Consider the related financial, reputational and compliance risks for your business

On 1 July 2021 wage theft became a crime in Victoria and it is expected that other states will follow.

The Wage Theft Bill 2020 creates new employee entitlement offences, comprising wage theft offences and new record keeping offences. It is designed to capture employers who falsify or fail to keep records for the purposes of concealing wage theft.

The key objective of the Bill is to ensure that employers who withhold employee entitlements dishonestly are held to account and protect vulnerable employees from exploitation.

The new law states that employers who dishonestly withhold wages, superannuation or other employee entitlements could be fined up to $198,264 for individuals, $991,320 for companies and be sentenced to up to 10 years’ jail.

Directors of companies / Council members have a legal responsibility to ensure the company meets its Pay As You Go (PAYG) withholding and Superannuation Guarantee Charge (SGC) obligations. If the company does not meet these obligations, Directors / Council members may become personally liable for a penalty equal to these amounts.

Payroll health check

In light of these new laws and given the number of organisations that have been publicly identified to have underpaid employees we urge all businesses to undertake a payroll health check. The health check will ensure that all entitlements, including superannuation, are accurately determined and paid in compliance with the current ATO requirements to avoid any penalties.

- Underpayments to casual and permanent staff for ordinary pay, overtime and leave loading

- Inconsistencies and incorrect interpretation and payment of payroll entitlements under various Awards

- Underpayment of Superannuation entitlements.

What is the impact?

Financial risks

- Underpayment to employees

- Payroll tax underpayment

- Superannuation underpayment

- WorkCover underpayment

- Annual leave loading underpayment

- Penalties arising from underpayments

Reputation risks

- Staff morale

- Community expectations

- Adverse media attention

- Criminal prosecution

Opportunity

- Self report to avoid potential financial and/or criminal actions

- Meet your social and legal obligations to act in the best interests of your employees

- Be able to potentially claim a corporate tax deduction for the payment of underpaid superannuation

- Receive a reduction of potential penalties that can be up to 200% of the total underpaid superannuation.

Action required – how we can help

- Review current payroll processes to ascertain compliance with the relevant awards, enterprise agreements and identify if there are any underpayments.

- Through the use of data analytics, quantify the underpayment in addition to the superannuation, annual leave, WorkCover and leave loading liabilities within the required timeframes.

- Review historical superannuation guarantee payments to ensure that any shortfalls are rectified.

- Check that payroll codes are correctly categorised as ordinary times earnings and any awards applied correctly to ensure that employers are meeting their payroll obligations going forward to avoid penalties.

- Maintain auditable records for any external review.

- Liaise with legal advisors re ramifications of underpayments on tax and superannuation liabilities and any provisions required.

- Work with you to identify root causes of the issues, implement required process changes and identification of all costs requiring quantification.

- Work with you to disclose any underreporting of payroll costs to the ATO.

Changes to treatment of casualised workforce

Employers are required to review and reassess their contracts for all casual employees.

Following the landmark decision handed down by the High Court of Australia in the Workpac Pty Ltd v Rossato case and statutory changes to the Fair Work Act 2009 (FWA) in March 2021 with retrospective effect, employers are required to review and reassess their casual labour contracts. Particularly where there is regular and systematic work provided and the employee’s contract has a commitment to future work.

Leave entitlements can be a minefield for employers, especially when relating to casual employees. To help you understand the potential risks and obligations, please read our alert and FAQs.

Get in touch

Through the use of sophisticated data analytics and a review of your current awards, enterprise agreements and payroll processes, SW can assist you to manage your organisation’s payroll and superannuation risks efficiently, as well as identifying potential savings opportunities.

We use our customised data analytics tool to review your payroll records to identify any shortfalls or disclosure concerns.

Rest assured that whilst the Government’s social distancing guidelines are in force, we are able to assist you remotely during this period and are able to provide the full benefits of these services.

Reach out to one of our SW experts below to discuss how we can support you.

Contacts

The ruling on the definition of ‘land development’ is of particular relevance to nomination arrangements under a contract of sale of land and to foreign purchasers in Victoria.

In September 2020, draft ruling DA-064 on the meaning of the term ‘land development’ was released for consultation.

The Victorian Commissioner’s view under the draft ruling was quite controversial. It was widely believed by industry that the view expressed in the draft ruling, regarding what was considered to be land development went beyond what was contemplated or intended to be captured by the law.

After consideration of submissions from various stakeholders, amendments were made to the draft ruling and a more balanced final ruling has now been released.

The ruling and the definition of ‘land development’ in a duty context is of particular relevance to:

- foreign purchasers

- purchasers involved in pre-settlement nomination arrangements.

Foreign purchasers

Foreign purchasers may be liable for additional duty if they acquire:

- residential property

- property which is intended to be converted into residential property.

This additional duty impost is commonly referred to as Foreign Purchaser Additional Duty (FPAD). The FPAD rate is 8% over and above the normal duty rate.

Relevantly, the definition of residential property includes land on which a person has undertaken or intends to undertake land development to create residential property.

Nomination arrangements

The definition of land development also has relevance to arrangements involving nominations of land contracts pre-settlement. Where there has been an acquisition of a transfer right between contract/option date and settlement of a transfer, the performance of land development can trigger double duty under the ‘sub-sale’ duty rules. A common scenario that attracts a liability under the sub-sale provisions is where ‘land development’ occurred between the contract date and the nomination date.

What does ‘land development’ mean?

The term ‘land development’ is defined in section 3(1) of the Victorian Duties Act 2000. It has six alternative limbs, the satisfaction of any one of which would mean that a land development activity is involved.

These limbs are:

(a) preparing a plan of subdivision of the land or taking any steps to have a plan registered under the Subdivision Act 1988

(b) applying for or obtaining a permit under the Planning and Environment Act 1987 in relation to the use or development of the land

(c) requesting under the Planning and Environment Act 1987 a planning authority to prepare an amendment to a planning scheme that would affect the land

(d) applying for or obtaining a permit or approval under the Building Act 1993 in relation to the land

(e) doing anything in relation to the land for which a permit or approval referred to in paragraph (d) would be required

(f) developing or changing the land in any other way that would lead to the enhancement of its value.

