The Australian Labor Party (ALP) steered clear of controversial tax debate during the Federal Election campaign this year. However, with the ALP forming Government, many people are wondering what to expect in terms of tax reform.

Whilst the important details of the framework have yet to be released (and remain the subject of an intended consultation process), the Albanese Government’s intention is to “to ensure multinationals pay their fair share of tax“.

The Government plans to do this via 4 major areas of reform or expansion:

- implementation of BEPS 2.0

- modification of thin capitalisation rules

- restricting Intellectual Property deductions, and

- expanding Tax Transparency measures, including requiring:

- public release of Country-by-Country (“CbC”) information

- a public registry of ultimate beneficial ownership of entities

- mandatory reporting of “tax haven exposure”, and

- transparency requirements for Australian government tenderers.

Adoption of BEPS 2.0

The ALP has confirmed its commitment to the timely implementation of the Base Erosion and Profit Shifting framework (BEPS 2.0) to follow through on Australia’s agreement to the global arrangement reached in October 2021 and membership of the OECD’s Inclusive Framework.

This will include the domestic implementation of what is known as a 2-Pillar solution, which includes:

- a global minimum effective minimum corporate tax rate set at 15% for multi-nationals, and

- a fairer distribution of profits by multinationals.

The new Government is clearly hoping that the introduction of these measures will increase Australia’s proportion of the tax take on many multinationals.

Thin capitalisation reform

The ALP is proposing to further limit interest deductions to bring Australia in line with the OECD recommended approach. In particular, the Government is proposing to limit interest deductions to 30% of EBITDA from 1 July 2023, while retaining the arm’s length and worldwide gearing debt tests.

The proposed reform is simple in statement but difficult in execution, and will likely have significant impact on a range of sectors that are traditionally highly leveraged and increase the compliance burden for many multinationals.

Thankfully, the ALP has stated that these reforms will only proceed after industry consultation, and we hope that due consideration is given to the broader implications of such a change.

Intellectual Property restrictions

The Government has seemingly sought to ‘borrow’ certain integrity measures from other tax systems such as the UK and US in seeking to deny tax deductions for the use of intellectual property when those payments are paid to a tax haven jurisdiction.

These measures are intended to only apply to Significant Global Entities (SGEs) and are intended to stop “treaty shopping”. The Government intends to introduce provisions that would deny such a payment unless it could be substantiated that the royalty payment was not for the dominant purpose of avoiding Australian tax.

There are many complexities evident with this proposal, not the least the interaction of these proposed rules with existing tax provisions such as Part IVA and Diverted Profits Tax.

Tax Transparency expansion

The remainder of the ALP’s reform agenda is focused on expanding requirements for multinationals to be transparent in their dealings.

These expansions focus on 4 areas:

Public reporting of CbC information

It is currently only mandatory to provide CbC Reporting information to the ATO. The ATO then shares that information with certain other global revenue authorities.

The ALP intends to require “large multinational firms” (presumably SGEs) to publicly disclose the CbC information.

Ultimate beneficial ownership information

The Government intends to create and maintain a public registry of ultimate beneficial ownership. Ultimate beneficial ownership is essentially the identity of who ultimately owns, controls, or receives profits from a company or other type of entity.

Implementation of a public register of such information will bring Australia in line with other G20 nations such as Canada, UK, and the US.

We expect that such a register would be limited in scope to large multinationals given the broader context of the reform agenda. However, limited information has been provided at this stage.

Mandatory reporting of “tax haven exposure”

Presumably tied to the implementation of BEPS 2.0, these changes will require multinationals operating in jurisdictions below the proposed global minimum 15% tax rate to disclosure a “material tax risk” to shareholders.

Tax transparency requirements for Australian Government tenderers

Lastly the ALP plan to implement a “Fair Go Procurement Framework” requiring companies tendering for Government contracts worth more than $200,000 to disclose their country of domicile for tax purposes.

