Anti-Money Laundering & Counter Terrorism Financing (AML/CTF) reviews are currently in full swing, and the regulator is expected to step up proactive monitoring.

Following criticism and concern regarding Australia’s customer due diligence requirements, amendments to the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act) were passed by parliament in December 2020, and these came into force on 18 June 2021.

The changes bring Australia into compliance with the standards published by the Financial Action Task Force (FATF), an international, inter-governmental body which develops and monitors policies to combat money laundering and terrorist financing.

The Act empowers AUSTRAC, Australia’s AML regulator, with a range of measures to detect and deter money laundering and terrorism financing, including monitoring a reporting entity’s AML/CTF program, independent reviews and compliance reporting.

Through working with clients for over 20 years to streamline financial crime prevention processes and controls, our experts have a deep understanding of both the business structures of financial and other reporting institutions, and the regulatory compliance requirements that AUSTRAC will enforce.

What are the changes?

Several changes were made to improve collaboration and information sharing between agencies, increase due diligence obligations, streamline cross-border currency provisions, and in some areas reduce costs and regulatory burden.

Typically when conducting AML /CTF reviews we have helped organisations improve their AML/ CTF control framework in the following areas:

- Appropriate Know Your Customer (KYC) risk assessment processes

- Strengthening of gaps identified in the policy and procedure framework

- Automated controls around monitoring of suspicious transaction activity, and

- Effectiveness of sanctions and Politically Exposed Persons (PEPs) screening including processes in place to monitor Australian blacklists / watch lists.

How we can help?

Reporting entities, particularly ADIs and other financial institutions operating in Australia, must ensure the business has robust policies, procedures and controls in place through an AML/CTF Program to help it prevent, detect and report instances of money laundering and terrorism financing that might occur through the legitimate products and services the business offers.

The Program is required to be independently reviewed for compliance regularly.

- Is your AML/CTF Risk Assessment up to date and does it adequately identify your risks?

- Does your AML/CTF Program cover the updated requirements set out by the AML/CTF Act and Rules?

- Have you commissioned an independent review of your AML/CTF compliance in the last two years?

Contacts

Get in touch to talk to an expert about a specialist AML/CTF program review.

For further information see the AUSTRAC reforms guidance.

Grants of up to $50,000 are available to Victorian Primary Producers looking to modernise their production processes.

The Victorian Government is investing $10m into primary producers through the Digital Agriculture Investment Scheme. Farmers and agribusinesses can now apply for funding to invest in on-farm digital technologies to improve productivity, resilience and long-term viability.

Grant funding can be used to invest in hardware, software, network connectivity and cloud based applications to:

- Improve animal and/or crop health

- Track key assets with smart devices

- Improve business efficiency with novel technologies and farm management platforms

- Purchase satellite imaging and GPS tracking solutions

- Increase on-farm connectivity; and more.

Grants from $5,000 to $50,000 are available on a 50% co-funded basis, with the Victorian Government offering up to half the cost of eligible projects.

Who is eligible?

‘To be eligible, businesses must register a turnover greater than $50,000 from primary production activities in an average year, with consideration made for drought, extreme weather, and COVID-19 related downturn. Businesses must also be registered for GST and be specifically focused on Primary Production.

Please note that off-farm food processors, packers, cold storage facilities, government agencies, not-for-profits and industry associations are not eligible for the fund at this time.

Key dates

Grant funds will be allocated through a competitive application process, with applications assessed by Rural Finance and Agriculture Victoria.

Applications will be accepted until 31 October 2021, or when the funding allocation is exhausted. Given the competitive nature of the scheme we recommend applying well in advance of this date.

The Government Grants landscape is highly complex and competitive, with most programs being heavily over-subscribed.

How can SW help?

SW’s team of Agribusiness and Government Incentives professionals can assess your eligibility to the Digital Agriculture Investment Scheme and improve your chances of submitting a successful application.

Contacts

Get in touch with our team below to find out how you can access this opportunity!

