SW Accountants & Advisors (SW) is thrilled to announce the appointment of three highly accomplished professionals as partners, solidifying its position as a leading provider of exceptional accounting and advisory services.

Effective 1 July 2023, Janelle McPhee and Laura Toscano will join as partners, followed by respected tax partner, Paul Hum, in mid-July. These new partners will serve clients both domestically and internationally, further expanding SW’s reach and expertise.

Mr. Duane Rogers, CEO of SW, conveyed his congratulations to the three new partners, underscoring how their appointments symbolise the firm’s continued growth, success, and unwavering commitment to supporting its talented professionals in realising their career aspirations. “The increasing demand for exceptional talent in serving our clients positions us favourably to promote our exceptional professionals,” remarked Mr. Rogers.

With the addition of these experienced individuals, SW’s partnership now boasts a strong team of 41 partners strategically located across Brisbane, Melbourne, Sydney, and Perth. Mr. Rogers emphasised the firm’s steadfast dedication to nurturing aspiring leaders within the firm, providing them with opportunities to develop important skills that drive both clients and the firm’s success.

SW Accountants & Advisors eagerly anticipates the continued outstanding contributions of Janelle, Laura to their clients, and looks forward to welcoming Paul. Their appointment not only marks an exciting new chapter in their careers but also reinforces the firm’s unwavering commitment to opening doors of opportunity and consistently delivering quality outcomes for both its talented professionals and valued clients.

Janelle McPhee has been promoted to Partner. Janelle has been with SW for seven years and has 25 years’ experience delivering tax and accounting services along with CFO outsourcing and payroll services for large complex clients.

Janelle heads up the Business Private Client & Advisory (BPCA) Outsourcing and Payroll offering and is also a member of the Praxity Global Alliance outsourcing working group. Janelle partners with her clients to deliver accurate, timely and valuable information to assist with decisions in real time and to remain compliant. Janelle delivers webinars regarding Casualised Workforce and Superannuation changes, and has written several alerts on Working from Home Claims, Payroll Tax Mental Health & Wellbeing Levy, Super Stapling and STP Phase 2.

Laura Toscano has been appointed as a Partner. Laura has been with SW in the Internal Audit and Risk Advisory team with the Assurance & Advisory Division for over seven years and has over 14 years’ experience. Laura works across multiple industries and markets, servicing clients in financial services, education, government and public and private sector clients. Laura presents for clients, at industry conferences and for webinars on topics that includes risk management and Anti-Money Laundering and Counter Terrorism Financing (AML/CTF).

Paul Hum joins us with 15 years of specialist experience across a range of employment tax and payroll related obligations. He started his career with KPMG in employment taxes and has experience in the mid-tier where he was technical lead for employment taxes for Pitcher Partners for four years. He also spearheaded KPMG’s move into employment tax data analytics and technology related offerings. Paul comes to us having led some of the largest and most high-profile superannuation and payroll remediation programs in Australia.