ALP plan needs broad consultation

The ALP’s proposals clearly represent a significant pivot from policies in previous elections and have generally focused on ways of addressing tax avoidance by multinational corporations. Whilst they may provide some headaches and uncertainties for taxpayers, they are unlikely to unsettle Australian voters or mums and dads.

Nonetheless, the potential application of the reforms are significant and may impact many small and medium sized enterprises – as well as the SGEs. We welcome the opportunity for broad consultation to ensure that the plan achieves its objectives in an appropriate and measured way.

Contributors

The NSW Government has announced first home buyers will be able to choose to pay an annual property tax instead of stamp duty. This significant proposed property tax reform aims to reduce the upfront cost for purchasing a home.

First home buyers purchasing properties up to $1.5m as their principal residence will now be able to choose to pay an annual property tax instead of stamp duty. Announced in the 2022/23 NSW State Budget, this proposed reform gives first home buyers a choice of opting out of stamp duty and instead paying an annual property tax.

How does it work?

The property tax will only be payable by first home buyers who choose it. Unlike earlier consultation proposals, the property tax will not automatically apply to subsequent purchasers of a property unless they are a qualifying first home buyer who also elects to pay the property tax.

Existing stamp duty concessions for first home buyers are available for purchases of up to $800,000, and these concessions will continue. [It is not clear at this stage if the election affects any entitlement to the First home Owners Grant. The First Home Buyer Assistance Scheme which provided a full exemption for new homes up to $800,000 and a concession for new homes up to $1m ceased from 31 July 2021.]

Who is eligible?

- you must be an individual (not a company or trust)

- you must be over 18 years old

- you, or at least one person you’re buying with, must be an Australian citizen or permanent resident

- you or your spouse must not have previously owned or co-owned residential property in Australia or received a First Home Buyer Grant or duty concessions.

- the property must be worth less than or equal to $1.5m

- you must move into the property within 12 months of purchase and live in it continuously for at least 6 months

Additionally, the contract of purchase must be entered on or after the scheme commencement date:

- for a contract of purchase on or after 16 January 2023 an eligible purchaser may opt into the property tax and will not be required to pay stamp duty in order to complete their transaction.

- for a contract of purchase between the passage of the legislation and 15 January 2023, an eligible purchaser will be required to pay any applicable stamp duty within the usual required periods and from 16 January 2023, will be able to apply for and receive a refund of that duty.

Stamp duty or annual property tax?

Eligible purchasers can choose between:

- paying the usual amount of stamp duty based on the ‘dutiable value’ of the property (i.e. the value including any improvements) or

- paying an annual property tax based on the unimproved land value of the property.

Property tax rates

The property tax rates for 2022-23 will be:

- $400 plus 0.3% of land value for properties whose owners live in them

- $1,500 plus 1.1% of land value for investment properties.

These tax rates will be indexed each year. Unlike land tax, annual property tax assessments will be issued in respect of financial years and not calendar years.

What about principal residences?

Whilst the property is occupied as a principal residence it is likely to be exempt from land tax. However there was no announcement that the property would be exempt from land tax whilst subject to the annual property tax.

Once it ceases to be the principal residence, it is possible that both the annual property tax (at the 1.1% rate) plus an annual land tax could apply – for instance, where the owner decides to move interstate after 6 months occupation and then rent out the property.

It is assumed that there will be some process to adjust any election if the property Is not occupied for the continuous 6 months and retrospectively assess transfer duty.

For properties that are owned for less than a full financial year, a pro rata adjustment to the annual property tax will be made based on the number of days in the year the property is owned. There will therefore be no need to adjust for the annual property tax on the sale of the property.

Click here for more information about NSW considering signifcantly expanding the stamp duty regime.

How can SW help?

Please reach out to one of our tax and property experts below for assistance navigating the implications and opportunities of the property tax reform.

