The 2023/24 State Budget delivered by the Victorian Government seeks to repay COVID-19 debt through taxing big business and property investors. Temporary levies and job cuts are central to the 10-year fiscal repair plan which are set to impact business and employment.

Key takeaways

- Larger businesses and landlords will have to pay additional taxes to help the Government repay the COVID debt

- The Government continues to invest in education and healthcare as this remains a key focus

- Certain infrastructure projects have been paused such as the Melbourne Airport Link. However, the Government continues to invest in road upgrades and railway networks.

What does the State Budget mean for you?

Contributors

For companies with R&D activities, applications for Advance and Overseas Findings must be lodged before the end of the income year. For companies with a June year-end, this means the Application deadline for activities conducted in the 2023 income year is 30 June 2023.

What is an Advance Finding?

An Advance Finding is a decision about the eligibility of R&D activities for the R&D Tax Incentive. A positive Advance Finding can cover R&D activities for up to three years. While eligible Australian R&D activities can be registered with or without an Advance Finding, any R&D activities conducted overseas must have an Advance Overseas Finding in place before an R&D Tax Offset for these activities can be claimed.

In order to register and claim the R&D Tax Offset for activities conducted overseas a company must first apply for an Overseas Finding.

The Overseas Finding process

To receive an Overseas Finding for an overseas R&D activity, the company must demonstrate that it meets the following 4 conditions:

- The overseas R&D activity must be an R&D activity (meet the R&D Tax Incentive requirements for being either a core R&D activity or a supporting R&D activity).

- There must be a scientific link to an Australian core R&D activity and the Australian core R&D activity can’t be completed without conducting the overseas activity.

- The overseas R&D activity must not be able to be conducted in Australia or its external Territories.

- The costs of overseas R&D activities must be less than the costs of related R&D activities undertaken solely in Australia.

When should I start the process?

Applications for Advance and Overseas Findings must be lodged before the end of the income year of the registrant. Late applications cannot be accepted under any circumstances.

Advance and Overseas Finding Applications can be complex. If a company considers an Advance and Overseas Finding Application, the process should be started as soon as possible and well before the Application deadline on 30 June 2023.

How can SW help?

Our R&D Tax Incentive experts have extensive experience in preparing Advance and Overseas Finding Applications and assist in:

- determining the eligibility of overseas activities

- providing guidance regarding the required evidence to demonstrate why an activity can’t be solely conducted in Australia

- the preparation of detailed Advance and Overseas Finding Applications

- the finding process post-lodgement of the Application.

Contributors

Thomas Demel, Senior Manager R&D Tax and Government Incentives Tax

Lachlan Murfett, Assistant R&D Tax and Government Incentives Tax

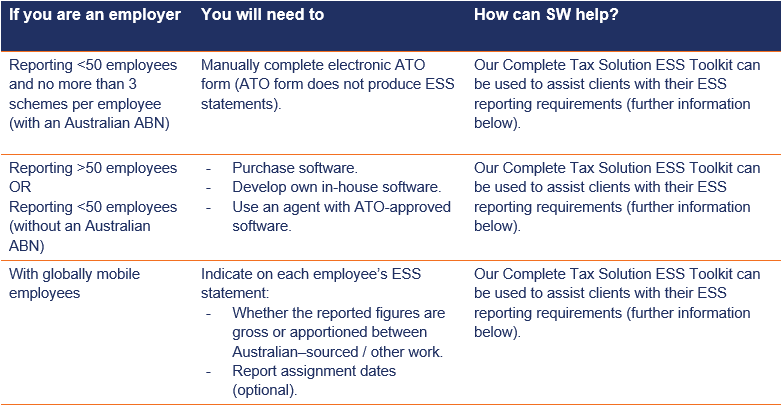

The ATO have upcoming reporting obligations affecting those offering employee share schemes (ESS). Find out how the CTS ESS Toolkit, our ATO-approved software can simplify your reporting obligations.

