The ATO have issued draft tax determination TD 2026/D1, providing their view on what it means for an individual to have the ‘right to occupy the dwelling’ under the deceased’s will.

What the draft determination covers

Draft taxation determination (TD 2026/D1) outlines the Australian Tax Office’s (ATO’s) view on the meaning of right to occupy the dwelling under the deceased’s will, as set out in item 2(b) of Column 3 of Subsection 118-195(1) of the ITAA 1997.

The determination considers the right to occupy a dwelling which can have an impact on whether the capital gain or loss can be disregarded under the ‘main residence’ rules.

The right to occupy must be granted under the terms of the deceased will to an individual named in the Will or as a result of a court order.

When the main residence exemption may not apply

The CGT impact of the sale of the dwelling may not be disregarded if the right to occupy occurs through one of the following ways. Careful consideration needs to be given to the rules and examples outlined in the TD.

This includes situations where:

- right to occupy under a separate agreement

- right to occupy using broad trustee discretion

- right to occupy and testamentary trusts. The determination has raised issues that need to be carefully considered for testamentary trusts that affect life and remainder interests.

How SW can help

These rules can be complex, particularly where a right to occupy is intended but the conditions are not met. In those situations, there is a real risk of capital gains tax consequences on the sale of the deceased person’s main residence because the main residence exemption may not apply.

We regularly assist lawyers, administrators and executors of deceased estates to ensure that the estates tax obligations are met. Our Deceased Estate Consulting specialists, Heather Dyke and Taylah Cooke, also review the Estates income tax obligations under subsection 118-195 of ITAA 1997.

Contributors

Heather Dyke – Deceased Estate Consulting

Taylah Cooke – Deceased Estate Consulting

The Queensland Government has announced sweeping changes to its foreign tax regime as part of the 2025–26 Mid-Year Fiscal and Economic Review (MYFER). These reforms aim to reduce barriers for Australian-based developers and encourage foreign investment into Queensland’s property sector.

Queensland introduced the Additional Foreign Acquirer Duty (AFAD) in 2016 and the Foreign Land Tax Surcharge (FLTS) in 2019 to curb speculative foreign acquisitions. While these measures were designed to protect local buyers, they inadvertently captured Australian developers using international funding, creating a prohibitive tax environment that delayed projects and discouraged investment.

Since 2016, twelve new or increased property taxes have been introduced, impacting Queensland’s competitiveness. The latest reforms aim to address these issues by reducing compliance barriers, clarifying eligibility criteria, and introducing faster approval processes, signalling a shift towards a more investment-friendly framework.

Key changes announced

Dwelling threshold reduced

One of the most significant changes is the reduction of the dwelling threshold for relief eligibility from 50 dwellings to 20 dwellings. Previously, only large-scale residential projects could access AFAD and FLTS relief, leaving mid-sized developments exposed to additional costs.

By lowering the threshold, the government has opened the door for smaller projects, such as townhouse complexes and boutique apartment developments, to qualify for relief. This change is expected to stimulate housing supply and encourage more diverse development across Queensland.

Pre-approval process

The introduction of a pre-approval process marks a major improvement in how relief is administered. Under the old system, developers could only apply for relief after acquiring land, creating uncertainty and financial risk. The new process allows developers to secure approval before acquisition, giving them confidence to proceed with transactions and improving access to finance. This proactive approach reduces risk and supports better project planning.

Published service standards

To complement the pre-approval process, the Queensland Revenue Office (QRO) has introduced published service standards for processing applications. Frequent applicants and renewals will be processed within 30 working days, while new applicants will receive decisions within 60 working days. These timelines provide transparency and predictability, addressing long-standing concerns about delays and improving investor confidence.

Broader recognition of group entities

The reforms also broaden eligibility by recognising the activity of the relevant corporate group of which the entity is a group entity in determining if the entity has made a significant contribution or is a significant contributor. Many projects involve joint ventures or complex corporate arrangements, and under the new rules, these structures will be considered when determining if the exemption criteria is satisfied.

Five year averaged significant contributor test

For landholders seeking relief from the FLTS, a new five-year averaged significant contributor test has been introduced. This test ensures that entities demonstrating sustained economic contribution to Queensland can access relief, rewarding long-term investment rather than short-term activity. It encourages stability and ongoing engagement with the state’s economy.