Contributor

The Queensland 2022/23 Budget includes increased mental health support, payroll tax relief and mining companies face higher coal royalty rates. Queensland Treasurer, Cameron Dick, has handed down his 3rd budget as part of the government’s plan for economic recovery from the Covid-19 pandemic.

Revenue measures announced as part of the 2022–23 Queensland Budget, include:

- a mental health levy on payroll taxes above $10m

- extension of payroll tax deduction for small and medium Queensland businesses with the deduction being extended from the current ceiling of $6.5m in annual Australian taxable wages up to $10.4m

- 50% payroll tax rebate for apprentices and trainees will be extended for a further 12 months to 30 June 2023, and

- foreign acquisition duty relief for foreign buyers who are retirement visa holders when purchasing their principal place of residence on or after 1 January 2023.

Mental health levy

A mental health levy will be introduced which will apply to payroll tax liabilities arising on or after 1 January 2023. This will be applied to large employers, or groups of employers, with annual Australian taxable wages over $10m, including an additional levy applied to taxable wages over $100m, providing funding for mental health services.

The mental health levy will be applied as follows:

- a 0.25% levy on the annual Australian taxable wages of employers, or groups of employers above $10m

- an additional 0.5% levy on the annual Australian taxable wages of employers, or groups of employers, above $100m.

The levy will only apply to the portion of the wages above the respective taxable wage amounts (i.e. on a marginal basis).

Payroll tax relief for small to medium employers

Payroll tax relief will be provided for small and medium businesses, by increasing the payroll tax deductions available to employers, or groups of employers, with annual Australian taxable wages of between $1.3m and $10.4m. These changes are proposed to apply to payroll tax liabilities arising on or after 1 January 2023.

Racing levy

A 5% racing levy will be applied to the betting tax rate and bonus or free bets will be incorporated into the calculation of betting tax for liabilities arising on or after 1 December 2022.

Progressive coal royalty rates

3 additional progressive coal royalty rates will apply. The new tiers will apply on that part of the average price per tonne of the coal sold, disposed of or used on or after 1 July 2022 as follows:

- 20% for prices exceeding $175 AUD,

- 30% for prices exceeding $225 AUD, and

- 40% for prices exceeding $300 AUD.

How can SW help?

Please reach out to one of our experts below for assistance navigating the implications and opportunities this Budget presents for you, your business and your industry.

Contacts

The SW team wish to advise you that the ATO’s Small Business Superannuation Clearing House (SBSCH) online service will NOT be available from 11:30pm on Saturday 25 June to 7:00am on Sunday 26 June 2022 AEST, due to scheduled maintenance.

It is important to note, super payments can take up to 7 business days to be transferred through the ATO and super fund before they reach the employee’s super fund account. Scheduling payments too close to 30 June 2022 may mean the super payments may not clear in time.

Key super dates

As we approach the 2022 financial year end, we remind employers of some key dates for superannuation (super) processing.

- If you are an employer planning to claim a tax deduction for super payments made for the quarter ended 30 June 2022, (not actually due until 28 July 2022), the super must be paid through your bank account before 30 June 2022 and received by the actual fund by 30 June 2022.

- If you currently employ 19 or fewer employees or you have an aggregated turnover of less than $10 million, you may be an employer using the ATO’s SBSCH to pay super for your employees.

- If you are an employer currently using the SBSCH and you are planning to claim a tax deduction for super payments for the year ended 30 June 2022, it is advisable to adjust your payment plans by scheduling payments before the outage takes place. This will ensure the payments are received by your employees’ super funds before 30 June 2022.

- From the perspective of your employees, they are likely to be expecting their June quarter super amounts (SG and salary sacrifice amounts) to be included in their total concessional contributions for the 2021/2022 financial year.

- Your employees have a concessional cap of $27,500 per annuum. If the contributions are received after 30 June 2022, your employees may need to allocate these to the 2022/2023 financial year. This may adversely limit future contributions they wish to make.

