Transfer Pricing: Singapore Telecom v Commissioner of Taxation

18/01/2022

Another win for the ATO on transfer pricing litigation involving inbound related party financing.

Singapore Telecom Australia Investments Pty Ltd v Commissioner of Taxation [2021] FCA 1597

On 17 December 2021, the Federal Court of Australia (the Court) decided in favour of the ATO against STAI in a transfer pricing dispute involving the pricing of inbound related party financing (the Case). Notably this was another ATO victory, following Chevron(1) four years ago.

The Case reinforces the importance of commerciality surrounding financing transactions with international related parties. The Court tends to weigh heavily not only on the commerciality of the terms of the loan contract but also on the commercial nature of the dealings and interactions between the parties.

Multinational groups (MNEs) with Australian operations should self-assess their existing and proposed intra-group loan arrangements to identify the implications of the Case, amid a series of resurging ATO review programs.

Loan notes

- Original – 28 June 2002

- Amendment – 31 March 2003

- Amendment – 30 March 2009

Interest denial – A$895 million over four years 2010–2013

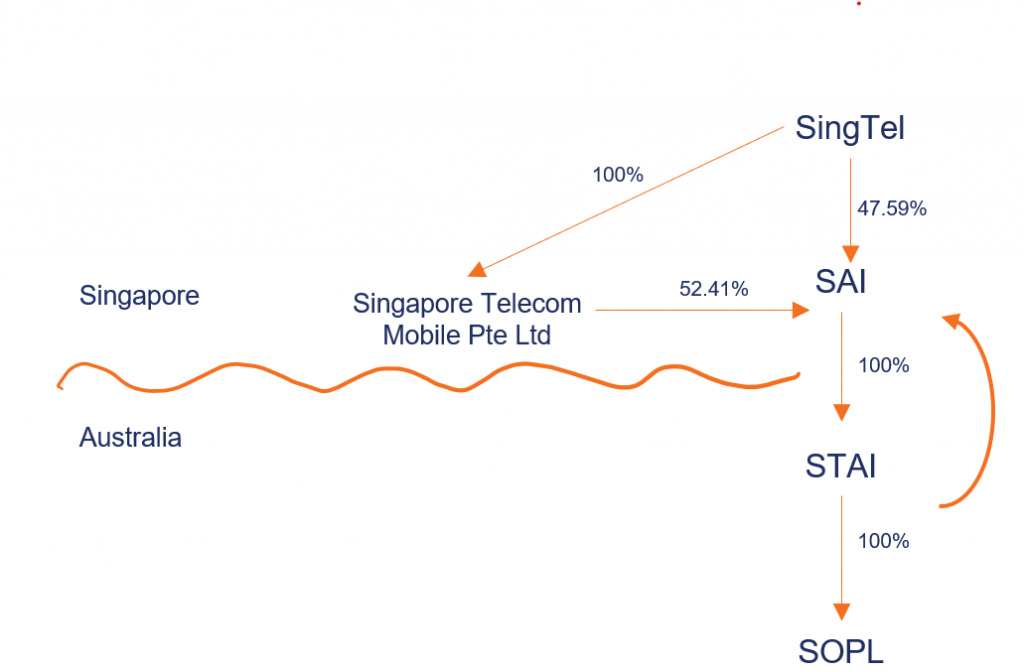

Singapore Telecommunications Ltd (SingTel) is a publicly listed company resident in Singapore, principally engaged in the operation and provision of telecommunications systems and services.

In May 2001, Singtel Australia Investment Ltd (SAI) and Singapore Telecom Australia Investments Pty Ltd (STAI) were incorporated, with residency in Singapore and Australia respectively. In October 2001, SAI acquired 100% of the shares in Cable & Wireless Optus Ltd. The acquired company was then renamed to Singtel Optus Pty Ltd (SOPL). The acquisition was funded by SingTel via debt and equity contributions, which substantially involved external debt raised by SingTel.

In June 2002, under a group restructure, STAI acquired all the shares in SOPL from SAI for approximately A$14.2 billion. This was funded by the issue of A$9 million of shares to SAI, and A$5.2 billion of Loan Notes under a Loan Note Issuance Agreement (LNIA). The terms of the LNIA were amended over time, as follows.

| Timing | Key terms |

|---|---|

| Original LNIA | •Applicable interest rate – (BBSW + 1%) x 10/9 (withholding tax gross-up) •No guarantee provided by SingTel •Payment of accrued interest could be deferred and capitalised •Amounts outstanding were repayable on demand by SAI and could be repaid at any time by STAI Facility maturity date – just under 10 years (term added in December 2002) |

| 2003 Amendment | •Interest accrued to date (A$286 million) was relieved •Interest only commences to accrue / payable after specific profit benchmarks were met by STAI •4.552% was added as a ‘premium’ to compensate for the interest-free period, so the applicable interest rate became (BBSW + 1%) x 10/9 + 4.552% |

| 2009 Amendment | •Floating BBSW converted to a fixed rate at 6.835% •Applicable interest rate therefore increased to 13.2575% |

Key decisions

The Court’s decisions were primarily based on the application of Subdivision 815-A of the Income Tax Assessment Act 1997 (ITAA 1997) in determining whether STAI derived any transfer pricing benefit from the LNIA.