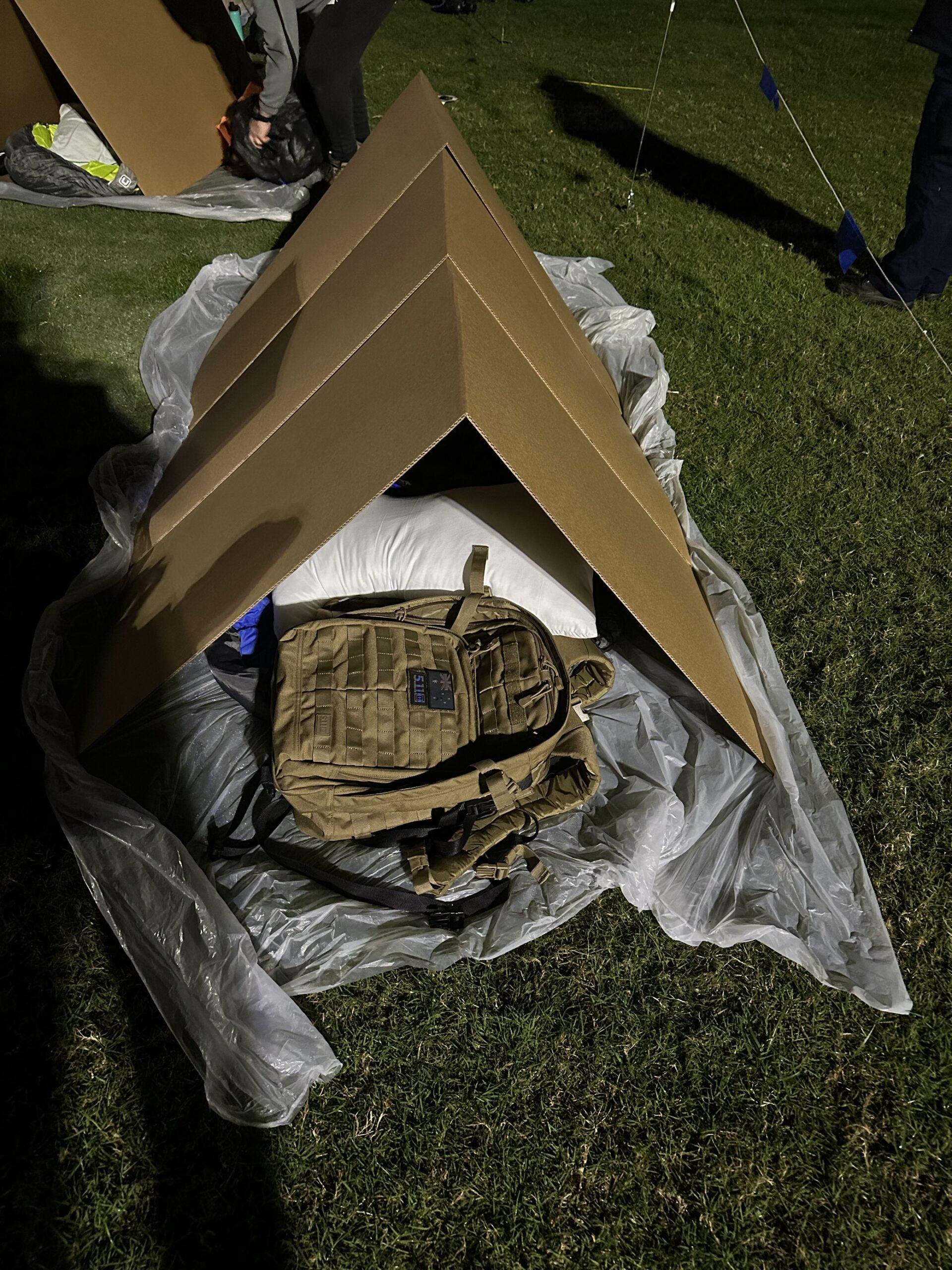

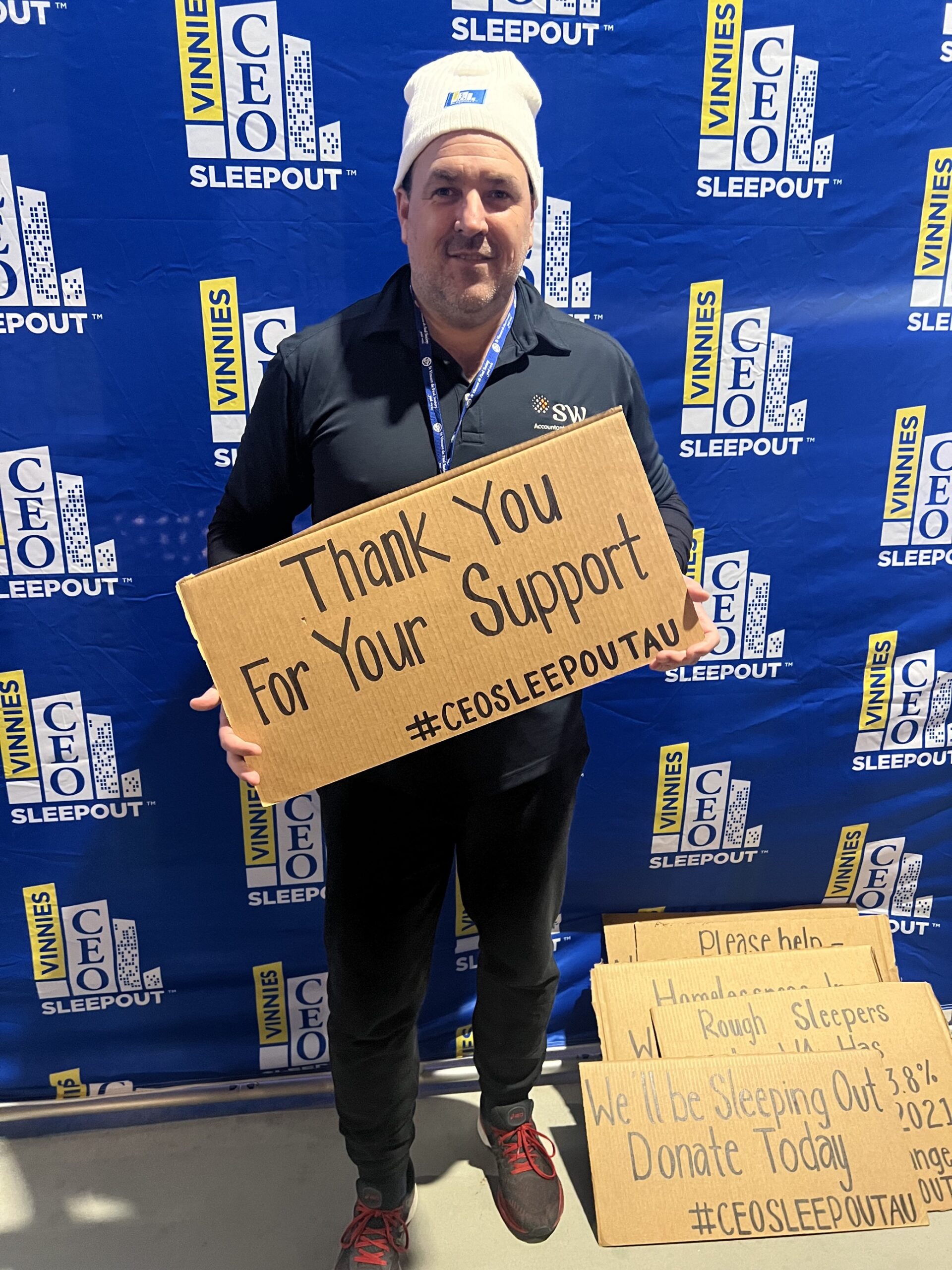

Together as a team, SW has raised over $100,000 nationally for Vinnie’s CEO Sleepout this year, bringing our seven year tally to over $400,000. All of these funds will have a positive impact on helping end the cycle of homelessness in Australia.

We are incredibly proud of our 15 participants this year, not only for the amount they raised but also for their compassion towards Australians who are struggling to find shelter and enduring the cold while living on the streets this winter.

Matthew Oakey

Jeremy Wicht

Vikas Nahar

Bessie Zhang

Leo Luan

Michael Qin

Chris Dexter

Tony Principe

Vicki Lam

John Dorazio

Stephen O’Flynn

Neville Lin

Tom Mullarkey

Abi Chellapen

Luke Fernandes

CEO Duane Rogers said, “Of course, it can’t be done without all our team members, staff and the generous donors, and we are humbled by their contributions. Also, a very big congratulations to Partner, Matt Oakey for taking the lead with this firm community initiative for its 7th year, and to Amanda Lee and the Co2 Committee for their organisation and promotion to build awareness of our efforts.”

Matt Oakey says: ” This is the 7th year I have participated in the Vinnies CEO Sleepout, and there were two key words from last night: respect and hope. I know that through our participation and fundraising, SW has created hope for the hard working team at Vinnies and the people that need their support. With the increased cost of living, Vinnies have had a 