ATO reporting obligations

The Australian Taxation Office (ATO) have reporting obligations in place, affecting employers who issue shares or share options to their employees. The deadlines to comply with the reporting requirements are:

- ESS statements are due to be issued to employees by 14 July 2023

- ATO reports are due for lodgement with ATO by 14 August 2023.

What do the ATO reporting obligations mean for you?

Please note that for all ESS interests (new and existing) that are subject to deferred taxation with the deferred taxing point on or after 1 July 2022, cessation of employment has been removed as a deferred taxing point.

Our innovation solution | CTS ESS Toolkit

SW has developed the ‘Complete Tax Solutions Employee Share Scheme’ Toolkit (CTS ESS Toolkit), an ATO-approved and compliant software which enables employers to simplify their online annual employee share scheme reporting obligations.

Using the CTS ESS Toolkit, SW have been successfully working with businesses to meet their ESS lodgement requirements since electronic reporting began. We are one of only a handful of providers to have passed ATO testing and have ATO approval for our specialised software. CTS ESS Toolkit is designed to help you meet the ATO’s ESS reporting requirements.

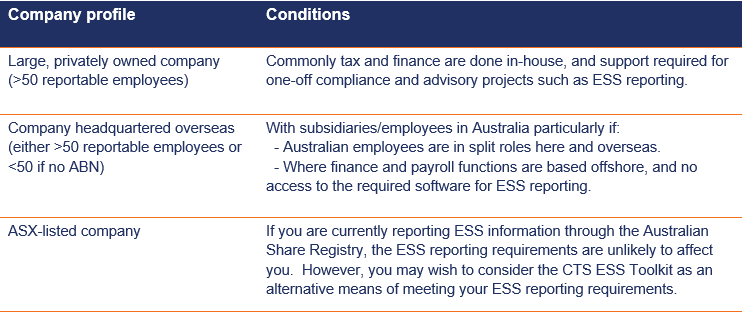

The table below outlines the types of companies that are most likely to benefit from using the CTS ESS Toolkit.

Introduction of ‘New Division’ into Corporations Act 2001 (Cth)

Please note any offer of ESS interests to employees made under any existing share plans or new plans should consider whether offers will comply with the recently introduced Division 1A of the Corporations Act 2001 (Cth). The ‘New Division’ overhauls the existing ESS regulatory framework for unlisted and listed companies and updates the legislative framework for entities seeking disclosure relief.

Next steps

Time is limited to make the necessary arrangements to comply with the ESS reporting requirements. The ATO is particularly keen to ensure corporates are compliant and provide timely and accurate reporting.

Now is the time to ensure your business is not left behind and that everything is ready for reporting season. We can provide a fully outsourced service or license our software; whichever you prefer.

If you would like to discuss how to comply with the ATO reporting requirements or learn more about how our ESS Toolkit will help you, please contact either Sam Morris or Justin Batticciotto on the details below.

Contacts

Justin Batticciotto

With increased globalisation and digitalisation creating growing concern about tax avoidance by multinationals, the OECD Two-Pillar approach aims to address international corporate tax challenges.

In the 2023-24 Budget, the Government announced the implementation of a 15 per cent global minimum tax and domestic minimum tax, key aspects of Pillar Two of the OECD/G20 Two-Pillar Solution to address the tax challenges arising from the digitalisation of the economy.

The Two-Pillar Solution will ensure that multinational enterprises (MNEs) will be subject to a minimum effective tax rate of 15%, and will re-allocate profit of the largest and most profitable MNEs to countries worldwide. Under the OECD, 136 countries and jurisdictions have agreed to implement the new framework and proposed reforms.

After years of joint development, members of the G20/Organization for Economic Co-operation and Development (OECD) Inclusive Framework (IF) on Base Erosion and Profit Shifting (BEPS) (the Inclusive Framework) agreed on the Two-Pillar Solution to address the Tax challenges arising from the Digitalization of the Economy. Two detailed blueprints were published in October 2022 on the tax reforms for addressing the Nexus and profit allocation challenges (Pillar One) and for Global Minimum Tax (GMT) rules (Pillar Two).