AusTrade’s flagship Export Market Development Grant (EMDG) is transitioning from a retrospective reimbursement to an upfront grant agreement, providing greater certainty and support for businesses that look to expand to foreign markets.

The change will fundamentally alter how applications are made and managed, impacting every business that is currently accessing the scheme.

Key changes include:

- Transitioning to an up-front agreement model, with funding agreed in advance

- Introduction of funding ‘tiers’ for businesses at different stages of their export journey

- Life-time cap of $770,000 grant funds receivable per business through the EMDG program

- Reduction in the turnover cap for eligibility – Businesses must have a turnover of less than $20M to access the fund

What is the impact of this change?

Businesses that are currently accessing the EMDG scheme, or are looking to execute their export strategy in the coming years should be acting now to assess their eligibility for this revised EMDG program.

Prior to submitting an EMDG grant application for planned promotional expenditure, businesses will need to self-assess their eligibility to the updated program and determine which funding tier they should be applying to. Tiers include:

Tier 1: for eligible SMEs who are ready to begin exporting – grants of up to $40,000 per financial year for 2 years

Tier 2: for eligible exporters who plan to expand their exporting – grants of up to $80,000 per financial year for 3 years

Tier 3: for eligible exporters who plan to make a strategic shift in their export activities – grants of up to $150,000 per financial year for 3 years

Key dates

Eligible expenses incurred up to 30 June 2021 will be claimable under the existing scheme, with applications open from 1 July 2021 through to 30 November 2021.

Applications for ‘forward looking’ EMDG grants for the 2021-2022 year must be made between 16 August 2021 and 30 November 2021.

How can SW assist?

Applications for the revised EMDG scheme will initially run alongside the existing EMDG program, increasing the complexity for applicants once the program opens for applications.

The EMDG process is highly complex and rigorous, and never more so than this year! SW’s team of Government Incentives experts can assist you in determining your eligibility, produce high-quality funding applications and maximise your chance of funding success.

Get in touch

To learn more and find out how you can seize the opportunity, contact one of our experts below.

Thomas Demel

Australia has taken the lead with the UK, creating a free trade agreement (FTA), in what we see as a significant development to help those in the Agribusiness sector.

It’s great to see that Australia has taken the lead with the UK in what we see as a significant leap forward in helping those in the Agribusiness sector. The in principal FTA is seen as a major boost for Aussie farmers, providing an opportunity to diversify trade and vital for the success of the industry. It will provide instant and immediate access to tariff reductions across several areas including beef, sheep, sugars, dairy, rice and wine.

Even though there will be an instant duty-free quota available to farmers, the tariffs are expected to be phased out over the next 5-10 years. This will see continual benefit to the Australian economy and more importantly Australian farmers.

The Australian government scrapping the 88-day farm work requirement for UK visitors was expected to create a 10,000 person shortfall, however this has been addressed with both a new specialised Ag-Visa with the UK as well as an expected announcement of a new agriculture visa with 10 ASEAN countries, including Vietnam, Indonesia and Malaysia – which is designed to combat the growing work shortage and open the doors to Australian farms.

What this means for you?

If you are in the Agribusiness sector, you might be able to benefit from this FTA once it is finalised. Get in touch with one of our Agribusiness experts below today to see how you can take advantage of this opportunity for your business.

Contributors

Brent Sheers

Exporters are often uncertain about how to optimise their chances of getting paid. There are currency aspects to be aware of, and we include several tips to assist companies on their journey.

Australia is a major producer and exporter of natural resources and energy, food and agricultural commodities, education and tourism. We also export many other goods and services globally.

Regardless of what you are exporting, there are several aspects to understand and consider – from trade structuring to the currency in which your trade is denominated, to payment protections employed.

Let’s review some essential background knowledge and then provide some suggested tips.

Capital vs current account

A number of countries globally still have closed capital accounts, but open current accounts. It is important to distinguish the nature of a payment when addressing this issue.

Countries with a closed capital account and an open current account restrict capital payments and receipts (loan repayments, foreign investments, capital injections into a business etc), but allow current account payments such as international trade transactions supported by appropriate documentation. Capital payments and receipts in such countries generally require approval from a foreign exchange regulator.

