JobKeeper extension updated

22/07/2020

UPDATE: Following announcements by the Government on 6 August 2020, some modifications have been proposed to the rules outlined below.

These are designed to support businesses that have been affected by the second wave in Victoria and to retain employees that may not otherwise have been supported by the JobKeeper Extension.

Updated: 7 August 2020

| This article contains updates to our previous release on the extension of JobKeeper Payments. Changes are bolded in each section below. Key changes to the extension rules are as follows:

|

On 21 July 2020, the Government announced a range of changes to the JobKeeper Payment scheme, extending the potential application until 28 March 2021 for certain businesses still experiencing the negative effects of the COVID-19 pandemic.

The key changes in relation to the extension of the JobKeeper payments are:

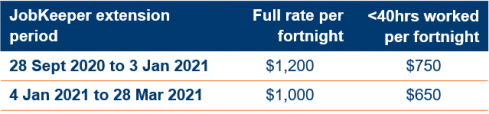

- a reduction in the payment amount per fortnight to a tiered payment ranging from $1,200 per fortnight down to $650 per fortnight, depending on the period and eligibility of the employees

- the introduction of a two tier payment system for each period after 27 September 2020, determined based on the hours worked by each employee in February or June 2020

- further decline in turnover testing to determine ongoing eligibility for the business on a quarterly basis, based solely on actual 2020 GST Turnover. This further testing has been relaxed under the announcements on 6 August 2020. See below.

JobKeeper arrangements as are currently applying for eligible businesses will remain largely unchanged until 27 September 2020.

Effective from 3 August: the employment testing date will be 1 July (previously it was 1 March) meaning that eligible employees on 1 July 2020 will now be eligible for JobKeeper 1.0 payments for the remaining JobKeeper fortnights, as well as similar modifications to the other employment tests including casual employees working on a regular and systematic basis for the 12 months prior to 1 July and employees now aged 18 and over as at 1 July 2020 for the purposes of the casual employee tests.

JobKeeper Extension

The extension of the JobKeeper scheme has been split into two further periods being:

- From 28 September to 3 January 2021 (JobKeeper Fortnights 14-20)

- From 4 January to 28 March 2021 (JobKeeper Fortnights 21-26).

Each period will require re-testing of the decline in turnover for the business to remain eligible, and the amount of the JobKeeper payment for eligible businesses will reduce for each period. This means that where current payments are $1,500 per fortnight per employee, from 28 September that will be reduced to a maximum of $1,200 per fortnight per employee and down to a maximum of $1,000 per fortnight per employee from 4 January.

These payments for the periods after 27 September will be further reduced for employees working less than 20 hours per week on average in February 2020 or June 2020 to $750 and $650 per fortnight per employee for the two extension periods respectively.

The requisite degree of decline in turnover to be tested remains unchanged as follows:

- 50% for businesses with an aggregated turnover of more than $1 billion

- 30% for businesses with an aggregated turnover of $1 billion or less and

- 15% for Australian Charities and Not-for-profits Commission-registered charities (excluding schools and universities).

The JobKeeper extension is now proposed to apply for any eligible employee who was employed on 1 July (rather than the previous 1 March requirement) allowing for any new employees brought on during the first three months of JobKeeper to be supported.

First extension period – 28 September 2020 to 3 January 2021

Decline in turnover

To determine eligibility for the JobKeeper Payment scheme in the first period of the extension, businesses will need to show that their actual GST turnover has dropped below the relevant threshold (as noted above) in only the September quarter 2020 (July, August, September) relative to comparable periods (likely to be the corresponding quarters in 2019).

It would appear that the decline in turnover test will require businesses and not-for-profits to “compare actual turnover in a quarter in 2020 with actual turnover in a quarter in 2019”, rather than relying on projected GST turnover as the previous JobKeeper testing required. There is also no references to testing periods other than quarters, unlike the previous tests that allowed testing based on monthly GST turnover.

As before, a discretion is available to the Commissioner to set out alternative tests in specific circumstances where the new basic test is not appropriate.

It is unclear how this retrospective testing based on actual GST turnover will work for the start of each period where such information may not yet be available in time for the first fortnight, however, as before, the Commissioner will have a discretion to extend the time available to businesses to meet such obligations should it be deemed necessary.

As the deadline for lodging the relevant Business Activity Statement (BAS) for the preceding month or quarter at each testing point will be after the end of the first JobKeeper fortnight for that period, businesses may need to take steps to assess their eligibility prior to completing their BAS.

JobKeeper payments from 28 September 2020 to 3 January 2021

Payments for the first extension period are split into two tiers:

- $1,200 per fortnight – available for all eligible employees working in the business for 20 hours or more a week on average for the 4 weekly pay periods prior to 1 March 2020, and for eligible business participants who were actively engaged for 20 hours or more per week on average in their business in the month of February 2020

- $750 per fortnight for all other eligible employees.

The Commissioner will have the discretion to set out alternative tests where hours of certain employees/business participants were not usual during the testing period, for example where an employee was on leave, or not employed for all or part of February 2020.

Second extension period – 4 January 2021 to 28 March 2021

Decline in turnover

Where previously businesses had to show that their actual GST turnover declined in the both the September and December periods, eligibility for the second extension period will now require businesses to show decline only in the December 2020 quarter relative to comparable periods.

As above, the Commissioner will have a discretion to extend the time available to businesses to meet such obligations should it be deemed necessary.

JobKeeper payments from 4 January 2021 to 28 March 2021

Payments for the second extension period are again split into two tiers with a further reduction in the payment available as follows:

- $1,000 per fortnight – available for all eligible employees working in the business for 20 hours or more a week on average for the 4 weekly pay periods prior to 1 March 2020 or 1 July 2020, and for eligible business participants who were actively engaged for 20 hours or more per week on average in their business in the month of February or June 2020

- $650 per fortnight for all other eligible employees.

What should we be doing now?

Any businesses that are currently eligible for JobKeeper payments should consider undertaking the following in advance of the end of the current JobKeeper arrangement:

- Identify any employees who may have previously been ineligible for Jobkeeper 1.0 or 2.0 due to the 1 March employment requirement, but are now eligible as they were employed as at 1 July 2020

- Review February and/or June payroll data for all potentially eligible employees as their hours worked during this month will determine the level of JobKeeper payment from 28 September 2020; and

- Prepare the process to expediently undertake a similar review once the September (and December) quarters’ actual GST turnover data is available.

Key additional information

In line with the announcement on 21 July 2020, the following reference materials have been made public:

- The Government’s media release announcing these changes

- Treasury Fact Sheet: Extension of the JobKeeper Payment and

- Report of the Treasury JobKeeper Review, June 2020

No amendments have yet been made by the Treasurer to the JobKeeper Rules. The details to give effect to the Government’s announcements will be found in these updated Rules once released.

We also note that the current legislation under which these Rules are published only provide such power to the Treasurer until 31 December 2020. As such, amended legislation will need to pass through Parliament before these changes can be properly implemented which will likely occur during the next sitting on 24 August 2020.

Contact us

|

Jae Debrincat |

Tony Principe |