The new Victorian Commercial and Industrial Property Tax (CIPT) will impact property purchases after 1 July 2024. This is a significant change to transition away from stamp duty for commercial and industrial property. There are numerous complexities in the proposed legislation.

The Commercial and Industrial Property Tax Reform Bill 2024 was introduced into the Victorian Legislative Assembly on Wednesday 20 March. This follows the Victorian Government announcement of the final design details of the Commercial and Industrial Property Tax Reform in December 2023. The Government has asked for written submissions or suggested adjustments to the legislation by 3 April.

The CIPT will be an annual property tax with the Bill providing for the transition of qualifying land to the commercial and industrial property tax (CIPT) scheme.

CIPT key points

- The first purchase of a 50% or more interest in a property (directly or indirectly) after 1 July 2024 will be liable to stamp duty (either upfront or via a Government facilitated transitional loan over 10 years).

- Certain subsequent transactions will not be subject to duty under the Duties Act as long as the property remains qualifying land.

- The land will become subject to an annual CIPT after the expiration of 10 years from the land entering into the scheme. The rate of CIPT will be 1% of the site value of the land or 0.5% of the value of BTR land for qualifying build to rent schemes.

- Interestingly, the first purchaser of a 50% or more interest in a property after 1 July 2024 will be subject to both duty and the VCIP after 10 years (so effectively they will suffer double tax).

- The CIPT will not apply to transactions that occur pursuant to an agreement or arrangement entered into prior to 1 July 2024.

What type of properties and land will this apply to?

The reform will apply to Victorian qualifying commercial or industrial use land that fall within the below ranges of the Australian Valuation Property Classification codes (AVCC):

- 200–499, which relate to commercial, industrial and extractive industry uses

- 600–699, which relate to infrastructure and utilities uses or

- the land has been allocated more than one AVPCC in the latest valuation not all of which are in the above ranges, and the land is used solely or primarily for a use described in an AVPCC in the above ranges. Therefore, mixed use properties will be subject to the CIPT where the sole or primary use of the property is one of the above.

Student accommodation

Land will have a qualifying use if the land is solely or primarily used for eligible student accommodation which is defined to mean residential premises that are:

- designed for occupation by students of a higher education provider (higher education provider is defined later in this clause) and

- occupied or available for occupation by students of a higher education provider; and

- commercial residential premises within the meaning of section 195-1 of the A New Tax System (Goods and Services Tax) Act 1999.

Entry into the Scheme

Land with a qualifying use enters the scheme on the occurrence of:

- certain dutiable transfers or relevant acquisitions under the Duties Act 2000 in respect of that land and

- certain subdivisions and consolidation involving land already in the scheme.

Generally, a dutiable or landholder transaction brings land into the scheme if the transaction is not fully exempt from land transfer duty or landholder duty, and the transaction relates to an interest in land that amounts to a qualifying interest, being an interest of at least 50% in the land.

Aggregation

There are aggregation rules that apply in determining if the 50% threshold has been met. Interests acquired with associated persons and acquisition of interests which occur with a 3-year period will be aggerated. Examples are provided in the Bill.

Who pays CIPT?

The owner of taxable land is liable to pay CIPT on the land.

The owner of CIPT taxable land is the same as the owner of the land for the purposes of the Land Tax Act 2005, however, the provisions deeming the holders of beneficial interests in certain trusts to be owners of land for the purposes of imposing land tax surcharges relating to trusts, are not applicable to CIPT.

Rate of CIPT

The rate of CIPT will be:

- for land other than BTR land: 1% of the taxable value of the land

- for BTR land: 0·5% of the taxable value of the land.

The taxable value of CIPT taxable land or part of CIPT taxable land is the same as the taxable value of the land or part under the Land Tax Act 2005. This is usually the site value contained in a valuation of land undertaken by the Valuer-General under the Valuation of Land Act 1960.

Exemptions from transfer and landholder duty on subsequent sales

There will be exemptions from transfer duty and landholder duty for certain transactions in relation to land that has entered the CIPT scheme.

Acquisitions of 100% interest in land

If the tax reform scheme land has entered the CIPT scheme through a transaction involving a 100% interest, no further duty is payable on a subsequent transaction.

Acquisitions of less than 100% interest in land

Where an interest of over 50% is acquired (but less than 100%), a subsequent transaction which relates to a different interest in the land may be subject to duty for a 3 year period or until full duty has been assessed on the interest (whichever occurs sooner).

The Bill includes as an example:

Person A acquires a 50% interest in a landholder under a relevant acquisition which occurs on 1 September 2025. The landholder holds a 100% interest in land. This relevant acquisition amounts to an interest of 50% in the land which is a qualifying interest and the qualifying landholder transaction is an entry transaction. Person B holds the remaining 50% interest in the landholder. On 1 January 2026, Person C acquires a 100% interest in the landholder from Person A and Person B. The value of the land holding of the landholder is to be excluded from the calculation of duty to the extent that the interest acquired by Person C is the same, or substantially the same, as the entry interest for the land (50%). The value of 50% of the land is included for the purposes of assessing duty on the relevant acquisition made by Person C.

Change in use

Where there is a change of use of land to a non-qualifying use (such as a rezoning to a residential use) after an exempt transaction, duty becomes payable on that transaction by the transferee.

Duty is assessed on the previous transaction based on the dutiable value of the land at the time of that transaction, not at the time of the change of use.

The amount of duty is to be reduced by 10% for each calendar year that has elapsed since the date of the transaction that is being assessed for duty. Note this is not necessarily the entry date of the land to the CIPT scheme.

Exclusions from the CIPT

As noted above, only commercial and industrial land (as well as student accommodation) is captured by the CIPT. Properties primarily used for residential, primary production, community services, sport, or heritage and culture purposes will not be captured.

The following transactions will also be excluded and will remain subject to duty regardless of whether the land has entered the CIPT transition:

- grant or transfer of leases

- economic entitlements.

Furthermore, transactions eligible for corporate reconstruction and corporate consolidation exemptions or concessions will not trigger entry into the CIPT regime.

