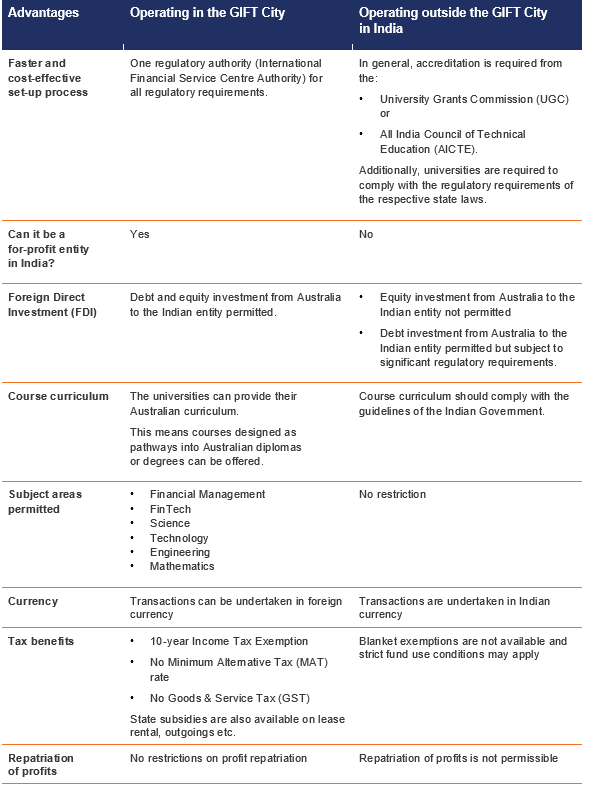

The new regulations introduced by International Financial Services Centre Authority (IFSCA) have opened a plethora of opportunities for foreign universities (FU) or foreign educational institutions (FEI) in India.

The new regulations allow the FU & FEI to operate an International Branch Campus (IBC) or an Offshore Educational Centre (OBC) in the GIFT City, which is a smart hi-tech city in the state of Gujrat.

We have outlined below the key advantages of operating in GIFT City:

Key contacts

If you have any questions or require advice regarding the new IFSCA regulations, please reach out to

our SW Team.

Stephen O’Flynn

Director – Tax

Rahul Sanghani

Senior Manager – Tax

Saurrav Sood

Practice Support Leader, International Tax & Transfer Pricing, SW India

From 1 July 2023, clubs seeking to maintain their income tax exempt status will be required to lodge an online Annual Self-Review Form with the ATO (Australian Tax Office).

In the 2021 Federal Budget, the former Government announced that it was providing $1.9m to build an online system to enhance the transparency of income tax exemptions claimed by Not-for-profits (NFPs). From 1 July 2023, NFPs’ seeking to maintain their income tax exempt status will be required to lodge an online Annual Self-Review Form. This is part of the ATO’s recently revised guidance on the games and sports income tax exemption for not-for-profit clubs under Tax Ruling 2022/2.

SW has liaised with the ATO and can confirm that this announcement is still expected to be implemented.

Annual Self-Review Form

The ATO has confirmed the following details:

Lodgement timing

The first return will need to be lodged for the 2023–24 income year, with those clubs with a 30 June year end being the first required to lodge. This means the earliest anyone will be required to submit a return is 1 July 2024.

Who is required to lodge?

Only self-assessing income tax exempt entities (e.g. sporting clubs) with an active ABN are required to lodge a return under the new self-assessing reporting arrangements. For those clubs applying the principles of mutuality as to their income tax obligations, there is no change to existing income tax return lodgement processes.

Entities that do not hold an active ABN, will not be required to lodge a return or satisfy ongoing ABN registration requirements.

Are there additional obligations?

The two additional obligations for ongoing ABN registration are:

- the obligation to comply with income tax return lodgement requirements, and

- the obligation to update the accuracy of details on the Australian Business Register (ABR), annually.

It is intended that the return for self-assessing income tax exempt entities will collect the information required to satisfy the new ABN requirements, without the need for these entities to provide further information.