How can SW help

If you would like to discuss your superannuation payment requirements or deadlines, please contact your SW advisor or one of our experts.

Contributors

The Australian Taxation Office (ATO) has reporting obligations in place affecting those who offer employee share schemes. Find out how our ATO-approved software can simplify your reporting obligations.

ATO reporting obligations

The Australian Taxation Office (ATO) have reporting obligations in place, affecting employers who offer shares or share options to their employees. The deadlines to comply with the reporting requirements are:

- ESS statements are due to be issued to employees by 14 July 2022

- ATO reports are due for lodgement with ATO by 14 August 2022 (15 August due to weekend)

What do the ATO reporting obligations mean for you?

| If you are an employer | You will need to | How can SW help? |

|---|---|---|

| Reporting <50 employees and no more than 3 schemes per employee (with an Australian ABN) | Manually complete electronic ATO form (ATO form does not produce ESS statements) | SW can help with the completion of the manual forms or producing ESS statements |

| Reporting >50 employees OR Reporting <50 employees (without an Australian ABN) | -Purchase software -Develop own in-house software -Use an agent with ATO-approved software | Our Complete Tax Solution ESS Toolkit can be used to assist clients with their ESS reporting requirements (further information below). |

| With globally mobile employees | Indicate on each employee’s ESS statement: -Whether the reported figures are gross or apportioned between Australian–sourced/ other work -Report assignment dates (optional) | Our Complete Tax Solution ESS Toolkit can be used to assist clients with their ESS reporting requirements (further information below). |

Legislation removing the cessation of employment as a taxing point received Royal Assent on 10 February 2022 and will apply to all ESS interests (new and existing) that are subject to deferred taxation, provided the deferred taxing point occurs on or after 1 July 2022. This change will therefore not impact prior year ESS interests or the 2022 lodgements.

Innovation solution

SW has developed compliant software that has been approved by the ATO to enable employers to simplify their online annual employee share scheme reporting obligations.

We have developed the ‘Complete Tax Solutions Employee Share Scheme’ Toolkit (CTS ESS Toolkit) which can help you meet the ATO’s ESS reporting requirements. SW is one of only a handful or providers to have passed ATO testing and we have ATO approval for the software. We have been successfully working with businesses to meet their ESS lodgement requirements since electronic reporting began.

The table below outlines the types of companies that are most likely to benefit from using the CTS ESS Toolkit.

| Company profile | Conditions |

|---|---|

| Large, privately owned company (>50 reportable employees) | Commonly tax and finance is done in-house and support required for one-off compliance and advisory projects such as ESS reporting. |

| Head-quartered overseas (either >50 reportable employees or <50 if no ABN) | With subsidiaries/employees in Australia particularly if: -Australian employees are in split roles here and overseas -Where finance and payroll functions are based offshore, and no access to the required software for ESS reporting |

| ASX listed company | If you are currently reporting ESS information through the Australian Share Registry, the ESS reporting requirements are unlikely to affect you. However, you may wish to consider the CTS ESS Toolkit as an alternative means of meeting your ESS reporting requirements. |

Next steps

Time is limited to make the necessary arrangements to comply with the ESS reporting requirements. The ATO is particularly keen to ensure corporates are compliant and providing timely and accurate reporting.

Now is the time to ensure your business is not left behind and you have everything in place ready for reporting season. We can provide a fully outsourced service or license our software; whichever you prefer.

If you would like to discuss how to comply with the ATO reporting requirements, or learn more about how our ESS Toolkit will help you, please contact either Sam Morris or Justin Batticciotto on the details below.

Contacts

Justin Batticciotto

The Victorian Government has delivered the 2022/23 Budget with a clear emphasis on health, education and infrastructure projects in Victoria and no major surprises or material new taxes for Victorian businesses.