Also as noted above, dutiable transactions and landholder acquisitions which are eligible for an exemption will not result in entry into the CIPT transition.

Our observations

- It is clear that there will be a number of complexities in the transition to the new CIPT regime.

- Some transactions, such as the grant of a dutiable lease or an economic entitlement in relation to land that has entered the tax reform scheme will remain subject to duty.

- Some dutiable transactions will not result in qualifying land becoming tax reform scheme land such as an acquisition of a direct interest in land of less than 50% or a landholder transaction involving an interest of less than 50%. Unless aggregated with other transactions to reach the 50% threshold, the land will not enter the scheme. The overlay between the landholder regime and the CIPT regime is complex and require further consideration by the Government.

- If transacted multiple times, the same minority interest may incur multiple amounts of transfer or landholder duty before the land enters the scheme (e.g. a 20% interest in a landholding unit trust that is transferred multiple times may incur duty each time it is transferred but the land will not enter the scheme even though the total duty payable may be equal to or more than the duty payable on a 50% direct interest).

- The application of the aggregation rules are complex but appear to not apply to aggregate interests acquired directly in land with interests acquired in a landholder that holds that same interest in the land.

How SW can help

This is a significant change in the application of duty to commercial and industrial property. For advice on how this will impact acquisitions in your pipeline or for assistance in modelling the tax payable on proposed acquisitions, reach out to your SW contact or one of the key contacts below.

Key contacts

For the seventh consecutive year, SW has been recognised as a finalist in Beaton’s Client Choice Awards, solidifying its position as one of the leading accounting and consulting firms across Australia and New Zealand. This year, SW proudly secured three finalist spots, reflecting its unwavering commitment to excellence in client service and innovation.

CEO Duane Rogers reflected on the firm’s continuous recognition, stating, “Since our inaugural entry in 2018, these awards have provided invaluable insights into our client engagement and market positioning. It’s truly humbling to be acknowledged by our clients year after year. Being recognised not only in our revenue category but also as a finalist for Most Innovative Firm and Best Customer Experience underscores our firm’s dedication to our purpose and values, guiding our client interactions and supporting our talented team.”

Dr. George Beaton, Executive Chairman of Beaton, commended SW’s performance, stating, “This year’s competition was fierce, with 250 entrants vying for top honours. SW stood out with some of the highest client service scores we’ve seen, evidence of a deep commitment to client satisfaction in a hyper-competitive market.”

Building on its success, SW has established avenues for clients to provide feedback, including through beaton debrief surveys and direct conversations with Chief Marketing Officer, Ms. Amanda Lee.

Ms. Lee emphasised the significance of these dialogues, explaining, “Client conversations offer profound insights into their priorities and expectations. This feedback loop informs our continuous improvement efforts, shaping our learning and development initiatives. It also reaffirms that our core behaviours, such as responsiveness and understanding client needs, are ingrained in our culture.”

In recognition of its outstanding client service, SW is a Finalist for three award categories:

Award categories for SW

- Finalist: Best Accounting & Consulting Firm ($30m – $100m)

- Finalist: Most Innovative >$30m

- Finalist: Best CX >$30m

The Client Choice Awards, based solely on client feedback, celebrate excellence in professional services and reflect the evolving expectations of clients. By prioritising transparency and objectivity, Beaton ensures the integrity of the evaluation process, reinforcing the significance of client satisfaction in shaping industry standards.

SW extends its congratulations to all winners and finalists for their exceptional contributions to the professional services sector in 2023 and commends the Beaton team on their 20th anniversary. For more details, click here.

Media contact

The decision in AusNet Services Limited v Commissioner of Taxation [2024] FCA 90 has been handed down and could be a win for taxpayers with its impact on the ‘nothing else’ criteria for CGT rollover relief.

AusNet Services Limited faced a distinct challenge in trying to extricate themselves from a previously chosen rollover relief election, when hindsight showed that a different approach could lead to greater tax benefits. Though AusNet Services Limited lost the case, the decision may well assist taxpayers seeking to rely on CGT rollover relief more generally.

Background

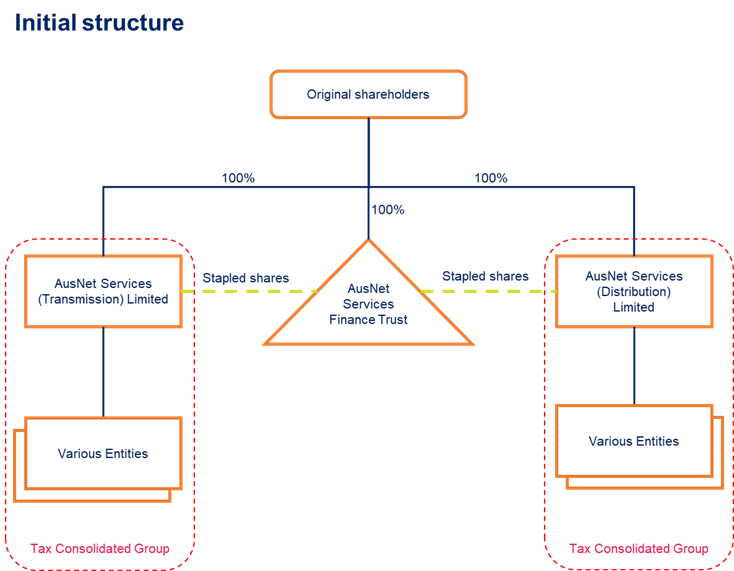

The Ausnet Group consisted of the following entities which were stapled:

- AusNet Services (Transmission) Limited (Transmission).

- AusNet Services Finance Trust (Finance).

- AusNet Services (Distribution) Limited (Distribution).

After a separate dispute with the Australian Taxation Office, it was decided to interpose a new entity above the AusNet Group and form a new tax consolidated group (TCG).