Under this administrative arrangement, a significant contribution means that an entity (or relevant corporate group) has:

- Current commercial activities, or committed future commercial activities over a 12-month period from the liability date, at the requisite contribution level or

- Commercial activities approved by the Commissioner.

In this context, requisite contribution level means employing 75 or more full-time equivalent employees in Queensland (excluding labour hire or contractors) or incurring expenditure in Queensland of more than $20 million annually (comprising Queensland payroll tax and land tax liabilities, Queensland goods and services and wages paid to Queensland residents).

In relation to commercial activities approved by the Commissioner, the Commissioner will have regard to:

- the commercial activity in the context of population size, demographics, and industry maturity in the area

- the nature of the area and/or industry

- the contribution the activity makes to the area and/or industry (for example, whether the entity is a major employer in the area or whether the industry would exist without the presence of the entity) and

- any other relevant factors.

Clearer criteria and transitional arrangements

Finally, the reforms provide clearer eligibility criteria and transitional arrangements for entities already receiving relief. This removes ambiguity and ensures continuity for ongoing projects, reducing compliance risk and supporting developers during the transition to the new framework.

Rulings

To implement these reforms, the QRO has issued the following updated rulings:

- Public Ruling GEN012.1 Administrative arrangement—exemption from AFAD and land tax foreign surcharge for residential land developers

- Public Ruling LTA000.6.1 Administrative arrangement—exemption from land tax foreign surcharge for landholders undertaking commercial activities that make a significant contribution

- Public Ruling DA000.15.5 Additional foreign acquirer duty—ex gratia for significant development for liabilities arising before 15 December 2025

- Public Ruling LTA000.4.4 Guidelines for ex gratia relief from the land tax foreign surcharge for liabilities arising before 30 June 2026

How SW can help

Navigating these new rules can be complex, especially with multiple rulings and transitional arrangements.

We assist developers and investors by:

- Providing tailored advice on eligibility under the new AFAD and FLTS relief framework.

- Preparing and lodging pre-approval applications with QRO to secure relief before acquisition.

- Structuring projects and ownership arrangements to maximise compliance and minimise tax exposure.

Contributors

Robert Parker – Consulting Director, Tax

If you’re part of a multinational enterprise group operating in Australia, new Global and Domestic Minimum Tax (Pillar Two) lodgement requirements are on the horizon.

From 30 June 2026, Australian subsidiaries, consolidated groups, and joint ventures will need to determine whether they fall within scope, and when exemptions apply.

At SW, we’re already helping clients map their entities, minimise compliance costs, and prepare for lodgement with our CTS Pillar Two software.

Why CTS Pillar Two?

CTS Pillar Two is your comprehensive solution for navigating the complex landscape of OECD Pillar Two calculations. As international tax regulations continue to evolve, it’s crucial for businesses to stay ahead of the curve and ensure compliance with the latest standards set by the OECD.

CTS Pillar Two is designed to be user-friendly, highly flexible, and intuitive. It seamlessly integrates with any internal workpapers, ensuring a smooth and efficient workflow.

Key features

General

- Intuitive calculation methodology: Our user-friendly software simplifies the complex calculations required for Pillar Two compliance

- Excel integration: Easily import your Excel calculations for seamless linking

Workflow

- Team formation and workflow: Assemble project team members, plan workflows, identify information sources and automation approaches and monitor the status of tasks.

- Member attributes recording: Record attributes of MNE Group members to streamline inputs into the GloBE Information Return (GIR).

- Transitional Country-by-Country Safe Harbour (TCSH): Utilise work papers for TCSH calculations and understand your exposure to Pillar Two taxes.

Analysis and reporting

- Automated Status Generation: Automatically generate the status of Pillar Two implementation across jurisdictions where your MNE Group operates.

- Comprehensive Reporting: Generate detailed reports that provide insights into your organisation’s top-up tax exposures, enabling informed decision-making and strategic planning.

- Interactive Dashboard: Access a dashboard with drill-down options and visual depictions.

GloBE calculations

- Automation features:

- Rollover

- Map your trial balance to CTS Pillar Two

- Automated calculations with protected formula cells

- Scalability: Perform GloBE calculations for large MNE groups.