The purpose of the ruling is to clarify the SRO’s interpretation of each of these six limbs.

What does the SRO regard as land development under the above limbs?

The final ruling indicates the Commissioner will generally consider the following matters in determining whether any of the above limbs are satisfied:

- the facts, circumstances and contexts of each matter

- the tangible and intentional actions associated with developing and changing the use of the land

- the overall effect and consequence of the activities undertaken.

Generally, the Commissioner will only take into consideration activities undertaken directly or indirectly by a party to the contract/agreement and nomination, including activities by related parties, agents, and others who act with the knowledge or consent from any of the parties. This is a change from the draft Ruling.

It is important to note the final ruling provides that it is not necessary to demonstrate that there is an increase in value or change in utility of the land for land development to be considered to have occurred (other than development under limb (f)).

The change provides clarity that an appreciation of value is not necessarily required to be shown when contemplating if an activity carried out under limb (a) – (e) is considered land development. An activity that does not fall within the ambit of limb (a), (b), (c), (d) or (e), may still constitute land development under limb (f) if it enhances the value of the land.

In addition, the draft ruling previously outlined that it is irrelevant who carries out or intends to carry out the process of development. This wording has been removed from the final ruling which now states the Commissioner will only take into consideration activities undertaken directly or indirectly by a party to the contract/agreement and nomination, including activities by related parties, agents, associates or tenants who act with the knowledge or consent from any of the parties.

Evidence of land development

A number of factors are listed in the ruling as being evidence, in the Commissioner’s view, that one of the ‘land development limbs’ referred to above is satisfied. This list (which is not exhaustive) includes items that are relatively obvious, but also includes activities like:

- engaging professional surveyors to undertake surveys and/or prepare reports for the purpose of a plan of subdivision or consolidation (limb (a))

- engaging with a municipal council to request that the council pursue an amendment with the Minister for Planning to rezone land in the planning scheme from farming to residential (limb (c))

- decontamination activities that enhance the value of land (limb (f))

- a rezoning of land may also amount to land development under limb (f) where:

- a Minister rezones land as a result of submissions from any of the parties to the contract (including their associates and persons under their instructions), or

- any of the parties to the contract (including their associates and persons under their instructions) made a submission in support of a proposed rezoning of land.

Limb (a) includes ‘taking any steps to have a plan registered under the Subdivision Act 1988’. The final ruling states that this includes engaging professional surveyors or drafting a plan of subdivision. Therefore ‘land development’ can occur well before any formal steps to register a subdivision take place.

The Ruling states that ‘preliminary research’ and ‘informal surveys’ of a property will not amount to ‘land development’. Nevertheless, many areas of uncertainty remain.

In the draft ruling the following activities were considered land development:

- engagement of an architect or draftsmen to prepare building plans based on the land survey

- the commissioning of feasibility studies to make recommendations on the optimal use and project strategy; and

- professional town planning advice.

This wording has now been removed from the final ruling, however it is unclear whether the Commissioner would still take into consideration such activities when determining whether land development has occurred.

For reference, a full list of the factors outlined in the ruling have been included in the table below.

| Limb of Legislation | Activities that will constitute ‘land development’ under Final Ruling | Activities that will not constitute ‘land development’ under Final Ruling |

|---|---|---|

| (a) Preparing a plan of subdivision of the land or taking any steps to have a plan registered under the Subdivision Act 1988 | Under this limb, initial activities undertaken to prepare a plan of subdivision or measures towards registering a plan of subdivision or consolidation under the Subdivision Act 1988 constitute land development. These activities include:

| Activities that are not considered to be land development under limb (a) include: Preliminary research and analysis on the market and the area in order to identify the general development potential of the property, including:

|

| (b) Applying for or obtaining a permit under the Planning and Environment Act 1987 in relation to the use or development of the land | There are two sub-limbs within limb (b):

The satisfaction of either of the sub-limbs amount to land development under limb (b). There are three types of applications that can be made in relation to permits under the Planning and Environment Act 1987:

An application for a permit, the granting of the permit or granting of the permit with conditions under the Planning and Environment Act 1987 constitute land development within the meaning of limb (b). A Permit to renovate or restore a derelict property would be considered as land development under limb (b). | In relation to amending an existing permit, generally, municipal councils require minor amendments to be made in a Secondary Consent Form. The Commissioner takes the view that such minor amendments do not constitute land development under limb (b).

Asking for an extension of time for an existing permit in itself may not be contemplated in limb (b). However, if the value of the land is enhanced as a result of the time extension, the granting of the time extension may constitute land development under limb (f). Generally, the commissioner will not regard a permit solely for maintenance work (for example, a permit for minor repairs on part of an existing fence) as amounting to land development. Note Example 2A which refers to a contract of sale that is subject to a planning permit being granted, where the contract price includes consideration for the permit. This is stated to be ‘land development’ but not subject to additional sub-sale duty. |

| (c) Requesting under the Planning and Environment Act 1987 a planning authority to prepare an amendment to a planning scheme that would affect the land | A planning scheme which is issued by the Minister has more extensive coverage than a permit referred to in limb (b). A planning scheme may apply to a municipal district, a number of municipal districts and/or any other area(s) that are not in the same municipal district.

There is no formal process set out in the Planning and Environment Act 1987 on how a request is to be made to a planning authority to prepare an amendment to a planning scheme; it is also silent on who can make such a request. The commissioner takes the view that a request for the purpose of limb (c) would generally be in the form of a submission. The following are examples where a submission would constitute a request under limb (c):

| Submissions that do not advocate for amendments to be made to a planning scheme do not constitute land development under limb (c).

