Like most other technology, a great deal has changed over the 10 years that I’ve been working with cloud accounting software – ease of use and set-up, breadth and speed of real-time financial visibility, and most significant of all, cost.

During this time, I’ve specialised in migration and software adoption, guiding and assisting dozens of clients on the latest and most reliable software stack for their specific needs. We are assisting with the internal processes to see you operating in a totally paperless office, achieving maximum efficiency and automation, and having real time visibility and data that many talk of, but rarely have.

The majority of junior explorers we speak with look for software with a solid market reputation that’s easy to use and familiar to most bookkeepers and accountants. We often see MYOB or Reckon as the likely preferred platforms followed by Pronto for those that have really reached production phases. More recently the likes of Xero and QuickBooks Online have become more prevalent themselves.

Reporting processes

Companies in the junior explorer or small cap mining space need to be aware of additional reporting requirements including to the Department of Mines, preparation of quarterly Cash Flow Statements, consolidation of subsidiaries and dealing with Joint Venture arrangements. These all require the assistance of our favourite tool in Excel, and an adept financial operator to pull together.

This process requires manual effort and processing at every turn as well as regular duplication. Most of these platforms do not give you the layers of reporting to breakdown your data as required on demand.

In this space, we very regularly see shortfalls in operational efficiencies and are charging ourselves with the responsibility to bring this to life for junior exploration companies.

The Solution

Get your processes in the Cloud. We would recommend migrating to Xero and utilising it’s open API and multitude of direct partner integrations to fulfil the various requirements.

We have identified the ideal software stack on page three of the download below and the processes to automate and streamline the entire end-to-end financial, accounting and taxation processes of your business.

We cover all critical items including:

- Mobile app processing of timesheets for geologists and contractors, giving you real time project/tenement based costings

- Streamlined and automated processing of all accounts payable, expense claims and credit card expenditure, including real time tenement allocations

- Paperless, expense and payroll approvals, based on projects, tenements – any approval you want

- Build in fixed asset register for automated monthly depreciation

- Automated and templated Cash Flow Statements for your Appendix 5B, costings for the Department of Mines, Annual Tenement Expenditure reports, etc.

- Online BAS lodgement within the accounting software

- Direct link of mapped Chart of Accounts to Income Tax software that provides tax deferred journal entries and tax return preparation

- Live dashboards in Power BI to be customised and married with your geological data

- Rolling 3 way financial forecasts and budget monitoring

- Consolidated financial reporting for Joint Venture arrangements and subsidiaries – in any currency

The Cost

The software subscription costs detailed in the download below would typically equate to $150 to $300 per month. A no-brainer isn’t it?

* We also capture the notoriously difficult aspect of statutory reporting through cloud-based software for interim and annual reporting and streamline this process. Please reach out if you would like to explore this to facilitate an easier statutory reporting framework.

Contact us

Get in touch via our experts below to discuss how we can help streamline your business.

| Rick Hemphill |

| Blayney Morgan |

The Australian Taxation Office (ATO) has reporting obligations in place affecting those who offer employee share schemes. Find out how our ATO-approved software can simplify your reporting obligations.

ATO reporting obligations

The Australian Taxation Office (ATO) have reporting obligations in place, affecting those who offer shares or share options to their employees. The deadlines to comply with the reporting requirements are:

- ESS statements are due to be issued to employees by 14 July 2021

- ATO reports are due for lodgement with ATO by 14 August 2021.

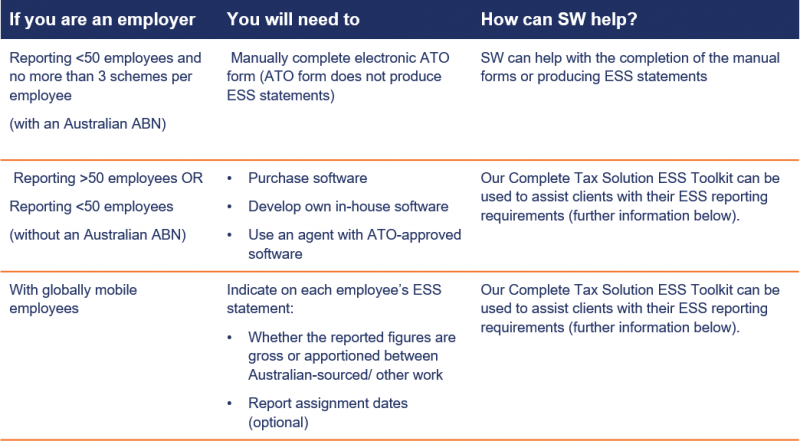

What do the ATO reporting obligations mean for you?