- Enhanced Integrity: Support the integrity of calculations with additional functionalities such as checklists, validations and guidance on relevant adjustments.

Lodgement

- Form Completion and Submission: Complete and lodge required forms, including GIR and Combined Global and Minimum Domestic Tax Return

- Data Conversion: Convert data based on the ATO requirements.

CTS Pillar Two empowers you to navigate the complexities of OECD Pillar Two calculations with confidence and efficiency.

Want to find out more?

To arrange a demo and learn more about CTS Pillar Two, get in touch with our CTS team. A team member will be in touch within the next business day.

The ATO has released draft Legislative Instrument LI 2025/D17, which specifies when certain entities are exempt from lodging domestic Pillar Two forms. However, this exemption does not apply to the Global Information Return (GIR).

The purpose of the instrument is to help multinational enterprise groups reduce compliance costs by removing the need to lodge certain global and domestic minimum tax return, where the Commissioner of Taxation considers it to be unnecessary because they could only ever disclose a nil liability.

Streamline your Pillar Two compliance with SW’s CTS Pillar Two software – designed to simplify lodgement of the GIR and domestic forms when exemptions don’t apply.

For more information on the Pillar Two obligations in Australia during the transition period, see our previous alert.

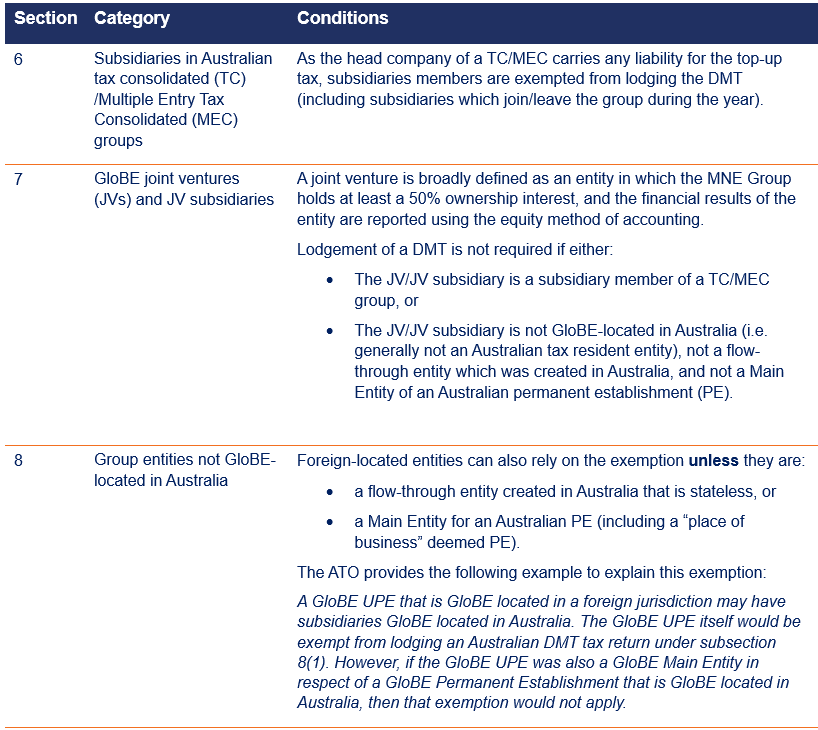

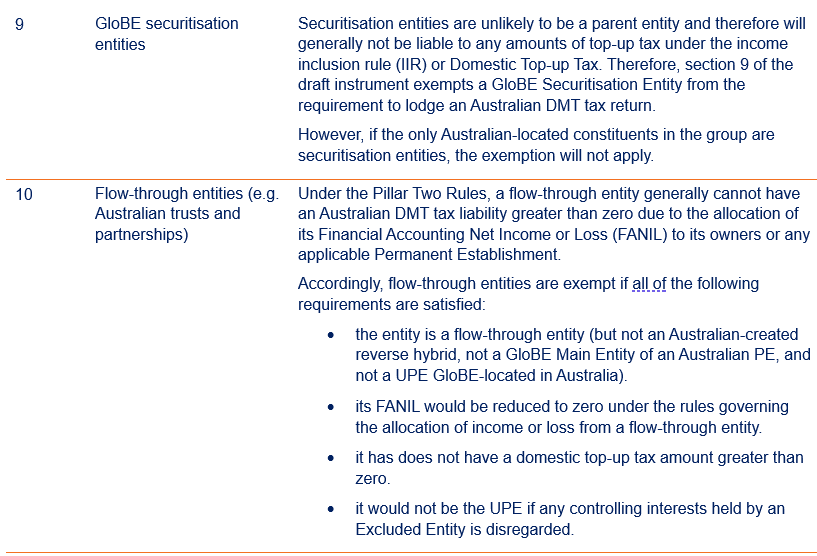

Below are the five main exemption pathways from the requirement to lodge the domestic minimum tax return (DMT).