In particular, submissions that seek to preserve the status quo or informal discussions about the process for a planning scheme amendment would not be considered as a request under limb (c). Note that the final ruling is narrower than the draft ruling and it is now limited to amendments to the planning scheme made at the initiative or request of the parties to the contract or their agents. It is understood that amendments initiated by other bodies, such as a Council initiated Precinct Structure Plan (PCP) would not be considered ‘land development’. |

| (d) Applying for or obtaining a permit or approval under the Building Act 1993 in relation to the land | There are two sub-limbs within limb (d):

If a building permit or approval is issued after the contract date, land development under limb (d) has occurred even if the application was made prior to the contract date. Under the Building Act 1993, a permit or approval is required to carry out building work except for exempt building work. Building work is defined broadly to mean work for or in connection with the construction, demolition or removal of a building. The application and approval processes for a building permit and an amendment to an existing permit are set out in the Building Act 1993. An application for and the granting of a building permit or approval under the Building Act 1993 constitute land development under limb (d). Amendments to building permits could also constitute land development under limb (f). | Nothing referred to in DA-064. |

| (e) Doing anything in relation to the land for which a permit or approval referred to in paragraph (d) would be required | This limb captures activities undertaken on land which require a permit or approval under the Building Act 1993 and which are done with or without obtaining such permit or approval The Commissioner takes guidance from the Building Act 1993 and its subordinate instruments regarding the type of works that would constitute land development under this limb. | Nothing referred to in DA-064. |

| (f) Developing or changing the land in any other way that would lead to the enhancement of its value | Limbs (a), (b), (c), (d) or (e) of the definition of land development encompass activities typically involved in developing land regardless of whether they lead to an enhancement of its value. Limb (f) Is focused on activities that enhance the value of the land. Even if an activity falls outside the ambit of the other limbs, it may nevertheless constitute land development under limb (f) if it leads to the enhancement of the value of land.

Activities that do not alter the physical characteristics of land may still amount to land development if they lead to an enhancement of the value of the land. These may include a removal of a covenant on title (e.g. removal of a single dwelling covenant) or a removal of land from the Victorian Heritage Register. A rezoning of land may also amount to land development under limb (f) where: 1.A Minister rezones land as a result of submissions from any of the parties to the contract (including their associates and persons under their instructions), or 2.Any parties to the contract (including their associates and persons under their instructions) made a submission in support of a proposed rezoning of land. If there is an activity that leads to an enhancement of the land value, it is irrelevant whether there are any other contemporaneous activities that may have a negative impact on the land. Where necessary, the Commissioner will rely on the opinion of the Valuer-General or another competent valuer to determine if there has been a change in the value of the land and whether that change resulted from the activity or market forces. | Nothing referred to in DA-064. |

How SW can assist

If you believe that you may be effected by the final ruling, have any questions, or even believe that there are circumstances that would warrant a further submission to the SRO, please contact us – either your usual SW contact or any of our experts below.

Get in touch

Carmelin De Francesco

Robert Parker

The NSW Government has now made rent relief assistance available to help minimise the impact of lockdown on NSW businesses with lease agreements.

The relief comes following amendments to the Retail and Other Commercial Leases (COVID-19) Amendment Regulation 2021 (NSW) (‘the Regulation’) earlier this month.

The amendments were passed on 13 August 2021 and provide greater protections to impacted lessees by reinstating National Cabinet’s Commercial Leasing Code of Conduct. The Regulation seeks to ensure that the economic impact of COVID-19 is shared by both property owners and tenants.

Combined with the land tax concessions and the newly established Commercial Landlord Hardship Fund available to property owners, the Regulation seeks to limit the economic damage of COVID-19 and maximise the number of businesses able to resume normal operation when public health orders are lifted.

What do the Regulations provide for?

Under the Regulation, property owners must negotiate rent relief agreements with eligible impacted lessees in accordance with the leasing principles in the National Code of Conduct.

Under those principles, property owners are required to offer tenants rent relief proportionate to the tenant’s decline in turnover. Waivers should make up at least 50 per cent of any rent relief provided (unless the impacted lessee agrees otherwise). Rental deferrals make up the balance.

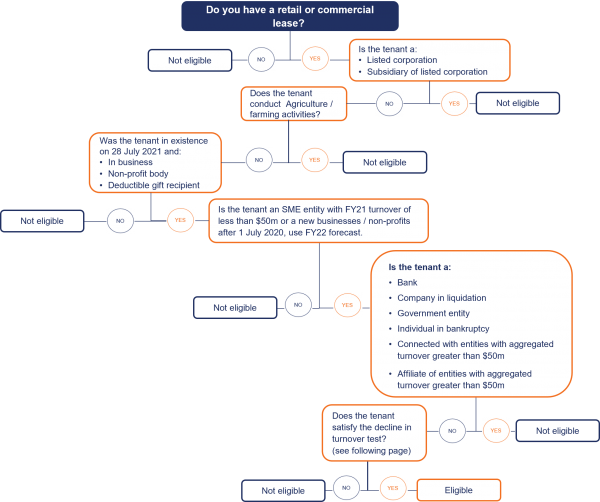

Eligibility

In order to be eligible an ‘impacted lessee’ must:

- first qualify for the 2021 COVID-19 Microbusiness Grant, the 2021 COVID-19 Business Grant or the 2021 JobSaver Payment

- have a turnover of less than $50 million for the 2020/2021 financial year. If the lessee is a member of a group, the turnover of the group is the relevant turnover. If the lessee is a franchisee, the turnover of the business conducted at the premises of the franchisee is the relevant turnover. In all other cases, the turnover of the business conducted by the lessee is the relevant turnover. Turnover includes any turnover of the business and would therefore include amounts earnt from internet sales (notwithstanding the business may ordinarily operate from a shopfront), and

- have entered into their lease before 26 June 2021.

Decline in Turnover Test

The Regulation does not prescribe a specific period that parties should use to calculate decline in turnover. As such, parties are free to determine an appropriate period that works for them.

Impacted lessees should provide evidence of their decline in turnover to their property owner to help them calculate the appropriate rent reduction. Evidence could include a Business Activity Statement (BAS) or an Accountant’s Letter.