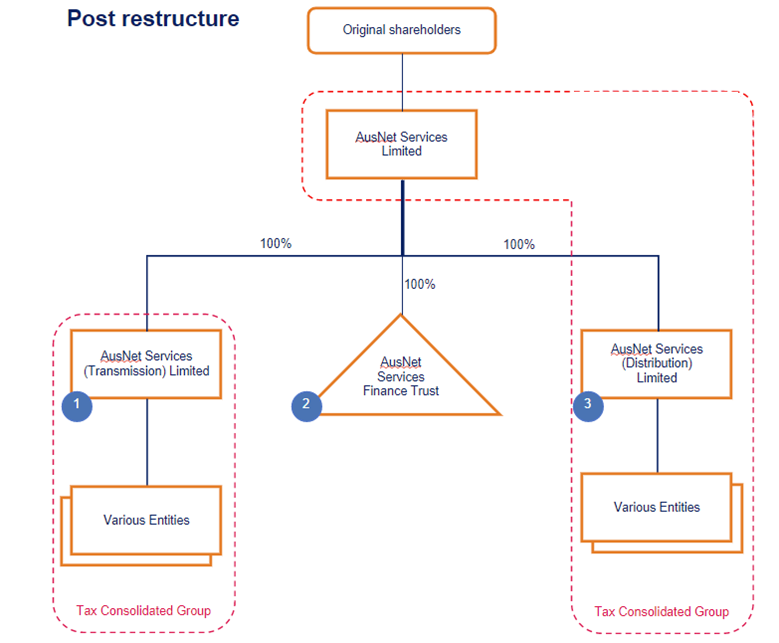

As shown in the above ‘post restructure’ diagram, after the 3 companies were unstapled, AusNet Services Limited (AusNet Services) acquired each of the 3 companies under a scrip-for-scrip exchange in the following order:

- Transmission,

- Finance, then

- Distribution.

The original intention was that CGT rollover would be sought for the interposition of the new head company under Division 615 of the Income Tax Assessment Act 1997. On the same day as the interposition, AusNet Services elected to apply Division 615 (noting this is a separate election that automatically applies for the shareholders where the new interposed entity is the head company of a TCG). This election was supported by the Class Ruling CR 2015/45 (link) that AusNet Services sought from the Commissioner.

The issue with a Division 615 rollover is that the cost base of the shares that Ausnet Services (the interposed entity) holds in Distribution is equal to the cost base of the Distribution’s assets net of liabilities. Where there is significant value in the goodwill of Distribution, the ACA will be skewed to the goodwill, rather than other assets which have tax benefits.

Because of the rules that apply under Division 615 to determine the cost base of shares acquired in the 3 companies, AusNet Services came in time to experience what might be described as ‘rollover regret’. With the benefit of hindsight, AusNet Services came to realise that the effects of the Division 615 were disadvantageous for the group in relation to the acquisition of Distribution. Unfortunately, the relevant legislation explicitly states that once the decision to apply Division 615 is made, it cannot be revoked. The only recourse for amendment was therefore to contend that Division 615 should not have been applicable to Distribution in the first place.

Rollover relief and ‘nothing else’

Whilst there were several arguments raised by AusNet Services as to why rollover relief under Division 615 should not apply, for the purposes of this alert we will be focusing only on the argument that is pertinent to a number of tax rollover relief provisions, which will have broad implications.

The argument boils down to the following question:

- Was there a scheme for reorganising the affairs of Distribution under which the original shareholders received shares in Ausnet Services for disposing of their shares in Distribution (and ‘nothing else’)?

Notably the ‘and nothing else’ requirement is an important precondition for rollover relief in several other rollover provisions beyond Division 615, including:

- Subdivision 124-E – exchange of shares in the same company or units in the same trust;

- Subdivision 124F – exchange of rights or options in a company or unit trust;

- [IK1] Subdivision 124Q – exchange of stapled ownership interests for ownership interests in a unit trust;

- Division 125 – demerger relief.

Arguments of the case

| AusNet Services arguments | Court view |

| There was no scheme for reorganising the affairs of Distribution, as AusNet Services was not a shelf company. The reference to ‘its affairs’ in section 615-5(1)(c) meant that Division 615 only applied where the affairs of Distribution were not amalgamated or merged. Note that the Commissioner has previously indicated in earlier rulings on predecessor provisions that rollover relief may not be available where multiple entities are being restructured unless the interposed company is a shelf company – see Taxation ruling TR 97/18 (link). | The affairs referred to in 615-5(1)(c) relate to the affairs of the shareholders and not that of the original or interposed company. In any event, Distribution, Finance and Transmission were a single economic unit and their affairs could not be dealt with in isolation. Essentially, the Court did not accept that it was a requirement of Division 615 that a shelf company be used where a new company is interposed between multiple entities and their shareholders. |

| Distribution failed to meet the and ‘nothing else’ criteria of the rollover relief because the shareholders of Distribution received: shares in AusNet Services, which, unlike the shares in Distribution, included substantial franking credits; andan increase in value of the AusNet Services shares due to the synergy created by Distribution, Transmission and Finance being brought under the one umbrella parent entity. | The Court has interpreted the and ‘nothing else’ condition quite narrowly, where it stated that: By its terms, s 615-5(1)(c) focusses on that which a shareholder receives under the scheme in exchange for the shares. It does not look to the consequences of the scheme, but rather the consideration or quid pro quo received for the disposal of the shares. In this case the implementation deed specifically stated that for each share disposed of in Distribution, one share in AusNet Services would be received. Therefore, this quid pro quo would be viewed as the relevant consideration in determining the and ‘nothing else’ criteria. Where there were consequences of the scheme that arguably added further value to the consideration received, they would be ignored in the application of the and ‘nothing else’ condition. As an aside, it is interesting to note that in Class Ruling CR 2015/45 and the present case, the Commissioner accepted that there could be successive rollovers that were eligible for relief under Division 615. This should be contrasted with the Commissioner’s views in Taxation Determination 2020/6. Given the comments of the court, we would expect that the Commissioner’s views in Taxation Determination 2020/6 would need to be reconsidered. |

AusNet lost in this case however the narrow construction of the and ‘nothing else’ condition is a win for taxpayers.

Key takeaways

- The key outcome is essentially that certain rollovers may have broader application than what was previously thought to be the case (at least by the Commissioner). The Court’s concluded is that the and ‘nothing else’ requirement may not be as challenging as the Commissioner has to date indicated.