30% increase in requests for assistance. For a wealthy country like Australia, I question why do we have people who are sleeping rough and making choices about paying the rent or food? We need to respect those in our communities who are disadvantaged and help lift them up.”

Here’s what some of our other team members had to say about their experience:

“We heard heart-wrenching stories, that moved me deeply, from some of the people that have been helped by Vinnies’ holistic approach.”

Stephen O’Flynn

“Doing the Sleepout is always a great reminder of both how hard it must be to sleep rough night after night and the great work that Vinnies do to assist those in need.”

Chris Dexter

“Certainly extremely grateful to have a home. The stories of other experiences were heart wrenching.”

Tony Principe

“After one night sleep rough with snoring, having a safe and comfortable place/bed to sleep, it is such a treasure gift.”

Vicki Lam

“The food was good, and it wasn’t too cold so I can’t complain at all. The hard floor did made sleeping difficult. And the snoring. ‘Twas a symphony of snoring during the night!”

Tom Mullarkey

“It’s hard to imagine anyone sleeping well when sleeping rough – the 11pm and 4am street noise soundscapes gave us a small glimpse of what it can be like.”

Luke Fernandes

“In my third year of the CEO Sleepout, the sobering reality of homelessness continues to strike a chord. This event continually reinforces my commitment to channel our collective resources towards addressing and alleviating this issue.”