If an impacted lessee’s circumstances change, they can make a subsequent request to negotiate future rent adjustments.

For the purposes of calculating an appropriate rent reduction, payments from Government COVID-19 grants should be included as part of an impacted lessee’s turnover.

Process for agreeing rent relief

The period during which the rules apply is 13 July 2021 to 13 January 2022. Impacted lessees in financial distress and their property owners should start the process of negotiating rent relief agreements as soon as possible. Support measures will be reviewed regularly as required due to the changing environment brought about by the pandemic.

For the six-month period (July 2021 – January 2022), commercial and retail property owners cannot take certain actions against an impacted lessee (e.g. evict an impacted lessee, increase rent level) unless they have first renegotiated rent and attempted mediation.

If a lessee is asked to negotiate rent reduction, they must respond within 14 days of receiving the request, or another period if agreed by both parties.

Commercial property owners and impacted lessees must negotiate rent relief agreements by taking into consideration the following principles in National Cabinet’s Code of Conduct on commercial tenancies (unless otherwise agreed by both parties):

- Landlords must not terminate leases for non-payment of rent

- Impacted lessees must remain committed to the terms of their lease, subject to any amendments negotiated, and material failure to do so will forfeit additional COVID-19 protections provided to impacted lessees

- As noted above, landlords must offer impacted lessees proportionate reductions in rent (in the form of deferrals and waivers) of up to 100 per cent of the amount ordinarily payable, in proportion to the decline in the impacted lessee’s trade.

- Rent waivers, as opposed to deferrals, must constitute at least 50 per cent of the rent reduction provided by landlords (in negotiating this, regard must be had to the landlord’s financial ability to provide such a waiver)

- Any rent deferral must be amortised over the balance of the lease term and for a period no less than 24 months, whichever is greater, unless otherwise agreed by the parties

- Landlords must pass any reduction in statutory charges (e.g. land tax, council rates) to the impacted lessee

- Landlords should seek to share any benefit received due to deferral of loan payments by a bank or otherwise with the impacted lessee in a proportionate manner

- Landlords should, where appropriate, seek to waive recovery of any other expense (or outgoing payable) by an impacted lessee under the lease terms during the period the impacted lessee is unable to trade

- Repayment of other (non-rent) expenses should not commence until the earlier of the COVID-19 pandemic ending (as defined by the Australian Government), or the existing lease expiring

- Landlords must not charge fees or interest on rent or fees that are waived or deferred

- Landlords must not draw on a impacted lessee’s security for the non-payment of rent (be this a cash bond, bank guarantee or personal security) unless agreed by the impacted lessee and landlord

- Impacted lessees should be allowed to extend their lease for an equivalent period of any rent waiver/deferral period.

- Landlords must freeze rent increases (except for retail leases based on turnover)

- Landlords may not apply any prohibition or levy any penalties on impacted lessees that reduce operating hours or cease to trade during the COVID-19 pandemic.

Requirements for both parties

Commercial property owners and impacted lessees should work together to negotiate a rent relief agreement. Where parties are unable to do this, they must attend mediation through the Small Business Commission.

Interim arrangements for urgent matters involving a threatened or actual eviction, can be sought through the NSW Civil and Administrative Tribunal or the courts.

For standard matters, the Small Business Commission aims to offer a date within five weeks of application.

For urgent matters, mediation can be arranged within days. The mediator cannot impose any outcome but, if a mediation is successful, parties can enter a binding deed.

Where mediation is unsuccessful, parties can pursue action through the NSW Civil and Administrative Tribunal or the NSW civil courts.

As a result of the Regulation a landlord may not:

- try to regain possession of premises with respect to a relevant lease,

- try to terminate such a lease, or

- exercise or enforce any other right of the landlord with respect to such a lease

unless the Small Business Commissioner has first certified that mediation has failed to resolve the dispute, whilst also enunciating the reasons for the mediation being unsuccessful.

It is important that impacted parties obtain advice from their legal advisers with respect to the matters noted above to ensure their obligations and rights are appropriately dealt with as provided by the Regulation.

Landlord’s assistance/relief

Where landlords have provided rent relief to ‘impacted lessees’, they are entitled to land tax relief of an equivalent amount of their land tax liability for 2021, with the relief limited to the actual land tax liability. The relief will be a rebate for those landlords who have already paid land tax and a waiver for those landlords that have not paid their land tax. Please refer to our previous update on land tax relief for further information.

The New South Wales government is also in the process of establishing a new $40 million Hardship Fund. This Fund will provide a monthly grant of up to $3,000 for qualifying landlords who provide a rent waiver of at least the same value of the Hardship Fund grant, as well as any land tax relief that the landlord is granted.

How SW can assist

Whether you are a commercial landlord or business tenant, our experts are highly experienced in assisting with calculations of decline in turnover, eligibility assessment, the application and negotiation process.

Reach out to one of our tax and property experts below for a conversation about your circumstances.

Get in touch

Tony Principe

Blake Rodgers

The Governor in Council released the Commercial Tenancy Relief Scheme Regulations 2021 on 24 August 2021.

The scheme seeks to provide rent relief to commercial tenants affected by COVID-19 and operates in a similar manner to the Regulations released in March 2020, which expired on 28 March 2021. However, there are key differences including more specific details as to how to calculate the tenant’s decline in turnover and a mandatory reassessment process which will adjust the relief percentage from 31 October 2021.

Outlined below are the key eligibility requirements, the turnover reduction calculation methodology and the processes to be followed.

Eligibility

Decline in Turnover Test

Turnover means Current GST Turnover as defined in the GST Act, with some modifications in Regulation 11.

Decline of at least 15% for ACNC registered charities (with some exclusions); or 30% for all other entities.

Turnover test, periods to compare:

- If a tenant commenced trading before 1 April 2019,

- Any consecutive 3-month period between 1 April 2021 and 30 September 2021; compared to either:

- the equivalent period in 2019; or

- the tenant’s chosen applicable alternative comparison periods (see table on page 4 for alternative options).