The change to the cessation of employment taxing point announced in the Federal Budget will apply to ESS interests issued on or after 1 July following Royal Assent. Therefore, this change will not impact prior year ESS interests.

Innovation solution

SW has developed compliant software that has been approved by the ATO to enable employers to simplify their online annual employee share scheme reporting obligations.

We have developed the ‘Complete Tax Solutions Employee Share Scheme’ Toolkit (CTS ESS Toolkit) which can help you meet the ATO’s ESS reporting requirements. SW is one of only a handful or providers to have passed ATO testing and we have ATO approval for the software.

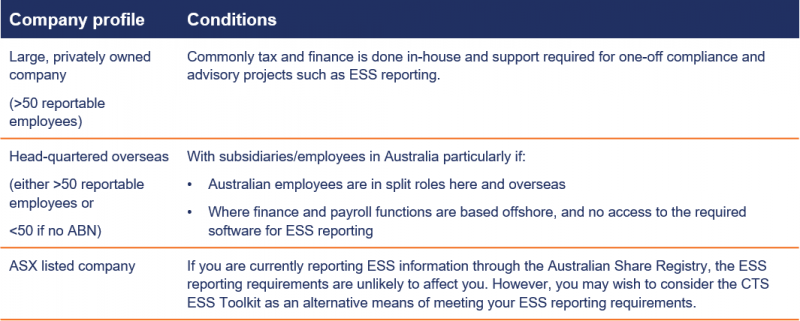

The table below outlines the types of companies that are most likely to benefit from using the CTS ESS Toolkit.

Next steps

Time is limited to make the necessary arrangements to comply with the ESS reporting requirements. The ATO is particularly keen to ensure corporates are compliant and providing timely and accurate reporting.

Now is the time to ensure your business is not left behind and you have everything in place ready for reporting season. We can provide a fully outsourced service or license our software; whichever you prefer.

If you would like to discuss how to comply with the ATO reporting requirements, or learn more about how our ESS Toolkit will help you, please contact either Sam Morris or Justin Batticciotto on the details below.

Get in touch

| Sam Morris |

| Justin Batticciotto |

Last night Treasurer Josh Frydenberg delivered the 2021 Federal Budget which was an extension of October’s 2020 COVID-recovery Budget, and focused on job creation and spending for individuals, in the wake of the pandemic.

With an election looming, the conservative Budget included few surprises, continuing to give support to some key industries (but not all), that have been most significantly impacted by the economic downturn.

Did you miss out or do you want to watch the Budget Breakfast again? The full recording is now available to you online and free of charge to watch whenever suits you.

Federal Budget 2021/22 Mandarin Overview

Watch our Mandarin team give us a review of what took center stage in this year’s Budget.

Fast Facts

Our Fast Facts take a look at what took centre stage in the Federal Budget in areas of personal, business and industry support.

SPIC Pacific Hydro Pty Ltd v Chief Commissioner of State Revenue was a decision of a single judge of the Supreme Court (Payne JA) handed down on 21 April 2021.

The case involved the acquisition by SPIC on 12 May 2016 of the shares and units in the entities operating the Taralga Wind Farm. The case involved an assessment under the landholder provisions of the NSW Duties Act applicable at the relevant time. These have now been amended although the case remains relevant to some issues under the current NSW provisions as well as the landholder provisions of other States.

Taralga was an operating wind farm with leases of approximately 25 years. Taralga as the tenant had installed wind turbine generators (WTGs) and associated infrastructure such as roads, hardstands, met masts, and control and switching stations. The tenant had a right to remove the plant & equipment at any time and an obligation to remove the WTGs and restore the land at the end of the term under the terms of the leases.

The Court considered 5 issues:

Issue 1

What, if any, of the plant and equipment installed on the leased land is a fixture?

Issue 2

To the extent that any plant and equipment installed on the leased land is a fixture, to what, if any, interest in land did this give rise on the part of the Holdco Land Trust (through its linked entities)?