What information does the Annual Self-Review Form need to include?

The return is not an income tax return but rather a form containing the information that a club would ordinarily use for self-assessing eligibility for income tax exemption on a yearly basis.

The form needs to satisfy three elements:

- Entitlement to income tax exemption

- Basis for entitlement (category), and

- Whether all requirements are being met.

How to prepare for the new reporting regime

There are 3 things your club can do to prepare for the new reporting regime:

- Update your contact details with the ATO. It’s an ABN registration requirement to keep your contact details current and it also means you’ll receive important information about your tax and super obligations.

- Use the ATO worksheets to review your eligibility for an income tax exemption.

- Stay informed.

How can SW help?

If you would like to discuss how to best prepare for the new Annual Self-Review reporting regime and/or broader eligibility for income tax exemptions, please contact us.

Contributors

With new concessions for foreign universities operating in India, take a look to learn about the International Financial Services Centres (IFSC) and the opportunities for Australian universities entering the Indian market.

Hear from Dipesh Shah, Executive Director, International Financial Services Centres Authority (IFSCA), Sandip Shah, Head of the IFSC Department, Atul Puri, Managing Partner & Co-founder, SW India and Saurrav Sood, Practice Leader, SW India as they discuss the IFSC regulations and highlight the advantages of GIFT City and what it can offer in terms of its world class infrastructure to Australian universities.

In a recent policy update, the Government of India issued regulations enabling Foreign Educational Institutions to establish an International Branch Campus (IBC) or Offshore Education Centre (OEC) in International Financial Services Centres (IFSC) in the Gujarat International Finance Tec-City (GIFT City) in India.

This much anticipated legislation is welcome news for Australian universities looking to establish a location for teaching, research and industry engagement in India. This provides an opportunity to enter the Indian market in a more tax effective and less heavily regulated environment.

If you have any queries or would like more information, please contact the Marketing team via marketing@sw-au.com.

Treasurer Jim Chalmers handed down our second Federal Budget for FY2022-23 last night. The Labor Party’s first Budget showed spending restraint amidst rising inflation with key investment areas including education, infrastructure and energy & resources.

With the change of government, there was great anticipation on the updated Federal Budget. However, this Budget may not provide enough support for households in managing the cost of living. Many businesses, especially small to medium-sized businesses are still feeling the impact of the COVID-19 pandemic and rising prices and interest rates.

On 25 October 2022, the Treasurer announced the Government’s plan for a more inclusive and sustainable economy. This budget is in line with the Labor’s five-point Economic Plan, aiming to reduce the costs of living, drive productivity growth and expand the capacity of the economy to alleviate supply side pressures, increase real wages and genuine economic investment for Australians. The SW team has navigated the papers to find key measures for industry and sectors.

Did you miss out on our Federal Budget webinar?

Check out Bill Lang, Director at Small Business Australia and our panel of industry experts as they share their insights and key takeaways from the Budget.

What does the Federal Budget mean for you?

Our Fast Facts provide an overview of the budget insights and potential opportunities from our team of experts. Tailored to your industry or business type, SW also reviews if the Federal Budget support measured up to expectations.

Take a look at what the Federal Budget means for you in 2022:

On 19 September 2022, the Federal Court (single Judge) handed down a decision on section 100A of the Income Tax Assessment Act 1936 (ITAA36) which supports the expansive interpretation in the ATO’s draft guidance (Taxation Ruling TR 2022/D1) released in February this year.

There are a number of cases pending in relation to this controversial provision, including the Full Federal Court appeal by the Commissioner of the Guardian1 decision of earlier this year, which dealt with section 100A and was decided in the taxpayer’s favour. To read more about our analysis of the Guardian case click here.

To recap, section 100A is a long standing anti avoidance rule originally introduced to counter aggressive ‘trust stripping’ schemes, but which can potentially be applied more broadly to certain arrangements (referred to in the legislation as ‘reimbursement agreements’) where trust beneficiaries are made entitled to trust income, but where there is a benefit or payment provided to a person other than the beneficiary to which the income is distributed. Where section 100A applies, the result is that the beneficiary is deemed not to be entitled to the income, and the trustee is assessable in relation to that income at the top personal rate of tax (currently 47%).

