2023 Employee Share Scheme (ESS) Reporting

22/05/2023

The ATO have upcoming reporting obligations affecting those offering employee share schemes (ESS). Find out how the CTS ESS Toolkit, our ATO-approved software can simplify your reporting obligations.

ATO reporting obligations

The Australian Taxation Office (ATO) have reporting obligations in place, affecting employers who issue shares or share options to their employees. The deadlines to comply with the reporting requirements are:

- ESS statements are due to be issued to employees by 14 July 2023

- ATO reports are due for lodgement with ATO by 14 August 2023.

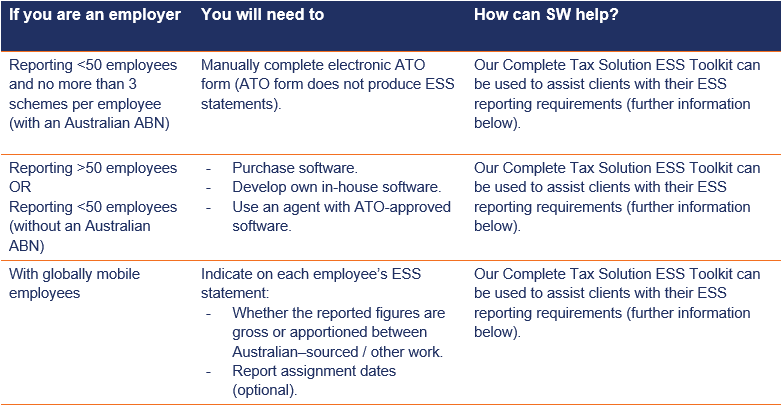

What do the ATO reporting obligations mean for you?

Please note that for all ESS interests (new and existing) that are subject to deferred taxation with the deferred taxing point on or after 1 July 2022, cessation of employment has been removed as a deferred taxing point.

Our innovation solution | CTS ESS Toolkit

SW has developed the ‘Complete Tax Solutions Employee Share Scheme’ Toolkit (CTS ESS Toolkit), an ATO-approved and compliant software which enables employers to simplify their online annual employee share scheme reporting obligations.

Using the CTS ESS Toolkit, SW have been successfully working with businesses to meet their ESS lodgement requirements since electronic reporting began. We are one of only a handful of providers to have passed ATO testing and have ATO approval for our specialised software. CTS ESS Toolkit is designed to help you meet the ATO’s ESS reporting requirements.

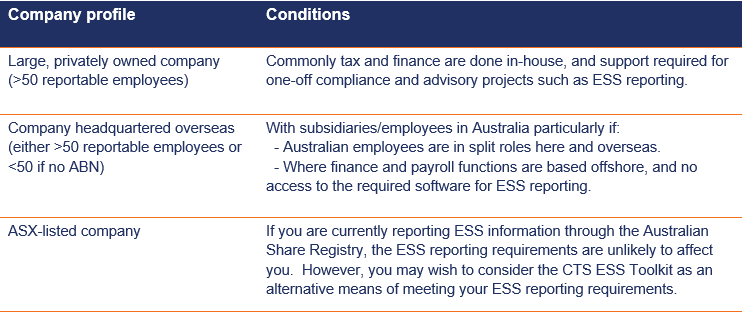

The table below outlines the types of companies that are most likely to benefit from using the CTS ESS Toolkit.

Introduction of ‘New Division’ into Corporations Act 2001 (Cth)

Please note any offer of ESS interests to employees made under any existing share plans or new plans should consider whether offers will comply with the recently introduced Division 1A of the Corporations Act 2001 (Cth). The ‘New Division’ overhauls the existing ESS regulatory framework for unlisted and listed companies and updates the legislative framework for entities seeking disclosure relief.

Next steps

Time is limited to make the necessary arrangements to comply with the ESS reporting requirements. The ATO is particularly keen to ensure corporates are compliant and provide timely and accurate reporting.

Now is the time to ensure your business is not left behind and that everything is ready for reporting season. We can provide a fully outsourced service or license our software; whichever you prefer.

If you would like to discuss how to comply with the ATO reporting requirements or learn more about how our ESS Toolkit will help you, please contact either Sam Morris or Justin Batticciotto on the details below.

Contacts

Justin Batticciotto