Issue 3

Having regard to the answers to issues 1 and 2, was the Holdco Land Trust a “landholder” for the purposes of the relevant provisions of the Duties Act?

Issue 4

How are any interests in land on account of fixtures to be valued?

Issue 5

Is the power under s 163G of the Duties Act available and, if so, should it be exercised?

1. Were the plant & equipment a fixture

The Court found that the WTGs and most other installations were fixtures due to the degree of annexation and the expectation that the WTGs and associated equipment would likely remain in place for their effective useful life.

SPIC argued that the WTGs were “strongly affixed to the land” because otherwise they would fall over. Therefore, the affixation was for the better use of the WTGs as chattels. Payne JA concluded:

116: I find that every item was fixed in place on the land for the better enjoyment by the tenant of the land as an integrated wind farm operated on the land. The Wind Farm was purpose-built after an extensive (18-year) wind study of the area establishing its suitability as a wind farm. The location of the WTGs was selected based on this wind assessment. A characteristic of the land was that 80 metres above the land the wind blew at a speed conducive to the operation of a wind farm.

123: I find that the function served by the annexation of the items was the use of the land as a wind farm. The wind turbine generators need to be upright and 80 metres high in order to capture the wind. Hence, the concrete foundations are significant and the turbines are secured to those foundations so that they may stand and function upright safely and efficiently to capture the wind. The function of the annexation of each of the eight met masts (through guy wires and the connection of the masts to the ground by concrete) is to have the masts upright at the same height as the turbines so that wind and weather conditions can be monitored.

The Court’s conclusion is very much one of characterisation where different courts may take different approaches. The answer depends upon whether a court focuses on the use of the land as an integrated wind farm or the use of the WTG as an asset that generates electricity with the use of the land being incidental. The judge may have equally concluded ‘… the function served by the annexation of the items was the use of the WTG to generate electricity.’

The judge considered the right and obligation to remove the plant and equipment at the end of the term was a factor but was not determinative.

120: The rights and obligations in the leases no doubt demonstrate that the parties to the leases have turned their minds to the question of rights of severance, ultimately to ensure that ownership of the plant and equipment to be installed on the property throughout the term of the lease will revert to the tenant upon severance and to the obligations of the tenant to remediate the land at the end of the lease. Those rights and obligations are relevant to, but not determinative of, the purpose of the affixation of the plant and equipment to the land. If those rights and obligations were determinative, there would be no need for the doctrine of tenant’s fixtures. As I have said, I am bound to conclude that the intention of the party making the improvement ultimately to remove it from the land, will not, by any means, be a controlling fact.

121: I am not satisfied that, no matter how firmly relevant plant and equipment is affixed to the land and regardless of the objective purpose of the affixation, a requirement for remediation at the conclusion of commercial and industrial undertakings means that plant and equipment affixed to land is therefore not a fixture.

In coming to this conclusion the judge distinguished a series of Victorian cases: Commissioner of State Revenue v Uniqema Pty Ltd [2004] VSCA 82; Vopak Terminals Australia Pty Ltd v Commissioner of State Revenue (2004) 12 VR 351 and AWF Prop Co 2 Pty Ltd v Ararat Rural City Council [2020] VSC 853. AWF Prop Co 2 involved another wind farm where the court considered the tenant’s rights and obligations to remove the wind turbines at the end of the lease led to the conclusion that the plant and equipment had not become a fixture.

However, the Victorian cases may be influenced by the existence of section 154A of the Property Law Act 1958 (Vic). Uniqema and Vopak determined that the effect of that section is that tenant’s installations retain their character as a chattel, and do not become a fixture. The SPIC Pacific Hydro case therefore has limited application to Victorian matters.

2. Taralga’s interest in the fixtures

The Court found that the WTGs and associated plant and equipment were tenant’s fixtures. The roads and below ground structures (wiring, hardstands) had become landlord’s fixtures as there was no intention of removing these.

Nevertheless, legal title to the fixtures vested in the landlord, not Taralga until Taralga exercised its rights to sever and remove the asset at the end of the lease.

This is consistent with the High Court decision in TEC Desert Pty Ltd v Commissioner of State Revenue (2010) 241 CLR 576.