Currency

Some currencies are restricted to domestic trading only, but remain hedgeable. An example, is the Chinese currency – known on the China mainland as Chinese yuan (CNY) and outside the mainland as CNH – the ‘H’ notionally stands for ‘Hong Kong’, but really means Chinese currency anywhere outside the mainland. CNH foreign exchange risk can be hedged by Chinese and global banks just the same as mainstream global currencies such as the USD, EUR, GBP, JPY and AUD.

Whilst it is generally easier for Australian businesses to structure their trade in Australian dollars (AUD) to remove any currency risk, naturally it is always easiest for a foreign importer to pay in their own currency and this can sometimes secure an exporter a better price, given the convenience for the importer of not having to manage foreign exchange risk.

Tips for successful export relationships

While many of our clients know to engage us to assist with establishment of their offshore operations, we also have clients engage us after they’ve learnt some hard lessons. As always, the key is to surround yourself with experienced advisors and do your homework on any proposed business partners.

1. Due diligence is even more important

Resist the temptation to be blinded by the size of the deal or the size of the market you are entering!

When a foreign company doing business offshore enters into a new business relationship, a common mistake is a failure to undertake the same due diligence as the company would do in their home country.

All countries have different laws, regulations and norms of doing business, so it’s important to engage local expertise and advisors who understand the market to undertake physical, online, regulatory and financial background checks on who you are dealing with prior to entering into new business arrangements.

In some countries an internet search in English won’t help you. Two key reasons:

- search engines such as Google are blocked in a number of foreign jurisdictions

- for non-English speaking countries, you need to conduct searches on local entities or individuals in the local language, rather than English, to get an optimal result.

The key here, is to do the same or more due diligence on your business partner offshore than you would at home. If you are experiencing hurdles, we can assist.

2. The right payment structures can assist

International trade is conducted based on a continuum of trust. If you don’t know who you are dealing with, put payment protection mechanisms in place with providers that you trust.

Think about how you structure your trade:

- currency used – offering your purchaser trade terms denominated in their local currency can potentially secure better pricing and enhance your chances of being paid in timely fashion. Banks can help to hedge foreign exchange risk for widely used currencies.

- payment terms – seek whole or part payment up front, or at least staggered payments that stay ahead of the value provided over the contract period to help mitigate your payment risk.

- consider the use of Letters of Credit (and consider who the counterparty bank providing the Letter of Credit is). This adds an additional layer of payment protection from your client’s bank.

- consider additional layers of protection – Letter of Credit confirmations, export credit insurance, standby letters of credit for services trade, bank performance guarantees if clear contractual performance criteria can be established and agreed. This adds an additional layer of payment protection from either your client’s bank, or your bank.

- Importing and exporting? If you have incomings and outgoings in the same foreign currency, consider creating a natural hedge by opening a foreign currency account, thereby obviating the need for currency conversion.

3. Dig deeper on debtor payment issues

If you’re experiencing debtor payment problems, understand clearly the reason why you aren’t getting paid:

- is the counterparty not creditworthy?

- does the counterparty have cashflow problems that are ‘point in time’, meaning they can pay you later?

- is your documentation incorrect? In some countries, local laws won’t allow the counterparties you are dealing with to pay you if you have not provided the correct supporting documents

- have you invoiced in AUD or USD, and the business you are contracting with can’t buy or remit foreign currency?

Your bank can assist you to ensure your trade documentation efficacy, with opening foreign currency accounts and with other foreign exchange hedging mechanisms.

4. Do what the big exporters do

Sometimes businesses think that the nature of the product they are exporting – perishable versus non-perishable – impacts the mechanisms that can be utilised to assist secure payment. This is incorrect.

Further, structuring of the trade payment security mechanisms of physical goods export activity should be no different for a smaller business than those utilised by the world’s biggest exporters, regardless of product type.