Exemption to lodge an Australian Income Inclusion Rule (IIR)/ Undertaxed Profits Rule (UTPR) tax return

In addition, the draft instrument grants an exemption from the requirement to lodge the IIR/UTPR tax return, provided all conditions are met:

The Group entity:

- is not an Australian-located Parent Entity

- is an Australian-located Parent Entity of a wholly Australian group or

- is an Australian-located Parent Entity but a higher-tier Parent (intermediate or UPE) is required to apply a QIIR for the year

and any of the following apply:

- the Group entity is a subsidiary member of a TC/MEC group

- the Group entity is not GloBE-located in Australia and not a GloBE Main Entity for an Australian PE

- the Group entity is a GloBE Investment Entity or Insurance Investment Entity

- the Group entity is a GloBE securitisation entity meeting the relevant criteria or

- any of the group-level “switch-off” scenarios apply, i.e. Australia’s UTPR taxing rights would be wholly extinguished because:

- the group’s undertaxed profits are covered by the IIR charging mechanism such that Australia’s UTPR allocation would be zero or

- the Transitional UTPR Safe Harbour applies to the UPE jurisdiction and combined with IIR coverage elsewhere and thus reducing Australia’s UTPR allocation to zero.

For completeness, GloBE JVs and JV subsidiaries are not required to lodge an Australian IIR/UTPR tax return.

How we can advise your on Pillar Two with our CTS software

Navigating Pillar Two compliance can be complex, especially when determining which entities are exempt from lodging domestic forms. Our team can advise on your Pillar Two obligations by mapping your entities against the exemption categories each fiscal year. Where exemptions do not apply, we also support the implementation of SW’s CTS Pillar Two software to simplify and manage the lodgement of the Global Information Return (GIR) and Australian domestic forms.

We can assist in mapping your entities against the exemption categories each fiscal year to determine when lodging the relevant domestic forms is not required.

We can also support the implementation of SW’s CTS Pillar Two software to facilitate the lodgement of the GIR and Australian domestic forms, should the exemptions not apply.

In-person Pillar Two sessions will be held in Melbourne and Sydney on 15 and 23 October 2025 respectively. Reach out to your SW contacts for more information.

Contributor

Our submission to the Government’s consultation paper reflects feedback raised by trustees of affected Funds on the proposed increase to the minimum distribution rate. Based on our discussions, trustees are concerned that the change is inconsistent with their Funds’ objective of providing long-term charitable support.

The Treasury has released a consultation paper ‘Giving fund reforms: distribution rate and smoothing’, as part of its broader strategy to double charitable giving by 2030.

While these reforms aim to boost philanthropy, there are concerns that raising the minimum distribution rate could undermine the long-term sustainability of Private Ancillary Funds (PAFs), also known as Giving Funds (the Funds). These Funds were originally established to provide long term charitable support.

Our feedback on Giving Fund reforms

In response to these concerns, we have submitted feedback on the 31 July 2025, on behalf of our clients to Treasury’s consultation process.

Heather Dyke, Associate Director, expresses that

“Philanthropy is very important for many of our private clients. Most of our large private clients have set up Private Ancillary Funds (to be known as Giving Funds) to provide much needed long-term funding to charities.”

We are actively involved in the consultation process and represent our clients’ interests, with our Directors also serving on the boards of several Giving Funds, offering valuable insight into their investment and giving strategies.

Background

The Government has previously committed to working with the philanthropic, for-purpose, and business sectors to develop a national giving strategy.

What are the changes?