How SW can help

If you are considering a group restructure and/or have any queries on the contents of this article, please contact our expert team here at SW.

Contributors

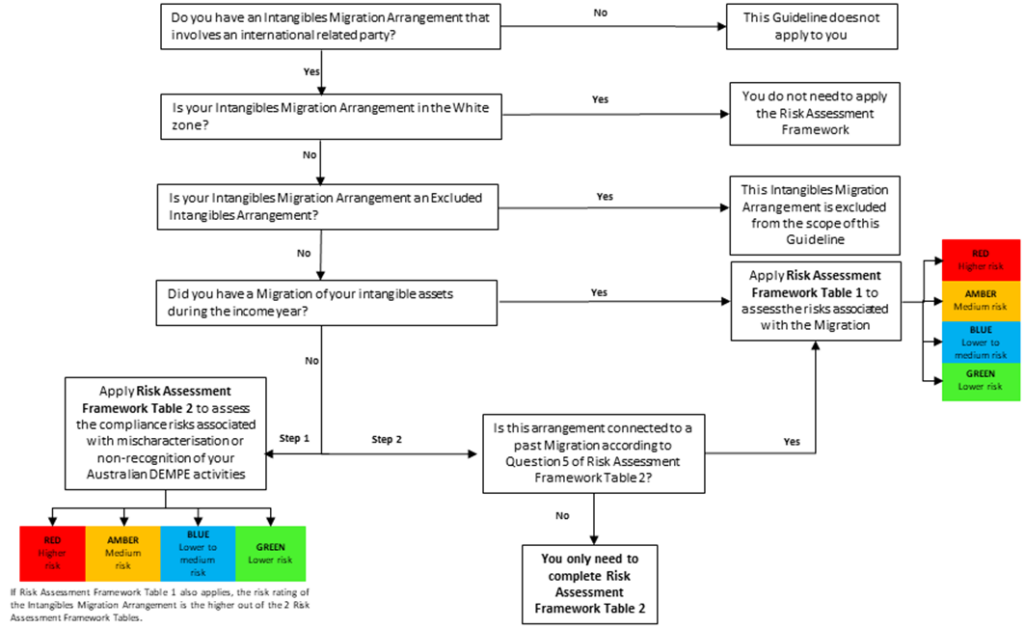

The Practical Compliance Guideline (PCG) 2024/1 (the Guideline) has been released with ATO poised to dedicate resources towards scrutinising cross-border related party intangible arrangements. As a result taxpayers will face increased disclosure and self-evidence requirements.

After a nearly three-year wait[1], the ATO finalised the risk guideline targeting cross-border related party arrangements (collectively referred to as ‘Intangibles migration arrangements’) involving:

- Migration of intangible assets – ‘Migration’ refers to any restructure or change associated with Australian intangible assets that allows another entity to access, hold, use, transfer or benefit from the intangible assets, and

- Mischaracterisation / non-recognition of Australian activities connected with intangible assets – this includes arrangements relating to the Australian development, enhancement, maintenance, protection and exploitation (DEMPE) activities in connection with intangible assets held offshore.

The Guideline addresses concerns with arrangements:

- under which Australia-led intangibles are transferred, licensed to or otherwise held by an international related party

- lacking the requisite substance to perform or control DEMPE activities and/or assume associated risk and

- where value-adding DEMPE activities remain in the hands of Australian taxpayers.

The Guideline applies from 17 January 2024, and will apply to existing and new arrangements.

The Guideline does not reflect the ATO’s interpretation of tax laws, however serves as a cautionary notice that ATO will focus on scrutinising[2] risky arrangements.

The ATO’s compliance approach

The ATO’s approach to risk assessment is determined by two point-based Risk Assessment Frameworks (RAFs).

RAF Table 1

The below risk factors may trigger risk points for a completed intangible migration during the current year:

- in connection with a restructure or change had associated with intangibles, the Australian entity continues to hold certain economic relationship with the intangibles

- Operational and functional circumstances of the relevant international related party (IRP)o

- tax outcomes of the relevant IRP as well as the Australian entity

- undocumented dealing involving Australian intangible assets / DEMPE activities that are not recognised.

RAF Table 2

RAF Table 2 becomes relevant where there was no intangible migration completed during the current year. It comprises the below risk factors:

- extent of Australia based DEMP activities in connection with intangible assets owned by an IRP

- operational and functional circumstances of the relevant IRP

- tax outcomes of the relevant IRP

- whether the ongoing intangible arrangement is connected to a past migration (if so, RAF Table 1 needs to be assessed on past migration).

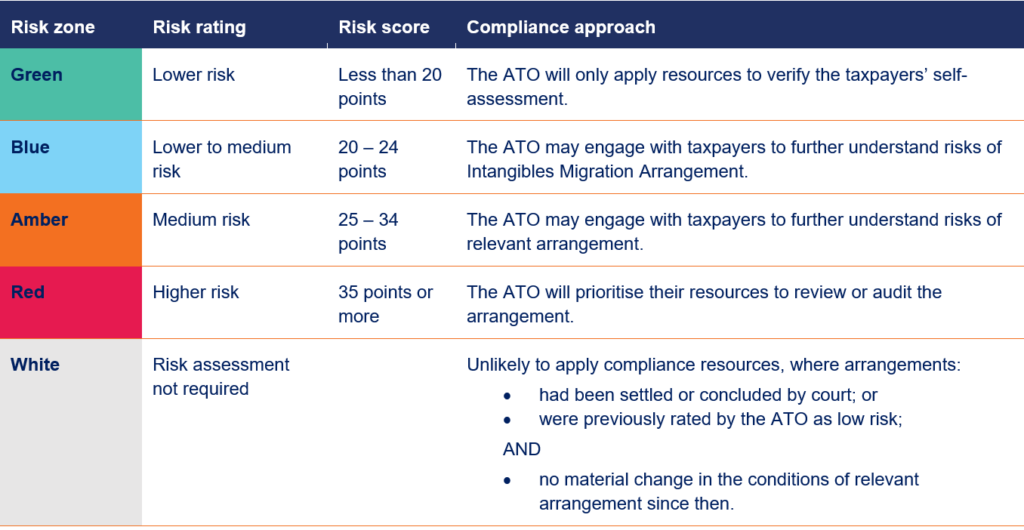

The risk zones / ratings and corresponding compliance approaches are summarised in the table below.

