ATO issues final risk guideline on Intangibles migration arrangements

13/02/2024

The Practical Compliance Guideline (PCG) 2024/1 (the Guideline) has been released with ATO poised to dedicate resources towards scrutinising cross-border related party intangible arrangements. As a result taxpayers will face increased disclosure and self-evidence requirements.

After a nearly three-year wait[1], the ATO finalised the risk guideline targeting cross-border related party arrangements (collectively referred to as ‘Intangibles migration arrangements’) involving:

- Migration of intangible assets – ‘Migration’ refers to any restructure or change associated with Australian intangible assets that allows another entity to access, hold, use, transfer or benefit from the intangible assets, and

- Mischaracterisation / non-recognition of Australian activities connected with intangible assets – this includes arrangements relating to the Australian development, enhancement, maintenance, protection and exploitation (DEMPE) activities in connection with intangible assets held offshore.

The Guideline addresses concerns with arrangements:

- under which Australia-led intangibles are transferred, licensed to or otherwise held by an international related party

- lacking the requisite substance to perform or control DEMPE activities and/or assume associated risk and

- where value-adding DEMPE activities remain in the hands of Australian taxpayers.

The Guideline applies from 17 January 2024, and will apply to existing and new arrangements.

The Guideline does not reflect the ATO’s interpretation of tax laws, however serves as a cautionary notice that ATO will focus on scrutinising[2] risky arrangements.

The ATO’s compliance approach

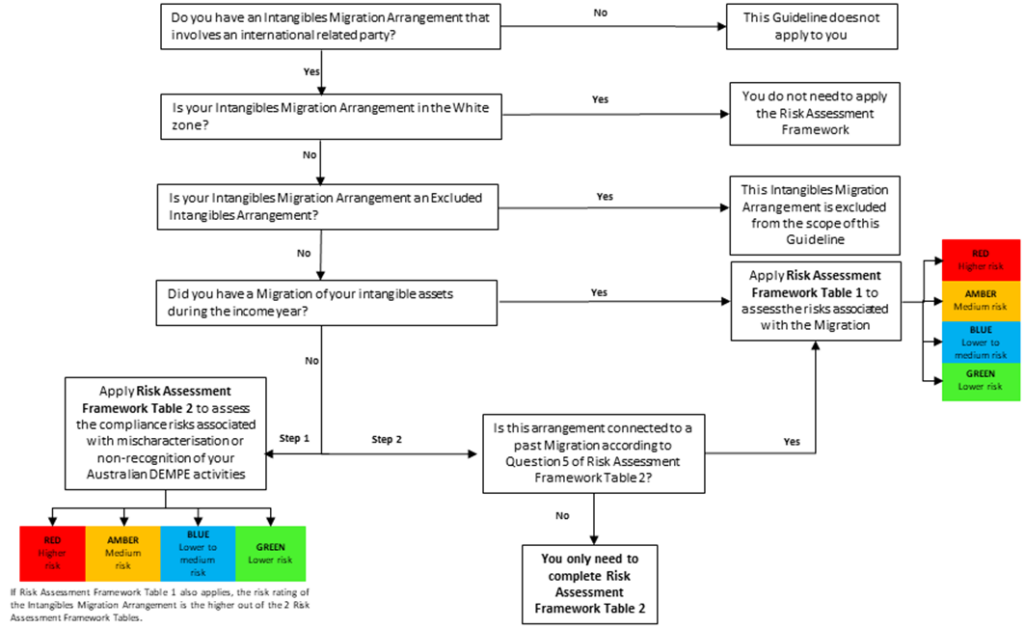

The ATO’s approach to risk assessment is determined by two point-based Risk Assessment Frameworks (RAFs).

RAF Table 1

The below risk factors may trigger risk points for a completed intangible migration during the current year:

- in connection with a restructure or change had associated with intangibles, the Australian entity continues to hold certain economic relationship with the intangibles

- Operational and functional circumstances of the relevant international related party (IRP)o

- tax outcomes of the relevant IRP as well as the Australian entity

- undocumented dealing involving Australian intangible assets / DEMPE activities that are not recognised.

RAF Table 2

RAF Table 2 becomes relevant where there was no intangible migration completed during the current year. It comprises the below risk factors:

- extent of Australia based DEMP activities in connection with intangible assets owned by an IRP

- operational and functional circumstances of the relevant IRP

- tax outcomes of the relevant IRP

- whether the ongoing intangible arrangement is connected to a past migration (if so, RAF Table 1 needs to be assessed on past migration).