Following the introduction of a new Deductible Gift Recipient (DGR) category for Community Foundations, the government announced it would also improve the support provided to charities through Funds by:

- aligning and increasing the minimum annual distribution rate for public and private funds

- allowing funds to smooth their minimum annual distributions over three years, and

- renaming Private Ancillary Funds in the tax law to Giving Funds to reflect their role in giving to charities.

Drawbacks of raising minimum distribution rate

The key message from our feedback is that a 5% minimum distribution rate should be maintained. A higher distribution rate may decrease the attractiveness of Giving Funds to donors and impact the long-term sustainability of perpetual funds.

As the minimum distribution rate is not a cap, our clients generally provide regular distributions to charities at the minimum rate and extra distributions for capital works, special projects or when natural disasters occur. If the minimum rate is increased, then smoothing becomes very important and could be overly complex to monitor.

Our full submission to the Giving Fund consultation can be found here.

How SW can help

SW supports private clients in establishing and managing Giving Funds that align with their long-term philanthropic goals. We provide strategic advice on fund structuring, compliance, and distribution planning to ensure sustainability and impact.

We are actively engaged in the consultation process and advocate on behalf of our clients to help shape policy outcomes that support enduring charitable giving.

For assistance in establishing or managing a Giving Fund please contact our private client specialists, Heather Dyke or Matthew Oakey.

Understanding Build-to-Rent (BTR) concessions across Australia can be complex — so we’ve broken it down to make it easier for you to compare the key differences and eligibility criteria in each State and Territory.

This guide provides a clear, side-by-side comparison of BTR definitions, tax concessions, and access requirements across all Australian jurisdictions. If you’re planning a BTR project or need help navigating the rules, get in touch with our property tax experts for tailored advice and strategic support.

SW-Build-To-Rent-comparison-of-states-and-territories-2025How can SW help?

We have helped clients navigate the complexities of the BTR scheme and determine their eligibility requirements. As specialists in property funds and property development, we provide strategic tax advice to support the success of your project.

For the 8th consecutive year, SW has been recognised as a finalist in Beaton’s Client Choice Awards, solidifying its position as one of the leading accounting and consulting firms across Australia and New Zealand.

This year, SW proudly took home the award for Best Provider to Financial & Insurance Services and was a finalist in four other prestigious categories, reinforcing its unwavering commitment to excellence in client service and innovation.

CEO Duane Rogers reflected on the firm’s continuous recognition, stating, “Since first entering in 2018, these awards have given us valuable insight into how we engage with clients and position ourselves in the market. Being recognised year after year is a testament to the trust our clients place in us. Winning in the Financial & Insurance Services category, alongside being recognised as a finalist in key areas such as Most Innovative Firm and Most Trusted Firm, highlights our dedication to delivering exceptional client experiences and staying true to our values.”

Dr. George Beaton, Executive Chairman of Beaton, praised SW’s achievement, noting, “Their recognition across multiple categories showcases their leadership and dedication in an increasingly competitive industry. Trust in professional services is evolving, with clients demanding more transparency, responsiveness, and genuine relationships. SW stood out for its ability to not only meet but exceed these expectations, reinforcing its position as a leader in client service and integrity.”

Their exceptional client service and industry leadership set them apart in a highly competitive market.”

SW values client feedback as a cornerstone of its service excellence, actively engaging through Beaton debrief surveys and direct discussions with Chief Marketing Officer, Ms. Amanda Lee.

Ms. Lee emphasised the significance of these conversations, explaining, “Being responsive to our clients and truly listening to their needs is at the heart of what we do. Every conversation gives us valuable insights that help shape our services and refine how we support our clients. This ongoing dialogue ensures that we continue to improve, evolve, and deliver the high standards of service our clients expect from us.”

SW’s 2025 Client Choice Awards recognition

Winner

- Best Provider to Financial & Insurance Services

(>$30m revenue)

Finalist

- Best Accounting & Consulting Services Firm

($30-$100m revenue) - Most Innovative Accounting & Consulting Services Firm

(>$30m revenue) - Most Trusted Firm: Accounting & Consulting Services

(>$30m revenue) - Best Provider to Government & Community

(>$30m revenue)

The Client Choice Awards recognise excellence in professional services through direct client feedback, highlighting the evolving standards and expectations within the industry. Beaton’s commitment to transparency and objectivity upholds the credibility of the awards, underscoring the vital role of client satisfaction in defining industry benchmarks.