In BBlood Enterprises Pty Ltd v Commissioner of Taxation [2022] FCA 1112, the Court held that a reimbursement agreement existed and that the arrangement was not explicable as an ordinary family or commercial dealing. As a result, the Court agreed with the Commissioner that section 100A applied.

The case | BBlood Enterprises Pty Ltd v Commissioner of Taxation [2022] FCA 1112

The facts

The facts of the case broadly are as follows:

- A family discretionary trust (IP Trust) held 99% of the shares in a company (IP Co) which had significant (franked) retained profits and nominal share capital

- The following steps were implemented during a particular year of income (2014):The trust deed of IP Trust was amended to ensure that the distributable income of the trust was income according to ordinary concepts (thus excluding profits of a capital nature)

- A new family company (BE Co) was established as a beneficiary of the IP Trust Arrangements were made under which IP Trust had a modest amount of (ordinary) dividend and distribution income for the year

- A selective share buy-back of the shares in IP Co was undertaken, the main result of which was that the franked retained profits of IP Co were flushed out to IP Co. Note that whilst the tax rules pertaining to share buybacks deem this component of the proceeds to be a dividend derived by IP Trust, it remains a capital receipt under ordinary concepts

- The ordinary income of IP Trust for the year was distributed to BE Co and subsequently paid out

- As a result of the operation of the normal tax rules relating to trusts, the deemed dividend component of the share buyback proceeds was taxable to BE Co, but being franked, no tax was payable by Be Co on this deemed dividend

- The share buyback proceeds were retained by the IP Trust

- The result of the above steps (subject to the operation of the various anti avoidance rules that the Commissioner was seeking to apply) was that the retained profits of IP Co had been distributed to and retained by IP Trust without further tax being suffered.

The decision

The Court determined that section 100A applied, despite the fact that the beneficiary of IP Trust (BE Co) received in cash its full income entitlement (being the ordinary income), which is a separate entitlement to the share buyback proceeds retained by IP Trust. The Court concluded that the arrangement was implemented with a purpose of ensuring that the profits of IP Co were distributed in a tax-free form and not the result of an ordinary family or commercial dealing.

The result of the application of section 100A is that the income entitlement of BE Co is deemed to not exist. Such that the taxable income of IP Trust (inclusive of the grossed up deemed dividend from the share buyback) is assessable to the trustee at 47% (net of franking credits), the highest marginal tax rate of the beneficiary.

In relation to section 100A, the Court held that:

- a ‘reimbursement agreement’ is not constrained by the ordinary meaning of ‘reimbursement’ and has a wide meaning restricted only by the tax avoidance purpose and the ‘ordinary family and commercial dealings’ exception to section 100A

- a tax avoidance purpose arises for section 100A where there is a purpose of tax avoidance (paying no tax or less tax than the purported beneficiary). This should be contrasted with other integrity measures where the tax avoidance purpose needs to the sole or dominant purpose

- the ordinary family or commercial dealings exception needs to be applied to the arrangement as a whole rather than the individual steps.

The Court also considered the possible application of the ‘dividend stripping’ rules, which the Commissioner relied upon as an alternative to section 100A. The Court held that, although some of the elements normally associated with a dividend strip (e.g. involvement of third party) did not exist, there was sufficient similarity between the arrangements implemented and a dividend strip to apply these integrity measures in the alternative. If applicable, the dividend stripping measures would deny BE Co franking offsets in determining its tax liability for the year. However, given that section 100A applied, this secondary issue was, for the taxpayers concerned, somewhat academic.

So what does this decision mean?

On the one hand, the decision could be viewed as an appropriate outcome, given that the arrangements appear to have been somewhat artificially engineered (and indeed replicated by the taxpayer’s advisers for other clients around the same time) to achieve a beneficial tax outcome. It is not surprising that the Commissioner sought to challenge the arrangement.