Evidence expectations

Similar to previous drafts, the Guideline continues to place a high bar for evidence and documentation.

The expected evidence focuses on the following aspects:

- evidencing the commercial considerations and business decision-making

- evidencing the legal form and substance of Intangibles migration arrangements

- identifying and evidencing the intangible assets and connected DEMPE activities, and

- evidencing the tax and profit outcomes of Intangibles migration arrangements.

The complexity of taxpayers’ business, the extent to which their Intangibles migration arrangements contribute to that business, and the risk rating of the arrangement will influence the type and level of evidence the ATO expects from them to substantiate the arrangement. However, the Guideline does not serve as substitute for the transfer pricing documentation requirements under Australian tax law.

Examples

Appendix 1 of the Guideline includes 15 examples of Intangibles migration arrangements to illustrate how the RAFs should be applied by taxpayers. Our transfer pricing experts break down and explain these examples here.

Some positive improvements, but still challenging to handle

Compared with PCG 2023/D2, there appears to be some “taxpayer friendly” changes which show that the ATO adopted public feedback during the consultation process. Some positive changes include:

- Introduced ‘Excluded Intangibles Arrangements’ that are not subject to the Guideline – essentially vanilla outbound / inbound distribution arrangement, or low value service arrangement (subject to strict eligibility criteria).

- Expansion of lower end risk zones to White Zone and Blue Zone.

- Reallocation of risk scores – for example, uplifted the point threshold (from 25 to 35) for higher risk zone, and Migration of intangibles, by itself, does not immediately trigger a risk point.

- Providing more scenarios where ‘grouping’ of Intangibles migration arrangements is allowed.

On the other hand, the Guideline remains to place significant challenges and administrative burden on taxpayers:

- The Guideline has very broad application, encompassing scenarios beyond the immediate transfer of assets. This requires a detailed function and risk analysis to demystify how the Australian entity and its relevant IRP interact in connection with DEMPE activities, regardless of the materiality[1] involved.

- The eligibility criteria for ‘Excluded Intangible Arrangements’ appears to be restricted, and the lack of any direct example for ‘Excluded Intangible Arrangements’ in the Guideline does not help provide confidence in application to the public.

- The Guideline scopes out consideration of other tax aspects such as ‘pricing’ of intangible arrangements. In the RAF, one significant risk trigger is ‘tax outcome’ which focuses on the tax treatment or condition of the IRP. However, if the pricing is good enough from an Australian perspective, the overall tax risk to the Australian taxpayer could have been lower than that derived from the Guideline. As such, the risk outcome derived from the RAF, by itself, could be misleading.

- Taxpayers are expected to self-assess their risk based on extensive evidential information, including information possessed by IRPs. Obtaining intangibles related information or cooperation from overseas could be very challenging, due to confidentiality or other concerns.

Key takeaway for taxpayers

The Guideline’s finalisation highlights the ATO’s focus on tax risks connected to intangible arrangements with offshore related parties. It is relevant to a wide range of Australian taxpayers, regardless where the relevant intangibles are held. The asessment of the relevance and associated risk is not a straightforward process. It is important for taxpayers to self-assess early and complete these self-assessments before tax returns for the relevant income year are lodged.

For larger taxpayers that are required to complete Reportable Tax Position (RTP) Schedules in the tax return, a new question on Intangibles migration arrangements will need to be completed. Getting in touch with relevant IRPs early to obtain necessary evidential support is critical for the RTP disclosure.

Regardless of materiality, taxpayers need to ensure sufficient coverage on the arm’s length nature of relevant intangible arrangements is included in its contemporaneous transfer pricing documentation. All the examples detailed in the Guideline have mentioned transfer pricing as a focus area under the ATO’s compliance approach across all risk categories.

How SW can help

Our experts can assist with:

- further clarification regarding the Guideline

- helping you understand more to what extent your arrangements will be subject to the Guideline

- assessing risk level of your arrangements

- ensuring your RTP disclosures are accurate and supportive

- putting in place transfer pricing documentation to provide a further line of defence for your intangible arrangements.

Reach out to your SW advisor for support from our specialist tax team.

Contributors

[1] With initial PCG 2021/D4 released in May 2021, followed by PCG 2023/D2 released in May 2023.

[2] Including the potential application of the general anti-avoidance, transfer pricing, capital gains tax rules etc.

The ATO has released a new draft tax ruling (TR 2024/D1) on the character of software arrangements for public consultation. This outlines the Commissioner’s view as to when payments would fall under a software arrangement and are subject to royalty withholding tax.

The over-arching view remains that payments made for vast majority of software arrangements may be royalties when made by an Australian entity to an offshore entity. This includes cloud-based distribution, distributors of tangible hardware with a software component licensing, software-as-a-service.

The current draft is in essence a comprehensive rewrite, notably removing the concept of a ‘simple use of software’ but further considers the interactions and applications of the royalty definitions in domestic tax laws and Double Tax Agreements (DTAs). It replaces draft ruling TR 2021/D4 (issued in June 2021), which replaced TR 1993/12 (withdrawn effective 1 July 2021).

What has changed?

Under the current draft:

- The ruling applies to all cross-border payments relating to ‘software agreements’, defined as

an agreement, arrangement or scheme under which a distributor makes payment(s) directly or indirectly to the owner or licensee…of the copyright (or other intellectual property (IP)) for the right to be in a position to earn income relating to the use of, or right to use, software.

- Removed notion of payment for simple use will not constitute royalty i.e. using a software as designed or intended to be used

- Substantial emphasis placed on substance over (legal) form – Contractual terms of an agreement are relevant but not determinative of the payment characterisation. Rather, the ATO will undertake an objective assessment of the agreement and consider the commercial and practical context. Where distribution agreements cannot be performed or without using the IP rights granted, the entire consideration will be characterised as a royalty.