SW extends its congratulations to all winners and finalists for their exceptional contributions to the professional services sector in 2025 and commends the Beaton team their hard work and dedication in this important endeavour. For more details, click here.

Media contact

Amanda Lee | Chief Marketing Officer

alee@sw-au.com | M: +61 430 322 306

Significant global entities (SGEs) face stricter Country-by-Country (CbC) reporting in 2025 with new formats, tighter exemptions, public disclosures, and harsher penalties.

2025 marks an important year for SGEs in respect of their CbC reporting obligations. The compliance standards have significantly heightened due to several developments in the Australian CbC reporting regime, including:

- new format for short form local file

- tightened (non-public) CbC reporting exemptions

- enaction of public CbC reporting

- further increased failure-to-lodge on time penalties.

Here’s what you need to know ahead of the busy CbC reporting compliance season.

1. New format for short form local file

On 14 November 2024, the Australian Taxation Office (ATO) issued a new CbC reporting template incorporating the new short form local file format. The new template applies to reporting periods beginning on or after 1 January 2024.

Background

As a mandatory disclosure component in the local file, short form previously has provided general information of the Australian taxpayer in a highly descriptive manner. However, this has fallen short of delivering detailed data anticipated by the ATO due to inconsistent and/or incomplete content being submitted.

The new format aims to address these inconsistencies by increasing the granularity and comparability of the information required, particularly for significant restructures and new intangible arrangements.

Key changes

Departing from the old format as a narration-based attachment, the new format incorporates short form directly into the Message Structure Table embedded in LCMSF Schema Version 4.0 template, in conjunction with local file Part A and Part B.

Specifically, some of the new disclosures required include:

- business strategy – required for all the main business lines / functions rather than on a whole-of-entity basis, including information on how each business line strategy overlaps

- organisational structure – must disclose Australia to overseas reporting lines for the most senior Australian-based individual by function/activity, not necessarily for the entire Australian business. Changes of reporting relationships throughout the year also need to be disclosed.

- significant restructures and new intangible arrangements – these types of arrangements will result in additional disclosures in greater level of details (over 50 questions expected), some of which are highly prescriptive such as:

- type of restructure (including any change in related party financing) or new arrangement involving transfer, licence or creation of intangibles

- total capital value of the restructure or intangible arrangement

- description of anticipated Australian and global tax impact

- commercial context and anticipated commercial impact

- step plan outlining steps of the restructure or intangible arrangement (as an attachment)

- each step involved in the restructure or intangible arrangement (including all connected steps involving overseas related parties). A series of disclosures will need to be disclosed for each step.

While only “significant” restructures are reportable, the definition of significant restructures is very broad. Certain restructures are deemed as significant regardless of its materiality, for example:

- changes in ownership by controlling entities

- changes in residence, entity classification or tax status of controlling entities or related counterparties

- related overseas counterparty acquires or licenses significant intellectual property from another overseas related party

- related overseas counterparty commences or expands an offshore arrangement treated as impacting the functional profile or level of remuneration of Australian operations

- new arrangements involving transfer, licence, or creation of intangibles involving the Australian control group.

There are non-reportable exclusions for restructures and intangible arrangements, however the eligibility criteria are strict and may require an extensive process of information gathering and evaluation at both Australian and overseas counterparty levels.

When the changes apply

| Entity type | When do the changes apply | Lodgement due date |

| December balancers | year ended 31 December 2024 | 31 December 2025 |

| June balancers | year ended 30 June 2025 | 30 June 2026 |

SW has upgraded our in-house CbC reporting software that complies with the LCMSF Schema Version 4.0 template, to support smooth transition of local file reporting under the new format.

2. Tightened (non-public) CbC reporting exemptions

On 29 November 2024, the ATO released its updated guidance on exemptions from lodging one or more of the CbC reporting statements. This new approach is significantly more stringent than in the past and will apply to all CbC reporting exemption requests received on or after 1 January 2025.