Where it is not feasible to seek payment up front, there are three ways that the world’s biggest exporters try to ‘guarantee’ payment for their exports to countries where payment certainty is more challenging:

- Primary payment obligation rests with the importing party

- Letter of Credit (bank guarantee of payment) issued in their favour – you’ll want this from one of the major international or local banks

- ‘Confirmation’ on the Letter of Credit from one of their trade panel banks, or their house bank. This effectively substitutes the credit rating of their trade panel or house bank for the credit rating of the purchaser’s bank. In essence, in this example, it’s saying that if the importer doesn’t pay and the purchaser’s bank doesn’t pay, then the exporter’s bank must pay – if the trade documentation is correct.

Client situations

Our client has been exporting to China for many years and has established client relationships in a number of different provinces. Unfortunately, one of those clients recently refused to honour their payment obligation on a regular invoice, and short paid our client by a significant amount.

Due to the longstanding relationship, the additional layers of payment protection described above were not in place and the client runs the risk of being unable to recover payment, or at the very least going through a lengthy and challenging litigation process. We are supporting the business in recovery of the unpaid amount, but the situation could have been avoided if payment protection mechanisms were put in place.

Separately, another client has a sizeable business in Asia and we recently enquired how they structure their trade to ensure payment. Their response was that 80% of their receivables are received via advance payment, which is of course fantastic. We asked about the remaining 20% and their response was that these receivables were supported by Letters of Credit from small provincial local banks.

While utilising Letters of Credit is excellent, the lack of strength, international standing and reputation of the banks used is potentially problematic. There is a higher payment risk under the secondary payment mechanism from the bank, if the primary obligor does not pay. We advised the client that this risk can be mitigated to a considerable extent by requesting their clients provide Letters of Credit from major international or local banks, which they have now incorporated into their credit processes.

While each business situation can be as different as the product or service it provides, our professionals and extended network across many parts of the world are highly knowledgeable in assisting clients structure their trade dealings to support and protect their long-term success.

Get in touch

Toby Graham

From 1 July 2021, the Victorian Government Purchasing Board (VGPB) will require more Government agencies to meet its procurement requirements. Government agencies will have until 30 June 2022 to be compliant.

Agencies will need to align with the VGPB policies by 30 June 2022. It’s imperative that agencies review their compliance immediately to address any discrepancies between their current procurement policies and the VGPB policies and procedures prior to the deadline.

Who do the VGPB policies now apply to?

The VGPB’s goods and services policies apply to:

- departments and specified entities including VGPB expansion agencies from 1 July 2021

- Victoria Public Sector Commission

- offices or bodies specified in section 16(1) of the Public Administration Act 2004, and

- Administrative Offices established in relation to a department under section 11(a) of the Public Administration Act 2004.

A full list of the departments, agencies and VGPB expansion agencies who these changes will impact is available on the Buying For Victoria website.

Key next step: Gap analysis

A gap analysis and action plan is necessary to understand and develop key processes for adoption of the VGPB requirements. The VGPB requirements are seen as best practice procurement, not just for government agencies, but across all sectors.

Common gaps in procurement frameworks

SW has extensive experience in undertaking procurement reviews as internal auditors, probity auditors and advisors to assist clients to comply and ensure best practice. Through this work, common gaps that have been identified include:

- inadequate policies and associated procedures to support consistency and hence demonstrate compliance

- lack of checklists to facilitate compliance and monitoring

- a lack of training and awareness on the what and why of the compliance requirements, and

- tendering processes lacking adequate evidence gathering and recordkeeping to support a probity audit and/or compliance.

How SW can assist

Contact one of our experts below to discuss how the changes to the VGPB may affect your procurement requirements.

We can:

- conduct a gap analysis

- assist you to design/amend policies, procedures and templates to address the gaps

- develop and deliver the required training and awareness programs

- assist to embed the policies and procedures, and

- develop monitoring procedures (including data analytics and software based checklists).

Don’t get caught out last minute!

Get in touch

The Superannuation Guarantee (SG) rate will increase to 10% from 1 July 2021 under the Superannuation Guarantee (Administration) Act 1992 (Cth) (SGAA) and will rise by 0.5% per year until it reaches 12% by FY 2025.