Neville Lin

“So glad to be able to do a small part in tackling a big issue. Being able to hopefully have some families and especially some children get a warm and safe place to sleep is the main reason I help out. Every child has the right to a safe environment to sleep or call home so its important to help. I am proud of the effort by my fellow SW partners to contributing in a small but vital way to addressing the major issue that WA is facing. I urge more people to get involved next year.”

John Dorazio

You can still make a donation and it is not too late! Tax deductible donation until 31 July 2023.

This activity supports two of our key SDGs

Citing a lag in action from the current Federal Government, Senator Andrew Bragg introduced a Private Senator’s Bill to Parliament on 29 March 2023 to progress Australia as a leading jurisdiction for crypto asset regulation.

The Digital Assets (Market Regulation) Act 2023 follows Senator Bragg’s earlier draft, proposed in September 2022. It proposes a licensing regime for anyone offering trading or the exchange of ‘regulated digital assets’, as a subset of the broader ‘digital assets’ definition. It also defines stablecoins and a range of exchange tokens to capture most crypto currencies.

Background

In 2019, Senator Andrew Bragg was appointed as a member of the Select Committee on Financial Technology and Regulatory Technology, which was tasked with investigating and reporting on the opportunities and challenges facing the fintech and regtech sectors in Australia.

The resulting report, known as the Bragg Report, made a number of recommendations for how Australia could position itself as a leader in fintech and regtech. One of the key recommendations was the need for a regulatory framework for digital assets that was both clear and technology-neutral.

Of the 12 recommendations in the Bragg report, 11 were adopted by the incumbent government and public consultation began on custody and licensing requirements.

The Digital Assets Act proposed by Senator Bragg seeks to implement this final recommendation.

Digital Assets (Market Regulation) Act 2023

The proposed bill introduces licenses for:

- Digital Asset Exchanges

- Digital Asset Custody services

- Stablecoin Issuers: (This includes requirements for Australian or foreign currency to be held in reserve in an Australian bank and for frequent reporting.)

- Disclosure requirements for facilitators of the e-Yuan in Australia, as the e-Yuan is the first Central Bank Digital Currency, or CBDC, released by a central bank of a major economy. The bill defines digital assets as ‘a cryptographically secured digital representation of value or contractual rights, which uses a form of distributed ledger technology and is transferable, storable or tradable electronically’.

The bill would require all digital asset providers to register with ASIC, and would subject them to a range of compliance obligations, including anti-money laundering and counter-terrorism financing requirements. It would also introduce a new licensing regime for digital asset exchanges, and require them to maintain adequate security measures to protect against cyber threats.

The implications of this bill for Australia’s digital assets sector are significant. By providing a clear and consistent regulatory framework, it will help to reduce the uncertainty that has plagued this sector. It aims to make it easier for businesses to operate in the sector, and encourage greater investment and innovation.

By introducing requirements for digital asset providers to comply with anti-money laundering and counter-terrorism financing regulations, the bill would also help to improve the overall reputation of the digital assets sector. With greater regulation and certainty, a broader range of investors, including institutional investors, are likely to be more attracted and able to invest in products that have been hindered by reputational concerns.

Will the Bill pass?

While the introduction of Senator Bragg’s Digital Assets (Market Regulation) Act 2023 proposesa significant development for Australia’s digital assets sector, it remains to be seen whether the bill will ultimately pass into law. The Australian government has been cautious in its approach to digital assets regulation, and there are likely to be competing priorities and concerns that could impact the bill’s chances of success.

Driving the call for regulation are broader priorities such as AML/CTF issues and customer safeguards, and many SW connections in the sector are keen to stablise the industry and improve the security of, and trust in products. However, some may be concerned about the potential for excessive regulatory burden on business and potentially consider the framework is not flexible enough to adapt to innovation in such a rapidly evolving sector.

Nevertheless, with increasing global recognition of the need for clear and effective regulation of digital assets, there is cause for optimism that Senator Bragg’s bill could ultimately play a key role in positioning Australia as a leading jurisdiction for crypto asset regulation.

How SW can help

SW works extensively with regulated financial services organisations operating in Australia in relation to licensing, internal audit, regulatory compliance, risk management, anti-money laundering and counter terrorism financing obligations, data protection mechanisms and tax structuring and compliance.

We have significant sector expertise and experience to support digital asset enterprises with preparatory activity prior to regulation, and necessary licensing and compliance activity when regulation is passed into law.

Reach out to our sector experts for a confidential discussion.

Contributor

In the lead-up to the May budget, the Albanese Government has announced a major change to taxes on superannuation earnings for balances over $3 million.