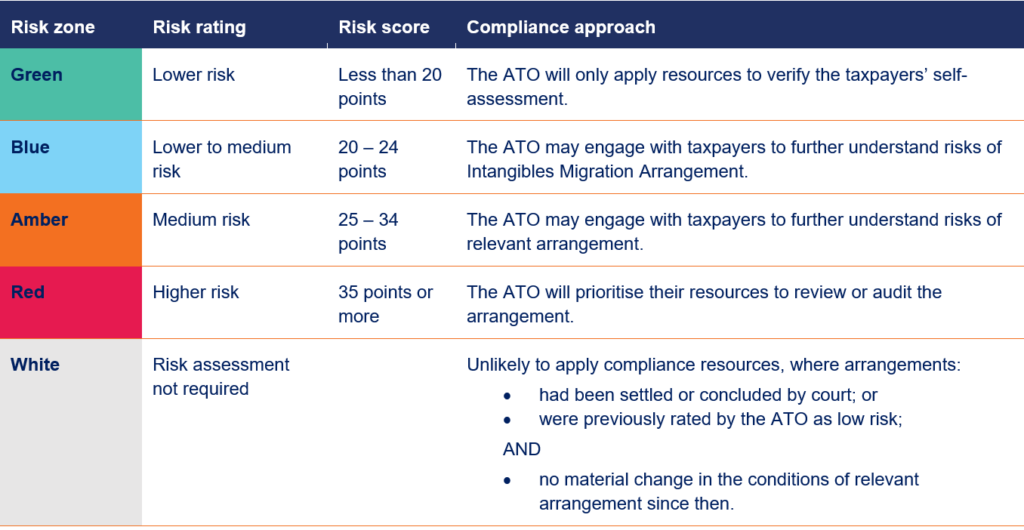

The risk zones / ratings and corresponding compliance approaches are summarised in the table below.

Evidence expectations

Similar to previous drafts, the Guideline continues to place a high bar for evidence and documentation.

The expected evidence focuses on the following aspects:

- evidencing the commercial considerations and business decision-making

- evidencing the legal form and substance of Intangibles migration arrangements

- identifying and evidencing the intangible assets and connected DEMPE activities, and

- evidencing the tax and profit outcomes of Intangibles migration arrangements.

The complexity of taxpayers’ business, the extent to which their Intangibles migration arrangements contribute to that business, and the risk rating of the arrangement will influence the type and level of evidence the ATO expects from them to substantiate the arrangement. However, the Guideline does not serve as substitute for the transfer pricing documentation requirements under Australian tax law.

Examples

Appendix 1 of the Guideline includes 15 examples of Intangibles migration arrangements to illustrate how the RAFs should be applied by taxpayers. Our transfer pricing experts break down and explain these examples here.

Some positive improvements, but still challenging to handle

Compared with PCG 2023/D2, there appears to be some “taxpayer friendly” changes which show that the ATO adopted public feedback during the consultation process. Some positive changes include:

- Introduced ‘Excluded Intangibles Arrangements’ that are not subject to the Guideline – essentially vanilla outbound / inbound distribution arrangement, or low value service arrangement (subject to strict eligibility criteria).

- Expansion of lower end risk zones to White Zone and Blue Zone.

- Reallocation of risk scores – for example, uplifted the point threshold (from 25 to 35) for higher risk zone, and Migration of intangibles, by itself, does not immediately trigger a risk point.

- Providing more scenarios where ‘grouping’ of Intangibles migration arrangements is allowed.

On the other hand, the Guideline remains to place significant challenges and administrative burden on taxpayers:

- The Guideline has very broad application, encompassing scenarios beyond the immediate transfer of assets. This requires a detailed function and risk analysis to demystify how the Australian entity and its relevant IRP interact in connection with DEMPE activities, regardless of the materiality[1] involved.

- The eligibility criteria for ‘Excluded Intangible Arrangements’ appears to be restricted, and the lack of any direct example for ‘Excluded Intangible Arrangements’ in the Guideline does not help provide confidence in application to the public.

- The Guideline scopes out consideration of other tax aspects such as ‘pricing’ of intangible arrangements. In the RAF, one significant risk trigger is ‘tax outcome’ which focuses on the tax treatment or condition of the IRP. However, if the pricing is good enough from an Australian perspective, the overall tax risk to the Australian taxpayer could have been lower than that derived from the Guideline. As such, the risk outcome derived from the RAF, by itself, could be misleading.

- Taxpayers are expected to self-assess their risk based on extensive evidential information, including information possessed by IRPs. Obtaining intangibles related information or cooperation from overseas could be very challenging, due to confidentiality or other concerns.

Key takeaway for taxpayers

The Guideline’s finalisation highlights the ATO’s focus on tax risks connected to intangible arrangements with offshore related parties. It is relevant to a wide range of Australian taxpayers, regardless where the relevant intangibles are held. The asessment of the relevance and associated risk is not a straightforward process. It is important for taxpayers to self-assess early and complete these self-assessments before tax returns for the relevant income year are lodged.

For larger taxpayers that are required to complete Reportable Tax Position (RTP) Schedules in the tax return, a new question on Intangibles migration arrangements will need to be completed. Getting in touch with relevant IRPs early to obtain necessary evidential support is critical for the RTP disclosure.

Regardless of materiality, taxpayers need to ensure sufficient coverage on the arm’s length nature of relevant intangible arrangements is included in its contemporaneous transfer pricing documentation. All the examples detailed in the Guideline have mentioned transfer pricing as a focus area under the ATO’s compliance approach across all risk categories.

How SW can help

Our experts can assist with:

- further clarification regarding the Guideline

- helping you understand more to what extent your arrangements will be subject to the Guideline

- assessing risk level of your arrangements

- ensuring your RTP disclosures are accurate and supportive

- putting in place transfer pricing documentation to provide a further line of defence for your intangible arrangements.

Reach out to your SW advisor for support from our specialist tax team.

Contributors

[1] With initial PCG 2021/D4 released in May 2021, followed by PCG 2023/D2 released in May 2023.

[2] Including the potential application of the general anti-avoidance, transfer pricing, capital gains tax rules etc.