Key takeaways

- Although there are no key tax measures introduced, direct property taxes will continue to be the source of over 50% of new revenue for the Victorian Government due to increased transaction volume and rising land values (although this is expected to be tampered by forecasted interest rate rises).

- A new Victorian Future Fund will be established to manage the fiscal impact of COVID 19. It will initially be funded from the VicRoads Modernisation joint venture and is expected to have a balance of around $10bn. Investment returns from the Fund is to be quarantined and returned to the Fund to help offset the current debt and return the Budget to surplus by 2025-2026.

- There is a clear focus in this Budget to repair the health system. Included in the Budget is more than $12bn of health-related expenditure including the training and hiring of additional healthcare workers and paramedic staff, funding for Ambulance Victoria to meet growing demand for services and investment to cut surgery waiting lists.

- The two-year Sick Pay Guarantee pilot program will receive $246m in funding to assist provision of a payment of up to five days of sick or carer’s pay at the national minimum wage for insecure work (casual employees).

- $250m provided for a one off $250 Power Saving Bonus to all Victorian households using the Victorian Energy Compare website to locate the cheapest electricity deal. The scheme will run from 1 July 2022 to 30 June 2023.

- A commitment of $111m to support Victoria’s tourism and major events.

- The Victorian Government has allocated $1.8bn to the school building project and plans to continue upgrading schools until it achieves its intended target of 100 new schooling facilities by 2026. The program includes upgrades to 65 schools including 36 special schools, building 13 new schools, additional stages at four more schools, and expanding capacity at two schools to meet enrolment demand.

- The Victorian Government also plans to invest $5bn in early three-year-old childhood education by increasing universal educational access for disadvantaged families as well as providing support to individuals from diverse backgrounds and $131m to assist students from rural areas to access four-year-old early childhood services.

For full overview of the infrastructure measures see our breakdown here.

Victorian Industry Fund to support Victorian Businesses

The Government has introduced a $120m fund to support the advancement of domestic manufacturing and other high priority sectors. Some of the initiatives to be supported by this Fund include:

- $40m to provide grants to support rapidly growing businesses

- $40m of targeted financial incentives to attract investment into Victorian businesses

- $20m for an equity investment pilot fund to attract highly innovative companies particularly in areas such as medical technology

- $7m low-carbon manufacturing grant program to help Victorian manufacturers to compete globally in the renewable energy space

- $4.5m for 300 digital jobs for manufacturing internships to help train Victorian workers in this industry.

Significant Tax Measures

No significant new tax measures were announced in the 2022/23 Budget although there were minor amendments in relation to:

- Equalisation of gambling tax rates for electronic gaming machine operators

- Exemption from motor vehicle duty for wheelchair accessible commercial passenger vehicles that provide unbooked services.

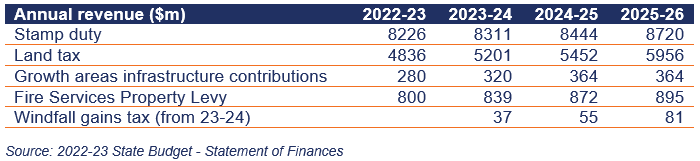

However, as noted above, the State Taxes are to be a major source of revenue for the Victorian Government. The table below shows the annual revenue expected from State Taxes over the next 4 years.

Opportunities

The opportunity for businesses may come from the expected economic growth although this is not anticipated to be significant. Business sectors such as Medtech, pharmaceuticals and manufacturing should benefit from the increase in funding.

Did the VIC Budget measure up to expectations?

The Budget fell short of providing the required assistance to boost businesses which are facing significant uncertainties.

The Government’s commitment to repairing Victoria’s health system in needed and welcomed. However, the Government has not sought to increase property taxes to decrease the State’s debt and is instead relying on solid economic growth to repair the budget.

Please reach out to one of our experts below for assistance navigating the implications and opportunities this Budget presents for you, your business and your industry.