Payne JA quoted the High Court decision in Tec Desert:

78: The Court in TEC Desert (HCA) quoted C Harpum, S Bridge and M Dixon, Megarry & Wade The Law of Real Property (7th ed, 2008, Sweet & Maxwell) at p 1072 [23-010] to this effect:

“Prima facie, all fixtures attached by the tenant are ‘landlord’s fixtures’, i.e. must be left for the landlord at the end of the lease. But important exceptions to this rule have arisen, and fixtures which can be removed under these exceptions are known as ‘tenant’s fixtures’. This expression must not be allowed to obscure the fact that the legal title to the fixture is in the landlord until the tenant chooses to exercise his power and sever it. The tenant may do so only during the tenancy or (except in cases of forfeiture or surrender) within such reasonable time thereafter as may properly be attributed to his lawful possession qua tenant.” (Footnotes omitted.)

The Commissioner submitted that a tenant has a separate equitable interest in the tenant’s fixtures as well as a legal interest created by the lease. Payne JA rejected that there was any separate equitable interest, the tenant’s only interest in land was its rights under the lease.

These issues were intertwined, but effectively revolved around how the interest as tenant under the lease was to be valued.

The Court accepted the approach of one of the valuers (Mr Thomas) involving the following steps:

- Having regard to the unencumbered value of the plant and equipment as at the date of the Acquisition, Mr Thomas estimated what it would cost to rent that plant and equipment each year. By comparing this to the much lower actual rental paid under the leases each year, he determined the per annum value of the right to use the plant and equipment during the term of the leases

- Mr Thomas then calculated this value to the tenant over the unexpired term of the leases at the time of the Acquisition, discounted to “present” value as at the date of the Acquisition

- He then deducted from this the expected costs to the tenant to remediate the site, again discounted to present value as at the date of the Acquisition.

On the facts of the matter, the Court rejected the discount rate adopted by SPIC’s valuer and adopted a valuation closer to the Commissioner’s assessment. Nevertheless, the approach taken to valuing the lease, including the right of use of the plant and equipment during the term of the lease, was correct.

As the value of the leasehold interest was above $2m, Taralga was a landholder.

In light of the conclusions above, the plant and equipment were not ‘goods’ and therefore sec 163G was not applicable.

Get in touch

Please contact your SW advisor or one of our experts below should you have any questions.

Contacts

| Stephen O’Flynn |

| Matt Birrell |

| Rob Parker |

Reminder: 30 June 2021 deadline to nominate beneficiary for discretionary trusts holding South Australian land acquired pre-16 October 2019.

As part of the measures introduced in The Land Tax (Miscellaneous) Amendment Act 2019 (Amending Act), surcharge rates (0.5% higher than marginal rates applied to non-trusts holdings) of land tax will be imposed on certain types of trusts including discretionary, fixed and unit trusts commencing from 1 July 2020.

However, Trustees of discretionary trusts holding land acquired on or before 16 October 2019, have the option to continue accessing the lower general rates of land tax. This can be done by nominating a natural person beneficiary as the owner for land tax purposes. The deadline to nominate ends on 30 June 2021. There will be no option to nominate after this deadline and discretionary trusts without a nominated beneficiary will be subject to the surcharge rates.

If the designated beneficiary owns other land, the land will be assessed in their ownership along with any other interests in land that they own. Consideration will therefore need to be given as to whether to nominate a beneficiary and, if so, which beneficiary. Once made, the nomination can only be changed in very limited circumstances.

Land acquired after 16 October 2019 by a discretionary trust will be assessed at the higher trust land tax rates. There is no exception to this, even if the trustee nominates a beneficiary for other land acquired by the trust prior to 16 October 2019.

Trust notification requirements

A reminder that any person holding land as a trustee as at 30 June 2020 was required to notify Revenue SA by 31 July 2020 of the land owned on trust.

For land acquired after 1 July 2020, you must notify Revenue SA within one month of acquiring any land on trust.

Aggregation of land

Another significant impact from the Amending Act is the aggregation of land holdings by companies and individuals.

Nomination of beneficiaries – Fixed and unit trusts

Trustees of fixed and unit trust also have an option to notify the Commissioner of State Taxation of the unitholders or beneficiaries, resulting in each unit holder being deemed the owner for the purpose of the Amending Act and taxed at normal tax rates accordingly on their proportion of the subject land.

This nomination can be made at any time and will be effective for the current and future financial years unless revoked.