- If a tenant commenced trading after 1 April 2019, but before 1 April 2021:

- any consecutive 3-month period between 1 April 2021 and 30 September 2021; compared to

- the tenant’s chosen applicable alternative comparison periods (see table on page 4 for alternative options)

- If tenant commenced trading on or after 1 April 2021,

- the period that is agreed to by negotiation between landlord and tenant; compared to

- the tenant’s chosen applicable alternative comparison periods (see table on page 4 for alternative options)

Process for agreeing rent relief

- Tenant assesses eligibility.

- Tenant requests relief. A request must be in writing and include a statement from the tenant that:

- the tenant is an eligible tenant

- the tenant satisfies the decline in turnover test including:

- Turnover for the test period

- Turnover for the comparison period

- Whether an alternative comparison period used

- Details of the calculation of decline in turnover

- The decline in turnover percentage

- The reduction in rent that would satisfy the minimum requirements of the regulations, consistent with the proportion of decline in turnover percentage provided

- Any other circumstances that the tenant would like to include.

- Within 14 days of making the request, the tenant must provide evidence of the turnover figures used including at least one of the following:

- Accounting record extracts

- Business Activity Statements

- Bank statements

- A statement prepared by a practising accountant.

The evidence must be accompanied by a statutory declaration from the tenant.

If a tenant fails to provide evidence within the required 14 days then the request automatically lapses. Up to 3 requests for relief can be made, i.e. 2 more if the first lapses. If they let 3 requests lapse then the tenant cannot apply again.

- Landlord makes offer within 14 days, unless otherwise agreed, of receiving everything required from the tenant including the request noted in 2. above, supporting evidence and the statutory declaration:

- the offer must be for rent reduction which at a minimum is proportionate to the decline in turnover

- at least 50% of the reduction must be a waiver and the balance can be a deferral.

- Tenant and landlord to negotiate.

- If no agreement is reached within 15 days of the landlord’s offer of rent relief, the tenant is deemed to have accepted the landlord’s offer unless the tenant has referred the matter to the Small Business Commissioner or the landlord’s offer does not comply with the requirements noted in 3) above.

- Agreed position to be documented by lease variation or other agreed approach.

Rent relief period

The period commences on either:

- 28 July 2021

- For complete and successful requests made on or before 30 September 2021

- The date of the request

For complete and successful requests made after 30 September 2021

The period ends 15 January 2022.

Mandatory Reassessment – before 31 October

For agreements reached on or before 30 September 2021, the tenant must provide the following by 31 October 2021 for re-assessment:

- Turnover for the quarter ended 30 September 2021.

- Turnover for the comparison period being:

- If the tenant began trading before 1 July 2019, the quarter ended 30 September 2019; or

- If the tenant began trading between 1 July 2019 and 31 March 2021, the quarter ended 30 June 2021; or

- An alternative test period (should be same as used for first request), including details of the comparison method.

- The percentage change in the above two periods

- Another statutory declaration.

The net percentage change is then used for the purposes of calculating rent relief from 31 October 2021.

If the tenant fails to provide the necessary information by 31 October, the rent relief agreement no longer applies to the extent that it relates to any waiver of rent from the assessment date. That means only the deferred portion of any rent relief will continue after 31 October.

Subsequent relief

Tenants can apply for further relief if their financial circumstances materially change, following the process described above under “Process for agreeing rent relief” subheading.

Any new rent relief agreement will apply in substitution of the original agreement.

Extension of term

The landlord must offer an extension on the same terms as were in place on 28 July equivalent to the period for which rent is deferred. E.g. if 3 months rent is deferred, 3 months must be added to the term of the lease.

Deferred rent

The landlord cannot request payment until after 15 January 2022.

Deferred amount is to be paid over the greater of the remaining term of the lease, including any extension, and 24 months.

Previous deferrals

Any leases subject to rent deferrals under the previous (2020) rent relief scheme, must have the repayment of those deferrals paused and resumed after 15 January 2022.

Dispute resolution

Either party can refer a dispute to the Small Business Commissioner for mediation.

Further powers are provided to the Small Business Commissioner to make a binding order in certain circumstances.

Application can be made to VCAT for review of a binding order in certain circumstances.

Alternative comparison periods

| Test | Comparison period |

|---|---|

| Began trading after 1 April 2019 | – If commenced trading between 1 April 2019 and 31 March 2020, the sum of each whole month turnover before 1 April 2020, divided by the number of whole months, multiplied by 3 – If commenced trading between 1 April 2020 and 31 March 2021, the sum of each whole month turnover before 31 July 2021, divided by the number of whole months, multiplied by 3 – If commenced trading after 1 April 2021, the total turnover to 31 July 2021, divided by the number of days trading, multiplied by 92 |

| Business acquisition or disposal affecting comparison turnover | Turnover for first full whole month after the acquisition or disposal multiplied by 3 |

| Business restructure affecting comparison turnover | Turnover for first full whole month after the restructure multiplied by 3 |

| Substantial increase in turnover by: – 50% or more in the 12 months before, or – 25% or more in the 6 months before, or – 12.5% or more in the 3 months before the (2021 COVID) turnover test period | Turnover for the 3 months immediately before the (2021 COVID) turnover test period |

| Business affected by drought or natural disaster | Turnover for the same period in the year immediately before the declaration of drought or natural disaster |

| Business has irregular turnover. Applies if business is not cyclical and in the 12 months before the turnover test period, the lowest consecutive 3 months turnover is no more than 50% of the highest consecutive 3 months turnover | Use the average monthly turnover in the 12 months before the turnover test period multiplied by 3 |

| Sole trader or small partnership with sickness, injury or leave | Turnover from the month immediately before the month of illness multiplied by 3 |

| Tenant temporarily ceased trading for 1 week or more during comparison period | – Turnover for 3 months immediately before the month in which the business ceased trading, or – Turnover for the same period but in the year before the business ceased trading |

How SW can assist

Our teams can assist commercial landlords and tenants to calculate the decline in turnover, assessing eligibility, the application and negotiation process.