Contacts

The Victorian Government has continued its emphasis on infrastructure investment in this Budget with a focus on schools, health facilities and social and affordable housing.

Significant measures

New infrastructure spending:

- $1.6bn for construction and development of new schools and school upgrades

- $1.6bn for construction and development of new hospitals, health facilities and related upgrades

- $2.6bn investment over 4 years in the Commonwealth Games 2026 which includes funding for building and upgrading sporting venues and related supporting infrastructure

- $991m investment in improving Victoria’s roads and rail

- $1bn to fund low interest loans for community housing agencies to deliver social and affordable housing.

Key continuing initiatives from prior Budget announcements:

- Victoria’s Big Build: an average $21.3bn a year over the budget and forward estimates, reflecting the continuation of major productivity-enhancing projects such as the North East Link, the Metro Tunnel, the West Gate Tunnel, the Melbourne Airport Rail, the Geelong Fast Rail, the Suburban Rail Loop and the removal of 85 level crossings by 2025

- $6bn Big Housing Build package – continued investment in new social and affordable homes

- Stamp duty concessions and exemptions for residential property transactions, particularly homeowners

- Victoria’s HomeBuyer Fund of $500m, expanding the HomesVic Shared Equity Initiative by contributing equity to the purchase price for eligible first home buyers

- Continued concessions to eligible BTR developments – a 50% land tax concession for up to 30 years and a full exemption from Absentee Owner Surcharge over the same period.

For all key takeaways of the Victorian State Budget 2022/23 see here.

Opportunities

- Continued focus on infrastructure spending; the 2022-23 Budget provides $22.2bn in output spending and invests $6.7bn in new and improved assets. Investment in hospitals, rail and roads, social and affordable homes will continue to provide opportunities for property sector professionals and contractors

- Wage growth and increased household income will continue to drive demand for residential housing

- Continued stamp duty concessions, coupled with the HomeBuyer Fund funding is also likely to support the demand for residential housing. These initiatives may also mitigate any settlement risk for developer

- Ongoing Build-To-Rent concessions will continue supporting new entrants into that market

- Constraints on construction labour and materials may increase demand and investment in new property technologies aimed at delivering efficiencies in output

- There are no new taxes introduced impacting property purchasers and owners.

Did the VIC Budget measure up to expectations?

There are no new tax relief measures introduced for Victorian property purchasers, developers nor landowners. The constraints on residential and non-residential construction output, such as ongoing shortages of construction materials and labour shortages are also acknowledged but not addressed by any direct Budget initiatives.

The increases in costs of construction will be driven by projected wage growth of minimum 2.75% in the construction industry. This coupled with increase in cost of construction materials, also due to shortages, will continue to increase the price of newly constructed property.

While there are tax measures aimed at providing relief to homeowners (potentially neutralised by today’s interest rate hike) there is little relief provided in the Budget for the rest of the property sector participants such as property investors and developers.

Please reach out to one of our experts below for assistance navigating the implications and opportunities this Budget presents for you, your business and your industry.

Contacts

Daren McDonald

Director, Chair of Property &

Infrastructure Industry Group

SW

Matt Birrell

Director, Tax

SW

Sejla Kadric

Director, Private Business Client Advisory

SW

Connect with visionary attendees from all corners of the industry at the NRXpo and explore the future of retail.

SW’s Danny Armstrong and Nick Michael join an impressive line up of experts to share their insights about how to successfully operate in international markets.

The National Retail Association and BNPL giant Klarna are proud to introduce the NRXpo. Retail is constantly evolving to meet and surpass the changing needs of customers and our local communities. The pandemic accelerated digital and ecommerce trends, and now it’s time for us to put a future-focus on the industry.

With 11 unique and insightful sessions, networking drinks and exhibition stalls, the NRXpo is an event designed to help retailers boost their business, gain key insights, and come away with valuable takeaways to build their plan for the future.