Employers need to start planning now for the change in the superannuation contributions.

Total remuneration package

Where employees are structured on a total remuneration model, employers will need to communicate to staff before 1 July 2021 that their cash salary will decrease to give them time to plan for the change.

For example, if an employee is currently on a total remuneration package of $150,000 (excluding any allowances and non-cash benefits), the current split is:

- Cash gross wages – $136,987

- Super – $13,013

Where the remuneration package is unaltered from 1 July 2021, the split will be amended as follows:

- Cash gross wages – $136,364

- Super – $13,633

Based on the example, the employee will have a reduction in cash gross salary of $623 per annum or $52 per month.

To avoid negative impact to employees, it may be an opportune time to complete salary reviews before 30 June 2021 to ensure the pay increments at least cover the hit to the employee’s cash salary component, provided the business can support the cost and cashflow.

Gross salary plus super

Employees who are packaged on a gross salary plus super arrangement will have no impact on their cash salary, although employers need to factor in the additional wages cost for the superannuation increment of 0.5%. This will mean the total wages costs will increase for other on-costs such as payroll tax, WorkCover.

Maximum Contribution Base (MCB)

The minimum SG superannuation contribution of 10% from 1 July 2021 is also capped to the MCB. The MCB will increase to $58,920 per quarter (FY 2021 $57,090 per quarter). This means the maximum superannuation contribution for an employee earnings more than $235,680 will be $23,568, ($58,920 x 4 = $235,680 x 10%). An employee’s contribution will be limited to the MCB of $23,568 unless the employer chooses to override the MCB cap.

The concessional superannuation cap will also increase from $25,000 to $27,500 for contributions received in FY 2022. This is the first increase in the concessional cap since FY 2017. The concessional superannuation cap covers both employer contributions (including salary sacrificed contributions) and personal contributions claimed as a tax deduction by the member.

How SW can assist

Contact one of our experts below to discuss how the changes to the SG rate may affect your business’ superannuation contributions.

Get in touch

Janelle McPhee

The Chinese Tax Authorities have announced that the VAT concessions advised as part of the response to the COVID-19 pandemic will be ending on 31 March 2021.

Further to the article below we have been advised that the latest interpretation by a number of local Chinese tax authorities is that:

“Chinese VAT will not apply to fees charged to Chinese students that are studying Australian university courses on-line in China as a result of not being able to travel to Australia as a result of COVID-19”.

We will continue to monitor the announcements and regulations put out by the Chinese Tax Authorities to see if they put out an official pronunciation on this particular topic.

Should you require any further details please reach out to one of our experts at the bottom of this article.

2021-03-30

VAT concessions to end 31 March 2021

This announcement will mean that from 1 April 2021, Chinese students studying Australian university courses remotely in China will be required to withhold a combined 6.72% of VAT and local charges on any payments to Australian universities.

International students have historically travelled to Australia to study. However, as a result of border closures due to COVID-19, many international students who have not been able to study in Australia have continued to undertake their study in their home country.

In response to the pandemic, China had provided a number of tax exemptions. One of these exemptions covered an exemption of VAT for students studying remotely until 31 December 2020. The Chinese Tax Authorities had verbally advised that this exemption would be extended. However, the Chinese Tax Authorities have now advised that this exemption will now cease from 31 March 2021. Therefore, from 1 April 2021, Chinese students studying Australian university courses remotely in China will be required to withhold 6.72% VAT and local charges on any payments to Australian universities.

Our initial understanding is that the rules should apply on a cash basis. Therefore, as most international students should have paid their annual course fees by the 31 March 2021 census date these fees should not be subject to the combined 6.72% VAT and local charges. However, any fees for courses undertaken after 31 March 2021 will be subject to the 6.72% VAT and local charges.

Actions for Australian universities

Should Australian universities be increasing fees to Chinese students to cover the 6.72% VAT and local charges?

To assist Chinese students to comply with these withholding obligations, Australian universities could appoint a withholding agent responsible for making payments. Any university that wishes to explore this should get in touch with us.