Available exemption categories

There will generally be only three circumstances where an exemption may be granted upon receiving a formal request.

| Exemption category | Exemption available |

| You are an Australian CbC reporting parent, or a member of a group consolidated for accounting purposes with an Australian CbC reporting parent, where the group has no foreign operations. | CbC report |

| The annual global income of your foreign CbC reporting parent is AUD $1bn or more but falls below the CbC reporting foreign currency threshold in the jurisdiction of the foreign CbC reporting parent. | CbC report |

| You were a CbC reporting entity in the preceding year due to your membership of a group of entities but left that group during the CbC reporting year due to a demerger or sale to a third party and will not be a CbC reporting entity under your new structure for the foreseeable future. | CbC report and master file |

Exemptions will be granted for a period of one year predominantly, and the exemption request should be made after the tax return has been lodged for the associated income year and financial statements are available.

Exemptions outside of the three categories above may only be considered in exceptional circumstances.

Of an important note, there is generally no administrative relief available for the local file with respect to reporting periods on or after 1 January 2024, where such relief was available in the past where the Australian taxpayer did not involve in international related party dealings.

Tax exempt entities under Division 50 of the Income Tax Assessment Act 1997 (e.g. Australia headed university groups) remain to have access to CbC reporting relief, if no overseas presence exists.

3. Public CbC reporting is now law

The lodging of public CbC report by applicable SGE groups will be mandatory effective from income years beginning on or after 1 July 2024, withthe proposed legislation for public CbC reporting receiving royal assent on 10 December 2024.

The final law is broadly similar to the revised exposure draft (released in February 2024), which SW analysed.

Who are affected?

| Who does it apply to? | The reporting obligation applies to a CbC reporting parent of a CbC reporting group with an Australian presence |

| Conditions | Only triggered if the CbC reporting parent’s Australian-sourced aggregated turnover is AUD $10m or more for the income year. If a CbC reporting parent’s reporting period is not an income year, it must assume the reporting period is an income year for calculating aggregated turnover. |

| Publishing requirements | The CbC reporting parent is required to publish selected tax information in the approved form to the Commissioner of Taxation, with the Commissioner facilitating publication on an Australian government website. |

When will the law apply?

| Entity type | When do the changes apply | Lodgement due date |

| December balancers | year ended 31 December 2025 | 31 December 2026 |

| June balancers | year ended 30 June 2025 | 30 June 2026 |

What information will need to be submitted and made public?

While there is significant overlay between the disclosures required under the existing non-public CbC report and the new public CbC report (such as by-jurisdiction revenue, tax and headcount data), the bar under the public CbC reporting is higher.

For example, it requires disclosure of the group’s approach to tax for which the Global Reporting Initiative’s Sustainability Reporting Standards GRI 207: Tax (2019) should be treated as the primary source of guidance.

For Australia and specified jurisdictions determined by the Minister, information must be published on a CbC basis. For all other jurisdictions, the CbC reporting parent has a choice to publish the same information on either a CbC basis or an aggregated basis.

Information published must be sourced from audited consolidated financial statements. In circumstances where the CbC reporting parent has not prepared audited consolidated financial statements, the information published must be based on amounts that would be shown in such statements, had the entity been a listed company.

It is expected that information must be submitted in XML schema as the approved form, and the detailed format will be released by mid 2025. SW will have our in-house public CbC report software ready by that time.

What exemptions are available?

In addition to the CbC reporting groups with a small Australian presence (less than $10m AUD Australian-sourced income), it is unclear what other specific exemptions are available (for example, if tax exempt Australia headed university groups with no overseas presence are exempt).

Generally, it appears that any further exemptions will be at the Commissioner’s discretion.

The ATO is working on a practical guidance on exemptions, which is expected to be completed by mid 2025.

4. Increased penalty rates

SGEs may face further increased penalties in the event of late lodgements.

| Days late | Failure-to-lodge on time penalties | |

| For forms due from 7 Nov 2024 | For forms due before 7 Nov 2024 | |

| 28 or less | $165,000 | $156,500 |

| 29 to 56 | $330,000 | $313,000 |

| 57 to 84 | $495,000 | $469,500 |

| 85 to 112 | $660,000 | $626,000 |

| More than 112 | $825,000 | $782,500 |

What’s next

As Australia embraces greater tax transparency, the compliance costs for SGE groups are continuously increasing, and the compliance bar is heightening. It is crucial for affected taxpayers and associated CbC reporting groups to stay informed and respond to these changes in a timely and efficient fashion.

