make to their employees.

The 0.5% increment will continue on 1 July each year until it reaches 12% in 2025.

What employers need to do prior to 1 July 2024?

To avoid any negative impact to employees, complete salary reviews before 30 June 2024. Provided the business can support the cost and cashflow, this will ensure the pay increments at least cover the increase to the employee’s cash salary component.

Employees who are packaged on a gross salary plus super arrangement will have no impact on their take home salary. Although, employers need to factor in the additional wages cost for the superannuation increment of 0.5%. This will mean the total wages costs will increase for other on-costs such as payroll tax and WorkCover.

Maximum Contribution Base (MCB)

The MCB will increase to $65,070 per quarter.

MCB is used to determine the maximum limit on any employee’s earnings base for each quarter in the financial year. Employers are not required to make the minimum SG payment for the part of earnings above the MCB.

Concessional contributions

From 1 July 2024, the concessional contributions cap will increase from $27,500 to $30,000, allowing individuals to add more to their super accounts.

Non-concessional contributions

The non-concessional contributions cap will increase from $110,000 per year to $120,000. This change will also affect the bring-forward rule which will increase to up to $360,000 depending on your super balance.

What’s not changing

Superannuation contribution payment due dates remain the same at 28days after the end of each quarter.

The superannuation guarantee charge (SGC) will apply when employers do not pay the SG to their eligible employees’ nominated superannuation fund by the due date.

The contribution quarters are as follows:

| Quarter | Period |

| 1 | 1 July – 30 September |

| 2 | 1 October – 31 December |

| 3 | 1 January – 31 March |

| 4 | 1 April – 30 June |

How can SW help?

SW has an experienced outsourcing team to assist with your payroll function. We can assist employers understand and become familiar with the new requirements to make this change as easy as possible, while also ensuring employers are meeting compliance requirements.

We can support with :

- Your employment taxes need

- as a registered tax agent we can request your stapled super fund details for employees

- assist in budgeting for these increases.

Contributor

The Victorian State Budget 2024/25 seeks to address the inflationary and interest rate pressures and focuses on health and education spending. With high debt levels, Treasurer Tim Pallas has curbed infrastructure expenditure with property taxes set to increase.

Key takeaways

- Focus on hospitals and schools.

- Health spending is 31% of the 2024-25 budget’s operating expenses.

- Infrastructure spending program has an added $4.9bn for targeted new investments in critical areas.

- The already announced Commercial and Industrial Property Tax (CIPT) regime is on the horizon.

- Delay of Airport Rail link.

- Payroll Tax threshold to be lifted to “make things easier” for small business.