On the other hand, the decision will potentially increase the Commissioner’s confidence to apply section 100A to circumstances that many may have thought it should not apply.

Notably, the Court determined that the fact that an income distribution was made and paid out in full was not, of itself, sufficient to conclude that section 100A had no role to play. The Court effectively viewed the income distribution as an enabling mechanism by which the retained profits of IP Co were transferred on a tax free basis to IP Trust and, more importantly, as a ‘reimbursement agreement’ with a tax benefit purpose for the purposes of section 100A. It is noted that facts in this situation are quite similar to one of the more controversial examples in Taxation Ruling 2022/D1 released earlier this year.[1]

The case also highlighted the importance of ensuring that there is solid evidence to support arguments that the arrangement is an ordinary family or commercial dealing. In the BBlood case, general assertions by the taxpayer that the arrangements were motivated by commercial (not tax) reasons, such as estate planning and group simplification, were not compelling and failed to discharge the taxpayer’s onus of proof.

Reach out to our SW team if you would like to further understand or discuss the implications of this case.

Our previous articles on 100A:

Guardian case – section 100A win for the taxpayer

Trust distributions – the game has changed

Contributors

1 Guardian AIT Pty Ltd v Commissioner of Taxation [2021] FCA 1619;114 ATR 136

2 Example 8 in Draft Taxation Ruling TR 2022/D1

On 14 September 2022, the ATO has revised its guidance on the games and sports income tax exemption for not-for-profit clubs.

While the application of the exemption has not changed, Taxation Ruling 2022/2 does provide further clarifications and references the Word Investments High Court case. This ruling replaces Taxation Ruling 97/22, which has now been withdrawn.

TR 2022/2 relates to the exemption of not-for-profit clubs from income tax. The games and sports exemption is applicable to a club (including societies and associations) where it:

- is founded for the primary goal to promote a sport or game

- does not have a profit motive for its individual members

- meets other special conditions under section 50-70 (including, is not carried on for profit or gain of its individual members)

What is included as a ‘sport’ or ‘game’?

TR 2022/2 clarifies that the terms ‘game’ and ‘sport’ also encompasses nonathletic activities such as chess or bridge, activities which involve machines to take part such as motor racing, and non-competitive activities such as mountaineering.

A requirement to qualify as a game or sport for the exemption include key features that it typically has rules, expectations and conventions. Competition is also another general feature of a game or sport, however this is not essential.

When determining if a club qualifies for the exemption, it is important to consider the club’s primary purpose. To be eligible, the club’s main purpose must be the encouragement of a game or sport. Where another purpose, such as the encouragement of sociability, participation and relaxation dominates the promotion of the sport or game, this would not meet the criteria of a sport or game.

Commercial activities and purpose

Clubs that engage in commercial activities to earn revenue are required to objectively establish the degree to which commercial activities are a means to the required primary purpose of encouragement of a game or sport.

A club is able to establish a purpose of supporting a game or sport where it provides financial and in-kind contributions to other organisations that directly carry out those activities.

Examples of direct or indirect activities that show the promotion of a game or sport include:

- organising and conducting tournaments

- improving the abilities of participants

- providing purchased or leased facilities for the activities or the game or sport for the use of club members and visitors, and

- marketing.

It needs to be objectively demonstrated that these activities are conducted as a means to further the main purpose of encouraging the game or sport.

In cases where a club has another purpose outside sporting purposes, it will not meet the games and sports exemption unless the non-sporting purpose is merely in relation to carrying out its sporting business or independent from the sporting purpose but is less significant than the sporting purpose.

To establish whether the club has a primary propose of promoting a game or sport, the circumstances and facts of each case needs to be considered objectively, considering the following factors deemed relevant by courts and tribunals:

- the club’s constituent documents

- extent of sporting activities

- the conduct of activities directly connected to the game or sport

- member participation in the game or sport

- marketing of the organisation to the public as one that encourages a game or sport

- involvement of the committee management in the promotion of sport

- the use of surplus funds for promoting the game or sport, and

- the provision of financial and in-kind support for encouraging the game or sport.

