ATO releases exemptions for Australian domestic Pillar Two forms

03/09/2025

The ATO has released draft Legislative Instrument LI 2025/D17, which specifies when certain entities are exempt from lodging domestic Pillar Two forms. However, this exemption does not apply to the Global Information Return (GIR).

The purpose of the instrument is to help multinational enterprise groups reduce compliance costs by removing the need to lodge certain global and domestic minimum tax return, where the Commissioner of Taxation considers it to be unnecessary because they could only ever disclose a nil liability.

Streamline your Pillar Two compliance with SW’s CTS Pillar Two software – designed to simplify lodgement of the GIR and domestic forms when exemptions don’t apply.

For more information on the Pillar Two obligations in Australia during the transition period, see our previous alert.

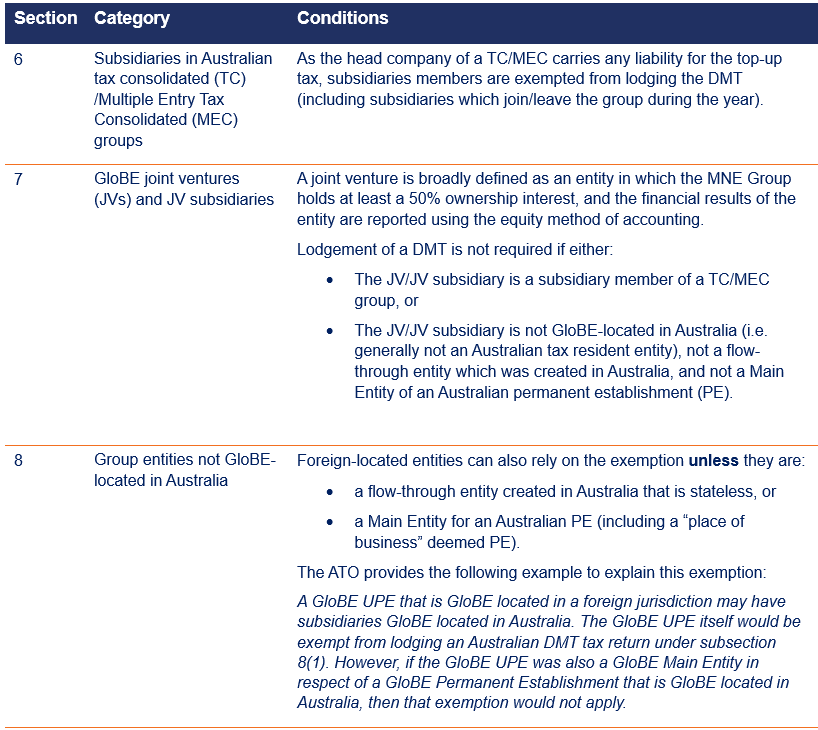

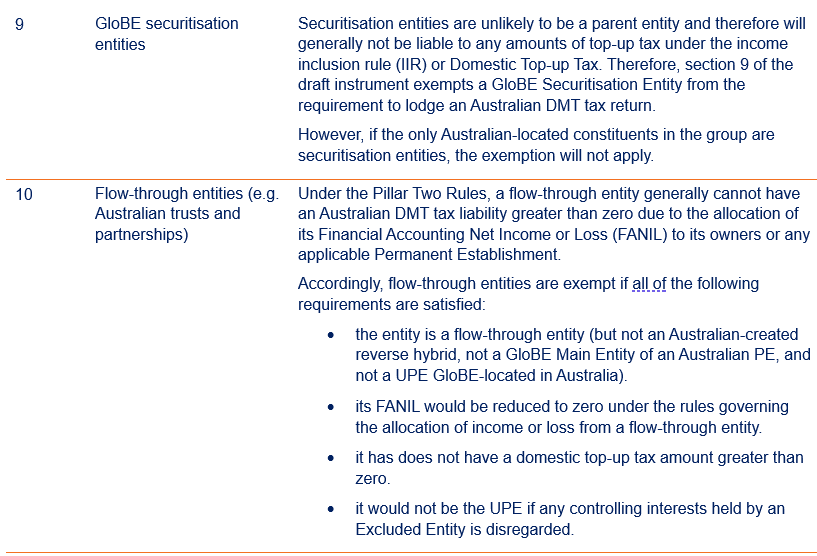

Below are the five main exemption pathways from the requirement to lodge the domestic minimum tax return (DMT).

Exemption to lodge an Australian Income Inclusion Rule (IIR)/ Undertaxed Profits Rule (UTPR) tax return

In addition, the draft instrument grants an exemption from the requirement to lodge the IIR/UTPR tax return, provided all conditions are met:

The Group entity:

- is not an Australian-located Parent Entity

- is an Australian-located Parent Entity of a wholly Australian group or

- is an Australian-located Parent Entity but a higher-tier Parent (intermediate or UPE) is required to apply a QIIR for the year

and any of the following apply:

- the Group entity is a subsidiary member of a TC/MEC group

- the Group entity is not GloBE-located in Australia and not a GloBE Main Entity for an Australian PE

- the Group entity is a GloBE Investment Entity or Insurance Investment Entity

- the Group entity is a GloBE securitisation entity meeting the relevant criteria or

- any of the group-level “switch-off” scenarios apply, i.e. Australia’s UTPR taxing rights would be wholly extinguished because:

- the group’s undertaxed profits are covered by the IIR charging mechanism such that Australia’s UTPR allocation would be zero or

- the Transitional UTPR Safe Harbour applies to the UPE jurisdiction and combined with IIR coverage elsewhere and thus reducing Australia’s UTPR allocation to zero.

For completeness, GloBE JVs and JV subsidiaries are not required to lodge an Australian IIR/UTPR tax return.

How we can advise your on Pillar Two with our CTS software

Navigating Pillar Two compliance can be complex, especially when determining which entities are exempt from lodging domestic forms. Our team can advise on your Pillar Two obligations by mapping your entities against the exemption categories each fiscal year. Where exemptions do not apply, we also support the implementation of SW’s CTS Pillar Two software to simplify and manage the lodgement of the Global Information Return (GIR) and Australian domestic forms.

We can assist in mapping your entities against the exemption categories each fiscal year to determine when lodging the relevant domestic forms is not required.

We can also support the implementation of SW’s CTS Pillar Two software to facilitate the lodgement of the GIR and Australian domestic forms, should the exemptions not apply.

In-person Pillar Two sessions will be held in Melbourne and Sydney on 15 and 23 October 2025 respectively. Reach out to your SW contacts for more information.