Who is affected?

Pillar One: will impact multinationals with revenues that exceed EUR 20b (~AUD 30b) per annum and have profit margins in ‘excess’ of 10%.

- Exclusions apply for extractives and regulated financial services

- Treasury currently estimates that no Australian headquartered multinationals would be impacted. However Australian subsidiaries of foreign headquartered multinational groups may need to take into account any profits allocated to them in Australia.

Pillar Two: will have a far wider impact and applies to multinational groups with a global revenue of EUR 750m (~AUD 1.2b) per annum.

- The OECD Framework excludes Government entities, international organisations (e.g. World Trade Organisation), non-profit organisations, pension funds or investment funds that are ultimate parent entities of an MNE Group or any holding vehicles used by such entities, organisations or funds from the scope of Pillar Two

- The OECD Framework includes de-minimis exemptions based on the revenue and profits within particular jurisdictions

- Further breakdown on each pillar can be found below.

When does it come into effect?

There is currently no draft legislation and no specified start date. However, it is expected that:

- Pillar One: the start date is to be announced.

- Pillar Two:

- The Income Inclusion Rule which will apply for income years starting on or after 1 January 2024. This rule will apply to Australian multinationals and Australian entities which are subsidiaries of a foreign-headquartered multinational located in a jurisdiction that has not implemented this rule.

- The Undertaxed Profits Rule which will apply for income years starting on or after 1 January 2025. Where no Income Inclusion Rule applies, the Undertaxed Profits Rule will apply to foreign multinationals that operate in Australia

How can SW help?

SW can help your business prepare for the international corporate tax reform, by assisting with the following:

- Review of current corporate structure to determine if Pillar One and/or Pillar Two will apply

- Implement systems to assist with compliance with the new rules.

- Formulate tax procedures and control framework to comply with the new rules.

If either, or both, Pillar One and Pillar Two are found to apply, we can provide the following services:

- Review bilateral tax treaties to determine if the STTR applies

- Model the impact of the rules

- Review transfer pricing agreements to determine risks and advise on changes to mitigate risks

- Determine where any remaining risks areas are and propose actions items to mitigate risks

- Lodge Global Anti-Base Erosion (GloBE) returns with the ATO. This lodgement is likely to be required regardless of whether a top-up tax liability exists.

SW held a seminar to discuss the operation of the rules in greater details. you can access the webinar video here.

Key elements of the Two-Pillar Solution

Pillar One

– Taxing rights over 25% of the residual profit of the largest and most profitable MNEs would be re-allocated to the jurisdictions where the customers and users of those MNEs are located

– Tax certainty through mandatory and binding dispute resolution, with an elective regime to accommodate certain low-capacity countries

– Removal and standstill of Digital Services Taxes and other relevant, similar measures

Pillar Two

– GloBE rules provide a global minimum tax of 15% on all MNEs with annual revenue over 750m euros

– Requirement for all jurisdictions that apply a nominal corporate income tax rate below 9% to interest, royalties and defined set of other payments to implement “Subject to Tax Rule” into their bilateral treaties with developing Inclusive Framework members when requested to, so that their tax treaties cannot be abused.

– Carve-out to accommodate tax incentives for substantial business activities

Pillar One

Under Pillar One, MNEs will need to determine whether their profit margin (profit before tax ÷ revenue) exceeds 10%. The excess being referred to as “residual profits”.

A quarter of the residual profits would be redistributed to the countries where the products or services are consumed, to be taxed in those jurisdictions. The allocation of the residual profits to source jurisdictions will broadly be based on the revenue sourced from those jurisdictions. There will be some de-minimis exclusions.

What are the key implications for affected taxpayers?