How SW can help

If you own land in South Australia through a trust structure and or need assistance navigating these amendments, reach out to your SW contact our property experts below for assistance.

Contacts

| Abi Chellapen |

| Rob Parker |

| Sejlla Kadric |

| Jae Debrincat |

The University of Melbourne has successfully argued that land tax is not payable with respect to land, situated on campus, that is leased to a student accommodation provider.

Background

The University of Melbourne (the University) entered into a number of agreements including the Project Deed, an agreement for lease, and an operator’s side deed between the University, CLV (Melbourne) Pty Ltd (CLVM) and Campus Living Villages Pty Ltd (Campus Living) for the purpose of providing student accommodation. The Project Deed included the University’s objectives which included:

- To obtain good quality, well located, secure and competitively priced facilities that meet students’ reasonable expectations

- To facilitate a good quality contemporary student residential living and learning community which contributes materially to a developing University community spirit, with an appropriate level of Residents’ support services and integrating with services to and opportunities for University students by and at the University

- For the continuing ability of the University to ensure appropriate standards and requirements are met, for example, with respect to amenities, Residents’ support services, security and renal levels but with no day-to-day management obligations.

There were requirements included in the Project Deed:

- Specific support services had to be provided to residents

- The accommodation was to be provided to students in preference to the general public

- The fees were inclusive of most of the costs of the ‘Residential Life Program’ provided by CLVM to encourage residents to participate in life at the Student Village

- There was an affordability criterion of 90% below market rental underpinning the rent charged by CVLM to residents of the Student Village

- The University was entitled to survey students regarding the accommodation.

The Law

Section 74 of the Land Tax Act 2005 provides a land tax exemption for land “if it is used by a charitable institution exclusively for charitable purposes”.

The applicability of this exemption turns on the proper interpretation of the words ‘used’ and ‘exclusively’. The Commissioner argued the land had to be used exclusively by the charitable institution. The taxpayer argued that the word exclusively was linked to the charitable purposes of the charitable institution. That is, it is the charitable purpose of the charitable entity that is relevant, not any business purpose of a third party leasing or occupying the land.

Key findings in judgement

The text of Section 74 alone points to a wider meaning of ‘use’ than the active physical use of the land by the lessee, as was held in Ryde Municipal Council v Macquarie University (the Ryde Case) and Chief Commissioner of State Revenue v Metricon (Qld) Pty Ltd.

The manner in which the provision is drafted points to an interpretation of ‘exclusively’ which is linked to the purposes of the charitable institution. The history of the provision and its predecessors indicated that the University used the land exclusively for its charitable purposes, even though it was leased to a commercial operator. The University furthered its objects through the arrangement as it actively promoted the provision of a quality contemporary student residential living and learning community. Whilst the University’s provision of student accommodation was indirect, it was held that the provision of the service in this way does not disentitle the University from relying upon the exemption.

This can be contrasted with an exemption where the land must be ‘used exclusively by a charitable institution for charitable purposes’ (such as an earlier exemption under the Land Tax Act 1958). This precluded any third party use.

It was held that university has ensured that in entering these agreements, it has been able to play an ongoing role in monitoring the provision by CLVM and Campus Living of the student accommodation and ancillary services. This was done to ensure that the University’s objectives with respect to the enhancement of the students’ overall educational objectives are maintained. This agreement is different to a situation where the land is leased to a lessee as office space who then uses the space for a business completely unrelated to the purposes of the charitable institution.

Therefore, the University is eligible to apply the land tax exemption.

In relation to a separate area sub-leased as a café, the Court concluded this was nevertheless exempt as the provision of the café and the attendant services provided by its operator were established in order to enhance the student living experience and to provide a further meeting place for residents to complement the other common areas in the Student Village. It was therefore ancillary to the charitable purposes of the University.

Importance of decision

This is an important decision for Universities that have leased land situated on campus to student accommodation providers. The findings in this case have hinged upon the particular facts of the arrangement and the University has been able to demonstrate that the land has continued to be used to achieve the universities charitable purposes not withstanding that it has been leased to a third party student accommodation provider that is endeavouring to derive a profit from the arrangement.

Get in touch

Please contact your ShineWing Australia advisor or one of our experts below should you have any questions.

