Concessions provided to foreign universities to operate in India

27/10/2022

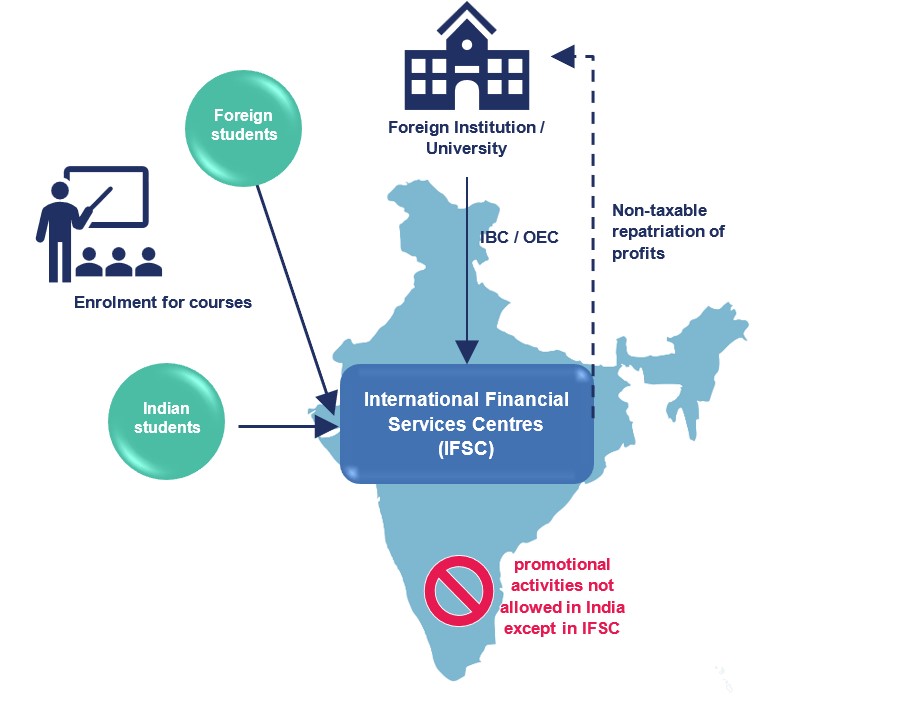

In a recent policy update, the Government of India issued regulations enabling Foreign Educational Institutions to establish an International Branch Campus (IBC) or Offshore Education Centre (OEC) in International Financial Services Centres (IFSC) in the Gujarat International Finance Tec-City (GIFT City) in India.

This much anticipated legislation is welcome news for Australian universities looking to establish a location for teaching, research and industry engagement in India. This provides an opportunity to enter the Indian market in a more tax effective and less heavily regulated environment.

Register SW’s webinar to hear more about the opportunities for foreign universities in the IFSC.

About IFSC Regulations 2022

The regulations came into effect on 11th October 2022 and are applicable to an IBC or OEC operating in the IFSC zone.

Key objectives of the regulations:

- to enable Foreign Universities to establish an IBC either on standalone basis or any other form as may be permitted

- to enable Foreign educational institutions to establish OEC

- to put in place an objective and transparent process for registration of a Foreign University/ Foreign Educational Institution offering courses including research program.

Permissible activities in IFSC

- An IBC or OEC shall not act as representative office of the Foreign University or Foreign Educational Institution for the purposes of undertaking promotional activities for their program in their home jurisdiction or outside the IFSC

- The course or program conducted shall be identical in all respects with the course or program conducted by the Foreign University or Foreign Educational Institution in its home jurisdiction and identical degree, diploma or certificate shall be conferred upon the students of the IBC or OEC directly by the Foreign University or Foreign Educational Institution

- A degree, diploma or certificate issued shall enjoy the same recognition and status as if they were conducted by the Foreign University or Foreign Educational Institution in its home jurisdiction

- Modification in the course curriculum or content shall be carried out with prior approval of academic council, syndicate or any other competent body of the Foreign University or Foreign Educational Institution and the IBC or OEC shall undergo the necessitated changes after intimation to IFSC Authority and shall be effected only after such intimation.

Permissible subject areas are courses, including research programmes, in:

- Financial Management

- FinTech

- Science

- Technology

- Engineering

- Mathematics

Eligibility criteria

- Foreign University within Top 500 in global overall ranking and / or subject ranking in the latest QS World Universities ranking

- A reputed Foreign Educational Institution in its home jurisdiction

- Financial capability to establish and ensure continuity

- Suitable infrastructure and facilities.

Key features of IFSC

About IFSC

- Set up in 2014, the Gujarat International Finance Tec-City (GIFT) is India’s first operational Greenfield Smart City followed by an announcement in 2015, to set up a Financial center in Gift City

- IFSC has been designed to cater to outside the domestic economy and intended to deal with finance, financial products and services across borders

- IFSC Unit is treated as a ‘non-resident’ under Indian exchange control regulations, thus no exchange control regulations shall apply.

Tax incentives

- Tax exemption of 100% for 10 consecutive years out of 15 years with a flexibility to select any 10 years with no need to set up ‘Not for Profit entity’

- MAT rate of 9% for units/companies set up in IFSC (regular MAT is 18%), however MAT paid is available as a credit for carry forward & adjustment upto 15 years and can accordingly be adjusted against future year income tax liability, as will apply after 10 years of tax holiday

- No GST on services received by unit in IFSC or provided to unit in IFSC or Offshore clients

- State subsidies also available on lease rental, electricity charges etc.

Other incentives

- Profit/Surplus repatriation permissible with no restriction from exchange control perspective

- All transactions undertaken by the IBC or OEC shall be in freely convertible foreign currency

How we can help

SW India can help you every step of the way from strategy formulation through to implementation.

If you require further advice regarding the new IFSCA regulations, please reach out to our SW Team – Rahul Sanghani, Stephen O’Flynn, Steve Allan and Sabrina Camilleri.

Webinar │ Concessions provided to foreign universities to operate in India

Join us to hear from Dipesh Shah – Executive Director, IFSCA, Sandip Shah – Head- IFSC Dept and Saurrav Sood – SW India who will discuss the IFSC regulations and highlight the advantages of GIFT City and what it can offer in terms of its world class infrastructure to Australian universities.

Date: Thursday, 24 November 2022

Time: 3.30pm – 4.30pm AEDT (11am – 12pm IST)