- Where a distributor is granted more than one right, (e.g. to distribute, use of copyright, etc.) under a single contract, the ATO accepts a ‘reasonable’ method of apportionment if the rights are independent. However, no further deliberation is provided in the ruling as to how to achieve this.

- The ATO takes a narrow interpretation of the example in the OECD Commentary and does not accept the a distributor could obtain certain rights for distributing the relevant software, without utilising the software copyright.

- As the term ‘copyright’ is not defined in DTAs, the Commissioner will take a ‘liberal interpretation’ of the meaning under the Copyright Act 1968. The copyright laws of foreign countries participating in various international copyright conventions may be considered.

Royalty ‘defined’

The table below sets out the ATO’s distinction when consideration constitutes a royalty payment.

| Royalty | Not a Royalty |

| – Grant of a right to use IP (e.g. to reproduce a computer program), (regardless of whether the right is exercised). – Use of an IP (under the standard tax treaty definition). – Supply of know-how in relation to an IP right. – Supply of assistance required to enable the application or enjoyment of the supply. – Sale by a distributor of hardware with embedded software, where the distributor is granted or uses rights in the IP of the embedded software. | – Solely for grant of right to distribute software without being provided the use, or right to copyright or another IP right. – Consideration for transfer of all rights with respect to software copyright. – Payment from distributor solely for acquisition of hardware with embedded software, provided the distributor does not use or is granted the right to use, any other copyright / IP in the embedded software. – Outright sale of all rights associated with the software and IP. Supplier must not retain any rights. – Consideration for the provision of services that are unrelated to any IP right referred to under the standard tax treaty definition. |

How does the ruling apply in practice?

To illustrate its view the ATO has replaced the eight high-level examples with two detailed scenarios.

In one scenario, the Australian entity (AusCo) is granted a non-exclusive right to resell its foreign parent’s (ForCo) software products in Australia. Whilst the agreement does not set out all the necessary rights and obligations to give effect to the software arrangement, certain key terms are provided, including:

- AusCo does not have any right / licence to any IP owned by ForCo

- End users enter into sales contracts with and pay AusCo

- Consideration for granting of non-exclusive right to distribute is determined based on sale of products, less an arm’s length fee for distribution services

- The products are stored in servers owned by the ForCo – for download / cloud-based access

- AusCo is required to maintain and enhancing the branding of ForCo.

The ATO considers payments made by the AusCo to ForCo is royalty because the rights and entitlements to use the software cannot be provided with the authorisation or communication by the ForCo (the copyright owner). Furthermore, AusCo has obtained other rights (e.g. use of ForCo’s trademarks, brands, enter into commercial rental arrangement (recurring licensing fee), etc.) under the agreement.

Reasonable apportionment may be applicable if sufficient evidence is provided to support the notion that the distribution right had substantial value independent of any right to use copyright or IP rights.

What is the (potential) impact?

The ATO is currently seeking comments on the draft ruling, with the consultation period closing on 1 March 2024. Once finalised, the ruling will apply to both prospective and retrospective arrangements.

Where a payment is royalty, it is subject to royalty withholding tax in Australia – either at the treaty rate (where there is a DTA) or the default rate of 30 percent. If the Australian resident makes overseas payments but failed to withhold and/or remit, deduction of these payments will be denied for income tax purposes until such time the withholding tax is remitted.

Whilst the draft ruling concerns payments relating to ‘software arrangements’, the ATO may also potentially extend its application to distribution / licensing arrangements to other industries (e.g. pharmaceutical), where the rights to distribute, copyright, technical know-how and/or provision of ancillary services may also typically be ’bundled up’ under a single agreement.

How SW can help

Our experts can assist with:

- further clarification regarding the draft ruling

- assessing and advising how the ruling may affect your existing and prospective cross-border arrangements.

Reach out to your SW advisor for support from our specialist tax team.

Contributors

The ATO has further updated their website to assist Not-for-profits (NFPs), including sporting clubs, prepare in advance of lodging their first online NFP self-review return for the 2023-24 income year.

The NFP self-review return will be available from the Online Services section of the ATO website from 1 July 2024. It will be due for lodgement between 1 July and 31 October 2024 for 30 June financial year balancers. For details of the previous update click here.

The ATO has released high level information regarding the questions that NFPs will be required to answer on the online NFP self-review return, which includes:

- Organisation details – including annual turnover

- Income tax self-assessment – organisations will need to choose a category (e.g. community service, sporting, etc.) that best reflects the main purpose of the organisation. The ATO has provided some high level instructions to help make this determination including highlighting:

- the appropriate clauses in governing documents that prohibit the distribution of income or assets to members.

- confirming that the organisation exists to operate and incur its expenditure entirely in Australia.

- Examples of the potential questions included on the return and additional information that the ATO will provide to support organisations to complete the questions.

Assuming answers indicate that an organisation is a tax exempt NFP, the ATO system will then generate a statement:

“Based on the information provided, the organisation has self-assessed as income tax exempt for this income year.”

A declaration is then required to be signed on behalf of the organisation. There is also the option to print a copy of the questions and answers to share with the board, committee or tax agent.

Get in touch with SW

We can assist in your preparation for the new online return. To discuss your broader eligibility for income tax exempt status, please contact our Tourism, Hospitality and Gaming (THG) industry experts and not for profit experts.

The Australian government has proposed a new bill that would require certain entities to prepare annual sustainability reports, aiming to enhance the transparency and comparability of climate-related information.

Introduction

To improve the disclosure and accountability of climate-related matters the Australian government’s final Policy statement proposes to mandate certain entities follow the new sustainability reporting standards issued by the AASB. This is consistent with the international sustainability standards.

The first group entities would need to prepare their sustainability report for annual reporting periods commencing on 1 July 2024, subject to submission feedback on a 6 month deferral, with smaller entities phased in over the next few years.

What are the changes?

New reporting requirements

There is a new sustainability reporting requirement for reporting information on climate-related matters. If applicable, the sustainability report will need to be prepared together with the annual report.

The report will follow the new sustainability reporting standard issued by the Australian Accounting Standards Board, which is closely aligned with the international sustainability standard. This will provide much-needed comparability across the companies.