Event details

Date

Time

Venue

Wednesday 11 May 2022

8:30am – 5:00pm

International Convention Centre Sydney

14 Darling Dr, Sydney NSW 2000

On March 24 2022, Australian media (Eyers, 2022) reported that ANZ Bank had created a stablecoin linked to the Australian dollar to reduce risk and improve transaction speed and cost for one of its clients to purchase digital assets.

This was a landmark transaction for the digital economy, as this is the first time an Australian bank has minted a digital asset linked to the value of the Australian dollar.

In this case, the ‘transaction’ was a proof of concept test case which involved ANZ minting a stablecoin, backed dollar for dollar by an AUD denominated deposit lodged with ANZ by its client, in a quarantined bank account. The stablecoin was then transferred to a digital currency exchange, and to a global digital asset custodian. A separate group provided anti-money laundering assurance for regulatory purposes and another group audited the capabilities of the coin and certified its existence on the blockchain and issuance to the highest security standards.

As this was a proof of concept, the client did not actually transact to purchase digital assets in this instance. The ‘transaction’ was unwound by reversing the process and ultimately ‘burning’ the stablecoin (i.e. removing it from the blockchain) and returning the customer’s fiat currency held in the quarantined ANZ bank account to them.

The next step to finalise prior to an actual transaction being facilitated is for the bank to arrange relevant licensing and ‘prove’ the process to exchange the AUD stablecoin for a USD denominated stablecoin to facilitate the purchase of digital assets by their client.

Potential for broader application

An interesting feature of ANZ’s stablecoin is that it is programmable for different use cases, such as execution and automation of different elements of smart contracts, making the scope for use in due course potentially limitless.

As an example, the bank is separately working on a use case that automates payment of excise duty to a digital wallet with the Australian Taxation Office when stock moves from a manufacturer to a wholesaler in a client’s supply chain.

A key element of the ANZ stablecoin is that it is issued by a regulated approved deposit-taking institution in Australia, which provides a layer of trust and gives clients confidence in the security standards surrounding issue and use of the coin. In the proof of concept transaction, the client’s fiat currency remained securely in the Australian banking system, while the stablecoin was utilised to move value through various elements of the transaction chain.

These types of transactions are only in the early stages of development in Australia, and accordingly are currently only potentially available to our largest institutional businesses. As the technology becomes more familiar over time, it is expected that they will become more mainstream and available to a wider range of users.

How can SW assist?

SW is working with a number of clients in the digital asset space in preparation for regulation of the sector in Australia following issue of the Bragg Report in October 2021 (Senate, 2021).

We anticipate that a licensing regime for the sector could be introduced as early as the end of 2022, and that it will include the establishment of capital adequacy requirements, auditing and responsible person tests, together with anti-money laundering and counter-terrorism financing regulation, in line with recommendations from the Report.

For advisory, tax or accounting assistance with your digital assets, reach out to your SW contact or the SW Digital Assets team to see how we can assist you.

Are you and your business across the latest superannuation changes come 1 July 2022?

With so much change going on for business, Sharon Burke and Janelle McPhee spent time running through the latest superannuation impacts that all businesses need to know before 1 July 2022.

There were several modifications to superannuation designed to make it easier for people to grow retirement savings and create opportunities for those who are younger, older and low-income earners.

The updated legislation will affect who is required to be paid superannuation, the Super Guarantee (SG) rate and who needs to meet the work test for voluntary contributions. For individuals working casually or working part-time across multiple jobs, they currently may not receive any superannuation contributions at all from employment.

If you missed out on joining us this morning, you can watch our webinar here:

Thank you to everyone who attended, and click here for more events that may be of interest.

Contact us

If you would like help with your superannuation obligations or payroll needs, please reach out for assistance to your key SW advisor.

Expert Speakers

Sharon Burke

Partner, Business and Private Client Advisory

SW

Janelle McPhee

Associate Director, Business and Private Client Advisory

SW