Current superannuation taxes

An individual’s retirement savings, held in a complying superannuation fund, is subject to concessional taxation on earnings of income and capital gains. The extent of the tax concession on the super fund earnings will depend on whether the individual has satisfied the conditions for release – this will generally be based on your age and whether you have retired or met a condition of release.

Individuals that are yet to satisfy their condition of release will have their superannuation fund earnings subject to tax at 15% on income. Individuals that have satisfied the super funds condition of release, and have elected to convert some or all of their super fund balance to support a pension, will not be taxed on the earnings arising on that balance.

Importantly the balance that is tax free is limited by the transfer balance cap, which is currently up to $1.7m. Earnings arising on amounts not supporting their pension, or above the transfer balance cap, are subject to 15% tax.

Proposed changes to superannuation taxes

The government is now proposing to limit the concessional 15% tax rate to member balances less than $3m.

It is proposed that, starting from 1 July 2025, for individuals with total superannuation account balances of more than $3m, an additional tax of 15% on earnings will be charged on the balance over $3m.

Earnings on the balance below $3m will continue to be taxed at 15% or 0% depending on whether the fund is in accumulation or pension phase, whereas earnings on funds over the $3m will be taxed at 30%.

For the purposes of administering the additional 15% tax, earnings are calculated as the difference in the total superannuation balance at the start and the end of the financial year, adjusting for withdrawals and contributions.

This means that earnings will include unrealised gains. It also means that any realised capital gains included in the earnings above $3m will potentially not attract the one third CGT discount which applies to superannuation funds.

Where a superannuation fund makes an earnings loss in a financial year, this can be carried forward to reduce the additional tax liability in future years.

Limited details are available on how this tax will be collected, but the announcement provides that:

- individuals will have a choice of either paying this additional tax themselves or from their superannuation funds, and

- this tax will be separate from an individual’s personal income tax, similar to the existing Division 293 tax regime.

Impact of the changes

This proposed change will impact Australians with superannuation account balances greater than $3m.

Estimates provided by the government suggest this will be around 80,000 superannuation members.

Should this change be passed into law, large and small superannuation trustees will also need to consider how their systems will operate to comply with the law.

Below is an example from the fact sheet released by the Treasury:

Carlos is 69 and retired. His SMSF has a superannuation balance of $9 million on 30 June 2025, which grows to $10 million on 30 June 2026.

He draws down $150,000 during the year and makes no additional contributions to the fund.

This means Carlos’s calculated earnings are:

$10 million – $9 million + $150,000 = $1.15 million

His proportion of earnings corresponding to funds above $3 million is:

($10 million – $3 million) ÷ $10 million = 70%

Therefore, his tax liability for 2025-26 is:

15% × $1.15 million × 70% = $120,750

How SW can help

The government is consulting the superannuation industry and other relevant stakeholders to discuss the implementation of the measure.

SW will be monitoring for new announcements and will keep you updated once more information is available.

Please reach out to your SW Partner or contact if you would like assistance determining whether you are affected by the change, or advice on structuring your superannuation account.

Contributors

Ampol Limited, formerly Caltex Australia, has settled a transfer pricing dispute with the Australian Taxation Office (ATO) for $157 million.

Ampol Group (Ampol) is an Australian energy company that operates in the fuel and convenience retail sector. Its subsidiaries in Singapore (Ampol Singapore) serve as a trading and shipping arm of the group, sourcing refined products and crude oil from outside Australia to provide secure and cost-competitive supply to Ampol’s customers. Ampol Singapore functions as an offshore procurement hub for Ampol Australia and has over 100 employees as of December 31, 2022.

On 20 February 2023, it was reported that Ampol had reached a settlement with the ATO regarding the tax treatment of earnings by Ampol Singapore from transactions with Ampol Australia.

The settlement covers the transfer pricing outcomes of refined products and crude oil between Ampol Singapore and Ampol Australia from 1 January 2014 to 31 December 2022. It also locks in the tax outcomes of the arrangement for future periods until 2033. The settlement also addresses how Australia’s Controlled Foreign Companies (CFC) regime will apply to the profits of Ampol Singapore.

Transfer pricing is the practice of setting the price for goods and services transferred between related entities within a corporate group. The ATO has been actively enforcing transfer pricing rules to ensure that related entities within a corporate group are charging each other an appropriate price for goods and services.

The CFC regime is designed to prevent Australian companies from using offshore entities to avoid paying Australian tax on foreign profits.