- Systems and processes should be implemented to meet this compliance requirement

- Subsidiaries based in Australia may need to consider any profits allocated to Australia before finalisation of their income tax returns

- Global transfer pricing policies will need to be reviewed in light of the new rules

- The tax impact should be modelled.

Pillar Two

Pillar Two is also referred to as the Global Anti-Base Erosion or Global Minimum Tax rules.

Objectives of Pillar Two

The objective of Pillar Two is to set a minimum Effective Tax Rate (ETR) to reduce incentives for multinational to move profits to low tax jurisdictions.

Calculating the ETR

- The ETR is not the corporate tax rate in the country. It is similar to how the effective tax rate is calculated under the accounting rules but will not be the same as the calculation required under the Pillar Two rules.

- The ETR = Adjusted Covered Taxes ÷ Net GloBE Income. The minimum ETR is 15% and is calculated on a jurisdictional basis.

- The financial accounts and tax effect accounting balances will be used in the calculation of the ETR to better align the financial accounts with tax purposes. The net GloBE income will generally be the accounting profits used in the parent entity’s consolidated financial statements subject to certain adjustments (see below).

- In calculating the net GloBE income, there will be some adjustments for certain permanent differences such as removing dividends and equity gains. The OECD framework also includes an exclusion for international shipping income.

- In calculating the net covered taxes, only tax on profits are relevant. Indirect taxes are excluded. Further, there are rules for addressing temporary differences. Therefore, the tax effect accounting workpapers will be relevant in calculating the ETR.

- Tax losses brought forward can broadly be carried forward and applied in the calculations.

- There are also adjustments to Net Globe Income based on the level of employment costs and tangible assets in each jurisdiction. This would reduce the profits subject to the top-up tax.

- As the calculations are complicated, SW will hold seminars when the legislation is released to discuss the operation of the rules in greater detail.

- If subsidiaries in a jurisdiction have an effective tax rate of <15% (say 10%), then the parent entity jurisdiction can levy a “top-up” tax of the difference i.e. 5% (15%-10%) on the relevant profits in the jurisdiction. This is referred to as the Income Inclusion Rule (IIR). This tax is in addition to the tax paid by the parent company on its own profits.

- Where the top-up tax amount is not fully covered by the IIR, then the Undertaxed Payment Rule (UTPR) will operate as a stop gap measure. In general, the remaining top-up tax will be allocated to the all the jurisdictions (in which the MNE operates) which have implemented the GloBE rules.

- Before calculating the IIR and UTPR, the Subject To Tax Rule (STTR) must firstly be considered. The STTR prevents companies from avoiding tax on their profit earned in developing countries by making deductible payments such as interest or royalties that benefit from reduced withholding tax rates under tax treaties and which are not taxed (or taxed at a low rate) under the tax laws in the treaty partner. In this case, the payer’s jurisdiction can levy an additional top-up withholding tax so that the income amount is subject to a minimum tax (in both countries together) of 9%. This is lower than the minimum 15% tax on profits because the STTR tax is calculated based on the gross amount.

Operation of Pillar Two

Step 1. Subject to tax rule (STTR)

Objective: Ensure that developing countries have an equal opportunity to tax certain types of income.

Implementation:

- Participating members who are taxing certain items of income below 9% will be required to include the STTR into a bilateral tax treaty when requested by a developing treaty partner.

- When the STTRs are included in a bilateral tax treaty, the payer jurisdiction may additionally tax certain related party payments if the receipt is taxed at a rate of less than 9% in the payee’s jurisdiction.

- This taxing right will be capped at the difference between the STTR minimum tax rate and the tax rate on the payment.

Impact on Australian taxpayers

The STTR is expected to have limited application to Australian taxpayers given our corporate tax rate and withholding tax system. However, this will need to be monitored to confirm that affected payments have been subject to the minimum 9% tax.

Step 2. IIR and UTPR

Once the STTR has been considered, the next step is to consider the IIR and UTPR rules.