- For Australia based CbC reporting parents, it is time to commence planning from a process and resource perspective to ensure due satisfaction with the relevant reporting requirements.

- For overseas headquartered CbC reporting groups, the Australian group members should ensure ongoing and proactive dialogue put in place with the group parents so that the group’s readiness and awareness of the Australian reporting requirements are well established.

This document is not intended to be formal advice. As these CbC reporting developments are complex and evolving, we recommend affected taxpayers reach out to our Transfer Pricing specialists to learn how these changes may impact your business.

Contributors

The Commissioner has sought special leave to appeal the Full Federal court decision that unpaid present entitlements are not loans for the purpose of Division 7A.

Since the appeal application has been made, the Commissioner has released a decision impact statement outlining their approach to Division 7A in the interim, pending the outcome of the appeal process.

For more insight on the original decision of the Full Federal Court see our previous alert.

What the Commissioner states

The Commissioner states that they will:

- continue to apply the law as though an unpaid present entitlement (UPE) is a loan for Division 7A purposes

- consider the application of other provisions (for example section 100A) where UPE remain unpaid.

- not issue any amended assessments, private binding rulings or objection decisions. If such decisions are required to be made, decisions will be made in accordance with the ATO’s existing view.

What an appeal involves

An appeal to the High Court is a 2-step process.

- There must be a special leave application accepted by the High Court (at this stage the Commissioner has only lodged an application) and

- if the special leave application is accepted, there will be a full hearing. However, only 10 – 15% of special leave applications are accepted by the High Court.

How SW can help

There is going to be a period of uncertainty for taxpayers about how to treat an UPE given the Commissioner’s position and the Commissioner’s chance of success.

In the meantime, we encourage you to discuss the Bendel decision and its impact on your own group’s UPEs with your SW contact or the specialist tax contacts listed in this alert.

Contributors

The final Higher Education Research Data Collection (HERDC) specifications for the collection of 2024 data have been released. It’s a great outcome to have further clarification on the treatment of Shared Income to Non-Higher Education Providers.

The main changes between the 2023 specifications and 2024 specifications are as follows:

- Reorganisation of sections: The ‘HERDC specifications – updates to note’ section was moved to the beginning of the document, and the ‘Introduction’ was shifted to the second section to enhance the document’s flow.

- Clarification on data usage: A minor amendment was made to specify that preliminary HERDC data may be shared with Knowledge Commercialisation Australasia (KCA) to assist with its Survey of Commercialisation Outcomes from Public Research (SCOPR) data collection, validation, and reporting processes.

- Materials required: The table detailing required materials was reworded and repositioned within the document for better comprehension.

- Inclusions and exclusions on income return:: Section 4.2.1(a) was restructured into parts (a) and (b) to provide clearer guidance on non-Commonwealth Government top-ups.

- Subsidiaries and affiliates: Clarifications were made regarding the eligibility of subsidiaries and affiliates as research end-users for the Research Training Program (RTP) industry internship weighting.

- Shared income: An example was expanded to demonstrate the treatment of shared income with non-Higher Education Providers (non-HEP) organizations that are neither affiliates nor subsidiaries. Example: If HEP A receives a grant of $50,000 and allocates $20,000 to HEP B and $5,000 to a non-HEP organization that is not an affiliate or subsidiary, HEP A should report only the remaining $25,000 as its R&D income. HEP B would report the $20,000 it received, while the $5,000 allocated to the non-HEP organization is not reportable by either HEP.

- Sub-category 3.8 International Government (Other): Grants from the US National Institutes of Health were removed as an example in this sub-category.

- References to the department: Updates were made to clarify that references to the department pertain to the Australian Government Department of Education.

Each HEP must arrange for an audit of the Category 1, 2, 3 and 4 R&D income in their respective R&D income return and provide the department with a Special Purpose Audit Report under the Auditing and Assurance Standard Board (AASB) Auditing Standard ASA800, which clearly certifies that the R&D income recorded is correct. The audit report is due 30 June 2025.

How SW can help

With a dedicated education group, we specialise in performing HERDC audits for HEPS. If you are looking for an experience team to perform your HERDC audit, please reach out to Christine Krause and Matthew Paull.

We will be at ARMS 2025 Melbourne Conference– looking forward to connecting and sharing insights from the HERDC 2024 audits.