Ampol tax settlement details

The settlement is expected to resolve transfer pricing issues related to Ampol Singapore’s transactions with Ampol Australia and provide clarity on the tax treatment of these transactions going forward.

While full details of the settlement are covered by confidentiality provisions, the outcomes include:

- Ampol will pay an additional $5.6 million in Australian tax on earnings between 2014 and 2021, and $0.1 million in interest. This is on top of the $104.1 million of tax already paid on Ampol Singapore earnings.

- Ampol will pay $48.2 million in Australian tax on Ampol Singapore earnings for the 2022 financial year.

- The ATO has neither imposed penalties on Ampol nor applied anti-avoidance provisions.

- Ampol Singapore has adjusted its functions such that the majority of earnings by Ampol Singapore from transactions with Ampol Australia will be subject to corporate income tax in Australia at 30% rate (effective from 1 January 2023).

Key takeaways from the Ampol tax settlement with the ATO regarding Ampol Singapore

The ATO’s Tax Avoidance Taskforce has been focusing on offshore procurement hubs to prevent profit shifting and excessive pricing of imported goods and services in an effort to reduce tax paid in Australia.

The ATO has raised tax liabilities of $30.6 billion from large public and private groups and multinationals over the period 2016 to 2022, with the Taskforce contributing over 60% of this amount.

The number of disputes resolved via settlements has increased by nearly 10% from 2020 to 2022, with the majority of settlements occurring at pre-audit or audit stage.

The scope of ATO’s independent review in large market disputes that involve transfer pricing issues is now restricted.

Settlement can be a practical solution to reach long-term tax certainty for taxpayers, as seen in the Ampol case.

However, defensible transfer pricing policies and adequate documentation remain critical for taxpayers involving complex or material cross-border related party dealings, such as offshore procurement hubs, to mitigate potential risk of ATO’s compliance actions.

How SW can help

Taxpayers engaging in cross-border related party dealings need to ensure that their transfer pricing policies and documentation are in line with ATO’s expectations to avoid potential disputes that cost enormous time and resources of taxpayers.

With the ATO’s increasing focus on offshore procurement hubs, it is important for taxpayers to stay informed of the latest developments in transfer pricing regulations and seek expert advice where necessary.

To avoid expensive disputes and ensure your transfer pricing requirements and compliance are up to date, reach out to our global transfer pricing specialist or your SW relationship Partner.

Contributor

On 8 February 2023, the ATO released a new Taxpayer Alert sounding a warning to taxpayers seeking to access private company profits tax free via a scheme involving the interposition of a holding company to access company profits tax free.

The Taxpayer Alert notes that participants in, and promoters of these types of arrangements, may be subject to penalties, including promotor penalties under Div 290 of Sch 1 to the Taxation Administration Act 1953.

Background on Division 7A

Division 7A (Div 7A) is a far reaching set of provisions the essential purpose of which is to treat certain payments and non-commercial loans made by private companies to shareholders or their associates as a distribution of profits and therefore a deemed (unfranked) dividend.

For a deemed dividend to arise, the relevant private company must have what is referred to in the legislation as a ‘distributable surplus’ (which is very broadly profits, reserves or surplus funds from which a dividend could theoretically be declared).

What types of arrangements is the ATO looking at?

Arrangements that are flagged by Taxpayer Alert TA 2023/1 as being high risk and in the crosshairs of the Commissioner are arrangements along the following lines:

- An individual who is a shareholder and director of a private company with retained profits.

- The individual disposes of their shares in the private company to an interposed holding company (set up by the individual) and receives shares in the interposed holding company in return.

- The value of the shares received in the interposed holding company equate to the net asset value of the private company, with the result that the interposed company has no ‘distributable surplus’ available for distribution.

- The individual applies CGT roll-over to disregard, for tax purposes, any capital gain arising on the disposal of the shares in the private company.

- The private company declares a franked dividend to the interposed holding company. Whilst the TA does not explicitly state this, it is expected that the dividend received by the interposed holding company (being a dividend received from pre-acquisition profits of the private company) would be recorded for accounting purposes as a reduction in the book value of the asset, rather than a receipt of profit.

- The private company discharges its liability to pay the dividend by ways such as cash, cheque or promissory note.

- The individual receives a loan from the interposed holding company, financed by the dividend received from the private company. The terms of the loan do not comply with Division 7A (which requires loans to meet criteria such as a minimum interest rate and maximum term).

- Whilst the loan is not on complying Division 7A terms, taxpayers are taking the position that Division 7A would not apply due to the absence of a distributable surplus in both the private company and the interposed holding company.