The requirement will be subject to the passing of the bill.

Who has to prepare annual sustainability reports and when

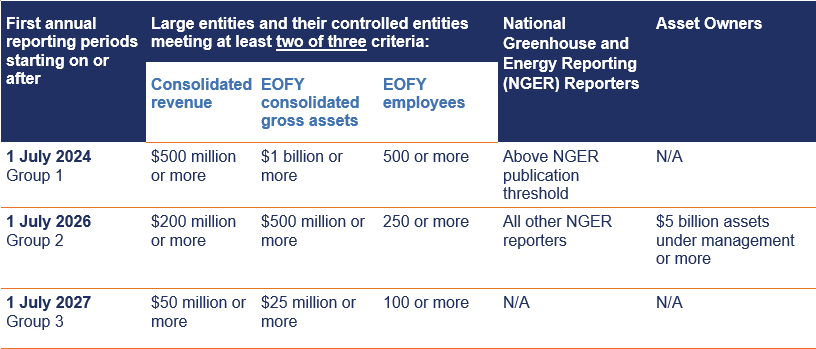

The government proposed a phased approach based on the size of the entities. The table below sets out the details of the threshold and date for the implementation.

The above table is extracted from Treasury Policy Statement

The smaller Group 3 (current Large Pty threshold) are only required to make climate disclosure if the entity has material risks or opportunities.

What do companies need to report?

The disclosure will need to follow the new stainability standards issued by AASB. The key areas of disclosure include:

- governance and strategies for climate-related matters

- risks and opportunities associated with climate change

- metrics and targets associated with emissions. This includes the current emissions by the company and from the electricity consumption (Scope 1 and 2 emissions) and the emission in the value chain (known as Scope 3 emission).

In addition to a qualitative description of the risks and opportunities, the company is also required to disclose a quantitative scenario analysis. There are several reliefs proposed by the government in relation to more complex disclosure on Scope 3 emission and quantitative analysis.

The above disclosure will need to be included in a new annual sustainability report. The structure and content of the sustainability report consists of:

- the climate statements for the year

- any notes to the climate statements

- any statements required by other legislative instruments to include matters concerning environmental sustainability and

- the directors’ declaration about the statements and the notes.

The annual sustainability report will be presented together with the financial report.

Audit requirements

The company’s financial auditor will also audit the sustainability report. The content subject to assurance will gradually move from Scope 1 and 2 emission data initially to the full report. The AuASB is currently consulting with stakeholders to develop the level of assurance required for climate related disclosures and will determine how assurance requirements will be phased in.

What your next steps should be

- Familiarise yourself with the content of the proposed standards and seek clarification on how you will be impacted

- Provide feedback to the AASB and Treasury regarding the content of the exposure draft. Consultation is open until the 9 February 2024.

How SW can help

Our team of audit and assurance experts are fully informed of the requirements of the sustainability accounting standards and can assist with providing guidance for your business, as well as keeping you abreast of developments from an Australian reporting context.

Reach out to your SW contacts or the key contacts here for a conversation.

Contributor

The ATO website has been updated to advise Not-For-Profits (NFPs), including sporting clubs, that they are required to lodge their first NFP self-review return for the 2023-24 income year, between 1 July and 31 October 2024.

First announced in the 2021 Federal Budget, NFP’s including sporting clubs, societies and associations, with an active Australian business number (ABN) need to lodge an annual NFP self-review return to continue accessing income tax exemption. Find out more about the original announcement here.

The annual return reporting is part of the ATO’s revised guidance on the games and sports income tax exemption for NFP clubs under Tax Ruling 2022/2, aiming to enhance the transparency of income tax exemptions.

Lodgement period

Their first NFP period is between 1 July and 31 October 2024. The lodgement period will differ for clubs who don’t adopt a 30 June financial year end however, specifics are yet to be determined by the ATO.

How to prepare

The lodgement of the self-review return marks a major change in the reporting obligations for Not-For-Profit clubs as to maintaining their income tax exempt status. It is imperative that clubs take all necessary steps prior to the lodgement deadline to ensure they have appropriate documentation and procedures in place to support their income tax exemption classification and to be prepared to lodge the self-review return with appropriate disclosures.

In order for NFPs to prepare for the new online self-review return the ATO has outlined what organisations need to do:

- check to see if you have an active ABN

- identify your main purpose

- complete an Early Self Review – this Early Self Review form has just been released and the ATO has indicated that the questions in this checklist will be similar to the questions asked in the online return that will be required to be lodged next year.

- setup your myGovID and Relationship Authorisation Manager (RAM) to allow you to complete the NFP self-review return

- subscribe to the ATO’s monthly Not for Profit newsroom

Get in touch with SW

We can assist in your preparation for the new online return and completing the Early Self Review. To discuss your broader eligibility for income tax exempt status, please contact our Tourism, Hospitality and Gaming (THG) industry experts and not for profit experts.

Contributors

Increased costs for foreign property investors will aim to improve the availability and affordability of homes for Australians. Foreign investors will face higher taxes on existing properties meanwhile the Federal Government will incentivise ‘Build-to-Rent’ projects by setting fees at the lowest commercial rate.

On Sunday 10 December, the government announced property tax changes to penalise overseas investors buying homes which are left vacant as well as cutting tax for Build-to-Rent investors. The reform is a bid to increase housing supply, however the effectiveness of these measures to address the broader housing crisis remains open to debate.

Increased costs for foreign buyers

From 2024, foreign investors purchasing established Australian homes will face tripled application fees.

Currently, the application fee charged to foreign investors for buying established homes in Australia is calculated on the property’s value. For instance, properties priced between $1m and $2 m incur an application fee of $28,200. This rises to a maximum of $1,119,100 for residential acquisitions of more than $40 million.

Additionally, if these properties are left vacant, the investors will incur an equivalent amount as a vacancy fee.

The tripling of application fee effectively is a six-fold increase in total fees (application plus vacancy fees) for properties bought since 9 May 2017. A vacant property costing between $1m to $2m will have an application fee of $84,600 and an annual vacancy fee of $84,600.

