2021 Employee Share Scheme Reporting

24/05/2021

The Australian Taxation Office (ATO) has reporting obligations in place affecting those who offer employee share schemes. Find out how our ATO-approved software can simplify your reporting obligations.

ATO reporting obligations

The Australian Taxation Office (ATO) have reporting obligations in place, affecting those who offer shares or share options to their employees. The deadlines to comply with the reporting requirements are:

- ESS statements are due to be issued to employees by 14 July 2021

- ATO reports are due for lodgement with ATO by 14 August 2021.

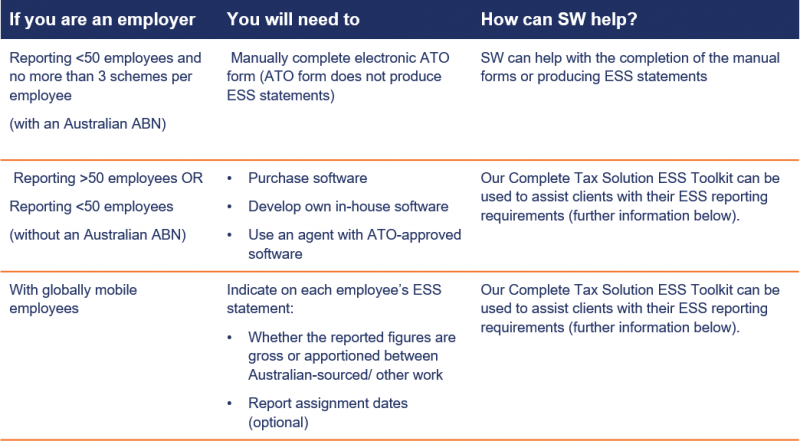

What do the ATO reporting obligations mean for you?

The change to the cessation of employment taxing point announced in the Federal Budget will apply to ESS interests issued on or after 1 July following Royal Assent. Therefore, this change will not impact prior year ESS interests.

Innovation solution

SW has developed compliant software that has been approved by the ATO to enable employers to simplify their online annual employee share scheme reporting obligations.

We have developed the ‘Complete Tax Solutions Employee Share Scheme’ Toolkit (CTS ESS Toolkit) which can help you meet the ATO’s ESS reporting requirements. SW is one of only a handful or providers to have passed ATO testing and we have ATO approval for the software.

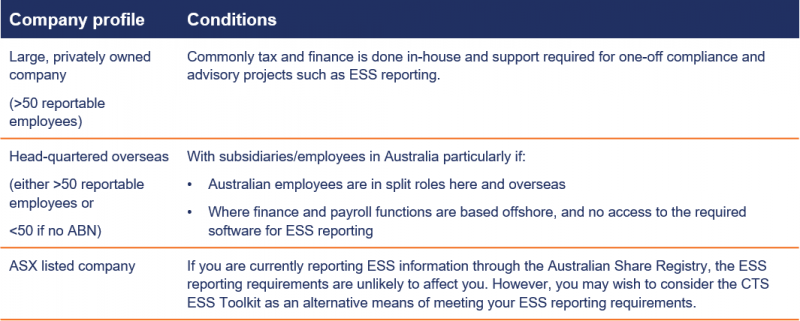

The table below outlines the types of companies that are most likely to benefit from using the CTS ESS Toolkit.

Next steps

Time is limited to make the necessary arrangements to comply with the ESS reporting requirements. The ATO is particularly keen to ensure corporates are compliant and providing timely and accurate reporting.

Now is the time to ensure your business is not left behind and you have everything in place ready for reporting season. We can provide a fully outsourced service or license our software; whichever you prefer.

If you would like to discuss how to comply with the ATO reporting requirements, or learn more about how our ESS Toolkit will help you, please contact either Sam Morris or Justin Batticciotto on the details below.

Get in touch

| Sam Morris |

| Justin Batticciotto |