Get in touch

ShineWing Australia can assist with the compliance of withholding obligations and any advice regarding the ending of these VAT concessions.

Reach out to one of our experts below to find out more.

Contacts

| Stephen O’Flynn |

| Steve Allan |

| Aidi Zhong |

The Australian Taxation Office released draft Practical Compliance Guideline 2021/D4 on 19 May 2021 (Draft PCG), outlining how international arrangements connected with the development, enhancement, maintenance, protection, and exploitation (DEMPE) of intangible assets and/or migration of intangible assets (Intangibles Arrangements) will be assessed.

Intangibles Arrangements is the long-awaited and last tranche of ATO’s focus areas following the revision of OECD Transfer Pricing Guidelines in 2017.

The Draft PCG discusses ATO’s risk assessment framework on Intangibles Arrangements based on the risk factors described as High, Medium, or Low.

| Focus area | High risk | Medium risk | Low risk |

|---|---|---|---|

| Documentation and evidence of commercial considerations and associated decision making, availability of alternative arrangement, and financial benefits | Not available | Available, but no incomplete | Available and complete |

| Form of Intangibles Arrangements, consistency with its substance, and related payments | No legal documents available Inconsistency between legal documents and actual conditions No justification for payments | Available but incomplete legal documents, consistency with actual condition, and payments | Complete information |

| Identification of intangible assets and connected DEMPE activities, and whether the entity performing DEMPE activities has the capability, financial capacity and/or assets to do so in substance | No information of intangible assets, DEMPE activities and the entity | Incomplete information | Complete information |

| Documentation and evidence of tax and profit outcomes | No information whether the economic outcomes and benefits align with DEMPE activities Inconsistency between tax and profit outcomes with the commercial economic substance of Intangibles Arrangements Inconsistency between characterisation and quantum of Intangibles Arrangements and the anticipated tax and non-tax benefits | Incomplete information | Complete information |

The following examples have been adapted from the PCG, and illustrate the application of these risk factors.

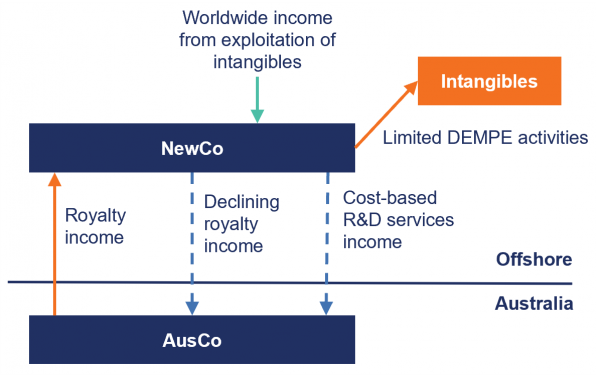

High-risk example 1: Centralisation of intangible assets

Facts:

- AusCo owns, manages and controls DEMPE activities of the group’s intangible assets

- AusCo and the global group decide to transfer these intangible assets from AusCo to be centralised in a new foreign entity, NewCo

- NewCo will receive worldwide royalty income from the rights to exploit the Existing Intangibles and any New Intangibles developed, while AusCo receives a declining royalty from NewCo associated with the exploiting the Existing Intangibles

- AusCo continues to undertake majority of DEMPE activities while receiving a cost-based remuneration under the R&D service agreement. NewCo hires additional staff and acquires additional assets, but these are not sufficient to allow NewCo to wholly manage, perform and control the DEMPE activities for the intangibles.

The above arrangement is regarded as a High-Risk Intangibles Arrangement because:

- There is a risk that this arrangement is not commercially rational for AusCo and may not be consistent with AusCo’s best economic interests having regard to the commercial options realistically available, disregarding potential tax impacts. The risk is emphasised when no documentation is available to substantiate the decision making or potential tax impacts that were taken into account

- AusCo has not been properly remunerated for the DEMPE activities it performs

- In the absence of this arrangement, AusCo would continue to own and derive income from the intangibles. AusCo would not need to pay royalties to NewCo.