Contacts

| Stephen O’Flynn |

| Abi Chellapen |

The Victorian Government is offering grants of up to $1m to businesses in agriculture supply chains to increase supply chain efficiency, grow existing & new export opportunities, increase value to Victorian food production and encourage collaboration throughout the sector.

Grants are offered on a 1:1 funding basis, with grants of $50,000 to $1m available. Grant funds can be put toward:

- Investment in plant and equipment

- Research and development for pilot projects and new product development

- Market promotion

- Business and marketing plans

- Feasibility studies

- Website development and network costs.

Application Process

Grant funding will be allocated through a competitive two-stage process.

Applicants are encouraged to submit an expression of interest (EOI) addressing the key merit criteria and project objectives.

Applicants whose EOIs meet the criteria will be invited to submit a full application for funding

Who is eligible

Businesses, industry associations, marketing cooperatives and local government authorities that operate in the Victorian agriculture sector are invited to apply.

To apply, businesses must have a current ABN that was held on the fund opening date. Businesses must also directly employ staff.

Important dates

EOIs opened on March 31 and will close once funding is exhausted. Get in quick to avoid missing out!

How ShineWing Australia can help

The application process is competitive and complex, with limited funds on offer.

ShineWing Australia’s Government Incentives team can assist in project identification, writing comprehensive applications and liaising with program managers to maximise your chance of funding success.

Get in touch

To learn more and find out how you can seize the opportunity, contact Sam Morris or John Anderson.

The Federal Government is offering Food & Beverage manufacturers grants of up to $20m to upskill the manufacturing workforce, develop new supply chains, implement Industry 4.0 manufacturing & traceability processes and encourage research & industry collaboration.

Through the Modern Manufacturing Initiatives program funding is being offered on a 1:1 basis, with the Federal Government contributing up to half the cost of eligible projects. The minimum funding for this round is $1m, with the average grant awarded expected to be approximately $4m.

Grants will be awarded through two funding streams – Translation and Integration.

Translation Grants: awarded to businesses who use new automated technology and equipment to produce new high value-add food and beverage products and production methods.

Integration Grants: available for businesses looking to invest and grow their businesses to support entry into new local and global value chains.

Grant funding received through both schemes can be used toward:

- Eligible plant and equipment

- Contractors

- Prototype expenditure

- Relevant travel

- Certain salary expenditure

- Other costs incurred in the process of completing the project

Application Process

Grant funding is awarded through a competitive process, with applicants having to submit a comprehensive application prior to the 27 April 2021 closing date.

The application is highly complex and must demonstrate the technical and business outcomes of the project in a clear and succinct manner.

Grant applications should be made through the Australian Government’s grants portal.

Who is eligible

Manufacturers in the Food and Beverage sector that are incorporated in Australia are encouraged to apply. Joint applications are welcome provided the lead applicant can fulfil the relevant eligibility criteria.

Partnerships, individuals and government bodies are unable to apply to this fund.

Important dates

Applications to both funds opened on 29 March 2021 and will close at 5pm on 27 April 2021.

How ShineWing Australia can assist

The application process is competitive and complex, with limited funds on offer.

ShineWing Australia’s Government Incentives team can assist in project identification, writing comprehensive applications, and liaising with program managers to maximise your chance of funding success.

Get in touch

To learn more and find out how you can seize the opportunity, contact Sam Morris or John Anderson.

Not-for-profit entities are required to disclose how they do not comply with the recognition and measurement requirements of the Australian Accounting Standards

Introduction

Whilst the removal of Special Purpose Financial Statements (SPFS) has yet to impact Not-for-Profit entities (NFPs), the AASB has introduced AASB 2019-4.

NFPs preparing SPFS from 30 June 2020 must now disclose its compliance with the recognition and measurement (R&M) requirements to the Australian Accounting Standard (AAS), including consolidation and equity accounting requirements.

Who is affected?

- Medium and large ACNC charities preparing SPFS that compliywith ACNC reporting requirements

- NFP entities lodging SPFS with ASIC (e.g. companies limited by guarantee)

Who is not affected?

- ACNC small charities

- ACNC charities not required to comply with ACNC reporting requirements due to transitional reporting arrangements

- NFP public sector entities

- FP and FP public sector entities preparing SPFS

What action must be taken?

- Review existing accounting policies and R&M requirements in AAS to assess impact on any future transition from SPFS to any potential new reporting requirements

- Draft disclosure in SPFS for approval by those charged with governance prior to year end

What are the disclosure requirements?