The new measures specifically target established dwellings, encouraging foreign investors to focus on new housing developments. This shift is intended to stimulate the construction sector, creating jobs and contributing to economic growth.

Incentivising ‘Build-to-Rent’ projects

To promote investment in new housing stock, the government is reducing application fees for Build-to-Rent projects. From 14 December 2023, the application fees for Build-to-Rent projects will be set at the lowest commercial rate – irrespective of the nature of the land involved. This initiative aims to make Australia’s foreign investment framework more consistent and attractive for long-term rental housing developments.

However, it’s important to note that this is in contrast with the proposed Federal thin capitalisation changes. Thin capitalisation involves tax reforms to ensure multinational companies pay their fair share, focusing on entities funded by high levels of debt over equity. For the latest update on the proposed changes, we have recapped the Thin Capitalisation rules.

Enhanced compliance measures

To strengthen the enforcement of its new property investment rules, the government is significantly increasing funding for the ATO. This aims to ensure strict adherence to the new regulations by foreign investors. A key regulation is the requirement for foreign nationals to sell their Australian properties upon leaving the country unless they have secured permanent residency.

This commitment to enhanced enforcement goes beyond merely introducing new rules; it reflects a concerted effort to effectively monitor and enforce compliance. Foreign nationals are typically barred from purchasing existing properties. This approach underscores the government’s dedication to addressing the complexities of the housing market and ensuring the integrity of its foreign investment framework.

The new foreign investment rules primarily impacts foreign investors, with increased fees and stricter compliance requirements. The construction industry may see growth from incentivised new housing projects. Australian residents, particularly those seeking affordable housing, could benefit from these changes. Real estate developers involved in Build-to-Rent projects are likely to gain from lower fees, encouraging investment in this sector. The repercussions of these changes are thus widespread, affecting various stakeholders in the property market.

Get in touch with SW

Get in touch with our property experts to learn more about how these new regulations affect you.

In light of these proposed changes, we encourage all stakeholders in the Australian property market to stay informed and actively engage with the evolving landscape. For further updates, insights, and guidance on navigating these new regulations, be sure to follow us on LinkedIn.

Contributors

With the festive season in full swing, businesses are celebrating their achievements and expressing appreciation for their employees. Ensure you consider the Fringe Benefits Tax (FBT) effects to prevent unexpected FBT costs.

Christmas celebrations are a wonderful way to end the calendar year, reflect and celebrate with your team. Find out if your Christmas events and gifts may be subject to FBT. While your staff enjoy the party, make sure your festive activities make sure you aware of tax implications.

Christmas events

Food and drinks provided at Christmas events could fall into the entertainment benefit category which may attract FBT based on several factors. These include:

- Location of the Party: Whether it is held on-site or off-site.

- Timing of the Party: If it’s during normal business hours or outside these hours.

- Cost Per Head: The total expenditure per attendee.

- Types of Attendees: Whether only employees, clients, or family members are present.

Parties held on business premises during ordinary hours of work

If your Christmas party is held on the business premises during a normal working day, no FBT is payable for food and drinks. This constitutes an exempt property benefit, rendering the entire cost of the party FBT exempt.

However, this concession applies exclusively to food and drink provided to employees. If food and drinks are provided to an employee’s associate (like family members), this portion will not be exempt and may attract FBT.

This exemption can only apply to property consumed on premises and other types of benefits may be subject to FBT (e.g. it will not apply to the cost of performers).

Parties not held on business premises or outside ordinary hours of work

For parties held off-site (such as in a restaurant) or outside regular business hours, the minor benefit exemption might apply.

To be eligible for this exemption, broadly the cost per person (inclusive of GST) must be less than $300, and the benefit should be provided on an irregular and infrequent basis.

Income tax-exempt entities – special considerations

Entities like government departments, universities, and some schools, which are exempt from Income Tax, face more stringent FBT rules for entertainment as the exemptions described above (i.e. exempt property benefit and minor benefits exemptions) are not available. For these organisations, the entire cost of food and drinks will attract FBT unless a particular exclusion applies such as:

- it qualifies as sustenance

- light refreshments that is incidental to the provision of entertainment to outsiders or

- it is provided as part of your hospitality business.

In addition, income tax exempt entities may utilise other concessions such as the 50/50 method to reduce the overall FBT cost.

Restrictions on concessions for tax exempt body entertainment benefits apply only to meal entertainment. Therefore, it becomes more important to determine which benefits should be considered entertainment, and/or what proportions may be subject to reportable fringe benefit rules (i.e. reportable on employee Income Statements).

Christmas gifts

For non-entertainment benefits like gifts or hampers, the ATO has confirmed that these are generally treated as separate non-associated benefits under the minor benefits exemption rule. For example, an employer can provide the following benefits and still remain within the bounds of the minor benefits exemption:

- food and drink at a Christmas Party costing $275 per person and

- a gift hamper costing $100 per person.

This seems to be a special case for Christmas gifts and events, where the minor benefits exemption and its $300 threshold can be applied separately to the gift without also considering the value of associated Christmas events.

This special treatment does not apply to the Christmas parties which could be made up of several distinct benefits in its own right (e.g. dinner and a social event or performance), These distinct benefits could be considered similar or associate benefits, and their combined costs must be considered collectively. If the combined costs are considered significant, then the minor benefits exemption is not likely to apply, Take, for instance, the expenses of a Christmas party. If the cost for food and drinks per person is $300, and the additional entertainment also amounts to $300 per head, the aggregate expense of $600 per person should be evaluated. Given this combined figure, it’s not likely that the minor benefits exemption would apply, as the total cost for these associated benefits is significant.

The minor benefits exemption is a practical way for employers to provide certain benefits without incurring FBT. To maximise this exemption, make sure you carefully plan and document the costs and frequency of these benefits to avoid doubling the cost of an event.

Get in touch with us

For personalised advice on the FBT implications for Christmas parties and gifts please contact your SW advisor.

We can also assist employers saving time and streamlining your FBT return process using our FBT software, CTSplus FBT. For more information on CTSplus FBT, please send us an email.

Contributors

Sharon Lee