TA 2023/1 also indicates that the Commissioner would be equally concerned should a similar arrangement be entered into where the relevant shareholder is a trust, rather than an individual.

Grounds to challenge

On the basis that arrangements such as the above exhibit a high degree of contrivance and would appear to be motivated by an objective of avoiding the application of Division 7A, TA 2023/1 notes that the Commissioner would be likely to challenge the arrangement on the following alternative bases:

- the Commissioner may assert that the loan is not a genuine loan, but a payment that is assessable as an unfranked dividend under the deemed dividend rules in Division 7A

- the arrangement may be challenged as a ‘dividend stripping’ scheme resulting in the loan amount being included in assessable income of the original shareholder and the franking credit on the dividend paid to the interposed holding company being cancelled

- under the general anti avoidance rules in Part IVA.

How SW can help

While the circumstances at which TA 2023/1 are directed are quite specific and may not affect many of our clients, the Taxpayer Alert highlights the efforts that the ATO are applying to enforce Division 7A.

Should you have any queries in relation to this Taxpayer Alert or Division 7A more generally, please reach out to your SW contact or Key Contacts here.

Contributors

Developing tomorrow’s leaders today

For the sixth year, we deliver an interactive 5-part seminar series to aspiring and emerging leaders in the Property Fund Management sector, with direct access to leading industry experts and their experience, strategic industry insights and pitfalls, and key issues ranging from structuring, debt and equity through to legal and compliance.

Facilitated by our property funds specialists, featuring content developed alongside industry, each session features practical working considerations and discussions with market leaders.

Who should attend?

- Emerging leaders in property fund management

- Professionals involved in the property funds industry

- Property developers looking to move into funds management

Benefits

- Learn how to protect your business & personal assets

- Different approaches to structuring a product

- Identifying methods to raise debt and equity capital

- Market trends in the different asset classes

- Tax issues arising from different structures

- Effective exit strategies for your investors

- How COVID has changed the landscape

Series Program

Session 1 | Fundamentals for Success – Part 1

11 October 2022 | Melbourne

The introductory session provides a brief overview of the series structure before hearing first-hand from industry specialists the key lessons they’ve learnt, what challenged them the most, what worked, what didn’t and tips on building the right team.

Session 2 | Fundamentals for Success – Part 2

10 November 2022 | Melbourne

How do you separate your business fund from your personal assets? Learn how to protect yourself, your funds and the appropriate ownership structures recommended to protect your investment and maximise your return.

Session 3 | Fund Structuring

8 December 2022 | Sydney

You may have a plan, but do you know which fund structure will give you the best competitive advantage? The industry experts will talk you through the fund structure matrix which covers local and international equity, fee structure and more.

Session 4 | Debt & Equity

9 February 2023 | Melbourne

Everything you need to consider and what to avoid in modern-day financing. Identify both the traditional and alternative methods for obtaining funding, how to strike a deal with the banks and how best to raise your debt and equity.

Session 5 | Legal, Regulatory & Compliance

9 March 2023 | Sydney

Ensuring your i’s are dotted and t’s are crossed are important for the property funds management industry. Our experts will talk you through the documentation and practical application involved in your fund set-up and provide tips on avoiding common pit-falls to ensure you stay compliant.

Event details

Location

Hybrid event

- In-person: delivered in either Sydney or Melbourne SW offices

- Online nationally – for attendees outside host city via Zoom meetings

Time

4 – 6pm, mid-month, minimising disruption to your day, week and month

Cost (exc. GST)

- $500 per person for the series

- $1,000 group booking for up to 3 people

Series speakers

Industry speakers

- David Southon | Aliro Group

- Howard Brenchley | APN Property Group

- David Omond | KM Property Funds

- Chris Langford | Newmark Capital

- Emma Donaghue | McMahon Clarke

- Georgia Liu | Commonwealth Bank of Australia

SW speakers

Simon Tucker

Director, Tax

SW

Rami Eltchelebi

Partner, Assurance and Advisory Services

SW

Stephen O’Flynn

Director, Tax

SW

Sejla Kadric

Director, Business & Private Client Advisory

SW

Matthew Schofield

Director, Corporate Finance

SW

Contact us

If you have any queries or would like more information, please contact the Marketing team via [email protected].

We are pleased to announce that, for the 5th consecutive year, SW is a finalist in the beaton Client Choice Awards Best Accounting & Consulting Firm ($50m – $200m revenue) category.

We are also finalists again for Most Innovative Firm and, in recognition of the value we place on client service, a finalist for Best CX Firm.