Factors that work against the conclusion that a club’s main purpose is the encouragement of a game of sport, include:

- an emphasis in its constitution to provide a social club for members

- the provision of social facilities for members

- no direct involvement in fielding sporting teams or entering into competitions

- funding of game or sport only on an inconsistent basis with its members taking priority

- the relative size and extent of social facilities provided for the benefit of members compared to the financial and in-kind support provided to sport and games.

Surplus funds

Where clubs accumulate surplus funds, they should have a detailed plan that show how the funds will be used to support the encouragement of sport or game.

Self review form

Clubs with an active Australian Business Number will be required to complete an online self-review form of their eligibility to the income tax exemption each year from 1 July 2023.

How we can help

Whilst it is pleasing that further examples have been provided in this ruling, there is still a significant grey area when determining if the games and sport exemption applies.

This is particularly the case for large clubs with significant commercial activities that have multiple purposes of encouraging a sport or game as well as providing significant benefits to members. Therefore, it is important for club’s objectives to be clearly documented and for any plans to clearly highlight how the club encourages a sport or game.

If you require further advice regarding this tax exemption, please reach out to our SW team.

Contributors

Alice Mulvogue, Assistant Manager, Tax

Sharon Lee, Consultant, Tax

Between August 2021 and March 2022, the SW team undertook a significant office refresh project for the Melbourne, Sydney, and Brisbane offices. As part of this project, the technology across locations was was redesigned for future working.

Barney Ling, Head of Information Technology at SW has compiled a detailed report on the key technology objectives and design decisions that went into the project, as well as reflections on the lessons learnt months after the project completed.

Prior to the pandemic a physical office refit had been in planning, however, the resulting disruption clarified our technology objectives and provided an opportunity to purpose build our office spaces to support hybrid working.

Our offices now not only look and feel great, but have also had a full technology uplift to support new ways of working. The technology uplift has included the following major elements:

- Wi-Fi only office

- Activity Based Working workstation design

- Advanced AV capabilities to support location equity

- A digital signage solution integrated with Teams rooms

If you are considering a similar initiative, please feel free to reach out with questions – we are only too happy to help and share our learnings.

Author

Barney Ling, Head of Information Technology

The Australian Government has released draft legislation to remove the double taxation of technical services provided remotely by Indian businesses (offshore services) to customers in Australia.

In April 2022, the Australia-India Economic Cooperation and Trade Agreement (AIECTA) was signed to strengthen the relationship between the two countries, facilitate bilateral trade and create opportunities for workers and businesses. This included an agreement that Australia will amend its domestic tax laws to prevent the double taxation offshore income arising to Indian entities from the provision of technical services to Australia.

The Australian Government has now released draft legislation to implement this agreement reached between the two countries regarding double taxation for services provided remotely and not through a permanent establishment in Australia.

Background on Australia-India double taxation

This resolves the issue raised by the Indian government about the Double Taxation Avoidance Agreement between the two countries, with the Australia-India Double Tax Agreement (DTA) first implemented in 1991.

Australia has been taxing payments or credits for technical services that are provided remotely by non-resident Indian firms even if they are not provided through a permanent establishment in Australia, due to the operation of both the Royalty definition (Article 12(3)(g)) and the Source Article (Article 23) under DTA.

Explanation of the royalty definition

The definition of royalty in Article 12(3)(g) is broader than the definition as provided in Income Tax Assessment Act 1936 (ITAA 1936) and captures any services which make available:

- technical knowledge

- experience

- skill

- know-how; or

- processes.

It also includes the development and transfer of a technical plan or design.

The example in the explanatory memorandum explains how payment for services is caught by the broader definition of royalty in Article 12(3)(g).

An Australian resident for tax purposes owns inventory control software for use in its own chain of retail outlets throughout Australia. It expands its sales operation by employing a team of travelling salespeople to travel around the countryside selling the company’s wares. It wants to modify its software to permit salesperson to access its central computers for information on what products are available in inventory and when they can be delivered. It hires a computer programming firm that is a resident of India for tax purposes to modify its software for this purpose.