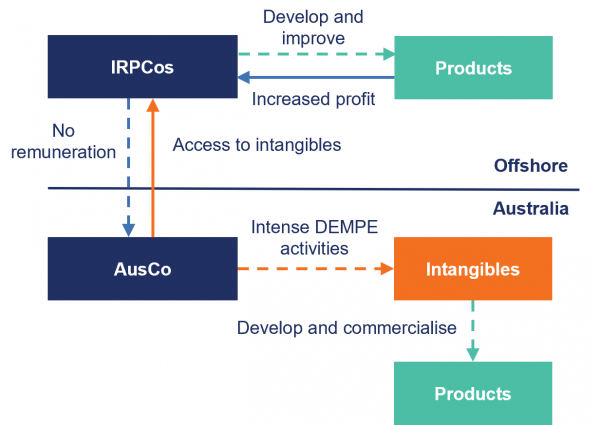

High-risk example 2: Non-recognition of Australian intangible assets and DEMPE activities

Facts:

- AusCo owns trademarks connected to products and services exclusively distributed in Australia. AusCo manages, performs and controls DEMPE activities and assumes associated risk of the intangibles

- AusCo’s DEMPE activities increase in intensity, resulting in new intangible assets. AusCo does not account for these in its financial statements or register them for legal protection. Likewise, AusCo’s global group does not maintain a comprehensive contemporaneous R&D or intellectual property policy or other relevant guidelines

- AusCo’s international related parties (IRPCos) are granted access to the new intangible assets to improve their products and services. No documentation is available for this arrangement

- The profitability of IRPCos increases as a result of accessing and exploiting the new intangibles and the DEMPE activities performed by AusCo

- AusCo does not receive any compensation for the intangibles.

The above arrangement is regarded as a High-Risk Intangibles Arrangement because:

- The absence of legal agreements may impede AusCo’s ability to protect its interests of the intangibles

- The lack of compensation for the use of the intangibles may be inconsistent with arrangements expected between independent parties.

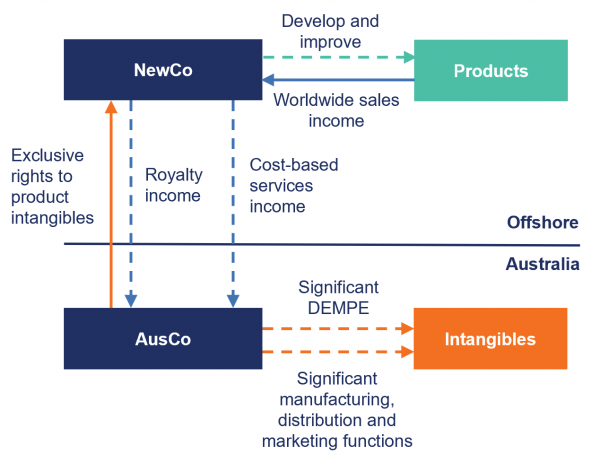

High-risk example 3: Migration of pre-commercialised intangible assets

Facts:

- AusCo undertakes years of R&D in Australia to develop a new product range, which results in the development of pre-commercialised intangible assets. The intangibles are owned by AusCo and are strategically important to the business

- Prior to the commercialisation of the intangibles, AusCo and the global group decide to incorporate a new offshore entity, NewCo, to own the rights to the intangibles. NewCo does not have sufficient assets to undertake DEMPE activities while AusCo has the capability and capacity to develop, manufacture and commercialise products associated with the intangibles. No documentation is available to substantiate the commercial rationales underpinning this decision or consideration of potential tax impacts

- AusCo and NewCo enter into a license agreement, which transfer the effective control of the intangibles from AusCo to NewCo. All the worldwide income that will be received from the global commercial sales of the related products will be derived by NewCo. NewCo pays ongoing royalties to AusCo in relation to worldwide sales of related products. No documentation is available to substantiate the arm’s length nature of the pricing or terms of this arrangement

- NewCo enters into a service agreement with AusCo where AusCo agrees to provide services for the development, manufacture, and distribution of the new products for a cost-based remuneration. No documentation is available to substantiate the arm’s length nature of the pricing or terms of this arrangement