Objective: Ensure an effective minimum 15% effective rate is imposed on multinationals with a global revenue of EUR 750 million (~AUD 1.2 billion) per annum.

Implementation: These rules would be carried out through two interlocking rules. Together they would work to collect a top-up tax on profits in jurisdictions which are deemed to be ‘undertaxed’.

- Income inclusion rule (IIR) – is the primary charging mechanism which would allow the parent company jurisdiction to apply a top-up tax on resident multinational ‘parent’ companies, where the group’s income in another jurisdiction is being taxed below the global minimum rate of 15%. Note that there are special rules applying to overseas branches of the parent company which operate differently to the IIR.

- Undertaxed payments rule (UTPR) – where the parent company jurisdiction does not implement the IIR or the top-top up tax is not fully captured by the IIR, then the UTPR as the secondary charging mechanism would broadly allocate the remaining top-up tax to all the implementing jurisdictions in which the MNE operates.

- For example, if a multinational subsidiary in Australia had a foreign subsidiary paying less than the global minimum rate on its profits, and there was no foreign jurisdiction applying the IIR in relation to those profits, then Australia may be required to apply the UTPR to the Australian subsidiary in respect of the under-taxation in the foreign subsidiary’s jurisdiction.

How can affected taxpayers prepare?

- Systems and processes will need to be implemented to allow for an effective and efficient calculation of the effective tax rates and completion of the GloBE information return

- The impact on the MNE group should be modelled

- Review current transfer pricing agreements to determine how they would be impacted by Pillar One and Pillar Two.

Contributors

Last night, the Federal Budget for FY23/24 was handed down by Treasurer Jim Chalmers. The Federal Government delivered a cost of living plan, promising it will not increase inflation. The budget included key measures for energy & resources, SMEs and healthcare with hospitality, tourism and property missing out.

Did you miss out on our Federal Budget webinar?

Check out Madeline Dunk, Senior Economist at ANZ, Bill Lang, Executive Director at Small Business Australia and our panel of industry experts as they share their insights and key takeaways from the Budget.

What does the Federal Budget mean for you?

Our Fast Facts provide an overview of the budget insights and highlight potential opportunities for your sector.

Take a look at what the Federal Budget means for you in 2023:

Showcasing our newly acquired Australian artwork collection, the SW offices feature works by renowned artists Daniel Boyd, Belinda Fox and Andrew Taylor.

Learn more below about the artworks in SW’s offices. From Daniel Boyd’s striking 3 panel digital installation of ‘Teach a Man to Fish’ to James Tylor and Rebecca Selleck’s Fire Country photographic series which addresses the significance of fire in Australian culture.

Matt Arbuckle

Daniel Boyd

Belinda Fox

Laura Kennedy

Benjamin Prabowo Sexton

Andrew Taylor

James Tylor and Rebecca Selleck

Amber Wallis

Alice Wormald

What will the Federal Budget 2023/24 deliver to support you, your business and your industry?

With inflation issues globally, we are seeing continued pressure on interest rates and cost of living, staffing shortages, supply chain issues and rising business costs. This Budget will need to deliver for Australian businesses, and particularly small to medium-sized enterprises (SMEs). Watch SW Director, Greg Will, talking to Ticker News about this topic below.