The payments which the Australian resident pays are royalties within the meaning of Article 12(3)(g). The Indian firm performs a technical service for the Australian company remotely, and it transfers to the Australian company the technical plan (i.e. the computer program) which it has developed for that company.

What are the new changes?

The exposure draft legislation amends the International Tax Agreements Act 1953 to exclude such payments or credits from Australian tax. New section 11J of the International Tax Agreements Act 1953 will stop Australian taxation on such payments or credits if three criteria are satisfied:

- Payment must be a consideration for service covered by Article 12(3)(g) – services that make available technical knowledge, experience, skill, know-how or processes or consists of the development and transfer of a technical plan or design.

- Payments or credits for services are not royalties within the meaning of the ITAA 1936 – where payment or credit is also considered a royalty under the ITAA 1936, then the amendment will not apply, and the payment or credit will continue to be subject to Australian tax.

- Payments or credits must only be subject to Australian tax because of the operation of Article 12(3)(g) and Article 23. If the payment is covered or dealt with by another article of the DTA, it will continue to be subject to Australian tax. For example, technical services provided through a permanent establishment in Australia will continue to be taxed as business profits (Article 7).

Further, where there is a permanent establishment (PE) that is engaged in providing such services, then the exclusion shall not apply. It will be beneficial to render these services from such PE so as to avoid the gross basis of withholding tax instead of a net basis where expenses can be claimed against the payment or credit.

The amendments made by this schedule will commence on the later of:

- the day this Act receives Royal Assent; and

- the day the AI-ECTA enters into force for Australia.

This is a significant relief for Indian Information Technology firms after Tech Mahindra lost an appeal against the Commissioner in the Federal Court in 2018. These amendments are an important step in the cooperation between the two countries.

How can SW help

SW Australia and SW India work closely with our mutual clients to navigate the complex tax regimes in each country to ensure that your international tax obligations are complied with.

If you have any questions or would like further information about the double taxation between Australian India, please contact one of our tax experts based in Australia or India.

Contacts

Stephen O’Flynn

Director

SW Australia

Rahul Sanghani

Senior Manager, Tax

SW Australia

Saurrav Sood

Practice Leader, International Tax & Transfer Pricing

SW India

The Government proposes to amend Australia’s existing thin capitalisation rules to limit interest deductions for multinational enterprises. Our modelling indicates one in four multinational enterprises (MNE’s) could be negatively affected by the changes.

The Australian Treasury has released Exposure Draft legislation aimed at strengthening Australia’s thin capitalisation (thin cap) rules on 16 March 2023. Click here to read the article about this latest update.

These amendments are part of a consultation paper released by the Treasury in line with the Government’s commitment to address tax avoidance practices of multinational enterprises. The thin capitalisation test will be changed to an earnings stripping approach. Under the proposed approach, net interest deductions will be limited based on a defined measure of profit (see below). This will impact taxpayers differently based on their profit profile, regardless of whether or not they are currently excessively geared based on the current safe harbour gearing level.

Who is impacted?

Affected groups will include:

- foreign controlled Australian entities and branches

- Australian entities with foreign subsidiary entities and branches

- certain associates of the above.

Background of thin capitalisation rules

The thin capitalisation rules seek to restrict interest deductions of affected entities. Historically, the rules were intended to prevent the shifting of profits offshore via interest payments to related parties or on loans guaranteed by related parties. However, the rules have since been expanded to apply to interest payments to all lenders including third party financiers whether or not guaranteed by the parent entity or another group entity.

The current thin capitalisation provisions provide for a safe harbour debt amount. This is broadly the maximum debt amount calculated based on the entity’s gearing level. Once exceeded, an entity interest expense is proportionately denied1. It is noteworthy that the 60/40 debt to equity safe harbour debt amount is the measure most widely used by multinational groups.

When will the proposed rules apply?

The rules may apply from as early as 1 July 2023. However, the consultation paper is not law and does not specify an intended commencement date.