- The basis on which the decision to prepare SPFS was made

- Accounting policy in SPFS

- Disclose an indication of where the accounting policy does not comply with the R&M requirements in AAS (except for consolidation and equity accounting), or

- State that assessment on compliance has not been made

- Overall compliance with R&M requirements

- Disclose whether or not, the SPFS overall comply with the R&M requirements in AAS (except for consolidation and equity accounting), or

- State that such an assessment has not been made

- Application of consolidation and equity accounting requirements

- Disclose whether or not interests in subsidiaries, associates or joint ventures have been consolidated or equity accounted consistent with requirements in AASB 10 and AASB 128. If not, disclose that fact and the reasons why

- If assessment has not been made and not required by legislation to do so, disclose that no assessment has been made

Reference

AASB 2019-4: Disclosure in Special Purpose Financial Statements of Not-for-Profit Private Sector Entities on Compliance with Recognition and Measurement RequirementsImportant Dates

Annual reporting periods ending on or after 30 June 2020.

How ShineWing Australia can assist

Contact one of our experts below to discuss how these financial reporting disclosure requirements affect your existing accounting policies.

Contacts

| Hayley Underwood |

| René Muller |

Guidelines have been released, outlining the Land tax concession, Surcharge land tax exemption and Surcharge transfer duty exemption for Build to Rent properties in New South Wales.

In August 2020, the NSW Government introduced certain tax concessions for approved Build to Rent (BTR) schemes in New South Wales, being;

- A 50% reduction in the value of the land for the purposes of calculating land tax (Land tax concession);

- A refund or exemption from surcharge land tax for an Australian corporation where an approved BTR property has been constructed on the land or the Commissioner is satisfied that such a building will be constructed (Surcharge land tax exemption); and

- A refund or exemption from the foreign purchaser additional duty where an Australian corporation purchases residential land for the purpose of constructing an approved BTR property that qualifies for the land tax concession (Surcharge transfer duty exemption).

The 3 exemptions / concessions are interrelated as the Surcharge land tax exemption and the Surcharge transfer duty exemption depend upon the land satisfying the Land tax concession once the building is completed.

The Land tax concession and Surcharge land tax exemption apply to residential land owned by an Australian corporation at midnight on 31 December in any year commencing with midnight on 31 December 2020 and ending with midnight on 31 December 2039.

However, if within the period of 15 years after a refund or concession is first applied, the land concerned is subdivided or the ownership of the land is ‘otherwise divided’ then the exemptions and concessions may be revoked, and reassessments issued retrospectively for up to 15 years as if the exemptions or concessions never applied.

The Surcharge land tax exemption and Surcharge transfer duty exemptions apply only to an Australian corporation, which is a corporation incorporated or taken to be incorporated under the Corporations Act 2001.

Such a corporation may nevertheless be a ‘foreign corporation’ if it is subject to foreign control.

It is not apparent whether an Australian corporation acting as a trustee of a trust may be exempted.

In addition, the term may not include bodies incorporated under other Australian legislation (such as an incorporated association, a co-operative society or a statutory body).

Land Tax Concession

For the purpose of assessing land tax, the land value of a parcel of land is to be reduced by 50% if—

a) a building is situated on the land, and

b) construction of the building commenced on or after 1 July 2020, and

c) the Chief Commissioner is satisfied that a significant proportion of the labour force hours spent on the construction of the building involves or involved work performed by persons whom the Chief Commissioner considers belong to any one or more of the following classes of worker—

i. apprentices or trainees,

ii. long-term unemployed workers,

iii. workers requiring upskilling,

iv. workers with barriers to employment (such as persons with disability),

v. Aboriginal jobseekers,

vi. graduates, and

d) the Chief Commissioner is satisfied that the building is being used and occupied for a BTR property in accordance with guidelines approved by the Treasurer for the purposes of this section, and

e) an application for the reduction is made in accordance with the requirements.

The Treasurer has now released the guidelines for the land tax reduction for BTR properties.

The purpose of the concession

The Guidelines state the purpose of the concession as follows:

- The purpose of this tax concession is to address one of the barriers to the institutional provision of rental services and, by doing so, improve the rental experience for tenants. By limiting the benefit to new developments, this measure is expected to help support new construction.