Reach out to one of our experts below for a conversation about your circumstances.

Blake Rodgers

The NSW Government land tax relief is now available to commercial and residential landowners who provide a reduction in rent to tenants experiencing financial distress due to COVID-19.

Following a similar scheme provided in 2020, the current program provides a reduction in land tax payable for the 2021 land tax year for eligible landowners providing rent relief to tenants between 1 July 2021 and 31 December 2021. Applications will be open until 31 January 2022.

Residential landlords have the option of choosing between the land tax relief or the Residential Tenancy Support Payment of up to $1,500 per tenancy agreement if they agree to reduce rent for COVID-19 impacted tenants from 14 July 2021 to 31 December 2021. If the residential landlord has claimed the Residential Tenancy Support Payment they will be ineligible for land tax relief.

How is land tax relief calculated and provided?

- The land tax reduction will be the lesser of:

- The amount of rent reduction provided to an eligible tenant for any period between 1 July 2021 and 31 December 2021, or

- 100% of the 2021 land tax attributable[1] to the parcel of land leased to that tenant.

- If eligible, the land tax relief will be available in the form of:

- A refund if 2021 land tax has already been paid in full, or

- An offset for the amount of land tax payable if the payment has not been completed.

Landlord eligibility requirements

- Must be leasing a parcel of land to:Must have reduced the rent of the affected tenant for any period between 1 July 2021 and 31 December 2021.

- A commercial tenant who has an annual turnover of up to $50 million and is eligible for the Micro-business COVID-19 Support Grant, the 2021 NSW Business Grant and/or the JobSaver scheme, or

- A residential tenant who has had a reduction in household income of 25% or more due to COVID-19.

- Must have provided the rent reduction without any requirement for it to be paid back at a later date.

- Must have land tax attributable to the parcel of land leased to that tenant for 2021.

Key evidence required

For all landlords

- Details of all eligible tenants, including ABN/ACN for commercial tenants.

- Confirmation of total rent reduced or waived for the 1 July 2021 to 31 December 2021 period. Examples include:

- Copies of tenancy agreements proving rental reduction

- Rental ledgers

- A letter from an accountant or property manager

- Tenant’s financial statements

For commercial tenants

- Documentation demonstrating an annual turnover of less than $50 million in the 2021 financial year in the form of a letter from an accountant, tax return, business activity statement, or other financial statements.

- Evidence of the tenants’ eligibility to be approved for the Micro-business COVID-19 Support Grant, 2021 COVID-19 NSW Business Grant, and/or the JobSaver scheme.

For residential tenants

- Documentation demonstrating a 25% reduction in household income in the form of

- a statement from the tenants explaining how they have been impacted by COVID-19

- copies of written communication with the tenants

- a letter from an employer or accountant, bank statements, payslips, or other financial statements.

How we can help

Our teams can assist both commercial and residential landlords of all sizes to review evidence documentation, financials, and provide accountant letters to ensure your application is successful. Reach out to one of our experts for a conversation about your circumstances.

Get in touch

Tony Principe

Blake Rodgers

Dilushi Wijesinghe

[1] Land tax attributable is the taxable value of the parcel of land divided by the aggregated taxable value of all parcels of land, multiplied by the landowner’s 2021 land tax liability.

Employers are required to review and reassess their contracts for casual employees before 27 September 2021.

Review required for casual labour contracts

It is a common misconception that casual employees are not entitled to any personal, annual and long service leave based on the premise that they receive a loading on hourly rates as compensation.

Following the landmark decision handed down by the High Court of Australia in the Workpac Pty Ltd v Rossato case and statutory changes to the Fair Work Act 2009 (FWA) in March 2021 with retrospective effect, employers are required to review and reassess their casual labour contracts. Particularly where there is regular and systematic work provided and the employee’s contract has a commitment to future work.

Leave entitlements can be a minefield for employers, especially when relating to casual employees. To help you understand the potential risks and obligations, we have set out below the current position for annual leave and long service leave.

When is a casual employee entitled to annual leave?

An employee’s entitlement to annual leave is prescribed in the National Employment Standards (NES) within the FWA. In general terms, a casual employee is not entitled to annual leave and generally other types of leave, i.e. personal leave etc. On 27 March 2021, the FWA was amended to include the definition of casual employment. The amendments have retrospective effect and provide a 6 month transition period.

A casual employee is defined as someone who has accepted a job offer from an employer knowing that there is no firm advance commitment to ongoing work with an agreed pattern of work.

A casual employee will be classified as permanent where there is a ‘casual conversion’. This will apply where the employee has completed 12 months of service. There is an exemption for small business where they employee less than 15 employees at a particular time.

Who is entitled to long service leave?

Long service leave in Australia is covered under Australian State legislation. In most instances, an employee will be covered by the Long Service Leave Act (LSL) in the applicable State where they work, although various industry sectors have separate Acts, e.g. construction and cleaning industries.

All State LSL Acts provide that full time, part time, casual, seasonal and fixed term employees are entitled to long service leave. The entitlement is subject to an important provision that their employment is ‘continuous’, i.e. no breaks in service. The contentious issue for casual employees is whether their services meets the definition of continuous employment. This definition varies between the LSL Acts although all contain the same principles with differing periods of time.

Continuous means there must not be an absence of more than 12 weeks (except for NSW, SA, WA and NT limited to 2 months) between any two instances of employment, unless:

- the employee and the employer agree before the start of the absence

- the absence is in accordance with the terms of the engagement

- the absence is caused by seasonal factors

- the employee has been employed on a regular and systematic basis and has a reasonable expectation of being re-engaged.

The key issue for employers to address is whether their current contractual arrangements with their casual staff provide for regular, certain, continuing, constant and predictable work.

By comparison, casual employment that would not be continuous is one where the work allocated to the employee is unpredictable, irregular, intermittent and not pre-allocated.

What should employers do?