- After the transfer, AusCo continues to employ specialised staff and uses its expertise and assets to manage, perform and control DEMPE activities associated with the intangibles. In the meantime, NewCo has limited relevantly qualified staff and manages and performs limited activities, owns limited assets, and assumes limited risks in connection with the intangibles

- AusCo employs specialised staff and uses its expertise and assets to manufacture and sell related products to the global market under the service agreements while it only receives cost-based remuneration. NewCo continues to have limited qualified staff, manages, and performs limited activities, and assumes limited risks in connection with the manufacture, distribution and marketing of related products while it derives worldwide income from the sale of related products

The above arrangement is regarded as a High-Risk Intangibles Arrangement because:

- There is a risk that AusCo’s entry in the license agreement and service agreement is inconsistent with comparable arrangements expected between independent parties. The risk is emphasised when no documentation is available to substantiate its decision making or potential tax impacts that were taken into account

- AusCo does not require NewCo as a partner to develop or commercialise the intangibles as it had the capability, expertise and capacity to do so

- The transfer results in AusCo not being able to derive worldwide income from the sale of related products

- NewCo did not have the capability or capacity to manage and be responsible for the rights and obligations it had under the Licence Agreement in connection with the Product Intangibles and the New Products which were instead, in substance, controlled and managed by AusCo.

Key takeaways

While the Draft PCG provides a detailed framework intended to facilitate taxpayers’ self-assessment of risks associated with related party intangible arrangements, the framework lacks quantitative risk indicators (as opposed to other PCGs). The framework reflects a move away from the traditional focus on legal ownership of intangibles to where the DEMPE activities are performed and the entity able to bear the risks associated with those activities.

In documenting where the DEMPE functions are performed, multinationals should have regard to commercial evidence (i.e. internal reviews / board presentations / briefing materials) associated with intangible arrangements, which may not be reflected in conventional transfer pricing documentation.

It is noteworthy that self-assessment of Intangible Arrangements are required for taxpayers who complete a Reportable Tax Position (RTP) schedule (i.e. Part of Category C disclosures).

The level of uncertainty resulting from transfer pricing disputes involving Intangibles Arrangements could be significant. Taxpayers should take prompt actions to thoroughly assess their material Intangibles Arrangements.

How SW can assist

Contact one of our experts below to discuss how the Draft PCG affects your Intangible Arrangements.

Get in touch

The Australian Government commenced the Payment Times Reporting Scheme on 1 January 2021 with the aim to improve payment times for Australian small businesses.

Large businesses (annual income $100m+) need to report their small business (<$10m annual turnover) payment terms and times. The regulator is the Department of Industry, Science, Energy and Resources and the first Payment Times Reports are required from 1 July 2021, with lodgement due by 30 September 2021.

Application

The scheme applies to businesses that:

- are ‘constitutionally-covered’ (could include private/public companies, trusts, partnerships, joint ventures, sole traders, etc.)

- carry on an enterprise in Australia

- meet the income threshold of over $100 million in total annual income, or

- have a total annual income greater than $10 million and that are members of a group headed by a controlling corporation with a combined total income greater than $100 million.

Key requirements

Reporting entities must lodge a Payment Times Report within 3 months of the end of each 6-month reporting period. For entities with June and December year ends, reporting commences in respect of the six-month period starting 1 January 2021 with the first report to be submitted by 30 September 2021.

The Payment times report template is available at the Payment Times Reporting Portal. Reports will be published to the Payment Times Reports Register (available for public access).

A Payment Times Report must comply with requirements relating to its preparation, content and approval and includes information such as:

- The proportion, determined by total number and total value, of small business invoices paid by the entity during the reporting period in each of the following:

- within 20 days after the issue day (ie the date when the invoice was received)

- 21-30 days after the issue day, or

- 31-60 days after the issue day .etc.

How SW can assist

Contact one of our experts below to discuss how the Payment Times Reporting Scheme affects your business reporting requirements.

Get in touch

| Kerry McGoldrick |

| Sharon Burke |