- The concession is expected to support the supply of large-scale rental housing that are professionally owned and managed, and that provide tenants with greater security of tenure and greater quality rental services than that typically offered by small retail investors.

Eligibility

A building (including a group of buildings or parts of buildings on the same parcel of land) must satisfy the following conditions in order to be considered as used and occupied for a BTR property:

- Planning requirements

-

- All requirements of the relevant development consent must be complied with.

- Building requirements

- 50 self-contained dwellings: At least 50 self-contained dwellings used specifically for the purpose of BTR must be constructed on the parcel of land;

- Dwellings can be spread across multiple buildings on the same land parcel.

- Where an adjacent site is consolidated with a land parcel that already qualifies for the concession, and the adjacent site provides additional BTR dwellings to the property, the additional dwellings do not have to separately meet the 50-dwelling threshold of Requirement 2a. as these dwellings will be added to the total number of dwellings on the original land parcel.

- Where an adjacent site is not consolidated with a land parcel that already qualifies for the concession (e.g. by remaining as a separate adjacent land parcel), eligibility for the concession will be determined separately and the 50-dwelling requirement will be applicable.

- Affordable housing policies: properties must comply with all relevant affordable housing policies that may be imposed under the Environmental Planning and Assessment Act 1979;

- Note that these concessions and exemptions form part of a larger reform package which includes new state environmental planning policies under the Environmental Planning and Assessment Act 1979 to promote the development of new affordable housing and social housing.

- Available to general public: BTR dwellings must be made available to the general public without restriction;

- This is subject to any restrictions necessary to ensure public health and safety, to promote announced Government policy, or to ensure dwellings designated for affordable or social housing are used for that purpose.

- 50 self-contained dwellings: At least 50 self-contained dwellings used specifically for the purpose of BTR must be constructed on the parcel of land;

- Ownership structure

- Unified Ownership structure: The dwellings and common land that comprise the BTR property must be held within a unified ownership structure;

- This can include a group of entities holding joint ownership.

- The property must not be held in such a way as to constitute, in the opinion of the Chief Commissioner, a de facto subdivision or divided ownership of the land, or otherwise contrary to the intention to restrict subdivision or division of the land.

- Unified Ownership structure: The dwellings and common land that comprise the BTR property must be held within a unified ownership structure;

- Management structure

- Single management entity, with on-site access: The dwellings that comprise the BTR property must be managed by a single management entity, with on-site access to management for tenants;

- This does not apply if those specific dwellings are made available for use as affordable housing or social housing for a continuous period of 15 years.

- The management entity can be different to the landholder. That is, the landholder may outsource the provision of the management services, provided that the services are delivered by a single entity.

- Single management entity, with on-site access: The dwellings that comprise the BTR property must be managed by a single management entity, with on-site access to management for tenants;

- Lease conditions

- Option for fixed term lease of at least 3 years: Each tenant must be provided a range of lease term choices, including a genuine option to enter into a fixed term lease of at least 3 years;

- A landlord will not be in breach of this condition if a tenant who has been provided the option of a fixed term lease of at least 3 years opts for a lease of a shorter duration instead.

- Each tenancy must be subject to a Residential Tenancy Agreement under the Residential Tenancies Act 2010. The requirement for tenants to be offered a Residential Tenancy Agreement likely means that the concessions will not be available for various types of “commercial residential premises” (such as rooming houses, serviced apartments, student accommodation and similar arrangements where residents are granted a licence to occupy their accommodation.

- Option for fixed term lease of at least 3 years: Each tenant must be provided a range of lease term choices, including a genuine option to enter into a fixed term lease of at least 3 years;

- Other factors

- The Chief Commissioner may have regard to any other factors that he or she considers relevant in deciding whether a property is being used for BTR

If a part of a parcel of land is used for purposes other than BTR purposes, the value of land tax concession may be reduced on a proportional basis.

The Guidelines suggest that floor space and area may provide a reasonable basis of apportionment.

How ShineWing Australia can help

Should you be interested in accessing these concessions please contact your ShineWing Australia advisor regarding how you can lodge an expression of interest of interest in the BTR Concessions with Revenue NSW.

Contacts

| Stephen O’Flynn | Robert Parker |

| Matt Birrell | Jae Debrincat |

| Abi Chellapen | Leo Luan |

| Daren McDonald |