- Conduct regular reviews of existing casuals to determine whether they have continuous employment and are entitled to long service leave. Remove casuals from employment lists when they are no longer needed (offboarding) and document this in writing

- Review onboarding processes to firm up the casual employment arrangement including documenting in the written employment contracts. For example, avoid where practicable any commitment to future work, provide the choice to refuse work, the ability for changes or fluctuation in the days and hours of work and termination at short or on no notice

- Ensure payroll software systems accurately calculate and record the accrual, what long service leave has been taken by employees and the amount they have been paid during the leave period

- Ensure the financial reports reflect long service leave liabilities for long-standing casual employees. Consider including payment of future provisions in cashflow forecasts

- Upon termination of a casual employee, ensure the full amount of the long service leave entitlement is paid out on the final day of employment

Record keeping

Employers must keep accurate records during the entire period of employment, retain these for at least seven years after the employment ceases and must be kept in the form prescribed by the regulations made under the applicable LSL Acts.

An employer must not refuse a request from an employee to provide their Long Service Leave record and criminal penalties may apply.

Calculation of entitlement

Casual and seasonal employees accrue long service leave in the same way as part-time and full-time employees.

An employee is entitled to be paid their long service leave based on their ‘ordinary pay’, ie: actual pay received for working his or her normal weekly hours and ordinary time rate of pay at the time the leave is taken or is to be paid out on termination.

The long service leave entitlement for casuals who do not have normal weekly hours, is calculated by averaging the hours of work.

If the casual does not have an ‘ordinary rate’, perhaps due to piece work rates, then averaging requirements will also apply. The calculation of rates vary between the States. For example, in Victoria the rate will be the greatest of the average earned over either the last 52 weeks, 260 weeks or entire period of employment.

|

What action is required before 27 September 2021? Employers (except small business) are required to review their current contractual arrangements with casual employees and:

How can SW assist?

|

Get in touch

Reach out to one of our payroll experts below for guidance on how you can navigate these changes.

Contacts

Janelle McPhee

SW summarises the key changes to investor visas and notes important advice from ASIC regarding who is legally allowed to provide financial investment advice in Australia.

Recognising that the growth of the Business Innovation and Investment Program (BIIP) is continuing to support Australia’s post-COVID-19 recovery through the investments and other economic contributions of visa applicants, the Federal Government has exempted all visas in the BIIP class with regard to travel restrictions to Australia. Additionally, late in 2020 the Department of Home Affairs announced that it would fast track Significant Investor Visa (SIV) and Investor Visa (IV) applications.

In 2020, a review of the BIIP program visa classes saw a reduction in the number of visa streams from nine to four, which included the cancellation of the Premium Investor, Significant Business History and Venture Capital Entrepreneur visas. It is expected that these changes will lead to an increased interest in the refurbished 188 SIV and IVs.

Overall, the changes are seen as being positive, with the attractive features and flexibility of BIIP continuing to prove popular to applicants.

What has changed for SIV and IV classes?

Minister for Immigration, Citizenship, Migrant Services and Multicultural Affairs, Alex Hawke, announced in May that the “Increased investment thresholds and the adjustment of investment ratios to focus more on venture capital and private growth equity will better support innovation and emerging enterprises in Australia”.

From 1 July 2021 the following CIF ratios will apply to both the Investor and the Significant Investor Visa streams:

- 20 per cent venture capital and Private Growth Equity funds (VCPE)

- 30 per cent funds investing in emerging companies

- 50 per cent in balancing investments

- Improvements to the Complying Investment Framework will include:

- A clearer definition of Fund of Fund (FoF)

- Applicants will be given 6 months to enter into their VCPE agreement, in lieu of the previously allowed 12 months.

- A tightening of Emerging companies rules to close previous loopholes.

- Fund managers will need to complete an annual audit for all of the funds they manage. The managers we work with are all committed to these changes including the annual audits.

A summary of these changes implemented from 1 July 2021 can be accessed here.

How we can help

For SIV and IV applications made between 1 July 2015 and 1 July 2021, the old rules will remain in place and the SW advisory team continues to provide advice and assist applicants and visa holders to manage and implement SIV and IV portfolios.

If you are considering applying under the post 1 July 2021 rules, our team can provide complete advice and assistance for:

- Visa applications

- Complying investments

- Financial review and wealth considerations

- Investment advice

- Relocation and concierge services

- Tax and accounting structure and services

Important note regarding Significant Investor Visa – Advice from ASIC

It has been found that some SIV applicants have been victims of serious financial fraud in Australia. Australia’s corporate regulator ASIC (the Australian Securities and Investments Commission) has expressed growing concern to the Department of Home Affairs (DHA) about investment referrals to particular managed fund products when visa applicants are being provided with immigration assistance.

Where a registered migration agent (RMA) or Australian legal practitioner refers a SIV applicant to a managed fund product, the referral might involve the RMA or Australian legal practitioner providing financial product advice under the Act.

With a message originating from the Immigration Integrity and Assurance Branch of the Department of Home Affairs, the Office of Migration Agents Registration Authority (OMARA) emailed all RMAs on 23 July to reiterate who can, and cannot, provide financial advice to Managed Fund Products under Australian law.

It stipulates that a person cannot provide financial advice in Australia unless the person holds an Australian Financial Services License (AFSL).

ASIC recommends that you encourage SIV applicants to seek independent financial advice and, as far as possible, that you refer SIV applicants only to fund managers with robust risk and governance frameworks.

The BIIP is a world class program, competing with other investment visa programs around the world to attract highly sought after investment capital. This reminder from OMARA and ASIC seeks to help to protect investors and enhance the integrity of the BIIP and assist visa applicants to obtain better quality investment advice that will lead to better investment outcomes.

How we can help

SW Wealth holds an authorised AFSL registration with ASIC and can assist with investment opportunities and advice. We can be found on the Financial Advisors Register, published by ASIC, here on the MoneySmart website. SW is an Australian owned accounting and advisory firm with an 85+ year history and provides a full range of wealth management and business advisory services, tax, assurance and corporate finance.