Commerciality

- the interest rate and other conditions under the original LNIA might be expected to have continued through the whole life of the LNIA.

- In the case of the 2003 Amendment:

- both STAI and SAI were exposing themselves to uncertainty risk as to when the profit benchmarks would be met.

- STAI’s argument that this amendment was needed to address SOPL’s cashflow issues was rejected. The original LNIA already permitted STAI to defer and capitalise interest.

- An independent entity in the shoes of SAI would not be expected to agree to the interest accrued to date (A$286 million, which was a substantial sum) to be treated as not having accrued.

- In the case of the 2009 Amendment, the floating rate was generally dropping during the Global Financial Crisis. While there was no expert evidence that 6.835% was an arm’s length substitute for the 1-year BBSW, it did not appear commercially realistic for a fixed rate conversion.

The Court took the view that enterprises dealing wholly independently with one another in STAI and SAI’s circumstances would not have agreed to the conditions per the amended LNIAs (effectively accepting the ‘No Amendment Model’ submitted by the Commissioner):

Comparability

STAI contended that the effective credit spread of the LNIA over its entire life (144 basis points plus a withholding tax gross-up) was lower than the credit spread that might reasonably be expected to have been agreed in an arm’s length debt capital markets (DCM) transaction between independent parties.

However, the Court found this approach:

- departed too far from the actual transaction. The actual transaction involved a vendor and purchaser of shares, and an issue of loan notes as partial consideration for the acquisition of the shares. It did not involve a DCM bond issue.

- involved the calculation (in hindsight) of the effective credit spread of the LNIA, rather than focusing on what independent parties in the positions of SAI and STAI might be expected to have agreed in June 2002, and at the time of each amendment.

Parental guarantee

Critical to the disagreement between the ATO and the taxpayer’s sides regarding the pricing of the debt was the degree of uplift in STAI’s credit quality for SingTel’s implicit support.

The Court found that it was reasonable to expect an independent entity in the position of SAI would require security for the provision of the loan, and the parent company in the position of SingTel would be likely to prefer to provide a guarantee rather than allow its wholly-owned subsidiary to suffer a greater amount in interest expense (which would likely affect the parent’s financial position), having regard to the following:

- there was a material difference between the credit rating of SingTel (AA-/A1) and that of STAI (BBB- to BB / Ba1 to Ba3) at the relevant time (June 2002)

- the very large size of the transaction

- SingTel actually provided a guarantee in relation to Optus Finance Pty Ltd’s $2 billion bank facility.

There was no probative evidence that SingTel charged a fee for guaranteeing the obligations of Optus Finance Pty Ltd under the $2bn facility. Notably, the lack of supporting evidence for the presence of a guarantee fee was also a key controversial area in Chevron.

Impact on Australian MNEs involving inbound related party financing

The Case further evidences the ATO’s tight scrutiny on cross border related party financing, and their commitment to standing up to challenges from the taxpayer in court.

For taxpayers, the Case appears to re-affirm that a ‘narrow’ benchmarking based approach in defending a transfer pricing position may not be adequate, in the absence of probative evidence on commerciality. The ATO were particularly vigilant in this aspect – for example: the ATO took the view that the profit benchmarks applied under the 2003 Amendment appeared to have been reverse-engineered to be met not at the time that STAI became profitable, but at the time it exhausted carried forward tax losses.

While the Case did not consider the application of Subdivision 815-B of ITAA 1997 (‘new’ rules which are already 8 years old), taxpayers may have to face a higher bar for evidencing arm’s length conditions through more rigorous steps for self-assessment, given the explicit ‘reconstruction’ provisions under section 815-130.

Considerations for your business

If your group is involved in cross border related party financing transactions, we suggest that you consider:

- Is there adequate probative evidence that demonstrates the commercial drivers of your transactions, including any amendments to their terms?

- Are the terms and conditions in the agreements common in the market?

- Was the pricing determined based on hindsight, or conditions occurring ‘real-time’?

- Are the comparables sought for self-assessing arm’s length prices true comparables?

- Is your transfer pricing self-assessment in line with the ATO’s documentation standards?

If you feel unsure about these implications, contact one of our SW international tax and transfer pricing specialists below.

Contributors

Stephanie Mulyawan

E [email protected]

(1) Chevron Australia Holdings Pty Ltd v Federal Commissioner of Taxation (2017) 251 FCR 40