“A special thank you to our clients for their ongoing support and to our people, who are dedicated to delivering consistent and outstanding service and outcomes, “ said Mr Duane Rogers, CEO of SW.

“As a values-led culture, we place great emphasis on building strong and trusted relationships with our clients that aim to add value. For the past two years, our people and our clients have had to overcome many challenges together, so it’s very pleasing to receive this independent recognition of our client-first thinking and dedication to supporting our clients.

“Over the past 12 months the economy has faced shock after shock, but these results tell us professional services firms have been there every step of the way for their clients,” said Dr George Beaton, Executive Chairman of beaton.

“The calibre of entrants this year was very high, but by reviewing over 15,000 pieces of client feedback we were able to determine who is the best of the best. It is those firms who can differentiate themselves and offer superior client experience who achieve success in the Client Choice Awards.”

The Client Choice Awards recognise best practice in the professional services sector and are based on client feedback for professional services firms in Australia and New Zealand. There are no panels, judges or self-nominations, only client ratings that are independently researched by Beaton Consulting + Research (‘beaton’).

The Awards reward firms and professional practitioners for excellent client service, expertise in clients’ areas of need, innovation and superior client experience. These are the only multi-profession and fully client-judged Awards anywhere in the world. The Client Choice Awards is now in it’s 18th year, with 250+ firms entering in 2022. Over 15,000 pieces of client feedback were used to adjudicate the awards.

“We are honoured to again be part of this highly regarded independent annual research undertaken for professional services firms across Australia and New Zealand, and wish all finalists the best for the award announcements,” said Mr Rogers.

The beaton team is dedicated to providing professional services firms with insights and advice related to their clients and business performance.

“Every firm that enters the Client Choice Awards is to be commended for their commitment to client feedback. These objective and independent Awards reward firms that have a culture of client-centricity and continuous improvement,” said Dr Beaton.

With the Federal election around the corner, how will the Federal Budget support Australia’s economic recovery and encourage sustainable growth?

Covid-19 continues to present significant challenges with labour shortages, supply chain issues and inflationary pressures. Australian businesses want to know how Treasurer Josh Frydenberg will tackle our economic recovery.

Join us for the 2022/23 Federal Budget Webinar where we will bring you expert insights into challenges and potential opportunities, tailored for your industry or business sector.

We will once again welcome back Catherine Birch, ANZ Senior Economist and our panel of experts hosted by Matt Birrell to share their insights and key takeaways from the Budget.

Register via the link below to find out what the budget means for you and your business.

Online registration details

Expert speakers

Catherine Birch ANZ Senior Economist |  Matt Birrell SW Director, Tax |

The Board and Partners of SW (formerly ShineWing Australia) have endorsed the appointment of Partner and current Chief Operating Officer, Mr Duane Rogers, to the newly formed role of CEO effective from 1 January 2022.

Current Managing Partner, Danny Armstrong, will continue with the firm as the leader of SW’s Banking Industry Group.

A chartered accountant by training, Mr Rogers has been with SW since 2014. He was previously an audit partner with one of Australia’s leading mid-tier firms.

“I’m excited to lead the firm through the next phase of its evolution. There will be a focus on national growth and building on our existing areas of strength, to continue to deliver value to our clients, whilst providing an engaging and flexible environment for our people,” said Mr Rogers.

“I look forward to working with the Board and our teams in bringing this strategy to life.

“It has been a privilege to work with Danny during his tenure as Managing Partner and we are extremely fortunate he will continue providing key advisory services for our clients given his strong background and experience in the Australian and Asian banking sectors and deep knowledge of export and trade,” said Mr Rogers.

Said Mr Armstrong: “Since joining SW, Duane has been an integral leader on the SW Executive Committee as Chief Operating Officer and has supported the firm’s growth agenda.

“He has been recognised by Partners and SW teams alike for his exceptional leadership through a global pandemic and he has been instrumental in helping design and implement measures to support the development of the firm’s new new workplace strategy as we work towards the launch of new working environments nationally.”

SW also announced the appointment of Stephen O’Flynn as the Chair of SW. Stephen has been with the firm for 25 years. He has led the National Tax team, is a member of the firm’s Executive Committee and chairs the Financial Services Industry Group.

He looks forward to working with Duane as he implements the firm’s strategy and will continue as a Director within the Tax group, supporting clients across the Property Funds, Education and Government sectors.

Tax Director and Chair of the Agribusiness Industry Group, Sam Morris, steps into the role as National Tax Leader.