Financial Planning and Debt Advisory services are provided by Authorised Representatives of ShineWing Australia Wealth Pty Ltd AFSL/ACL 236556 Registered Migration Agent MARN 1790838Contacts

Do you have assets controlled by you, but not in held in your name? You should consider estate planning, as you need more than a Will to ensure any transfer upon your death is managed in a tax effective way.

Over your lifetime you will likely build up a range of assets and wealth. Upon your death, these will need to be distributed in accordance with your through an estate plan.

What is estate planning?

Estate planning is not just about having a Will, it’s about ensuring that the assets you control are transferred to your intended beneficiaries, in a tax effective manner.

Your Will only looks after assets in your personal name. Your estate plan considers assets that are in entities controlled by you, such as through companies and trusts and importantly, your superannuation.

As accountants and business advisors, we are in a unique position to understand where all your assets are held and who ultimately controls those entities. It is also important to understand how debts and liabilities are to be dealt with as some debts may be paid off, while others may transfer to your beneficiaries.

What should business owners’ consider?

For businesses owners’, part of your estate planning should ensure that you have a Buy/Sell Agreement in place with the other shareholders in the business and Buy/Sell insurance. This is important because some beneficiaries will not want to be involved in the business and wish to cash out of the investment as soon as practicable. Without this in place, the business may need to be sold to pay the estate.

Additionally, surviving shareholders will have an increased percentage shareholding and a Buy/Sell Agreement will ensure an unplanned shareholder will not be involved in the running of the business.

A practical and beneficial estate plan is a collaboration between you, your accountant, and your solicitor.

How can SW help?

SW is co-hosting a three-part webinar series on Estate Planning and Power of Attorneys with Burke & Associates Lawyers. Join us to learn more about how estate planning can assist you.

Contacts

Heather Dyke

Keegan O’Rourke

Following the Disaster Payment Support announced by the NSW Government, the Federal Government and NSW Government have recently announced a further combined COVID-19 Support Package for businesses and individuals impacted by the current COVID-19 lockdown. This update will primarily focus on the support available to small and medium businesses to date.

Updated on 30 July 2021

COVID-19 business grant (refer to detailed criteria below)

- Tax exempt grants between $7,500 and $15,000 are available to eligible businesses with annual wages up to $10 million, to cover the first three-weeks of restrictions

- Three different grant amounts will be available depending on the decline in turnover experienced during restrictions:

- $7,500 for a decline of 30% or more

- $10,500 for a decline of 50% or more

- $15,000 for a decline of 70% or more.

Micro business grant (refer to detailed criteria below)

- Grants up to $1,500 per fortnight of restrictions will be available under a new grants program for micro businesses with annual turnover between $30,000 and $75,000 which experience a decline in turnover of 30% or more.

JobSaver (refer to detailed criteria below)

- From week four of lockdown, the Federal Government will help fund the cost of a new business support payment for entities with annual turnover between $75,000 and $250 million (up from $50 million) who can demonstrate that their turnover is 30% lower than an equivalent two-week period in 2019

- Eligible businesses, including not-for-profits, will receive payments equivalent to 40% of their ‘weekly payroll’[1] for work performed in New South Wales:

- The minimum payment will be $1,500 per week, and

- The maximum payment will be $100,000 per week (up from $10,000).

- Eligible non-employing businesses (e.g. sole traders) will receive a set payment of $1,000 per week

- To receive the payment, eligible entities will be required to maintain their full time, part time and long-term casual staffing levels as of 13 July 2021

- This payment made to eligible businesses will be tax exempt.

Other Measures

- Businesses will also benefit from payroll tax waivers of 25% for businesses with Australian wages of between $1.2 million and $10 million that have experienced a 30% decline in turnover

- Land tax relief equal to the value of rent reductions provided by commercial, retail and residential landlords, up to 100 per cent of the 2021 land tax year liability

- No recovery of security bonds, or lockouts or evictions of impacted retail and commercial tenants prior to mediation.

Detailed Criteria

Applications open from 19 July 2021 to 13 September 2021

| Basic criteria | Alternative circumstances | Other requirements (evidence in support of eligibility) |

|---|---|---|

|

|

|

NSW COVID-19 micro-business grant

Applications open from 26 July 2021 to 18 October 2021

| Basic criteria | Alternative circumstances | Other requirements (evidence in support of eligiblity) |

|---|---|---|

|

|

|

Applications open from 26 July 2021 to 18 October 2021

| Basic criteria | Alternative circumstances | Other requirements (evidence in support of eligibility) |

|---|---|---|

|

|

|

How we can help

Many businesses have found the eligibility criteria difficult to navigate, particularly for newer businesses without 2019 records.

Our experts can guide you through the process and help you gather accepted relevant documentation to ensure your business gains the maximum benefits from these support measures.

Tony Principe

Jae Debrincat

Dilushi Wijesinghe

[1] ‘Weekly payroll’ can be determined by referring to Item W1 in the most recent Business Activity Statement (‘BAS’) provided to the Australian Taxation Office prior to 28 June 2021 for the 2020-21 financial year.

[2] For businesses grouped by Revenue NSW, ‘total annual Australian wages’ should be calculated using the rules set out by Revenue NSW. Businesses not grouped should apply the ownership grouping provisions under the Payroll Tax Act 2007.[1] ‘Weekly payroll’ can be determined by referring to Item W1 in the most recent Business Activity Statement (‘BAS’) provided to the Australian Taxation Office prior to 28 June 2021 for the 2020-21 financial year.

[3] The Australian Taxation Office income assessment concept of ‘aggregated annual turnover’ will be applied.

[4] The Australian Taxation Office Goods and Services Tax (‘GST’) concept of ‘decline in turnover’ will be applied.

[7] If the associated person has more than one non-employing business, payments can only be claimed for one business.

[8] https://www.service.nsw.gov.au/jobsaver-payment-guidelines#attachment-b-ineligible-businesses