Discussion on proposed change

The Government recently released a consultation paper regarding the proposed multinational tax integrity package. One of the proposed measures is the amendment of Australia’s existing thin capitalisation rules to limit interest deductions of affected entities in line with OECD’s recommended approach.

The OECD’s recommended approach limits net interest deductions to 30% of Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA). The use of accounting EBITDA can be problematic as the measure does not account for items such as such as revaluations and impairments.

The Government has flagged the use of tax EBITDA. This means that the taxpayer will firstly need to calculate/model its taxable income to determine the safe harbour debt amount. Note that the use of tax EBITDA may mean that non-assessable non-exempt foreign income e.g. foreign non-portfolio dividends, foreign branch profits and participation exemption capital gains may have to be excluded. Adjustments could be required depending on the definition of “tax EBITDA”.

Regardless, it is hoped that the $2m de minimis exemption continues to apply or increased. As examples and broadly speaking, the “de minimis” interest level in Germany, France, Greece and some other EU countries is €3 million.

The Government has also indicated that the arm’s length debt measure will be retained. This is positive as particular industries (e.g. property funds) may be negatively impacted by the change.

Looking at thin capitalisation rules in comparable international jurisdictions

In the paper it was highlighted that approaches adopted by comparable international jurisdictions (for instance, the UK, Canada, France, Germany and the US) may be drawn upon. The deduction for net interest expense in the UK is restricted to the greater of:

- 30% of taxable earnings before interest, taxes, depreciation and amortization (EBITDA) in the UK (the Fixed Ratio Rule)

- a proportionate share of the worldwide group’s net interest expense, equal to UK taxable EBITDA multiplied by the ratio of worldwide net interest expense to worldwide EBITDA (the Group Ratio Rule).

Similar to Germany, the consultation paper also considers the Group ratio rule. This will provide greater flexibility of highly leveraged groups, which is defined in the Paper as those with a net third party interest/ EBITDA ratio above the 30% benchmark fixed ratio.

Additionally in Germany, any unused EBITDA potential may be carried forward for a certain number of years to cover future excess interest cost.

Meanwhile in Canada, the changes are phased in i.e. starting with a 40% ratio before reducing to 30%. Any net interest expense for a particular year that is denied in that year, could be carried backwards and forwards for a certain number of years. The incorporation of carry forward and carry back rules will provide a fairer outcome for taxpayers and allows for profit fluctuations arising from economic conditions and other disruptions.

In France, taxpayers will need to assess whether they are thinly capitalised (where related party debt-to-equity ratio exceeds 1:5). If so, then different ratios are applied depending on whether the debt is from a related or external party.

Examples

Example 1

In year 20XX, Ausco has EBITDA of $100m. Assume that AusCo has no interest, depreciation or amortisation. Included in EBITDA is a non-deductible impairment loss of $50m. Therefore tax EBITDA is $150m. Applying a fixed ratio of 30%, the maximum net interest expense (i.e. all borrowing & interest expenses minus interest income) allowed based on EBITDA and Tax EBITDA are $30m (30% x $100m) and 45 (30% x $150m) respectively.

Example 2

In year 20XX, AusCo derived a profit before tax (PBT) of $100m. Included in the EBITDA calculation are:

- accounting depreciation of $50m

- interest expense of 20m

- tax depreciation is $80m.

Subject to how tax EBITA is eventually defined, we calculate the maximum allowable net interest under EBITDA and tax EBITDA as follows:

| EBITDA ($) | Tax EBITDA ($) | |

|---|---|---|

| Profit before Tax/ Taxable Income | 100m | 70m |

| Add accounting depreciation | 50m | |

| Add tax depreciation | 80m | |

| Add interest | 20m | 20m |

| EBITDA/Tax EBITDA | 170m | 170m |

| Maximum net interest expense under model | 51m | 51m |

| Interest denied? | No | No |

How should taxpayers prepare?

Whilst legislation is yet to be released, taxpayers are advised to model the impact of the use of the earning stripping approach on their interest deductions.