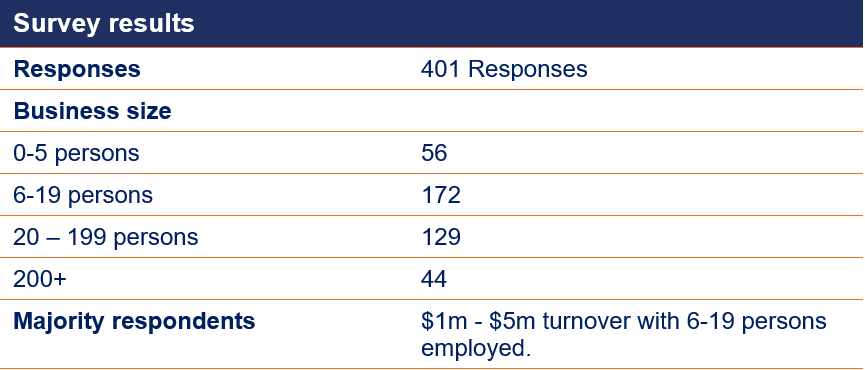

Opportunities for growth, investment and trade are critical to everyone’s success, so SW Accountants & Advisors has once again partnered with Small Business Australia (SBA) to get to the heart of what business is looking for from the Budget, come Tuesday 9 May 2023.

Take the survey!

Take this short 2-3min survey from SW and SBA and tell us what you need from the budget in order to Look forward and Open Doors. You’ll help us build a robust and current view of Australian small business.

Each survey respondent will RECEIVE $100 DISCOUNT on any of the business services offered by Small Business Australia. Vouchers will be provided after the close of the survey on 8 May 2023.

Budget Breakfast Webinar – 10 May | 9.30am AEDT

Join us as we share the details of the 2023 Federal Budget that incudes an interactive Q&A session.

Our host, Matt Birrell will be joined by esteemed guests ANZ Senior Economist, Madeline Dunk, and Bill Lang, Executive Director of Small Business Australia, as well as SW Director, Greg Will speaking on the impacts on SME business, together with SW industry experts.

Online registration details

Date Wednesday, 10 May 2023

Time 9.30am – 11am (AEDT)

Greg Will interview @ Ticker News | How Australian small businesses performed post-COVID

Federal Budget webinar experts

Gregory Will

SW

Director, Business and Private Advisory

Matt Birrell

SW

Director, Tax

Follow us on LinkedIn to receive the latest updates on Federal Budget and other important industry news.

SW Accountants & Advisors and Small Business Australia sentiment survey reveals alarming insights into the struggles and hardships faced by SME’s.

A ‘Small Business Sentiment’ survey conducted by SW Accountants & Advisors in partnership with Small Business Australia has revealed insights into the struggles and hardships faced by SMEs in Australia, with 30% of the 400+ businesses that responded indicating they would find it difficult to meet their financial commitments through 2023.

“This survey provides a clear picture of the challenges faced by SMEs in Australia, and the urgent need for government support. As we head into the May 2023 Budget, it’s clear that SMEs need help as they juggle increasing business costs, cash flow, managing employees, hybrid work policies and work-life balance,” said small business specialist Director of SW Accountants, Greg Will.

Top 5 issues for SMEs

Mr Will, who has over 20-years’ experience in helping SME’s manage and grow their businesses, said that in addition to the ongoing financial struggles that the survey also uncovered the top 5 issues faced by small to medium business owners:

- SMEs need help with employees, including attraction, retention, incentivisation and wage pressures

- Managing cash flow is critical, including budgeting, forecasting, and access to capital – debt or equity

- Businesses face a cost of doing business increase, including all costs like wages for staff, running costs, rents, etc., without being able to pass on higher prices on sales, leading to margin pressure

- SME owners need more time in the day to do everything, which is leading to work-life balance issues, mental health problems, and frustration

- White-collar SME businesses are struggling with work-from-home or work-from-the-office policies, leading to hybrid work policies as the fifth priority for 2023.

Other significant findings from the Small Business Sentiment survey included the impact of the change to minimum wage, the ability to meet financial commitments, supply chain disruptions, and business reliance on migrant labour.

Sector insights

The report broke down into specific sectors showing that half (50%) of the businesses in Accommodation and Food Services, Education and Training, and Manufacturing are impacted by the change to minimum wage increases, leading to increased financial pressure. Additionally, a whopping three-quarters (76%) of Manufacturing respondents believed their businesses are weaker now than before the COVID pandemic due to supply chain and skilled labour shortages.

The survey also highlighted that despite a slight easing of supply chain issues as we head into 2023, 43% of those in Construction will struggle to meet their financial commitments, which will continue to have significant impacts on housing, whilst staff shortages continue to remain a significant issue for the manufacturing and construction sector.

Bill Lang, Executive Director of Small Business Australia says: “The Small Business Sentiment survey has highlighted the struggles faced by many SMEs in Australia and the urgent need for sensible and stable government policies to support this sector in 2023. SW and SBA will continue to advocate for the needs of SMEs and provide expert guidance and support to ensure their survival and growth in 2023.”

This survey is the first of its kind, with SW and SBA planning to conduct another deep dive across all sectors to compare results from last year ahead of the budget in May 2023. The findings of the survey will provide a foundation for SMEs to advocate for their interests and highlight their struggles with the federal government and policy makers.

Upcoming event for Small Business

Opportunities for growth, investment and trade are critical to everyone’s success, so SW Accountants & Advisors has once again partnered with Small Business Australia (SBA) to get to the heart of what business is looking for from the Budget, come Tuesday 9 May 2023. Take the survey to tell us what you need from the budget and sign up for our Budget Breakfast webinar as ANZ, SBA and SW experts unfold the Budget for you.

Media contact

About the survey

About SW

About us – SW Accountants & Advisors (sw-au.com)

As an independent, national firm with a strong presence across Brisbane, Melbourne, Perth, and Sydney, SW offers a wide range of accounting and business advisory services. With 40 Partners and 300 staff, we are committed to delivering exceptional value to our clients. We are proud to be ranked as the 22nd largest firm by revenue in the 2022 AFR Top 100 Accounting Firms and the 10th largest national practice in Australia.

At SW, we believe in building real relationships and connectivity, both locally and globally. As a member of the SW International network , we provide integrated global services to our clients. Our international headquarters are located in Hong Kong, and our member firms offer assurance, business advisory, corporate finance, and tax consulting services. Additionally, we are a member of the Praxity Alliance, which enables us to leverage our combined global footprint and connections in over 110 countries across the USA, Europe, Asia Pacific, and the Middle East.

About Small Business Australia

Over 5 million Australian own or work in small businesses. Small Business Australia’s purpose is to ensure a thriving sector and financial security for these 5 million Australians. Small Business Australia conducts research with small businesses across Australia and provides information, advice and services to small businesses and the major organisations that support them. The Foundation Partners in Small Business Australia’s Buy Local movement include Australia Post, Nab, Telstra, PEXA and SW.

Greg Will

Director, Private Business and Advisory Services

Bill Lang

Executive Director, Small Business Australia

APRA has intensified supervision of regulated entities for compliance with the Information Security Standard CPS 234 to combat cyber threats following the recent Medibank cyber attack.

Concern for the security of information assets following the recent cyber incident at Medibank has prompted the Australian Prudential Regulation Authority (APRA) to step up its supervision of APRA-regulated entities for compliance with the Information Security Standard CPS 234.

Medibank confirmed that criminals claim to have stolen 200GB of data including names, dates of birth, Medicare numbers and claims data with codes relating to diagnosis and procedures. APRA’s UpGuard team reported in 2022 that the majority of data breaches ‘are the result of poorly secured software development practices’.

Fundamental questions for Boards of regulated entities include:

Do you know what data you are holding?

Do you know where it is?

How do you know it is safe?

And do you need to retain it?

APRA compliance recommendations

APRA recommends that regulated entities should undertake systemic testing and assurance at least annually to evaluate the effectiveness of their controls, including those managed by related parties and third parties.

To ensure that regulated entities are taking appropriate measures to protect their information assets, APRA has outlined specific steps that should be taken to comply with CPS 234. This includes:

- clearly defining information security-related roles and responsibilities

- maintaining an information security capability commensurate with the size and extent of threats

- implementing controls to protect information assets, and

- having mechanisms in place to detect, escalate and respond to information security incidents.