SW modelled the earnings stripping approach using the Tax EBITDA of 40 taxpayers. While we had to make certain assumptions in the absence of legislation, the results show that 25% of the entities modelled will be negatively impacted by the change. The results show a positive impact for 1 of the taxpayers modelled.

Taxpayers holding investment type assets (e.g. equity or property) which generate a low annual return/yield on the investments (but may derive future capital gains on their eventual disposal) are particularly impacted. A carry forward rule such as that in Canada would therefore be helpful so as to not discourage the growth of funds management in Australia. Also impacted are entities which are not yet generating income for example companies in the process or research or commercialising a new product/innovation or mining companies in the exploration stage.

Note that businesses are invited to be a part of the consultation process to ensure that the legislation is fair (i.e. advocating for: carry forward and carry back rules for excess interest deductions and for a world-wide group ratio similar to the UK). Information about how to respond can be found here.

How can SW help?

Our SW team can assist with:

- Modelling the impact of the use of the earing stripping approach on your interest deductions

- assessing the feasibility of restructuring the financing structure of the group

- consider whether one of the alternative tests would be applicable (i.e. arm’s length debt test).

Reach out to your SW advisor for support from our specialist tax team.

1 Entities with debts exceeding the safe harbour debt amount can also consider alternative debt measures being the arm’s-length debt amount and the worldwide gearing debt amount.

SW is delighted to announce further growth in the partner ranks, with four senior appointments to partner, Sejla Kadric, Michael Qin, Rick Hemphill and Yang Shi, effective 1 July 2022. These partners are based in the Melbourne office and service clients nationally and internationally.

“A very sincere congratulations to our four new partners. Their appointments truly reflect our continued growth and success, and our focus on supporting our people to achieve their career aspirations. The demand for outstanding talent in servicing our clients means we are well positioned to promote our people,” commented Mr Duane Rogers, CEO.

“These appointments are in addition to the two appointments made in December (Chris Dexter and Jeremy Wicht), and the four lateral Partner appointments of John Dorazio (Perth), Richard Gregson (Perth), Iggy Moro (Perth) and Gregory Will (Sydney), announced last month. SW now has 39 partners across Brisbane, Melbourne, Sydney and Perth,” said Mr Rogers.

Sejla Kadric appointed as a Partner. Sejla is part of our Property Development team in our Business and Private Client Advisory division. Sejla started at SW as a Manager seven years ago. Sejla is widely recognised within SW as having very strong property expertise and being able to advise clients on a wide range of property related tax or commercial matters.

Michael Qin appointed as a Partner. Michael assists clients with property investment and migration issues across international markets including Hong Kong, China and Macau. He has been with SW for 11 years and has outstanding expertise in cross-border transactions, guiding overseas investors through complex business, accounting and tax matters by providing professional and practical solutions.

Rick Hemphill appointed as a Partner. Rick joined SW as a Vacationer in 2009 and has taken every opportunity to develop his brand through his entrepreneurial flair and passion in his specialised areas, being cloud advisory and data analytics. Rick has built a significant profile in the technology software space, having written several articles and making the cover of Xero’s annual magazine. He is an activate participant in SW’s Energy & Resources, Funds Management and Property & Infrastructure Industry Groups’.

Yang Shi appointed as a Partner. Yang has worked at SW for seven years, having started with the firm as a Senior Manager in 2015. With 15 years’ experience, Yang is one of the most experienced mandarin-speaking Transfer Pricing practitioners in Australia. Yang’s primary focus has been with the Energy & Resources and Property & Infrastructure industry groups; however, his skills are relevant to all industry groups. Any clients with international dealings can benefit from Yang’s expertise whether they be large corporates or private groups.

“We have a strong foundation for aspiring leaders in our business. We work hard at ensuring we provide opportunities for those people to develop key skills that will help support both our clients and our direction in the future,” said Mr Rogers.

We look forward to seeing Sejla, Michael, Rick and Yang continue their outstanding contribution as they open doors to opportunity and deliver quality outcomes for our all people and clients.