In the event of a material information security incident, entities are required to notify APRA no later than 72 hours.

How SW can help

As an increasing number of major cyber attacks become known, the importance of your information security systems and processes are paramount to ensure sensitive information assets are protected appropriately.

Our experienced experts have undertaken annual audits of these systems and processes across information security, compliance, risk management, and internal audit services. Working closely with clients to understand their business, security needs and particular risks, we conduct a full review with clear recommendations to ensure proactive steps are in place to protect the business and its assets.

We recommend best practice plans for CPS 234 and guide clients to implement information security assessments to ensure your cyber resilience.

Our support can include:

- A gap analysis of current practices against CPS 234

- Review of information security practices and third-party security assessments

- Independent security controls testing

Reach out to Laura Toscano or your Key Contacts here for an obligation-free discussion to find out how we can assist with your testing and assurance program.

Contributors

The Government has released Amending Regulations that increase the review period from 2 to 4 years for small business entities with ‘complex’ tax affairs.

In the 2020-21 Federal Budget, the Government announced an increase to the small business entity turnover threshold from $10m to $50m, allowing greater access to certain concessions including the shorter 2-year period of income tax assessment review. Broadly, this limits the Commissioner’s period to amend a return unless fraud or evasion occurred.

The Income Tax Assessment (1936 Act) Amendment (Period of Review) Regulations 2022 (the “Amending Regulations”) will amend the Income Tax Assessment (1936 Act) Regulation 2015 to exclude certain entities with “particularly complex tax affairs or significant international tax dealings” from the shortened 2-year period to a 4 year period.

The regulations were issued in draft form in August 2022 and the final version is largely unchanged, other than “providing more certainty to when the period of review would apply to entities that engaged in certain activities”.

SMEs excluded from shorter review period

Exceptions for certain taxpayers already existed that excluded entities from the 2 year review period, allowing the Commissioner to amend for 4-years after the notice of assessment is issued.

Arm’s length dealings

This exception has now been expanded to remove the requirement that one of the parties was already subject to the 4-year review period. It has also been expanded to apply – not just where the parties are not dealing at arm’s length – but also where:

- the transaction results in an amount of $200,000 or more being included in or allowable as a deduction of any of the parties, or

- the transaction involves CGT events where the sum of the proceeds from the CGT events is $200,00 or more.

Additional SMEs excluded from the 2-year review period

The list of SME exceptions to the 2-year period of review has been expanded to entities:

- where the sum of their foreign sourced assessable income, and that of their affiliates and associated entities is at least $200,000

- that are Australian foreign controlled or non-resident entities

- subject to the Diverted Profits Tax or Multinational Anti-Avoidance Law in the assessment year

- with at least 10 connected or affiliated entities

- that have claimed a Research and Development (R&D) tax offset for an income year or may be entitled to certain related deductions, recoupments, and adjustments

- that have claimed CGT relief under the following roll-over provisions:

- Division 615 business restructure

- Division 125 demerger

- Subdivision 126-B companies in the same wholly owned group

- that have disregarded a capital gain/loss due to the operation of Division 855-10 (relating to foreign residents).

General tax assessment review rules

Subject to certain exceptions, the Commissioner may amend a tax assessment within 2 years of a notice of assessment for:

- an individual

- a company that is a small or medium business entity

- a person (in the capacity of a trustee of a trust estate) for a year of income if the trust is a small or medium business entity.

For other entities, the Commissioner may amend an assessment:

- within 4 years after the day on which notice of the assessment is provided to the taxpayer

- at any time if there has been fraud or evasion

- at any time to give effect to a decision on a review or appeal, or

- as a result of an objection made by the taxpayer or pending a review or appeal.

Date of effect

The amendments are now in operation, which means they apply to assessments for an income year if the assessment is made after 9 December 2022 and relates to income years starting on or after 1 July 2021.

How SW can help?

Reach out to your SW contact or the team here if you would like more information about how your tax assessment review period could be impacted.